What is a Medicare PPO plan?

A Medicare PPO, or Preferred Provider Organization, is just one type of Medicare Advantage plan. What is a Medicare PPO plan, and could a PPO plan be a good fit for your health coverage needs?

How much can I expect to spend with a PPO?

For example, your PPO may have an out-of-pocket limit of $1,000 for your in-network costs, and an out-of-pocket limit of $4,000 for your combined in-network and out-of-network costs. You could reach the combined limit by spending $1,000 on in-network services and $3,000 on out-of-network services, or by spending $4,000 on out-of-network services.

How many Medicare PPO plans are available in 2018?

There were 618 Medicare PPO plans available in 2018, which represented about 28 percent of all available Medicare Advantage plans. 1 As of 2018, every state except Alaska, Delaware, Minnesota, New Hampshire, North Dakota and Wyoming offered at least one local or regional Medicare PPO plan.

Do Medicare PPO plans pay out of pocket?

Medicare PPO plan beneficiaries will typically pay less money out of pocket if they receive care out of their network of providers, however, when compared to beneficiaries of other types of health plans. Where can I sign up for Medicare PPO plans?

What is the average monthly cost for a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100.

What is the cost of Medicare Advantage plans in 2022?

How much does Medicare Advantage cost per month? In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month.

What is the average deductible for a Medicare Advantage plan?

Average Cost of Medicare Advantage Plans in Each StateStateMonthly PremiumPrescription Drug DeductibleCalifornia$48$377Colorado$49$343Connecticut$79$318Delaware$64$23946 more rows•Mar 21, 2022

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the maximum out-of-pocket for Medicare Advantage plans?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

What will Medicare not pay for?

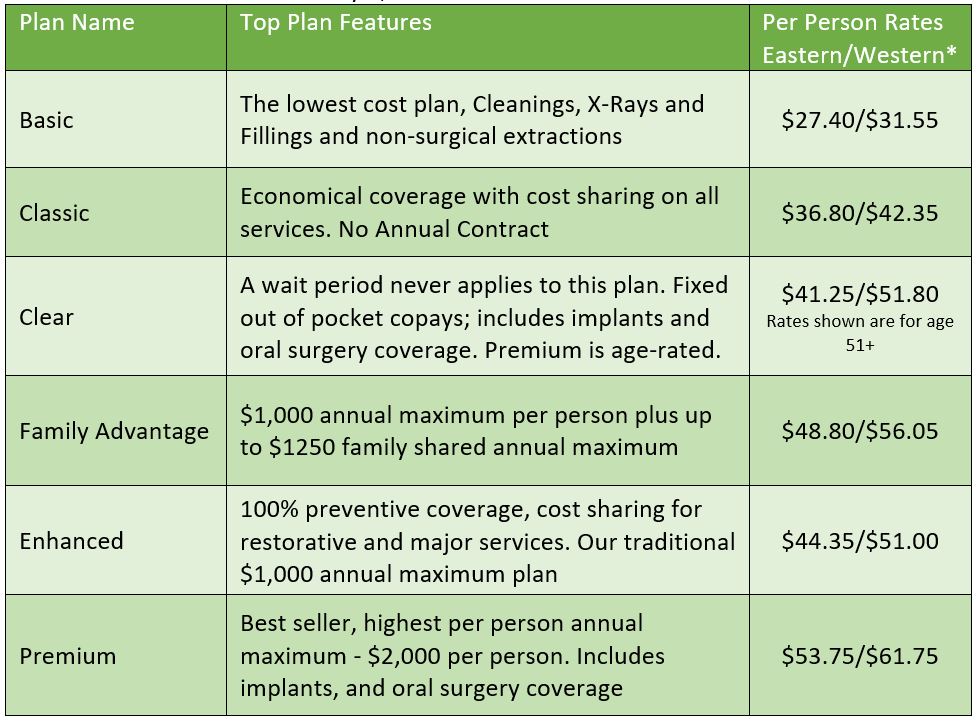

Medicare doesn't provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500.

Do Medicare Advantage plans pay the Part B deductible?

Regardless of the monthly premium your Medicare Advantage plan charges, you will still have to pay your Medicare Part B premium.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Do PPOs have the same benefits as Medicare?

Register. Medicare Preferred Provider Organizations (PPOs) must provide you with the same benefits as Original Medicare but may do so with different rules, restrictions, and costs. PPOs can also offer additional benefits. Below is a list of general cost and coverage rules for Medicare PPOs.

Do PPOs charge higher premiums?

Plans may charge a higher premium if you also have Part D coverage. Plans may set their own deductibles, copayments, and other cost-sharing for services. PPOs typically set fixed copays for in-network services and may charge more if you see an out-of-network provider.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare Advantage Plan?

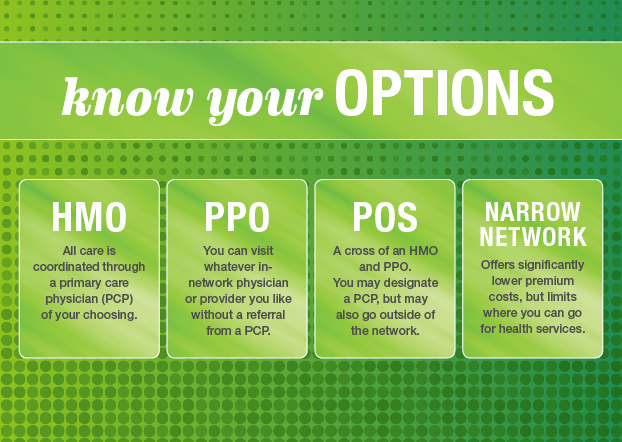

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

Who accepts Medicare?

who accepts. assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan.

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is a PPO plan?

They are provided by Medicare-approved, private health companies. A PPO plan is comprised of a group , called a network, of healthcare providers and hospitals from which a person can choose. These providers will be cheaper than using providers outside of the network. Most PPO plans are flexible, and a person can receive services from any healthcare ...

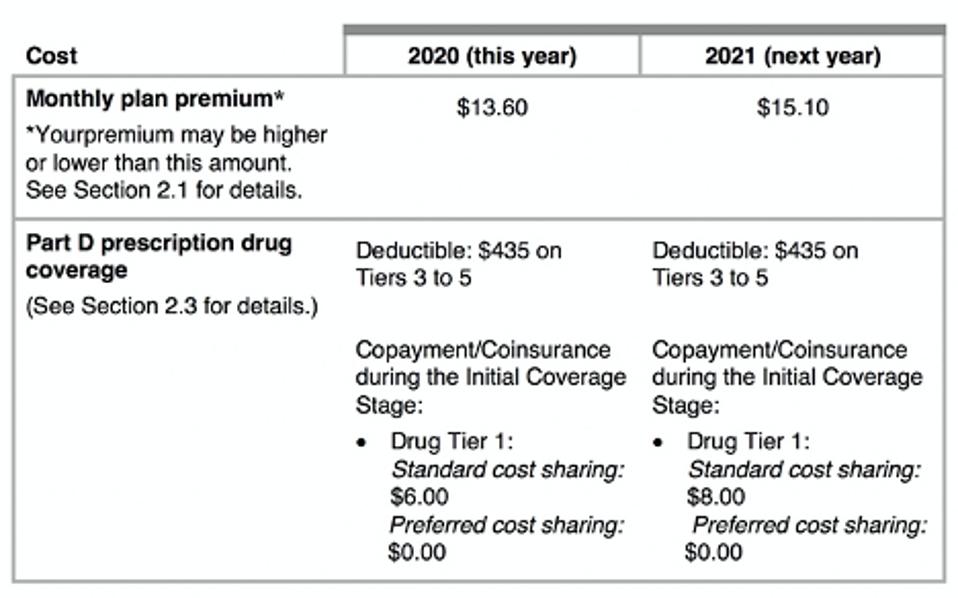

How much does a PPO cost in 2021?

In 2021, the regular cost of a Medicare Part B is $148.50 per month. It may be higher depending on a person’s income.

What is the difference between a PPO and an HMO?

PPO vs. HMO. While PPO plans and Health Maintenance Organization (HMO) plans share many characteristics, PPO plans offer more flexibility. A Medicare Advantage HMO plan member usually must receive their healthcare from a list of providers in the plan’s network. In contrast, people with a PPO plan can choose someone from outside of their network, ...

What is not covered by Medicare Advantage?

What is not covered? A Medicare Advantage PPO plan is a type of Medicare Advantage plan offered by a private health insurance company. Preferred Provider Organization (PPO) plans usually have an in-network or group of healthcare providers and hospitals from which to choose. Choosing a health care provider that is in-network may cost less ...

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

When do PPO plans change?

It may be higher depending on a person’s income. Keep in mind that PPO plans often make changes on the 1st day of each year. They may make changes to any or all of the following: benefits. pharmacy network. provider network. premium. copayments and coinsurance.

Does a PPO plan have a copay?

However, it is important to note that every PPO plan is different and may offer different coverage. Many prescription drugs have a copay . The copay amount will usually be less for a generic drug than for a particular brand.

What are the advantages of Medicare PPO?

The most significant advantage that a Medicare PPO plan offers is the flexibility to choose providers based upon your own preferences rather than being restricted to the plan’s in-network selections.

What is a PPO plan?

Medicare PPO plans are one of several types of Medicare Advantage plans available to those who are eligible for original Medicare. Every Medicare PPO plan provides both Medicare Part A and Medicare Part B benefits and caps the out-of-pocket spending that is required, but in doing so it also provides enrollees the freedom to choose ...

What is Medicare Advantage?

Among the Medicare Advantage plans there are several different types and options, all of which are offered by private insurance companies. Medicare Preferred Provider Organizations, or PPO plans, are among the most popular of these options. PPO plans allow beneficiaries the flexibility of using their in-network physicians ...

How long is the Medicare enrollment period?

The Initial Enrollment Period (IEP) and Initial Coverage Election Period (ICEP). When you become eligible for Medicare (by turning 65), there is a 7-month enrollment period that begins three months before you become eligible, includes the month that you become eligible, and ends three months after the month that you become eligible.

What is Medicare expert?

As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies. Once you are eligible for Medicare and enroll in both Parts A and Parts B, you have the option of remaining with that basic coverage or arranging for additional benefits via either a Medicare Advantage plan that is available in your state ...

How old do you have to be to get medicare?

Eligibility for Medicare is linked to being either a U.S. citizen or a legal resident of the United States for a minimum of five years and who have turned 65 years old. Disabled individuals who are under the age of 65 are also eligible for Medicare and can enroll in the program once they have been receiving either Social Security disability ...

Does Medicare PPO have copays?

There are also copays for hospital stays and services. Every Medicare PPO publishes a Summary of Benefits that provides details regarding the copay amounts for each of these services. Medicare PPO enrollees will pay higher costs for services from out-of-network providers and less for services from those who are in the plan’s network.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).