What Medicare Part D costs

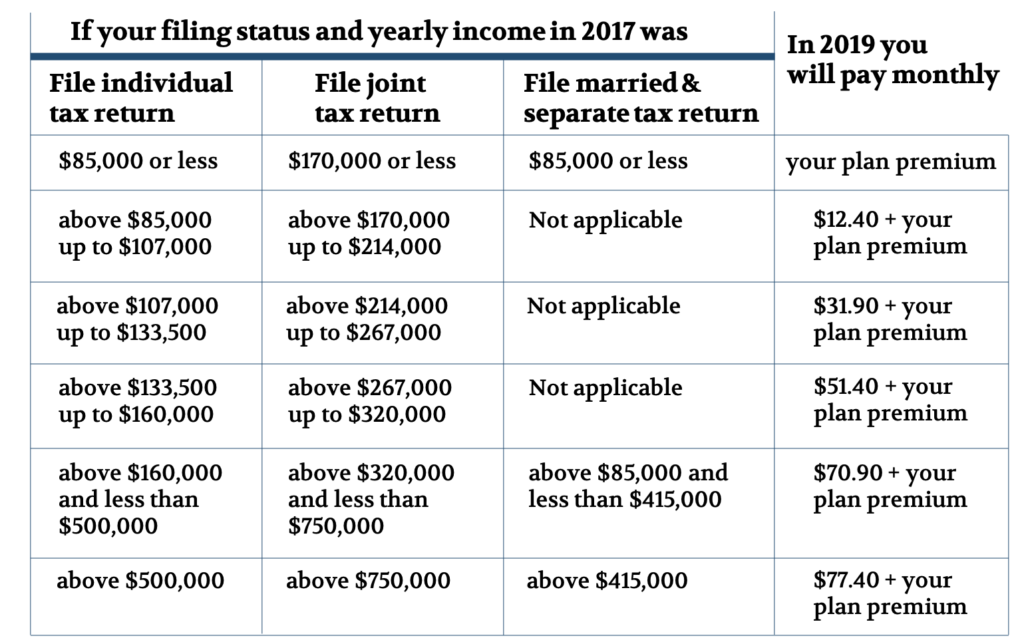

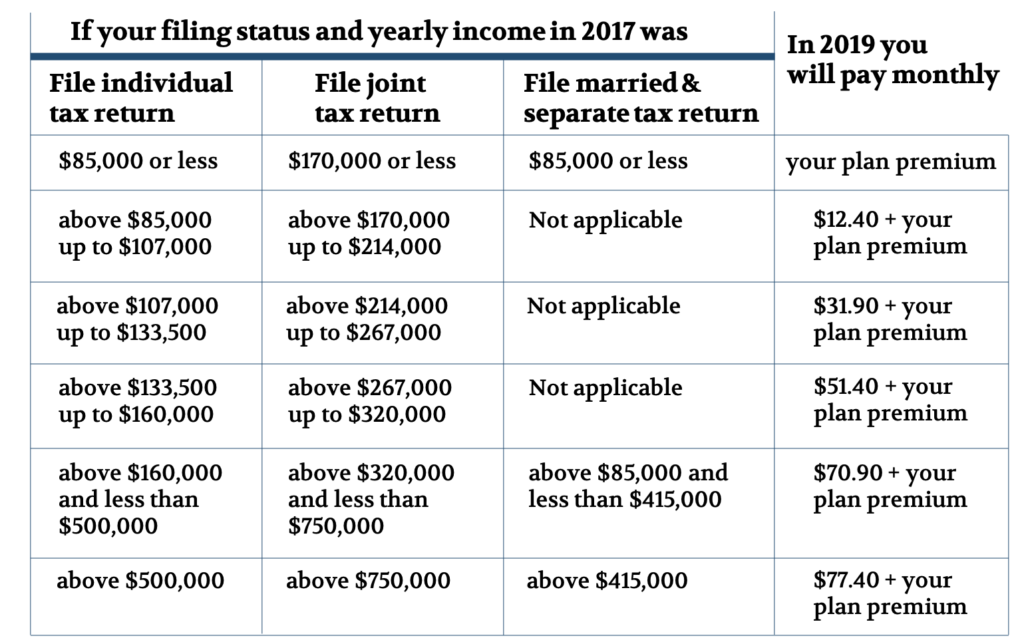

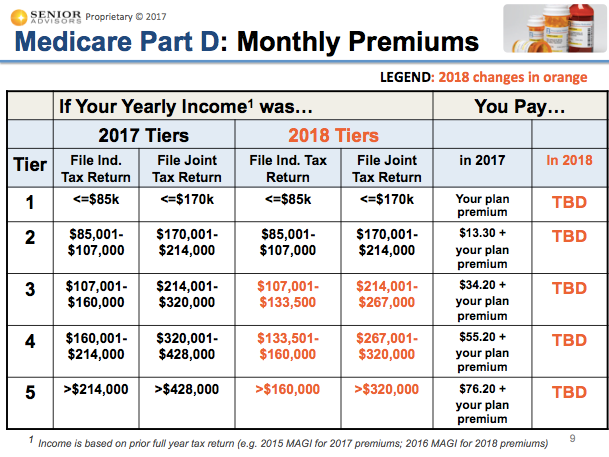

| Single Filer | Married Filing Jointly | Married Filing Separately | 2017 Monthly Premium |

| $85,000 or less | $170,000 or less | $85,000 or less | your plan premium |

| $85,001- $107,000 | $170,001- $214,000 | N/A | $13.30 + your plan premium |

| $107,001- $160,000 | $214,001- $320,000 | N/A | $34.20 + your plan premium |

| $160,001- $214,000 | $320,001- $428,000 | $85,001-$129,000 | $55.20 + your plan premium |

How much does Medicare Part D cost?

Medicare Part D also includes a "catastrophic coverage" provision. Once a patient's annual out-of-pocket costs have reached $4,950 out of pocket in 2017, he or …

Who is eligible for Medicare Part D?

For people who earn 30-39 quarter credits, the monthly premium is $227 in 2017. For those who earn fewer than 30 quarter credits, the monthly premium is $413 in 2017. Medicare Cost for 2018 Click Here To Get 2018 Pricing Even if you don’t pay a monthly premium for Part A, you’ll still be subject to the plan’s deductibles for hospital stays.

How to compare Medicare Part D plans?

Feb 28, 2017 · Medicare Part D also includes a “catastrophic coverage” provision. Once a patient’s annual out-of-pocket costs have reached $4,950 in 2017, he or she will pay only a small coinsurance amount or copayment for all covered drugs for the remainder of the year.

How much does a part D cost?

Surcharges in 2017 range from $13.30 to $76.20 a month, according to income level, in addition to the premiums that your Part D drug plan charges.

What was the Medicare Part D premium for 2017?

What were Medicare Part D premiums in 2018?

What is the annual cost of Medicare Part D?

What is the cost for Medicare Part D for 2022?

What are 2021 Medicare premiums?

How much is Medicare D per month?

Why is Medicare charging me for Part D?

What is the maximum out of pocket for Medicare Part D?

What is the Part D premium for 2022?

What is the best Medicare Part D plan for 2022?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

What is SMI in Medicare?

They needed to make sure that there were adequate reserves in the Supplementary Medical Insurance (SMI) Trust Fund. The SMI, which applies to both Medicare Part B and Part D (prescription drug coverage), is funded by beneficiary premiums, Congressional funding and general revenues. Aside from Parts B and D, the SMI pays for Medicare’s administrative costs.

How many people are covered by Medicare?

According to the Department of Health and Human Services (HHS), the agency overseeing the CMS, Medicare currently provides 47.9 million Americans 65 years or older with access to high-quality, affordable and convenient health insurance. Another 9.1 million individuals with certain disabilities, including end-stage renal disease (ESRD) and Amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease), receive this coverage today.

Will Medicare Part B premiums increase in 2016?

The news may be even better for Medicare Part B (medical insurance) premiums. As with 2013, 2014 and 2015, the majority of enrollees will not see their Medicare premiums for 2016 increase; they’ll again pay $104.90 per month. But those members who do pay a monthly premium can also take a breath of relief, as a previously announced — and huge — increase in premiums and deductibles never materialized. This increase was seen as necessary, due to multiple factors, including lack of a 2016 cost-of-living adjustment (COLA) for Social Security benefits.

Medicare Part D coverage

Understanding what drugs Part D covers is tricky, because accessing this benefit requires all patients to go through a private insurer. As such, each Part D plan provider has its own unique list of covered drugs, which Medicare refers to as a plan’s formulary.

Medicare Part D costs

Unlike other Medicare programs, the cost of accessing Part D benefits can vary wildly from person to person. A recipient’s actual expenses will change based on the drugs that he or she uses, the plan chosen, the pharmacy used, and whether the person qualifies for Medicare’s Extra Help feature.

How much did you pay in 2017 if you were not on Social Security?

If you're enrolled in Part B but are not receiving Social Security payments, or the premiums are not deducted from them, you'll pay $134 a month in 2017.

How much more will COLA pay for Part B?

In 2017, because the COLA will raise benefits by a measly 0.3 percent, they will pay an average of $4.10 more for Part B, depending on the dollar increase in their Social Security checks.

Can you pay more in Part B than you receive from Cola?

Under the law, people with Medicare who draw Social Security benefits cannot pay more in Part B premium increases than they receive from the COLA. So in 2016, these people — about 70 percent of beneficiaries — were "held harmless" from any premium increase and paid the same as they had in 2015. In 2017, because the COLA will raise benefits by ...

Will Part B premiums be paid in 2017?

If your Part B premiums are paid by your state because of low income, you will continue to pay no premiums in 2017, as long as you remain eligible for this assistance.

Will Medicare pay higher Part B premiums in 2017?

En español | Almost everyone in Medicare will pay higher Part B premiums in 2017, with most seeing modest increases while others are hit with much larger hikes.

How much is the 2017 Part D deductible?

The Part D deductible for 2017 is $400 up from $360 in 2016. It’s important to note that not all Part D plans require you to pay the deductible. Some plans begin with first dollar coverage. But as $34 is the average Part D premium those plans in that range and below are likely to require the $400 deductible before any benefit is realized.

How to get Part D for 2017?

Unless you are entitled to extra help due to a low income you have the option to obtain your 2017 Part D coverage either by enrolling in a stand-alone plan or by enrolling in a Medicare Advantage Plan that includes drug coverage. Some Medicare Advantage Plans offer $0 premiums even when drug coverage is included.

What is the 60% discount on drugs in the donut hole?

Due to legislation that closes the donut hole you will receive a 60% discount on brand name drugs while in thew donut hole. After you have spent $4950 you will enter the catastrophic portion of the Part D program.

How many Medicare beneficiaries are there?

There are approximately 55 million Medicare beneficiaries and all are eligible for Part D prescription drug coverage. The Medicare Modernization Act of 2003 established this voluntary prescription drug program for people on Medicare.

What is Medicare formulary?

The formulary is the list of covered drugs. Most Medicare Advantage Plans with drug benefits included (MAPD) have a basic formulary. A basic formulary includes the most common drugs prescribed to people on Medicare.

Does Medicare Advantage have a $0 premium?

Some Medicare Advantage Plans offer $0 premiums even when drug coverage is included. But you will not be immune to other costs associated with Part D. Part D costs include: If you are enrolling in a stand-alone Part D plan you’ll have the option of choosing a plan with either a basic or enhanced Part D formulary.

Is Part D a good plan?

The first thing you need to understand related to getting the best 2017 Part D plan is that if your drugs are not included in the Part D formulary it’s not a good plan for you. The same plan may be ideal for someone else but you need to enroll in a plan that covers your drugs. If you are considering a Medicare Advantage Plan be certain ...

How much is Medicare Advantage 2017?

Nationally, the average premium for Medicare Advantage plans will be slightly lower in 2017 as compared to 2016 ($62.48 versus $64.92). This average takes all U.S. Medicare Advantage plans into consideration and does not weight the averages by enrollment. 29% of these 2017 Medicare Advantage plans will have a $0 premium (though enrollees must continue to pay their normal Medicare Part B premium obligations). The average drug deductible amount will rise marginally to $164.71 in 2017 Medicare Advantage plans from $162.67 in 2016.

Is Medicare Advantage deductible positive?

Premium and deductible trends for Medica re Advantage and Part D are quite positive for 2017 on the national level but a state-by-state analysis reveals significant disparities in average costs. Whether examining premiums or deductibles, the differences between the averages in the most expensive states and the least expensive are substantial.

Do Medicare Advantage plans have a 0 premium?

For Medicare Advantage enrollees, some counties do have $0 premium plans. Nationally, about 29% of Medicare Advantage plans have $0 premium (though, as mentioned earlier, enrollees are still responsible to pay their Medicare Part B premiums). For Medicare beneficiaries living in areas without those options or who prefer stand-alone Part D drug plans, the state-by-state cost differences in premiums and deductibles raise questions regarding what can be done to improve the situation.

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the average Social Security premium for 2017?

Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold harmless” provision include beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2017, those who are directly billed for their Part B premium, those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies, and those who pay an income-related premium. These groups represent approximately 30 percent of total Part B beneficiaries.

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.

How much is the initial deduction for 2017?

Initial Deductible: will be increased by $40 to $400 in 2017. Initial Coverage Limit: will increase from $3,310 in 2016 to $3,700 in 2017. Out-of-Pocket Threshold: will increase from $4,850 in 2016 to $4,950 in 2017.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

What is the increase in the cost of a generic drug in 2017?

will increase to greater of 5% or $3.30 for generic or preferred drug that is a multi-source drug and the greater of 5% or $8.25 for all other drugs in 2017. will increase to $3.30 for generic or preferred drug that is a multi-source drug and $8.25 for all other drugs in 2017.

Does Medicare Part D count toward TROOP?

The 50% discount paid by the brand-name drug manufacturer will apply to getting out of the donut hole, however the additional 10% paid by your Medicare Part D plan will not count toward your TrOOP.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover prescription drugs?

Option al benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare.