What is the monthly premium for AARP Medicare Supplement?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

How much is AARP Medicare Advantage plan?

About 7 out of 10 of AARP's Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

Does AARP Medicare Supplement cover deductible?

AARP Medicare Supplement Plan B Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.Jan 4, 2022

Does Medicare supplement cost increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What's the difference between a Medicare Advantage plan and a supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is AARP worth joining?

Is AARP worth it? For most people age 50 and older, it's a great deal, as long as you're comfortable with the group's lobbying efforts and can stand the junk mail. Just one night in a hotel or a couple of dinners out per year can cover the cost of membership and then some.Aug 11, 2021

What is the deductible for AARP plan G?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.Sep 21, 2021

Does AARP cover Medicare copay?

Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of coverage and cost.

Is AARP plan f still available?

According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, it's the most popular plan among those eligible for Medicare. But with recent changes, Plan F is no longer available to everyone as of January 1, 2020.Jul 9, 2020

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is a premium?

A premium is a set amount (often monthly) you must pay for coverage.

Which costs do I share with Medicare or my plan?

Deductible:This is a set amount that you pay out of pocket for covered services before Medicare,your Medicare Advantage plan, and/or your Prescript...

Are there plans that limit out-of-pocket spending each year?

An out-of-pocket limit is also known as an out-of-pocket maximum. Whether or not there is a limit depends on which type of plan you have.Original M...

What costs can I expect for 2020?

Depending on which type of coverage you have, your costs may be different.Original Medicare:To get an idea of 2020 costs, you can visit Medicare 20...

What if I need help paying Medicare costs?

There are several programs that help pay Medicare costs. Unfortunately, many people who qualify never sign up. Don’t hesitate to apply. Income and...

Is AARP supplemental insurance good?

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it...

Is AARP the same as UnitedHealthcare?

An AARP Medicare policy gives you insurance through UnitedHealthcare. There is a business agreement between the two companies where AARP provides m...

Does AARP pay the Medicare deductible?

Deductible coverage will vary based on the plan you choose. The Medicare Part A deductible is fully covered by Medigap Plan B, D, G and N, and it's...

What is AARP Medicare Supplement Plan F?

Medicare Supplement Plan F has the highest enrollment and very strong coverage, but it's only available to those who were eligible for Medicare bef...

What is Medicare Supplement Plan?

A Medicare Supplement plan helps you cover costs such as deductibles, coinsurance, copays, and extended hospital care. iStock. AARP has joined forces with UnitedHealthcare, one of the largest insurance providers in the country.

When does Medicare enrollment end?

Your Initial Enrollment Period begins three months before your 65th birthday month, includes your birthday month, and ends three full months after your birthday month.

Does AARP pay royalty fees?

AARP endorses Medicare Supplement insurance plans through UnitedHealthcare. AARP is not an insurer — UnitedHealthcare pays AARP royalty fees for the use of its name . In terms of name recognition with seniors, AARP Medicare Supplement plans are noteworthy.

What is the most comprehensive Medicare Supplement plan?

All carriers who offer Medicare Supplement plans are required to offer at least Plan A, so that will be an option for you no matter where you live. Plans C and F are the most comprehensive plans, but they are only available to beneficiaries who were eligible for Medicare prior to January 1, 2020.

What is AARP Medicare Supplement?

AARP is simply a different branding of UnitedHealthcare policies. AARP does get to choose what UnitedHealthcare plans feature the AARP name. Agents who offer AARP Medicare Supplement plans undergo additional training to understand beneficiaries’ needs and how to match them with the best Medicare product ...

Is AARP the least expensive insurance?

Must be an AARP member to purchase. Plans aren’t the least expensive, but they are competitive in some areas. Often a better deal for beneficiaries who manage health conditions. Note: Some low ratings are due to customer service issues, but many of them are coverage complaints.

Our thoughts: Why we recommend AARP Medicare Supplement

Medicare Supplement Insurance (also called Medigap) plans from AARP/UnitedHealthcare are a good choice for most people. The customer service rating is not as strong as that of some other companies. However, the wide range of policy selections makes it easy to choose the best plan for you, and the AARP endorsement can give you peace of mind.

How do AARP Medicare Supplement plans work?

When you buy an AARP Medicare Supplement Insurance plan, you’re actually getting a policy from UnitedHealthcare. As part of the business agreement, AARP endorses and does marketing for select UnitedHealthcare plans, and in turn, AARP gets an estimated 4.95% fee for each plan sold.

Medigap costs vary by state

Costs for supplemental plans vary widely. To a large degree, this is due to state differences in pricing regulations.

How AARP Medigap costs compare to other insurance companies

Because of the variable plan structures, it can be difficult to compare costs, and the most accurate comparison will be based on insurance quotes for your location and situation . In states where prices change as you age, the different formulas for price increases can affect your total lifetime costs.

Customer reviews and satisfaction

AARP/UnitedHealthcare has mediocre customer reviews with several metrics indicating user complaints and frustrations.

Frequently asked questions

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it includes discounts on vision, dental, hearing, gym membership and more.

Sources and methodology

The above comparisons are based on plan coverage levels, policy details, third-party rankings and sample cost data for 2021. Price quotes for a female nonsmoker were analyzed based on age, location and provider.

What are the benefits of AARP?

Benefits of AARP Medicare Plans 1 Coverage provided for anywhere in the U.S. 2 You can use any doctor who accepts Medicare, including your current doctor 3 No referrals are necessary 4 Your policy can’t be canceled, or your premium increased, because of health problems 5 A supplement plan can be combined with Medicare Part D to help lower your prescription drug costs 1

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

Does AARP provide Medicare Supplement?

AARP Medicare Supplement Plans are provided through UnitedHealthcare Insurance Company. For seniors who are concerned that their Medicare plan may not provide all the health insurance coverage they need, these plans are available to supplement their Medicare coverage.

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

Does Plan G cover Part B?

Plan G. Plan G does not cover one item Plan C covers, but it does cover one item Plan C doesn't cover: Plan G does not cover the Part B deductible of $203. However, like Plan F, it covers 100% of Part B excess medical expense charges above the Medicare-approved amounts. 6 .

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

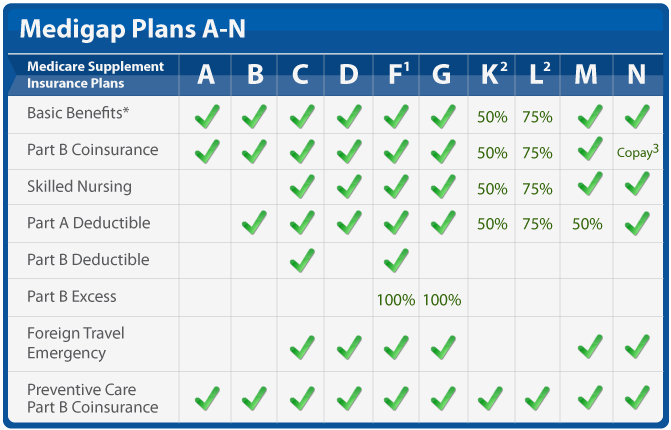

What are the different Medicare plans?

UnitedHealthcare offers eight standardized Medigap plans to AARP members: 1 Medicare Supplement Plan A. Plan A mainly helps pay for hospital and hospice coverage. 2 Medicare Supplement Plan B. Plan B offers the same coverage as Plan A but also covers your Part A deductible. 3 Medicare Supplement Plan C. Plan C is a very robust plan. It covers the Medicare Part B deductible, skilled nursing facility care, and foreign travel. This plan is available only to people who were eligible for Medicare before January 1, 2020. 4 Medicare Supplement Plan F. Plan F is the most comprehensive plan, covering the Part B excess charges in addition to all of the benefits of Plan C. This plan is also only available to those new to Medicare prior to 2020. 5 Medicare Supplement Plan G. This plan offers coverage for Part B excess charges and foreign emergency care. It is a popular plan for those who are not eligible for plans C or F. 6 Medicare Supplement Plan K. Plan K pays up to 50 percent of your costs after you meet your deductible. It also offers low monthly premiums. 7 Medicare Supplement Plan L. This plan pays up to 75 percent of your costs after you meet the deductible and also has low monthly premiums. 8 Medicare Supplement Plan N. With this plan, you’ll still have copays for Part B services, but they’ll be much lower than what you’d pay without the plan. You’ll also have coverage for hospital care, foreign travel, and more.

What is AARP Medicare Supplement?

AARP is a nonprofit, membership organization that offers Medigap plans through the UnitedHealthcare insurance company. There are eight AARP Medicare supplement plans you may be able to choose from, although not every plan can be purchased in every state or county.

Does AARP offer Medicare Advantage?

AARP offers Medicare Advantage and Medicare supplement (Medigap) plans through the UnitedHealthcare insurance company. Medigap plans are a type of supplemental insurance that is sold by private insurers. As the name implies, Medigap is meant to cover some of the gaps in healthcare costs that original Medicare ( Part A and Part B) doesn’t pay.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F. Plan F is the most comprehensive plan, covering the Part B excess charges in addition to all of the benefits of Plan C. This plan is also only available to those new to Medicare prior to 2020. Medicare Supplement Plan G.

Is Medigap the same as Medicare Advantage?

However, it is up to an insurance company to decide which plans they will sell. Medigap is not the same as Medicare Advantage (Part C).

What is a Medigap plan?

Medigap plans are a type of supplementary insurance that you may want if you have original Medicare. These plans pay some of the out-of-pocket costs that you are typically responsible for. Not every plan is available everywhere. The costs of these plans also vary from state to state. Medigap plans are standardized.

What is AARP insurance?

AARP is a nonprofit organization that offers its members Medigap plans through UnitedHealthcare. There are eight AARP Medigap plans available, although not every plan can be purchased in every state or ZIP code. Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, ...