The average Medicare Advantage monthly premium decreased in Texas compared to last year — from $11.11 in 2021 to $10.68 in 2022. There are 337 Medicare Advantage plans available in Texas for 2022, compared to 289 plans in 2021. All Texas residents with Medicare have access to buy a Medicare Advantage plan, including plans with $0 premiums.

Full Answer

What is the best Medicare plan in Texas?

- Texas Medicare Supplement premiums vary, depending on a variety of personal factors.

- In Texas, Medigap Plan G is the most popular plan for 2022.

- Every beneficiary has a Medigap Open Enrollment Period which lasts for six months and starts the month that they are 65 years old.

What are the requirements for Medicare in Texas?

More Information from CMS:

- Fact Sheet

- Three-Way Contract (PDF) Summary of Contract Changes (August 2017) (PDF) Texas Contract Amendment (11/01/2020) (PDF) Texas Contract Amendment Summary of Changes (11/01/2020) (PDF)

- MOU (PDF)

- Amendment to State Proposal (PDF)

- State Proposal (PDF)

How much does medical insurance cost in Texas?

Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

- POS: $244

- PPO: $251

- EPO: $254

What does Medicare cover in Texas?

What does Medicare B Cover in Texas? Medicare Part B helps pay for doctor visits related to diagnosis and treatment of an illness or injury; health check-ups and some preventive screenings; outpatient medical services such as physical therapy, lab work and X-rays, durable medical equipment, and some home health services.

How much is Medicare Texas?

In Texas, the average cost of a Medicare Advantage plan is $34 per month, and the average cost of a Medicare Part D plan is $52 per month. Among the companies offering plans for 2022, UnitedHealthcare/AARP stands out as one of the best Medicare Advantage providers for most people in Texas.

What is Medicare in Texas called?

In Texas, a type of Medigap plan called Medicare Select is also available. Medicare Select plans require you to use specific hospitals and doctors.

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

Does Texas have state Medicare?

If you are eligible for Medicare, the Texas' Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options.

What does Medicare B Cover in Texas?

Medicare Part B covers expenses that are medically necessary to treat or prevent a disease or condition. Basically, other fees that occur outside of room and board while in the hospital- those related to diagnostic testing, preventative care, and the supplies needed to diagnose or treat medical conditions.

Does Texas have Medicaid or Medicare?

Medicaid and Medicare are government programs that help cover healthcare costs. The state of Texas manages Medicaid, and program eligibility is based on income level. The federal government administers Medicare.

What will Medicare cost in 2023?

CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

What will Medicare cost me in 2022?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What are the income limits for Medicare in Texas?

Income limits: The income limit is $2,349 a month if single and $4,698 a month if married (and both spouses are applying).

Who is eligible for Texas Medicare?

Who Is Eligible for Medicare in Texas? People age 65 and older are usually eligible for Medicare. Although, you can qualify if you're under 65 and have received disability benefits for two years, or if you have End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

Is there free health insurance in Texas?

You can get access to low-cost or free health insurance in Texas through several plans: Obamacare, short-term, or catastrophic. You can also get coverage from a government-funded program, such as Medicaid or the Children's Health Insurance Program (CHIP).

What is the Texas Health Information, Counseling and Advocacy Program?

If you are eligible for Medicare, the Texas' Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

How old do you have to be to get medicaid?

Must be under age 65 and not otherwise receiving Medicaid.

Is Medicare preventive care free?

Maintaining health and wellness is important, and Medicare preventive services are available at no cost. The National Council on Aging provides a list of Medicare Preventive Services (link is external) that are available through the Affordable Care Act.

What is the Medicare program in Texas?

Medicare is a federal government health program that helps people age 65 or older, and people of any age with certain disabilities, pay for their medical care.

How much Medicare is there in Texas in 2021?

The average Medicare Advantage monthly premium decreased in Texas compared to last year — from $12.43 in 2020 to $11.42 in 2021.

When can I enroll in Medicare Texas plans?

Your Texas Medicare initial enrollment period begins 3 months before you turn 65 and continues for 3 months after.

How old do you have to be to qualify for Medicare in Texas?

To qualify for Medicare in Texas, you must be either: age 65 or older. a person of any age with certain disabilities. a person of any age with end stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS)

How many Medicare Advantage plans are there in Texas?

There are 289 Medicare Advantage plans available in Texas for 2021, compared to 231 plans in 2020. All Texas residents with Medicare have access to buy a Medicare Advantage plan, including plans with $0 premiums. There are 12 different Medigap plans offered in Texas for 2021.

When is the open enrollment period for Medicare Advantage in Texas?

There’s also an open enrollment period specifically for Medicare Advantage plans every year from January 1 through March 31. During this time, you can sign up for Medicare Advantage for the first time or switch Medicare plans in Texas.

Is Texas a big state for Medicare?

Texas is a big state. You want to be sure to choose one of the Medicare plans in Texas with a network that makes geographic sense for your lifestyle. If you travel, be sure to ask about coverage outside of the state as well.

How many Medicare Advantage plans are there in Texas?

Information about Medicare Advantage Plans in Texas. There are 109 different Texas Medicare Advantage Prescription Drug (MAPD) plans in 2021. 1 Not every plan may be available where you live in Texas, as plan availability, benefits and costs can vary. Read below to learn more about Medicare in your state.

How many stars does Medicare have?

The Centers for Medicare & Medicaid Services (CMS) issues star ratings for all Medicare Advantage plans every year, using a system of one to five stars. 2

What is the average deductible for Medicare 2021?

Average drug deductible in 2021 (weighted): $1921. It's important to note that Medicare Advantage plan premiums, deductibles and out-of-pocket costs may vary greatly depending on where you live and the plan you have.

What are the different types of Medicare Advantage plans?

The major types of Medicare Advantage plans include: HMO. If you have a Texas Health Maintenance Organization (HMO) plan, you'll typically be required to visit doctors, hospitals and pharmacies that are part of your plan’s network (except in the case of emergencies).

How many categories are there in Medicare Advantage?

Medicare Advantage plans are rated in the following five categories:

How long do you have to be a resident to qualify for Medicare?

To be eligible for Original Medicare at age 65, you must meet the following requirements: You must be a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years. You or your spouse must be eligible to receive Social Security or Railroad Retirement benefits.

When does Medicare AEP end?

Medicare Annual Enrollment Period (AEP): October 15 – December 7. You may enroll in a Medicare Advantage plan or switch from one Medicare Advantage plan to another during Medicare AEP, which lasts from Oct. 15 to Dec. 7 every year. You may also drop your existing Medicare Advantage plan and return to Original Medicare.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover prescription drugs?

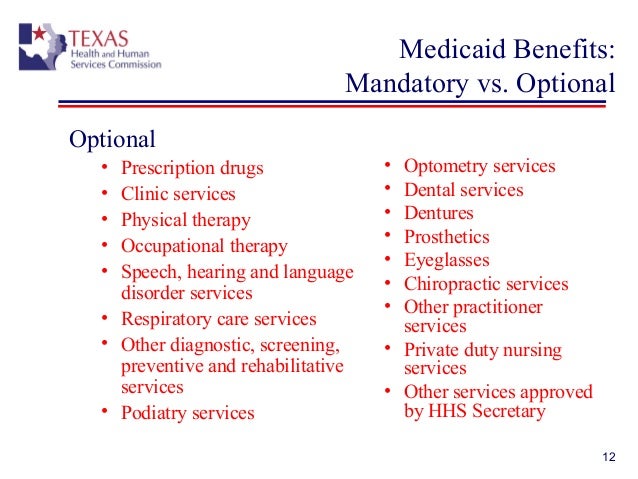

Option al benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicaid in Texas?

Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. However, this page is focused on Medicaid eligibility, specifically for Texas residents, aged 65 and over, and specifically for long term care, whether that be at home, in a nursing home, in an adult foster care home, or in assisted living. Most Medicaid plans in the state of Texas are provided by Managed Care Organizations (MCOs). Texas managed Medicaid for the elderly and disabled is often referred to as STAR+PLUS.

How long is the look back period for medicaid in Texas?

In Texas, there is a 5-year Medicaid Look-Back Period, which is the period of time that the state looks back on asset transfers. If during this time frame, a Medicaid applicant has given away assets or sold them under fair market value, a period of Medicaid ineligibility may ensue.

How much can a spouse retain on Medicaid?

For married couples, as of 2021, the community spouse (the non-applicant spouse of an institutional Medicaid applicant or HCBS waiver applicant) can retain 50% of the couple’s joint assets, up to a maximum of $130,380, as the chart indicates above. However, if 50% of the couple’s joint assets is less than $26,076, the non-applicant spouse is entitled to 100% of the assets, up to $26,076. This, in Medicaid speak, is referred to as the Community Spouse Resource Allowance (CSRA). In order to avoid confusion, it is important to mention that this resource allowance does not extend to non-applicant spouses of those applying for regular Medicaid.

How much does a non-applicant spouse get for Medicaid?

As of January 2021, a non-applicant spouse may receive as much as $3,259.50 / month from his or her applicant spouse. This rule allows the Medicaid applicant to transfer income to the non-applicant spouse to ensure he or she has sufficient funds with which to live. This spousal allowance is not relevant for couples in which one spouse is applying for regular Medicaid.

What is NFLOC in Texas?

For nursing home Medicaid and home and community based services via the Medicaid waiver, a nursing facility level of care (NFLOC) is required. Furthermore, certain benefits may have additional eligibility requirements specific to the particular benefit. ...

Can you take the Medicaid Eligibility Test in Texas?

The table below provides a quick reference to allow seniors to determine if they might be immediately eligible for long term care from a Texas Medicaid program. Alternatively, one can take the Medicaid Eligibility Test. IMPORTANT, not meeting all the criteria below does not mean one is not eligible or cannot become eligible for Medicaid. More.

Can seniors apply for medicaid in Texas?

Prior to submitting an application for Medicaid benefits in Texas, it is imperative that seniors are certain that all eligibility requirements (as discussed above) for the program in which they are applying are met. Persons who have income and / or assets over the limit (s), or are unsure if they meet the eligibility criteria, should seriously consider Medicaid planning. For additional information about applying for long-term care Medicaid, click here.

How does Medicaid provide financial assistance to Medicare beneficiaries in Texas?

Many Medicare beneficiaries receive Medicaid’s help with paying for Medicare premiums, affording prescription drug costs, and covering expenses not reimbursed by Medicare – such as long-term care.

How to apply for medicaid in Texas?

If you believe you may be eligible to enroll in Medicaid in Texas: 1 You can enroll through HealthCare.gov, either online or by phone at 1-800-318-2596. (Use this option if you’re under 65 and don’t have Medicare.) 2 You can enroll through the Medicaid website maintained by the Texas Health and Human Services Commission. 3 You can also download and print a paper application, or request that one be mailed to you, by using this page on the Texas Medicaid website.

Why is Texas refusing to expand Medicaid?

By refusing Medicaid expansion under the ACA, Texas has already missed out on billions in federal funding that would otherwise have flowed to the state to provide medical care for their low-income residents. And in addition, the state’s emergency rooms are providing $5.5 billion in uncompensated care each year, treating patients who don’t have health insurance. If Medicaid eligibility had been expanded, uncompensated care would have dropped considerably, so hospitals and business groups across the state have been pressuring lawmakers to relent on their opposition to Medicaid expansion.

What percentage of poverty is Medicaid?

As the ACA was written, it called for Medicaid expansion in every state for legally present residents with incomes up to 133 percent of poverty (138 percent, with the built-in 5 percent income disregard).

How many people are in the Medicaid coverage gap in Texas?

759,000 people are in the coverage gap in Texas. Non-disabled, non-pregnant adults only eligible if they have a minor child and earn less than 14% of the poverty level. Texas Medicaid enrollment has only grown by 3% since 2013. The state is missing out on billions in federal funding by not expanding Medicaid.

How much is uncompensated care in Texas?

Uncompensated care: $25 billion in federal funding. Political leaders in Texas have remained mostly uninterested in expanding Medicaid. Instead of pushing for legislation to expand Medicaid, Texas officials negotiated with CMS in an effort to secure ongoing funding to cover uncompensated care in the state.

What is the highest uninsured rate in the US?

According to U.S. Census data, 22.1 percent of Texas residents were uninsured in 2013. It stood at 17.7 percent in 2018, which was still the nation’s highest uninsured rate.

How Much Is the Medicare Tax Rate in 2021?

The 2021 Medicare tax rate is 2.9%. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Learn more.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who can help with Medicare enrollment?

If you’d like more information about Medicare, including your Medicare enrollment options, a licensed insurance agent can help.