Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

How much will Medicare cost this year?

You are eligible for Medicare and premium-free Part A, if you or your spouse paid federal taxes for 40 quarters. If you do not have 40 quarters, you may be eligible to purchase Part A coverage. This costs $458.00 per month if you have less than 30 quarters. If you paid federal taxes for 30 – 39 quarters, the monthly premium for Part A is $252.00.

What is the average monthly cost of Medicare?

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age. 1 Medicare Supplement Insurance Plan F premiums in 2021-2022 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month).

How much is the standard Medicare premium?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

How much are Medicare premiums for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the cost of original Medicare in 2022?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the Part B monthly premium for 2021?

$148.50The standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much does Original Medicare cost per month?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the average out of pocket cost for Medicare?

Our analysis shows that Medicare beneficiaries spent $5,460 out of their own pockets for health care in 2016, on average, with more than half (58%) spent on medical and long-term care services ($3,166), and the remainder (42%) spent on premiums for Medicare and other types of supplemental insurance ($2,294).

How much money is taken out of my Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Do they take money out of Social Security for Medicare?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much will Medicare cost in 2021?

The deductible for Part A is $1,484. The deductible for Part B is $203. The premium for Part B is $148.50.

How much does a beneficiary get for free Part A?

Most beneficiaries are eligible for free Part A. Those that don’t qualify could pay up to $471 a month. Some people may be close to qualifying; for example, if you contribute taxes for 30 quarters, you’re premium would be $259 a month.

How much is Part A copayment?

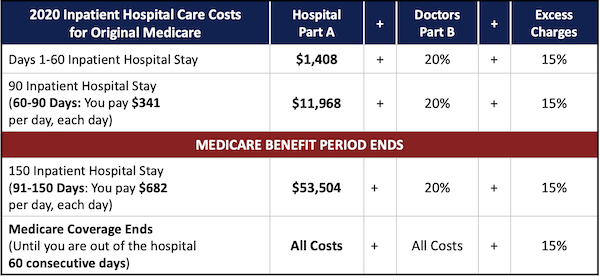

How Much are Copayments Under Part A? Copayments for Part A apply when you stay for more than 60 days in a hospital during a single benefit period or 20 days in a Skilled Nursing Facility. For example, days 6 through 90 cost $352 per day for each benefit period. Then, days 91 and further cost $702 each day. In a Skilled Nursing Facility, days 21 ...

Is Medicare Advantage a low cost plan?

Many Medicare Advantage plans across the nation have a $0 premium or a low monthly cost in general. While this coverage can seem appealing to many Americans, there are disadvantages to Medicare Advantage plans. Saving on the premium is great until you get sick and need real coverage.

Does Medicare cost change?

Medicare Costs at a Glance. Medicare costs change annually. Most of the time you’ll see increases year over year. We’ll go over all cost-sharing including premiums, deductibles, coinsurances, and copayments for all Medicare parts to give you a rough estimate on what you can expect to pay out of pocket in 2021.

Does Medicare Advantage have a deductible?

There are Medicare Advantage plans that don’t have a deductible for medical or prescription costs; although, many have a Part D deductible that applies. If the advantage plan you have requires a medical deductible, only care that’s in-network will apply towards that deductible.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much is Medicare Part A and Part B in 2021?

With Medicare Part A and Part B, you will pay premiums, deductibles, coinsurance, and copayments for your healthcare. The 2021 deductibles are $1,484 per benefit period for Part A and a yearly $203 for Part B. Part B premiums start at $148.50 in 2021. You can expect to pay 20% of the Medicare-approved amount for covered services as coinsurance.

How much is the Part A deductible for 2021?

The Part A deductible for 2021 is $1,484 for each benefit period.

How much is Part B insurance in 2021?

The standard Part B premium in 2021 is $148.50. If you made more than $88,000 as an individual in 2019 or more than $176,000 as a married couple in 2019, you will pay higher premiums thanks to an additional charge called the Income Related Monthly Adjustment Amount (IRMAA).

Do you have to pay a copayment for a Part B hospital?

You will pay a copayment for Part B-covered outpatient hospital services, but this is capped at 20% of the Medicare-approved amount for covered services. You will pay a copayment for each service provided. Some preventive services do not require a copayment.

How much is Medicare premium for 2020?

Although most Medicare beneficiaries receive Part A with no premium, if you do have to pay for it, the premium in 2020 is $458 per month if you worked less than 7.5 years, and $252 per month if you worked between 7.5 and 10 years.

How much is Medicare Part B?

Medicare Part B has a standard monthly premium of $144.60 in 2020, for people who earn up to $87,000 a year ($174,000 for a married couple). The premiums are higher if your income exceeds that amount. Part B enrollees pay an annual deductible of $198 in 2020. The Social Security Cost of Living Adjustment (COLA) was sufficient to cover the full amount of the Part B premium increase in 2020 for most beneficiaries, so most people are paying the standard premium.

Part A

Part A coverage includes hospital inpatient care, skilled nursing facility care, nursing home care (not custodial or long-term), hospice care, and home health care.

Part B

All Medicare beneficiaries pay premiums for Part B. The standard Part B premium is $148.50 for those filing an individual income less than $88,000 or filing jointly with an income less than $176,000.

Medicare Part A Costs

Medicare Part A covers hospital care (including inpatient mental health) and skilled nursing facility care. Most people get Part A for free, meaning no premium. That’s because Part A is funded through work taxes.

Medicare Part B Costs

Medicare Part B covers medically necessary outpatient care. This is a pretty broad portion of Medicare that includes things like:

Medicare Advantage Costs

Medicare Advantage is the private alternative to Original Medicare. Sold by individual companies on the private market, these plans are nevertheless still regulated by the federal government. By law, for instance, Medicare Advantage plans have to cover at least the same benefits as Original (both Part A and Part B).

Medicare Part D Costs

Original Medicare doesn’t cover prescription drugs, with the exception of a set of specific medications that are typically administered in a clinical setting, such as chemotherapy treatments. But for regular prescriptions, like blood pressure pills or insulin, you’ll need to find separate coverage for these.

Medigap Costs

Medicare supplement plans, also called Medigap, help cover the gaps left by Original Medicare — the gaps in cost, that is. In other words, they help offset out-of-pocket costs under Part A and/or Part B.