Cost protections In 2014 This year, Medicare will keep a set Part B premium of $104.90 and an annual deductible of $147. Maximum premiums for Part A will decrease slightly, to $426, although, as the report points out, the majority of seniors enrolled don't pay premiums for Part A at all.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

Does my income level affect my Medicare Part A premiums?

Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes. Most Part A beneficiaries qualify for premium-free Part A coverage.

How much does Medicare Part B cost?

Medicare costs at a glance. The standard Part B premium amount is $135.50 (or higher depending on your income).

How much is the average Medicare premium for 2020?

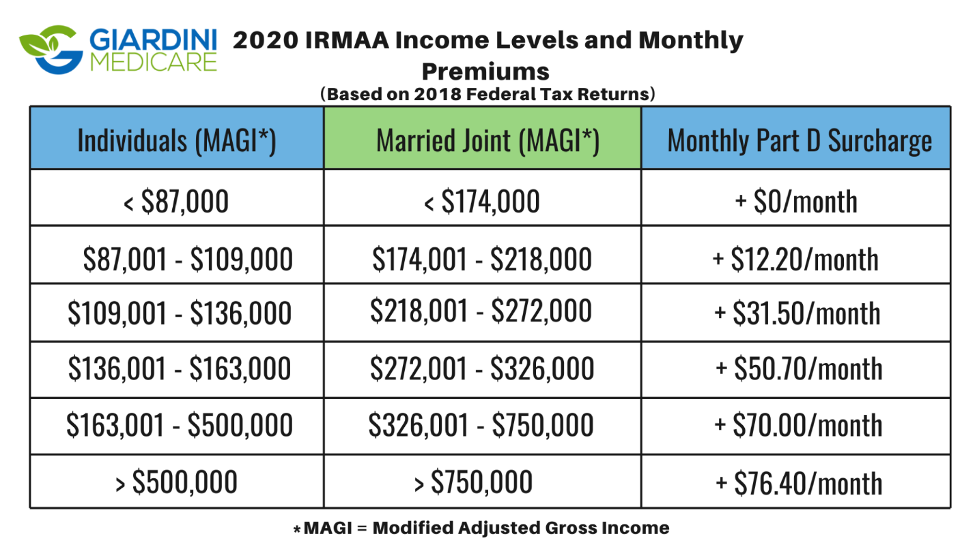

Monthly Medicare premiums for 2020 The standard Part B premium for 2020 is $144.60. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

How much did Medicare cost in 2014?

Per-enrollee spending increased by 3.2 percent in 2014. Average growth in per-enrollee spending was 7.4 percent from 2000-2009. Medicare spending, which represented 20 percent of national health spending in 2014, grew 5.5 percent to $618.7 billion, a faster increase than the 3.0 percent growth in 2013.

How much did Medicare cost in 2013?

Most people will pay more for this government health care plan for seniors.2011 ADJUSTED GROSS INCOME$85,000 or less (single), $170,000 or less (joint)More than $214,000 (single), more than $428,000 (joint)2013 Medicare Part B monthly premium$104.90$335.702013 Medicare Part D monthly premiumpremium only$66.40 surcharge

What was the cost of Medicare Part B in 2015?

$104.90 per monthMost beneficiaries pay $104.90 per month for Medicare Part B.

What were Medicare premiums in 2015?

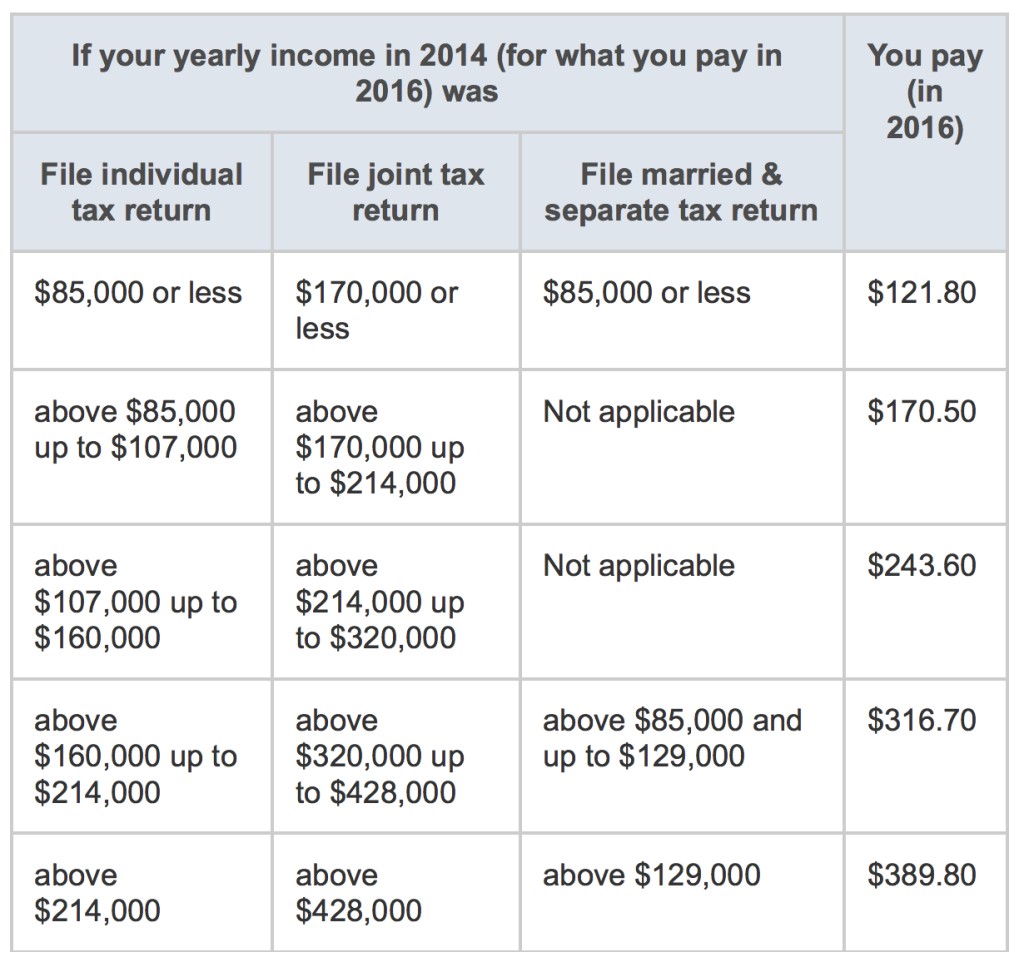

As a result of the Bipartisan Budget Act of 2015, the Part B monthly premium will be increasing for 30 percent of Part B enrollees from $104.90 in 2015 to $121.80 in 2016—a 16 percent increase, but far less than the increase initially projected by the Medicare actuaries (Figure 1).

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

When did Medicare start charging a premium?

July 30, 1965July 30, 1965: With former President Harry S. Truman at his side, President Lyndon B. Johnson signs the Medicare bill into law.

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

Are Medicare premiums adjusted for inflation?

Medicare Part B premiums are indexed for inflation. They're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you'll pay next year.

How much has Medicare gone up?

The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month. The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021.

How much did Medicare deductible increase in 2014?

The Centers for Medicare and Medicaid Services also announced that the Medicare Part A deductible, which people pay when admitted to the hospital, will increase by $32 in 2014, to $1,216.

How much was Medicare Part B in 2014?

How much will I pay in premiums for Medicare Part B in 2014? And is there still a high-income surcharge for Part B and Part D prescription-drug coverage? The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013.

What is the income limit for seniors in 2012?

Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than $170,000 if married filing jointly or $85,000 if single will continue to pay higher premiums, as they have since 2007. The high-income surcharges remain the same as in 2013.

What is the Part B and Part D surcharge based on?

Both the Part B and Part D surcharges are based on your income in 2012, which is the last tax return the government has on file for most people.

News not so bad related to 2014 Medicare Premiums and deductibles

Anyone who has been enrolled in Medicare for a while knows that this is the time of year when CMS announces any changes in Medicare Premiums and deductibles.

2014 Medicare premiums

The following table shows Part B premiums based on income. The vast majority of people pay $104.90 per month. The 2014 Part B premiums are remaining at the same level as 2013 premiums.

What is Medicare Advantage 2014?

2014 Part C (Medicare Advantage) Monthly Premium. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

What is the deductible for Medicare Part B in 2014?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2014 Medicare Part B annual deductible remains $147 (unchanged from 2013). *If you pay a late-enrollment Penalty, your monthly premium is higher.

How much is the 2014 Part D premium?

The 2014 Part D plan premiums range from $3 to $175. The 2014 standard Part D plan deductible is $310, however the actual plan deductible can be anywhere from $0 to $310 .

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What is fee for service in Medicare?

Since the inception of Medicare, fee-for-service claims have been processed by nongovernment organizations or agencies under contract to serve as the fiscal agent between providers and the federal government. These entities apply the Medicare coverage rules to determine appropriate reimbursement amounts and make payments to the providers and suppliers. Their responsibilities also include maintaining records, establishing controls, safeguarding against fraud and abuse, and assisting both providers and beneficiaries as needed.

When did Medicare pay for inpatient hospital care?

1989. The spell of illness and benefit period coverage of laws before 1988 return to the determination of inpatient hospital benefits in 1990 and later. After the deductible is paid in benefit period, Medicare pays 100 percent of covered costs for the first 60 days of inpatient hospital care.

How many days are covered by Medicare?

The number of SNF days provided under Medicare is limited to 100 days per benefit period (described later), with a copayment required for days 21 through 100.

What is Medicare Advantage?

Medicare Advantage plans are offered by private companies and organizations and are required to provide at least those services covered by Parts A and B, except hospice services. These plans may (and in certain situations must) provide extra benefits (such as vision or hearing) or reduce cost sharing or premiums.

How many days of inpatient hospital care can you use for Medicare?

If a beneficiary exhausts the 90 days of inpatient hospital care available in a benefit period, the beneficiary can elect to use days of Medicare coverage from a nonrenewable “lifetime reserve” of up to 60 (total) additional days of inpatient hospital care. Copayments are also required for such additional days.

How long do you have to be on Medicare to receive Part A?

Similarly, individuals who have been entitled to Social Security or Railroad Retirement disability benefits for at least 24 months, and government employees or spouses with Medicare-only coverage who have been disabled for more than 29 months, are entitled to Part A benefits.

When was Medicare first introduced?

When first implemented in 1966 , Medicare covered most persons aged 65 or older.

Medicare Part A and Part B Changes from 2013 to 2014

Medicare Part A in 2014

- 2014 Medicare Part A Premium:

The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate. - 2014 Medicare Part A Deductible:

The 2014 Medicare Part A deductible will be $1,216per benefit period, up from $1,184 per benefit period in 2013.

Medigap Protection Against Deductibles, Co-Pays, and Coinsurance

- Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next. An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all …