How high will the Medicare Part B deductible get?

A $5 deductible is also imposed under Medicare Part B and is doubled to $203 in 2021. Medicare Part C Changes for 2021: Fees for Plan B vary, and you must select a private plan provider.

What is the maximum premium for Medicare Part B?

Dec 14, 2021 · The Medicare Part B deductible is $233 per year in 2022. Medicare Part B provides coverage for outpatient care such as doctor’s appointments, outpatient surgeries, procedures performed in outpatient facilities, rehabilitation care, preventive medicine, durable medical equipment (such as wheelchairs and walkers) and more. Here's an example of how the …

Who pays part B Medicare?

Jun 14, 2020 · Most seniors pay $198 a year for their deductible. This is only due once each year, and then after that you can start to receive benefits for Medicare Part B services. That means you’ll be covered for anything that falls under the Part B umbrella of coverage according to your Original Medicare plan.

How much is the late enrollment penalty for Part B?

Part B deductible & coinsurance In 2022, you pay $233 for your Part B deductible . After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy Durable Medical Equipment (Dme)

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

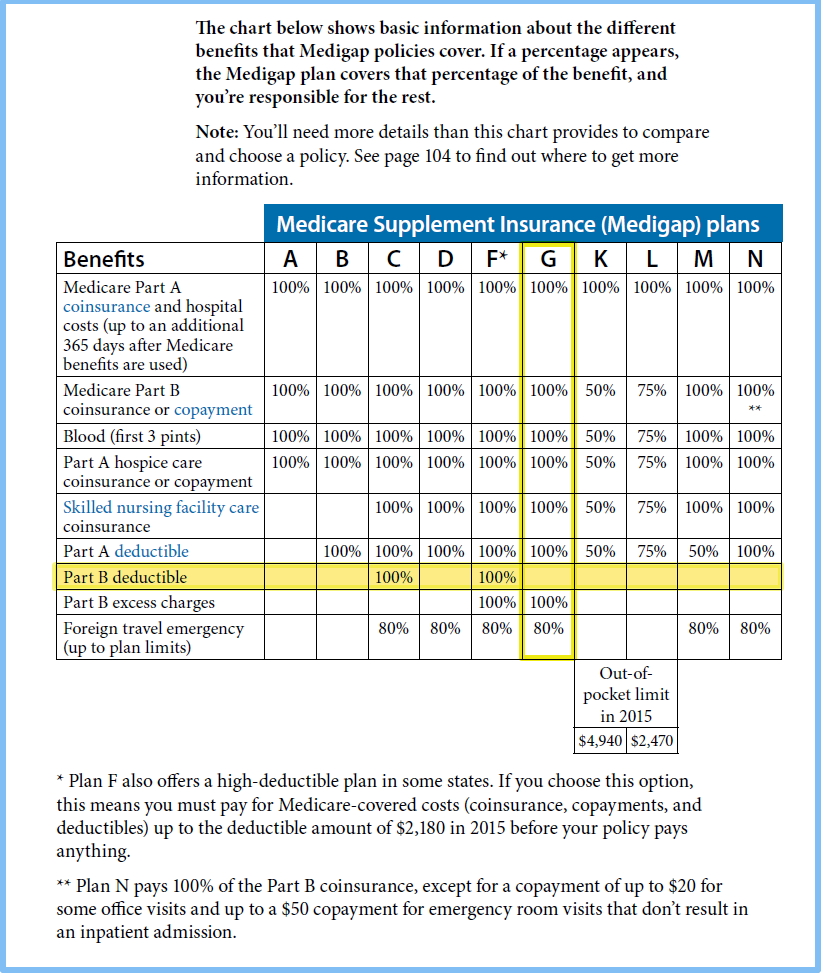

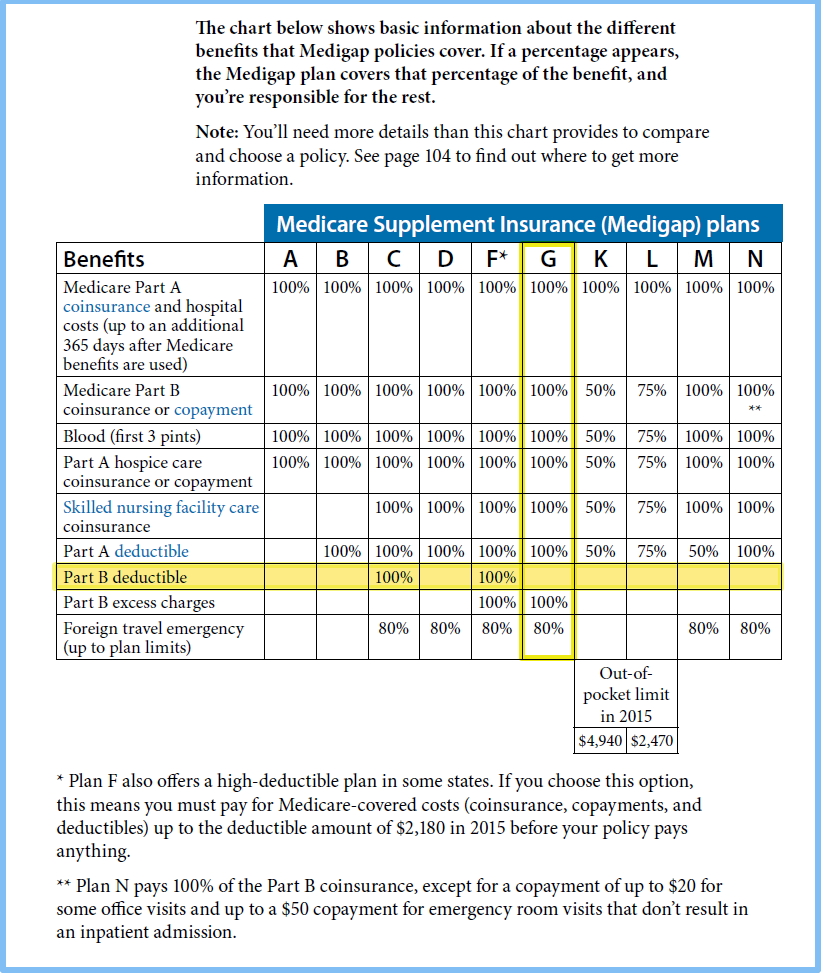

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

What is the Medicare Part B deductible for 2021?

The Medicare Part B deductible 2021 is an expense that seniors need to be aware of before they enroll in Part B or Original Medicare. It is an expense they will be responsible for and that can add to their overall medical expenses for the year.

How much does Medicare Part B cost?

There are other expenses to pay as well that you should be aware of. The monthly premium will be your most common expense. This costs $144.60 a month, but you may pay more than that if you make over $87,000 a year. You also have coinsurance and copays to take care of.

Does Medicare cover coinsurance?

Your insurance plan Original Medicare will cover you for the majority of these costs, but you have to pay some of the cost as well. The coinsurance tends to be 20% of the total cost of the service. Keep in mind that Part B costs and other Medicare costs will change from year to year. They tend to increase slightly every year.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is a benefit period for Medicare?

The benefit period begins the day you enter the hospital or facility and ends after you have not needed inpatient care for 60 days in a row. Source: Centers for Medicare & Medicaid Services.

How much is Medicare Part A deductible for 2021?

For 2021, the Medicare Part A deductible is $1,484 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,484 again as a new deductible.

Does Medicare Advantage cover out of pocket expenses?

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary , all plans must set a limit on your maximum out-of-pocket (MOOP) expenses.

What is the Medicare Advantage plan for 2021?

For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs. Some Medicare Part D prescription drug plans don’t have a deductible. Those that do may not have a deductible ...

Does Medigap cover Part A?

Some of these plans may cover all or a portion of your Part A deductible. Medigap Plans C and F were the only two to cover the deductible for Medicare Part B. However, Plans C and F are available only to people who became eligible for Medicare before Jan. 1, 2020.

What is a Medigap plan?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.