Beginning in 2011, the Affordable Care Act (ACA) took measures to close the donut hole, known as the Coverage Gap. Then, in 2012, the ACA implemented discounts for the Coverage Gap. In 2019, discounts meant that beneficiaries paid 25% of the cost for any brand-name medication, officially closing the donut hole, and 37% for generics.

What is the coverage gap in Medicare?

Dec 12, 2019 · The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage Prescription Drug plans pay for prescription drug costs. This gap will officially close in 2020, but you can still reach this out-of-pocket threshold where your medication costs may change.

What is the Medicare Part D coverage gap for 2021?

Nov 06, 2019 · Last Updated : 11/06/2019 4 min read. Summary: The Medicare coverage gap is the phase of your Medicare Part D benefit after you and your plan spend a certain amount within a year. The gap officially closes in 2020, but you could still spend more than the initial coverage limit and then pay a different amount for your medications.

What is the coverage gap for generic drugs in 2019?

Feb 09, 2018 · Under Friday’s budget deal, the doughnut hole will now close next year. Beginning in 2019, Part D enrollees will pay 25 percent of the cost of all their prescription drugs from the time they enter the gap until they reach catastrophic coverage. For 2018, the threshold for entering the doughnut hole remains at $3,750 worth of drug costs.

What is the Medicare Part D prescription drug gap?

Feb 14, 2022 · While you’re in the coverage gap, you’ll need to pay 25% of the cost of generic and brand-name drugs, until what you pay reaches $7,050. Catastrophic coverage kicks in when you’re out of the gap, leaving you responsible for just 5% of your drug costs. This lasts until the end of the year when your coverage ends and your plan restarts. The monthly statements you obtain …

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

What is the Medicare donut hole amount for 2019?

$3,820In 2019, you enter the donut hole when the total cost of your drugs (including the part you pay and the part your plan pays) reaches $3,820. Note that you will have paid much less than this amount out-of-pocket, because your drug plan will have picked up the majority of the cost.

Is the Medicare coverage gap going away?

Key Takeaways. The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

Is there a donut hole for Medicare in 2020?

The Medicare donut hole is the term used to refer to the coverage gap you can experience after reaching out-of-pocket cost thresholds when paying for prescription drugs. The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs.

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

How does Medicare Part D calculate donut holes?

Here's what counts toward the Medicare donut hole:Plan deductible.Coinsurance/copayments for your medications.Any discount you get on brand-name drugs. For example, if your plan gives you a manufacturer's discount of $30 for a medication, that $30 counts toward the Medicare Part D donut hole (coverage gap).

What year does Medicare donut hole end?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Does Medigap cover the donut hole?

There is not a Medicare plan that covers the donut hole. You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare.Dec 2, 2021

Why didn't the donut hole go away?

The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump. Are you looking for Medicare Part D prescription drug coverage?Feb 22, 2021

Is the Medicare donut hole going away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

What happens when the donut hole ends in 2020?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

How much is the coverage gap for 2020?

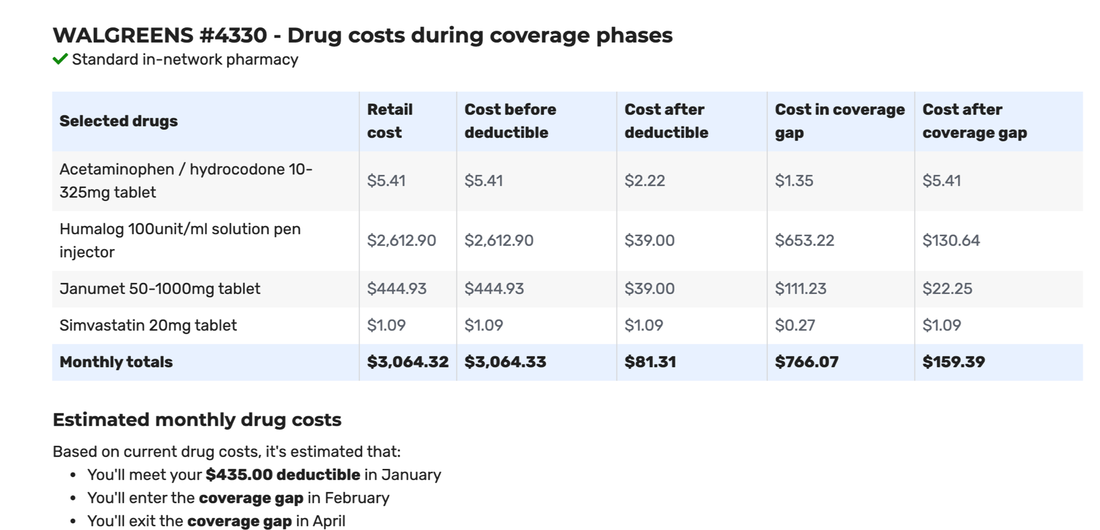

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

What happens after you reach your Medicare deductible?

After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below). Initial coverage phase: After you’ve ...

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

How many phases are there in Medicare?

Stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans can have the following four coverage phases, as applicable: Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach ...

What is the Medicare coverage gap?

As of 2019, Medicare beneficiaries enrolled in Part D prescription drug plans will no longer be exposed to a coverage gap, sometimes called the “donut hole”, when they fill their brand-name medications. The coverage gap was included in the initial design of the Part D drug benefit in the Medicare Modernization Act of 2003 in order to reduce ...

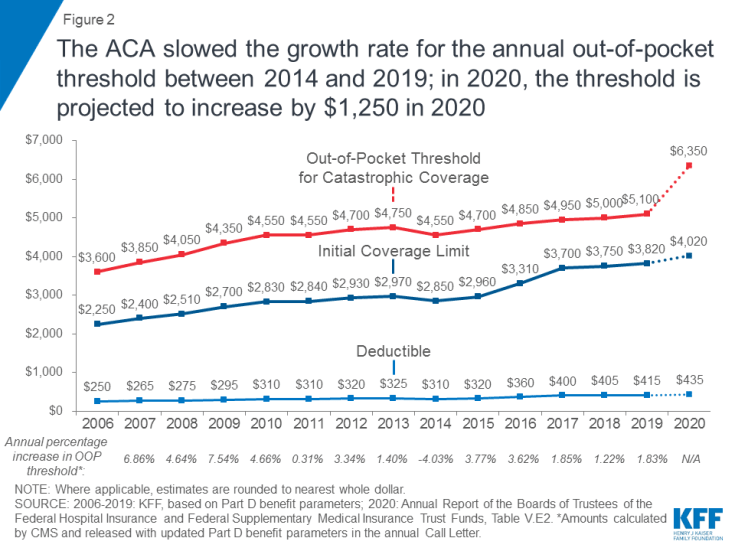

How did the ACA phase out the coverage gap?

The Affordable Care Act (ACA) included a provision to phase out the coverage gap by gradually reducing the share of total drug costs paid by non-LIS Part D enrollees in the coverage gap, from 100 percent before 2011 to 25 percent in 2020. The ACA required plans to pay a gradually larger share of total drug costs, and also required drug manufacturers to provide a 50 percent discount on the price of brand-name drugs in the coverage gap, beginning in 2011. The ACA stipulated that the value of this discount would count towards a beneficiary’s annual out-of-pocket spending.

What is the out of pocket spending threshold for 2020?

Between 2019 and 2020, the annual out-of-pocket spending threshold—the amount beneficiaries must spend before the coverage gap ends and catastrophic coverage begins—is projected to increase by $1,250. This is due to the expiration of the ACA provision that slowed the growth rate of this threshold between 2014 and 2019.

How much did Part D drug spending increase?

With total Part D drug spending increasing over time and more non-LIS beneficiaries reaching the coverage gap, the aggregate discount that Part D enrollees have received on brand-name drugs has also increased—from $2.2 billion in 2011 to $5.7 billion in 2016.

When did Medicare Part D coverage gap start?

Under the original design of the Medicare Part D benefit, created by the Medicare Modernization Act of 2003, when Part D enrollees’ total drug spending exceeded the initial coverage limit (ICL), they entered a coverage gap. Enrollees who did not receive low-income subsidies ...

Will the BBA change the coverage gap?

There are efforts underway in Congress to modify the coverage gap changes made by the BBA, while also preventing the upcoming steep increase in the out-of-pocket spending threshold. The effort to modify the BBA changes would reallocate payer liability in the coverage gap, motivated in part by pharmaceutical industry concerns about the requirement that they provide a larger discount on brand-name drugs starting in 2019. In addition, there is some concern that the reduced share of brand-name drug costs paid by plans in the coverage gap will weaken their financial incentive to manage enrollees’ costs once they cross the initial coverage limit and enter the coverage gap phase of the benefit.

Will there be a coverage gap for generic drugs?

As of 2019, there will no longer be a coverage gap for brand-name drugs, as a result of changes in the BBA. Beneficiary coinsurance for brands in the gap will be 25 percent in 2019, the same share of costs that they face for brands under the standard benefit design before they reach the coverage gap. The coverage gap for generic drugs will not be fully closed until 2020, as scheduled in the ACA. In 2019, beneficiaries will pay 37 percent of the cost of generic drugs, and plans will pay the remaining 63 percent.

When will the Medicare gap close?

The gap officially closes in 2020, but you could still spend more than the initial coverage limit and then pay a different amount for your medications. You might not reach this stage at all. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area.

How to delay or avoid coverage gap?

How can I delay or avoid reaching the coverage gap? There are a number of things you can do to help lower your prescription drug costs all year long and delay or avoid reaching the coverage gap: Talk to your doctor about using lower-cost generics that are right for you.

How much is Medicare deductible in 2020?

This is when your total out-of-pocket costs, including the annual deductible and copayments/coinsurance, reach $6,350 in 2020. If you reach the catastrophic phase, you’ll pay a small amount for each covered medication for the rest of the year. Some Medicare Advantage Prescription Drug plans and stand-alone Medicare Prescription Drug Plans provide ...

What is a donut hole in Medicare?

Most Medicare Advantage Prescription Drug plans and Medicare Prescription Drug Plans have a coverage gap, or “donut hole.”. The coverage gap is reached when your total drug costs (what you and your plan pay) exceed the initial coverage limit ($4,020 in 2020). You then pay for a certain portion of prescription drug costs out-of-pocket ...

What happens if you exceed your coverage limit?

After you exceed the initial coverage limit, you may have to pay more for your prescription drugs, until you reach the catastrophic coverage phase. Note that some plans don’t require you to pay higher costs in this “coverage gap.”. Most Medicare Advantage Prescription Drug plans and Medicare Prescription Drug Plans have a coverage gap, ...

How much will I pay for prescriptions in 2020?

However, if you and your plan spend past the initial coverage limit, you’ll still enter this coverage phase. In 2020, you’ll pay up to 25% for generic prescription drugs ...

Can I use a preferred pharmacy with Medicare?

This might save you money with many plans. Use a “preferred” pharmacy if your plan has both preferred and non-preferred pharmacies in its network.

What is the gap in Medicaid coverage?

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid. The economic downturn and change in Administration are likely to bring renewed attention to gaps in Medicaid coverage in states that have not expanded eligibility under the Affordable Care Act (ACA). In recent months, millions have gained health insurance coverage ...

Why do people fall into the Medicaid coverage gap?

At a time when many need health care services due to the health care crisis or face loss of financial security due to the economic downturn, millions fall into the Medicaid coverage gap due to their state’s decision not to expand eligibility.

What is the ACA expansion?

The ACA Medicaid expansion was designed to address historically high uninsured rates among low-income adults, providing a coverage option for people with limited access to employer coverage and limited income to purchase coverage on their own. In states that expanded Medicaid, millions of people gained coverage, ...

What percentage of people in the Medicaid coverage gap are adults without dependent children?

Reflecting limits on Medicaid eligibility outside ACA pathways, most people in the coverage gap (77%) are adults without dependent children. 4. Adults left in the coverage gap are spread across the states not expanding their Medicaid programs but are concentrated in states with the largest uninsured populations.

How many people would be eligible for Medicaid if they were not expanding?

If states that are currently not expanding their programs adopt the Medicaid expansion, all of the nearly 2.2 million adults in the coverage gap would gain Medicaid eligibility. In addition, 1.8 million uninsured adults with incomes between 100 and 138% of poverty 6 (most of whom are currently eligible for Marketplace coverage) ...

What is the uninsured rate in 2019?

In 2019 the uninsured rate in non-expansion states was nearly double that of expansion states (15.5% vs. 8.3%). By definition, people in the coverage gap have limited family income and live below the poverty level.

What happens if you remain uninsured?

If they remain uninsured, adults in the coverage gap are likely to face barriers to needed health services or, if they do require and receive medical care, potentially serious financial consequences.

What is the coverage gap in Part D?

Part D beneficiaries who have high prescription drug expenses currently have to pay more once the total cost of their medicines reaches a certain threshold. That’s due to a quirky aspect of Part D called the coverage gap, also known as the " doughnut hole .".

What percentage of Medicare is covered by generics?

Once a Medicare enrollee passes that limit, he or she is in the coverage gap and will have to pay 35 percent of the cost of brand-name drugs and 44 percent of generics. They will continue to pay those costs until their out-of-pocket spending reaches $5,000. Once they hit that limit, they’ll no longer be in the doughnut hole ...

How much does Medicare Part D cost?

Beginning in 2019, Part D enrollees will pay 25 percent of the cost of all their prescription drugs from the time they enter the gap until they reach catastrophic coverage. For 2018, the threshold for entering the doughnut hole remains at $3,750 worth of drug costs. Once a Medicare enrollee passes that limit, he or she is in ...

When will the ACA close?

The doughnut hole has been narrowing each year since the Affordable Care Act (ACA) was passed in 2010. The gap was scheduled to close in 2020, when beneficiaries would be expected to pay 25 percent of the cost of all their prescriptions while they were in the gap.

Will Medicare pay more for Part D?

Drug companies will pay more to lower some Part D costs. Medicare Part D beneficiaries who have high prescription drug expenses currently have to pay more once the total cost of their medicines reaches a certain threshold. En español | Medicare beneficiaries with high annual prescription drug costs will get some relief a year earlier ...

What is the gap in Part D?

What Does That Mean? When first implemented in 2006, the Part D drug plan had a gap in coverage. Drug plans did not pay anything toward the cost of drugs in the donut hole so beneficiaries were stuck with the tab for the entire cost. Beginning in 2011, the Affordable Care Act (ACA) took measures to close the donut hole, known as the Coverage Gap.

How much is Laura's insulin copayment?

Here's an example. In the Initial Coverage payment stage, Laura's insulin has a $47 copayment. Once she lands in the donut hole, she is responsible for 25%.

When did the Affordable Care Act close the donut hole?

Beginning in 2011, the Affordable Care Act (ACA) took measures to close the donut hole, known as the Coverage Gap. Over the last few years, beneficiaries have paid less for drugs. Here's what happened. In 2012, the ACA implemented discounts for the Coverage Gap.

Does closing the donut hole reduce the cost of medication?

Closing the donut hole may or may not reduce costs in the Coverage Gap. Those who end up in that payment stage will still have to pay 25% of the cost of medications. Last updated: 01-02-2020.

Is the donut hole closed for generics?

Now, now the donut hole for generic drugs is also closed. So, the donut hole has closed for all medications. Many think that means they won’t have to pay for medications once they get ...

What is a Medicare Part D gap?

When Medicare Part D prescription drug plans first became available, there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them ...

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

What is the limit for Part D coverage in 2021?

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.”.

How much is a deductible for 2021?

The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445.

How much will you pay for prescription drugs in 2021?

For 2021, once you've spent $6,550 out of pocket, you're out of the coverage gap and move into phase 4—catastrophic ...

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

What is the minimum copay for 2021?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: 5 percent of a drug’s cost or a small copay. The minimum copay for 2021 has increased a little from 2020: Generic drugs: minimum copay is $3.70, which is up from $3.60 in 2020.

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What to consider before choosing a Medicare plan?

Below are some things to consider before choosing a plan. Use the Medicare website to search for a plan that’s right for you. Compare a Medicare Part D with a Medicare Advantage (Part C) plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What percentage of the cost of generic drugs will be paid in 2021?

In 2021, you must pay 25 percent of the cost for both generic and brand-name drugs while you’re in the donut hole. For both generic and brand-name drugs, only a certain amount of the cost counts towards your OOP threshold. Let’s see how this works in some examples below.

What is the initial coverage limit?

The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.