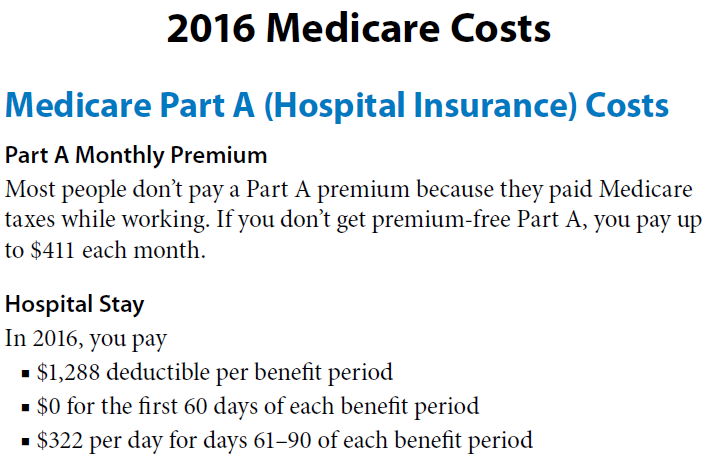

Part A costs

| Type of Cost | 2017 Cost (Change From 2016) |

| Hospital deductible | $1,316 (up $28) |

| Coinsurance for days 61-90 of hospital s ... | $329 (up $7) |

| Coinsurance for days 91 and beyond of ho ... | $658 (up $14) |

| Coinsurance for skilled nursing facility ... | $164.50 (up $3.50) |

Full Answer

How much will I pay for Medicare premiums?

Keep in mind that:

- Once you hit certain income levels, you’ll need to pay higher premium costs.

- If your income is more than $88,000, you’ll receive an IRMAA and pay additional costs for Part B and Part D coverage.

- You can appeal an IRMAA if your circumstances change.

- If you’re in a lower income bracket, you can get help paying for Medicare.

How should I Pay my Medicare premiums?

- automatic deduction from your Social Security monthly benefit payment (if you receive one)

- mailing a monthly check to the plan

- arranging an electronic transfer from a bank account

- charging the payment to your credit or debit card (though not all plans offer this option)

How to calculate Medicare premiums?

- Deductions for what you give to charity 8

- Deductions for adoption expenses 9

- Dependent tax credits 10

- The earned income tax credit (EITC) 11

How much are Medicare premiums?

In fact, new data from the Employee Benefit Research Institute reveals that based on 2021 data, a 65-year-old man needs $79,000 in savings for a 50% chance of having enough money to cover Medicare premiums and median prescription drug costs. A 65-year-old woman, meanwhile, needs $103,000. Image source: Getty Images.

What was the cost of Medicare in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the cost of Medicare in 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part D premium for 2017?

2017 Part D National Base Beneficiary Premium — $35.63 This figure is used to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in the table above.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

How much are Medicare premiums for 2019?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

When did Medicare start charging a premium?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program. 1972: President Richard M.

Are Medicare premiums adjusted for inflation?

Medicare Part B premiums are indexed for inflation. They're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you'll pay next year. Premiums are also means-tested, so they're somewhat dependent upon your income.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the Medicare Part D premium for 2022?

$33The Centers for Medicare and Medicaid Services (CMS) recently announced that the projected 2022 Medicare Part D monthly premium will average at $33. This is an increase from $31.47 in 2021.

What does Medicare Part D cost in 2021?

Premiums vary by plan but the base monthly premium for a Part D plan in 2022 is $33.37, up from $33.06 in 2021. If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on what's known as an income-related monthly adjustment amount (IRMAA).

How much does Part B pay in 2017?

If you're enrolled in Part B but are not receiving Social Security payments, or the premiums are not deducted from them, you'll pay $134 a month in 2017. If you enroll in Part B for the first time in 2017 — regardless of whether you're receiving Social Security payments — you will pay $134 a month.

How much more will COLA pay for Part B?

In 2017, because the COLA will raise benefits by a measly 0.3 percent, they will pay an average of $4.10 more for Part B, depending on the dollar increase in their Social Security checks.

Can you pay more in Part B than you receive from Cola?

Under the law, people with Medicare who draw Social Security benefits cannot pay more in Part B premium increases than they receive from the COLA. So in 2016, these people — about 70 percent of beneficiaries — were "held harmless" from any premium increase and paid the same as they had in 2015. In 2017, because the COLA will raise benefits by ...

Annual increases will hit those who rely on Medicare for their healthcare coverage

Medicare covers more than 57 million Americans, providing the healthcare coverage they need. Every year, though, the cost of Medicare typically goes up, and the program passes through those increases to its participants in the form of higher premiums, deductibles, and other expenses.

Part A costs

Most Medicare participants get hospital insurance coverage under Part A without paying a premium. However, for those who didn't collect enough credits for paying Medicare taxes during their career and don't have a qualifying spouse, Medicare charges a monthly premium of up to $413 per month. That's $2 higher than the maximum amount for 2016.

Part B costs

Medical care coverage under Medicare Part B will also see cost increases in 2017. The deductible that you have to pay on doctors' visits and other outpatient services goes up to $183 per year in 2017, climbing $17 from 2016.

How much will Medicare pay for prescription drugs in 2021?

For the year 2021, once you and your plan have spent a combined $4,130 on covered prescription drugs, you’ll reach the coverage gap (sometimes also referred to as the “donut hole”).

How much does Medicare cost if you don't qualify for Medicare?

Medicare Part A premium. If you don’t qualify for premium-free Medicare Part A, it will cost you $259 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, and $471 per month if you’ve worked and paid Social Security taxes for less than 30 quarters.

What is Medicare Advantage?

Medicare Part A continues to pay for hospice benefits when you have a Medicare Advantage plan. Some Medicare Advantage plans include prescription drug coverage and may include other benefits as well. Premiums and deductibles for Medicare Advantage plans may vary, depending on which plan you choose and the extent of your health coverage.

What is the 20% coinsurance for Medicare Part B?

Besides the premium and deductible, there are other Medicare Part B costs you should know about: for example, many Medicare services and supplies require a 20% coinsurance payment or a copayment after you’ve reached your annual deductible .

What is Medicare Part B 2021?

Medicare Part B costs in 2021. Medicare Part B (medical insurance) is also part of Original Medicare. Part B carries a monthly premium and an annual deductible. Costs shown below are for 2021. Medicare Part B premium. The amount you pay for your Part B premium may vary based on your situation.

How to calculate late enrollment penalty for Medicare?

You can calculate the late-enrollment penalty by multiplying the number of full months you went without Part D or creditable coverage by 1% of the national base beneficiary premium , which is $33.06 in 2021. Then, round the total to the nearest $0.10, and add it to your Medicare prescription drug plan’s monthly premium.

How much does Medicare pay after deductible?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services. If your income is over a certain amount, your Medicare Part B monthly premium may be higher. The government looks to your reported income from two years ago to see if you have to pay a higher amount.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much did Medicare save in 2017?

The FY 2017 Budget includes a package of Medicare legislative proposals that will save a net $419.4 billion over 10 years by supporting delivery system reform to promote high‑quality, efficient care, improving beneficiary access to care, addressing the rising cost of pharmaceuticals, more closely aligning payments with costs of care, and making structural changes that will reduce federal subsidies to high‑income beneficiaries and create incentives for beneficiaries to seek high‑value services. These proposals, combined with tax proposals included in the FY 2017 President’s Budget, would help extend the life of the Medicare Hospital Insurance Trust Fund by over 15 years.

What is the Medicare premium for 2016?

The Bipartisan Budget Act of 2015 included a provision that changed the calculation of the Medicare Part B premium for 2016. Due to the 0 percent cost-of-living adjustment in Social Security benefits, about 70 percent of Medicare beneficiaries are held harmless from increases in their Part B premiums for 2016 and continue to pay the same $104.90 monthly premium as in 2015. The remaining 30 percent of beneficiaries who are not held harmless would have faced a monthly premium this year of more than $150 (a nearly 50 percent increase from 2015). Under the Act, these beneficiaries will instead pay a standard monthly premium of $121.80, which represents the actuary’s premium estimate of the amount that would have applied to all beneficiaries without the hold harmless provision plus an add-on amount of $3. In order to make up the difference in lost revenue from the decrease in premiums, the Act requires a loan of general revenue from Treasury to the Part B Trust Fund. To repay this loan, the standard Part B monthly premium in a given year is increased by the $3 add-on amount until this loan is fully repaid, though the hold harmless provision still applies to this $3 premium increase. This provision will apply again in 2017 if there is a zero percent cost-of-living adjustment from Social Security.

What is the evidence development process for Medicare Part D?

It will be modeled in part after the coverage with evidence development process in Parts A and B of Medicare and based on the collection of data to support the use of high cost pharmaceuticals in the Medicare population. For certain identified drugs, manufacturers will be required to undertake further clinical trials and data collection to support use in the Medicare population, and for any relevant subpopulations identified by CMS. Part D plans will be able to use this evidence to improve their clinical treatment guidelines and negotiations with manufacturers. The proposal helps to ensure that the coverage and use of new high-cost drugs are based on evidence of effectiveness for specific populations. [No budget impact]

What is the Hospital Readmissions Reduction Program?

This proposal makes revisions to the Hospital Readmissions Reduction Program to allow the Secretary to use a comprehensive Hospital-Wide Readmission Measure that encompasses broad categories of conditions rather than discrete “applicable conditions.” The Secretary will be permitted to make future budget-neutral amendments to the measure to enhance accuracy as necessary. [No budget impact]

When will hospitals receive bonus payments?

Under this proposal, hospitals that furnish a sufficient proportion of their services through eligible alternative payment entities will receive a bonus payment starting in 2022. Bonuses would be paid through the Inpatient Prospective Payment System permanently and through the Outpatient Prospective Payment System until 2024. Each year, hospitals that qualify for this bonus will receive an upward adjustment to their base payments. Reimbursement through the inpatient and outpatient prospective payment systems to all providers will be reduced by a percentage sufficient to ensure budget neutrality. [No budget impact]

Can Medicare magistrates be used for appeals?

This proposal allows the Office of Medicare Hearings and Appeals to use Medicare magistrates for appealed claims below the federal district court amount in controversy threshold ($1,500 in calendar year 2016 and updated annually), reserving Administrative Law Judges for more complex and higher amount in controversy appeals. [No budget impact]

What are the most expensive conditions in hospital?

Four of the 20 most expensive conditions during hospital stays with an expected payer of Medicare were related to injuries and complications: Fracture of the neck of the femur (hip), initial encounter. Complication of cardiovascular device, implant or graft, initial encounter.

Is Medicaid the only expected payer?

Medicaid was the only expected payer for which 3 of the top 20 most expensive conditions were related to mental and substance use disorders. Figure 1. Aggregate hospital costs and hospital stays by primary expected payer, 2017. a Self-pay/No charge: includes self-pay, no charge, charity, and no expected payment.