2016 Medicare costs

| Medicare costs | 2015 | 2016 |

| Part A monthly premium | Up to $407 | Up to $411 |

| Part A inpatient hospital stay deductibl ... | $1,260 | $1,288 |

| Part A inpatient hospital stay co-insura ... | Days 61-90: $315 per day Days 91+: $630 ... | Days 61-90: $322 per day Days 91+: $644 ... |

| Part A skilled nursing facility co-insur ... | Days 21-100: $157.50 per day | Days 21-100: $161 per day |

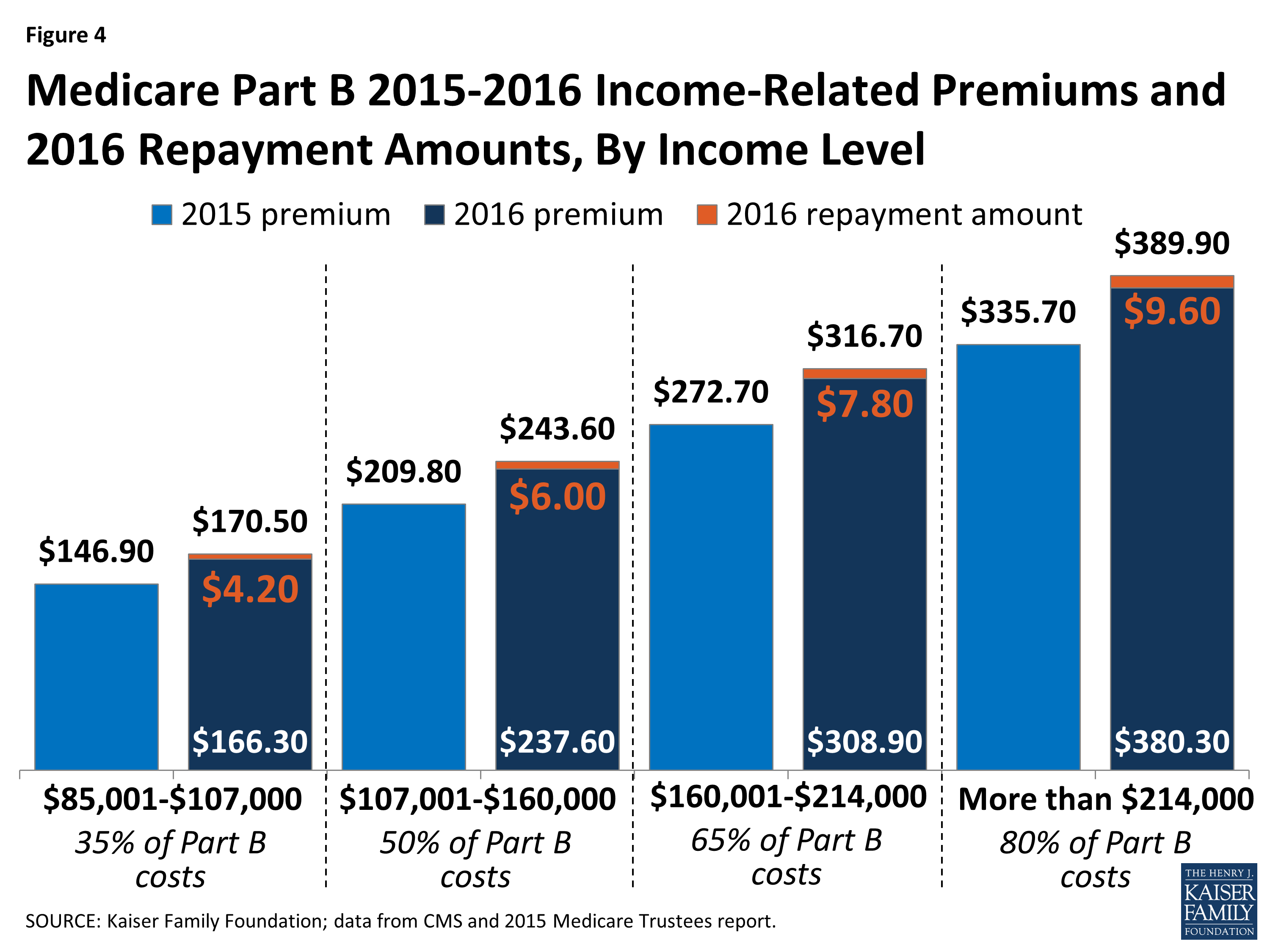

| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

| $160,001 - $214,000 | $320,001 - $428,000 | $316.70 |

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

Who is eligible for Medicare?

These are as follows: The Initial Enrollment Period(When a person turns 65 and decides what to do about Medicare). Generally, people are first eligible to enroll in Medicare during their IEP. This is a seven-month period, wrapped around a person’s 65th ...

What does Medicare cost?

Medicare Part B. Part B is for your doctor visits, tests, and other services. Premium costs: Each month you pay a premium of $148.50. If your income is higher than $85,000, you have to pay a ...

What was the Medicare Part A deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What was the monthly cost of Medicare in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the cost of Medicare Part B in 2015?

$104.90 per monthHow much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums.

What was the premium for Medicare in 2017?

Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years. For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80.

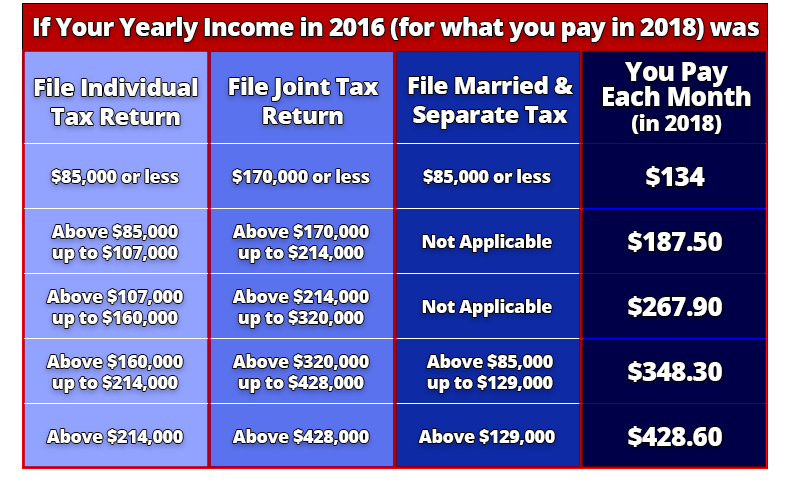

What is the cost for Medicare Part B for 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the cost of Medicare Part B for 2020?

$144.60 forMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

How much did Medicare cost in 2008?

$96.40The standard Medicare Part B monthly premium will be $96.40 in 2008, an increase of $2.90, or 3.1 percent, from the $93.50 Part B premium for 2007.

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What is the cost of Medicare Part B for 2019?

$135.50The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How much did Medicare go up in 2018?

Medicare Part A Premiums/Deductibles The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

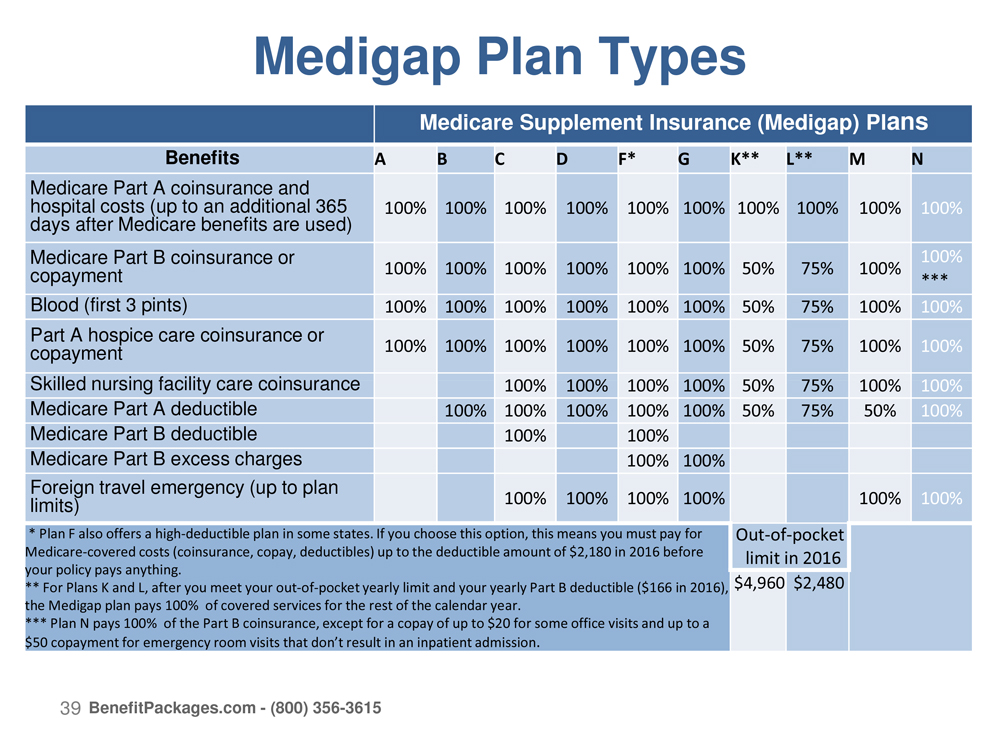

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

Is there a penalty for late enrollment in Medicare Part A?

Note that beneficiaries who delay enrollment in Medicare Part A after they first become eligible may be subject to a late-enrollment penalty in the form of a higher premium. Medicare Part B has an annual deductible ($166 in 2016).

How much is Medicare Part B?

The Medicare Part B premium will remain the same at $104.90 per month for most individuals. The Social Security Administration recently announced that there will be no cost of living increase for 2016.

Do Part B beneficiaries have to pay higher premiums?

Some Part B beneficiaries will have to pay slightly higher premiums. These beneficiaries include those not collecting Social Security benefits, those who are enrolling in Part B in 2016 for the first time, dual-eligible beneficiaries, and those who pay an additional income-related premium.

Will Medicare increase in 2016?

Medicare beneficiar ies will face higher Medicare costs in 2016. Several costs, including the Part A deductible, the Part A inpatient hospital stay co-insurance, and the Part B deductible will increase in 2016, according to a Centers for Medicare & Medicaid Services (CMS) news release .

Will Medicare Part B be held harmless?

Due to this, most Part B beneficiaries will be “held harmless” from premium increases in 2016, according to the CMS release. “Our goal is to keep Medicare Part B premiums affordable,” said Andy Slavitt, CMS Acting Administrator.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.