How much is Medicare Part B annual deductible?

Nov 10, 2015 · CMS also announced that the annual deductible for all Part B beneficiaries will be $166.00 in 2016. Premiums for Medicare Advantage and Medicare Prescription Drug plans already finalized are unaffected by this announcement. To get more information about state-by-state savings, visit the CMS website at.

What is the current deductible for Medicare Part B?

Dec 20, 2015 · Medicare Part B. What’s Changed for 2016? How Much Does it Cost? Part B premiums will undergo significant changes in 2016. The deductible will go up to $167 per year for all participants. The premium amounts will vary depending on your circumstances. If your Medicare premium is currently being deducted from your Social Security check, […]

Does Medicaid pay the Part B deductible?

Nov 11, 2015 · The annual Part B deductible will be $166 in 2016, increasing by $19 over the 2015 amount of $147 (Figure 5). This represents the same …

What is the monthly premium for Medicare Part B?

Aug 25, 2016 · Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the 2017 Medicare Part B premium?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the yearly Part B deductible?

Part B Annual Deductible: Before Medicare starts covering the costs of care, people with Medicare pay an amount called a deductible. In 2022, the Part B deductible is $233.

What was Medicare Part B premium in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What is the Medicare Part B deductible 2018?

$183 for 2018The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

What was the Medicare Part B premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.Nov 17, 2017

How much is the Medicare Part B deductible?

$233The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What was the Medicare deductible in 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible. The deductible covers beneficiaries' costs for up to 60 days of Medicare-covered inpatient hospital care in a benefit period.Oct 28, 2013

What is the Medicare Part B deductible for 2020?

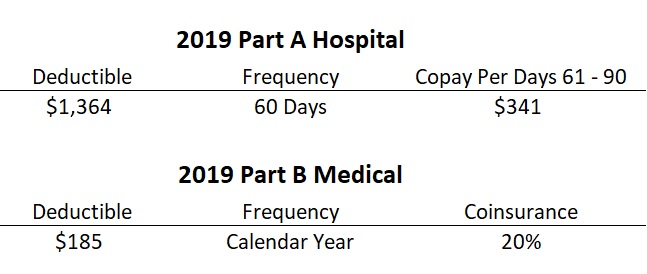

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.Nov 8, 2019

What is Medicare Part B premium in 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

The Annual Medicare Part B Deductible

The Medicare Part B Deductible is an annual deductible. It is based on the calendar year, not the effective date of your policy.

Medicare Part B Deductible Future

The Part B Deductible increases or decreases proportionally to the Medicare Part B Premium. The projected increases for 2017 through 2024 is 5.4% annually. If Part B spending increases faster than expected, the Part B Deductible will too.

Medicare Part B Deductible Coverage

Currently, Medigap Plan C and Medigap Plan F are the only plans that cover the $166 Deductible. With the passing of the Medicare Access and CHIP Reauthorization Act of 2015, this will change in 2020. Under the new law, Medicare Supplement Plans cannot sell plans that offer first-dollar coverage by covering the Medicare Part B Deductible.

How much is Medicare Part B deductible?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

Is Medicare dual eligible?

You quality for both Medicare and Medicaid benefits, and Medicaid pays for your premiums. This is called being “dual-eligible.”. Your income exceeds a certain dollar amount. Your premium could be higher than the amount listed above, as there are different premiums for different income levels.

Does Medicare Advantage have a deductible?

Premiums and deductibles for Medicare Advantage plans vary depending on which plan you choose . In brief, Medicare Advantage plans are offered by private health insurance companies contracted with the Centers for Medicare & Medicaid Services (CMS) to provide your benefits, and it is required by law to offer at least the same coverage as Original Medicare (with the exception of hospice care, which is still covered under Medicare Part A). Some plans offer extra coverage ( routine dental or vision services, for example).

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

What is the Medicare deductible for 2016?

The Medicare Part A deductible for all Medicare beneficiaries is $1,288. If you aren’t eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

What is dual eligible Medicare?

dual eligible beneficiaries who have their premiums paid by Medicaid, and. beneficiaries who pay an additional income-related premium. These groups account for about 30 percent of the 52 million Americans expected to be enrolled in Medicare Part B in 2016.

Will Medicare Part B premiums increase in 2016?

2016 Part B Premium. As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be "held harmless" from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Will Social Security increase in 2016?

As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.