Who pays Medicare Part D?

Apr 16, 2020 · Medicare Part D Deductible and Out of Pocket Costs. Last Updated : 04/16/2020 4 min read. Summary: The Centers for Medicare and Medicaid Services (CMS) sets the maximum Medicare Part D deductible each year. In 2020, the maximum Part D deductible is $435, but depending on where you live, you may find a plan with a lower deductible or even no deductible …

What is covered by Medicare Part D?

The Medicare Part D deductible is the amount you most pay for your prescription drugs before your plan begins to pay. The amount of the Medicare Part D deductible can vary from plan, but Medicare dictates that it can be no greater than $445 a …

Who is eligible for Medicare Part D?

What is the Medicare Part D Deductible? The Medicare Part D deductible is the amount you pay for your prescription drugs before your Part D drug plan pays its share. Medicare puts a limit on how much a plan can charge for a deductible. The limit can change each year. For 2021, the annual deductible limit for all Part D plans is $445.

What does Medicare Part D really cost?

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the Medicare Part D deductible for 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Does Medicare Part D have deductibles?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

What is the deductible stage for Part D?

During the deductible phase, you are responsible for the full cost of your prescription drugs until you meet the Medicare Part D deductible. After you reach your plan's deductible, Medicare Part D will then cover the cost of your medications.Mar 1, 2022

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

How do plan D deductibles work?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.Mar 9, 2021

What is yearly deductible for Medicare?

$233The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

Does Medicare Part D have copays?

No type of Medicare drug coverage may have a deductible more than $445 in 2021. Some plans don't charge a deductible. You pay copayments or coinsurance for your prescription drugs after you pay the deductible. You pay your share, and your plan pays its share for covered drugs.

What are the 4 phases of Medicare Part D coverage 2021?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

How Does Part D coverage work?

You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug's cost. The insurance company will pay the rest.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

What is deductible in Medicare?

You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles. “Deductible” is a common term in insurance. Generally the lower the deductible, the less you are responsible for paying out-of-pocket before your insurance coverage kicks in.

What are the tiers of Medicare Part D?

Medicare Part D plan prescription drug tiers are usually set such that the lower the tier number , the less expensive the drug, as in the following example:: Tier 1: preferred generic, generally the lowest cost tier. Tier 2: generic, generally cost more than tier 1. Tier 3: preferred brand, generally cost more than tier 2.

How much is Medicare Part D 2020?

According to 2020 eHealth research, the average deductibles for stand-alone Medicare Part D plans in the study increased from $335 in 2019 to $405 in 2020.*. Some Medicare Part D plans have $0 deductibles, which means you are only responsible for a set copayment or coinsurance amount when you pick up your prescription drugs.

What is tier 3 deductible?

Tier 3: preferred brand, generally cost more than tier 2. Tier 4: non-preferred brand, generally cost more than tier 3. Tier 5: specialty tier, generally cost more than tier 4. Tier 6: select care drugs. If you only take generic prescription drugs, for example, you may not be subjected to the deductible in certain plans.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

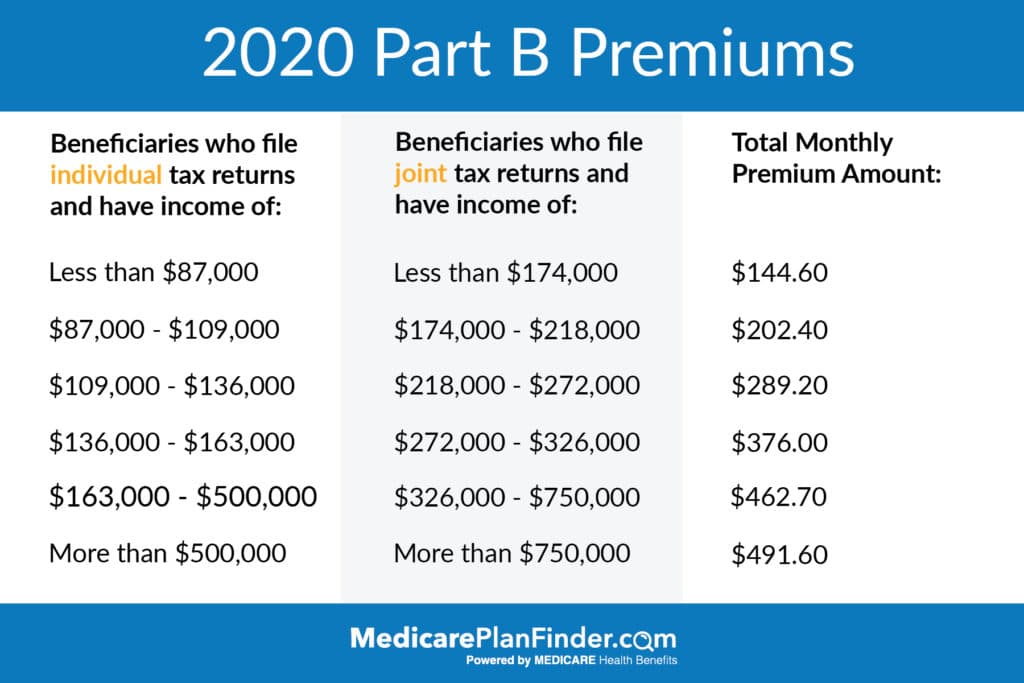

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.