Medicare provides coverage for certain preventive services at no cost to members. For the current list of covered preventive services, refer to your Medicare & You handbook or go to medicare.gov. For certain services covered by Medex, you pay a $15 copayment per visit. Some preventive covered services are highlighted below.

Full Answer

What is the difference between Medicare and Medi-Cal?

One fairly well-known difference between Medicare and Medi-Cal is that Medicare will typically not pay for costs of staying in a long-term care facility that employs skilled nurses. For that coverage, you will have to enroll in Medi-Cal.

What are the terms and conditions of Medex insurance?

The Medex policy defines the terms and conditions of all the Medex plans in greater detail. Should any questions arise concerning benefits, the Medex policy will govern. You must continue to pay your Medicare Part B premium.

Is Medex bronze the same as Medex?

Medex Bronze is Supplement-1. Despite the fact that people call them all Medex, which is Blue Cross' brand, in Massachusetts you can get almost exactly the same policy from AARP, Fallon, Health New England, Harvard, Humana, Readers Digest (in association with Humana) and Tufts.

What is the Medicare Part B deductible for Medex?

Although the $233 calendar-year Medicare medical insurance (Part B) deductible appears more than once in this benefit chart, only one $233 deductible is applicable in a calendar year. The Medex policy defines the terms and conditions of all the Medex plans in greater detail.

Is Medex the same as Medicare?

Ambulance Trips, Durable Medical Equipment, etc. Travel Outside the U.S. Full coverage for Medicare covered services (same as in U.S.)...Plan Information.Skilled Nursing FacilityOriginal MedicareMedex Core1-20 DaysFull coverage for 20 days in a Medicare-participating facilityCovered by Medicare2 more rows•Jan 1, 2022

What is Medicare Medex?

Medex Provides. Blood glucose monitors and. 80% of approved charges after $131. Full coverage of Medicare deductible. materials to test for the presence.

Is Medicare the same as Blue Cross?

BCBS is an iconic health insurance brand represented by numerous independent affiliated companies. BCBS companies have been part of the Medicare program since it began in 1966 and now offers multiple Medicare insurance options.

What is Medicare called in Massachusetts?

Massachusetts Medicaid – Medicare beneficiaries in Massachusetts with limited income may qualify for help with certain Medicare costs. Medicare Savings Programs are run through state Medicaid programs and help with costs like premiums, copayments, coinsurance, or deductibles.

Is Medex a supplemental insurance?

MIT offers a Medicare supplemental plan that can bridge the gap between what Medicare pays for covered services—80 percent of costs after your Part B deductible is met—and the remaining 20 percent you would otherwise owe. But remember, MIT's supplemental plan only covers services covered by Medicare.

What is Medex choice plan?

Medex is a Medicare supplement plan offered by Blue Cross Blue Shield of Massachusetts. It can be added to Medicare Part A and Part B coverage to fill “gaps” in your Medicare coverage. As a supplemental insurance plan, Medex helps cover health care expenses left over after Medicare has covered its portion of costs.

Is Blue Shield considered Medicare?

Discover your healthcare needs Blue Shield of California is an HMO and PDP plan with a Medicare contract.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What's the difference between Medicare and health insurance?

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

Can you be on MassHealth and Medicare?

One Care is a way to get your MassHealth and Medicare benefits together. One Care offers services that you can't get when your MassHealth and Medicare benefits are separate.

Do I need Medicare Part D if I have MassHealth?

If you get MassHealth, it will pay your Part B premium and your Medicare prescription drug coverage, Medicare Part D.

Do I need Medicare Part B if I have MassHealth?

If you have Medicare and qualify for MassHealth Buy-In, MassHealth will pay for your Medicare Part B premium.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is the most popular Medigap plan in Massachusetts?

You might not recognize those terms but -- as with Kleenex -- you will probably recognize the most popular Medigap brand names in Massachusetts: Blue Cross Medex and Medex Bronze. Medex is Core. Medex Bronze is Supplement-1.

What is the difference between Medigap Core and Supplement 1?

Everyone wants our business.) The major differences between Medigap Core and Medigap Supplement-1 is the monthly premium and how they cover Medicare co-pays. Roughly, Supplement-1 is $100 a month more expensive than Core but covers all co-pays. So that's your next decision point.

What is Medicare insurance?

Medicare. Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Is Medicare a federal program?

Small monthly premiums are required for non-hospital coverage. Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Do you pay for medical expenses on medicaid?

Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

How long does Medex Sapphire last?

Medex Sapphire. 1-60 Days. Coverage for 60 days, after the $1,484 deductible 2. Full coverage of Medicare deductible and co-insurance. 61-90 Days. Coverage for 61-90 days, after $371 daily co-insurance 2. Full coverage of Medicare deductible and co-insurance. Lifetime Reserve.

How long does Sapphire cover?

A benefit period begins on the first day you receive services as an inpatient in a hospital and ends after you have been out of the hospital and have not received skilled care in any other facility for 60 consecutive days. Sapphire coverage also includes $8 a day for days 1-365 at a non-Medicare-participating facility.

Does Medex Sapphire cover Medicare Part B?

Medex ® Sapphire covers your co-insurance and Part A deductible. After you pay your annual Medicare Part B deductible, you are covered for : Doctor visits. Home visits. Ambulatory care. Hospital ization. Medex Sapphire also provides full coverage for care received outside the United States.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

What is Medicare Advantage?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap. Instead of having multiple insurance plans to cover medical costs, a Medicare Advantage plan offers all your coverage in one place.

Does Medicare Advantage cover out of network services?

While Medicare offers the freedom to choose any provider within the Medicare network, most Medicare Advantage plans don’t provide as much freedom . Depending on the type of Medicare Advantage plan you have, you may face additional costs for out-of-network services, as well as specialist referrals and visits.

Is Medicare a government or private insurance?

Original Medicare is a government-run option and not sold by private insurance companies. Medicare Advantage is managed and sold by private insurance companies. These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in ...

Does Medicare Advantage save money?

For some people, Medicare Advantage plans can help save money on long-term medical costs, while others prefer to pay for only what they need with Medicare add-ons. Below you’ll find an estimated cost comparison for some of the fees associated with Medicare Advantage in 2021: Cost. Medicare. Advantage amount.

Does Medicare cover dental and vision?

Medical services. If you’re someone who rarely visits the doctor, Medicare and Medicare add-ons may cover most of your needs. However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Does Medicare cover all your needs?

For example, Medicare may not cover all your needs, but a Medicare Advantage Special Needs Plan could help with long-term costs.

What is the difference between Medicare and Medi-Cal?

One fairly well-known difference between Medicare and Medi-Cal is that Medicare will typically not pay for costs of staying in a long-term care facility that employs skilled nurses. For that coverage, you will have to enroll in Medi-Cal.

What is Medicare and Medi-Cal?

What is Medicare? The first distinction between Medicare and Medi-Cal is that Medicare is a federal program that acts as monthly health insurance. Once you reach the age of 65, you begin to receive this government benefit that you likely helped pay for through your payroll taxes over the years.

What is the number to call for elder law in California?

That’s why it’s essential to enlist the help of an experienced and qualified California elder law firm like MMZ Law. Give us a call at 909-256-6702 to discuss your options with us today. The following two tabs change content below. Bio.

What is Medi-Cal insurance?

Recipients sometimes have to pay a small monthly fee to access Medi-Cal benefits. Medi-Cal, unlike Medicare, is a means-tested government program.

What is the poverty level for Medi-Cal?

This means that you must meet certain financial qualifications to be eligible for Medi-Cal. The test for Medi-Cal coverage is a household income at 138 percent of the poverty line or less.

What are the three M's in California?

In California, the three M’s are known to citizens as Medicaid, Medicare, and Medi-Cal. You probably know that all three of these programs pay for various healthcare costs, but you might still be fuzzy on the distinctions between these three programs.

Can Medicare Part B be taken out of Social Security?

Recipients must pay for Medicare Part B, which can be taken out of Social Security benefits. In addition to seniors, some people with serious disabilities or end-stage renal failure that requires dialysis are eligible for Medicare benefits.

What is the difference between Medicare and Medigap?

A. There are very big differences between these two types of insurance, although both are options for people with Medicare. Technically, only medigap counts as "Medicare supplemental insurance" — in fact, that's its formal name — but Medicare Advantage plans may provide some extra benefits ...

How long do you have to buy Medicare if you turn 65?

But when you turn 65, you get federal protections—meaning you cannot be denied coverage or charged more due to health issues, wherever you live—provided that you buy a policy within six months of your 65th birthday. Medicare Advantage plans: Visit the Medicare Plan finder at the Medicare website.

Can you use Medigap for out of network?

Note: If you enroll in a Medicare Advantage health plan you cannot use a medigap policy to cover your out-of-pocket expenses;

Can you use Medigap for Medicare?

Medigap can be used only by people enrolled in traditional Medicare. It is not a government-run program, but private insurance you can purchase to cover some or most of your out-of-pocket expenses in traditional Medicare.

Does Medicare cover Part B?

Most charge a monthly premium in addition to the Part B premium, but some don't.

What is Medicare Advantage?

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

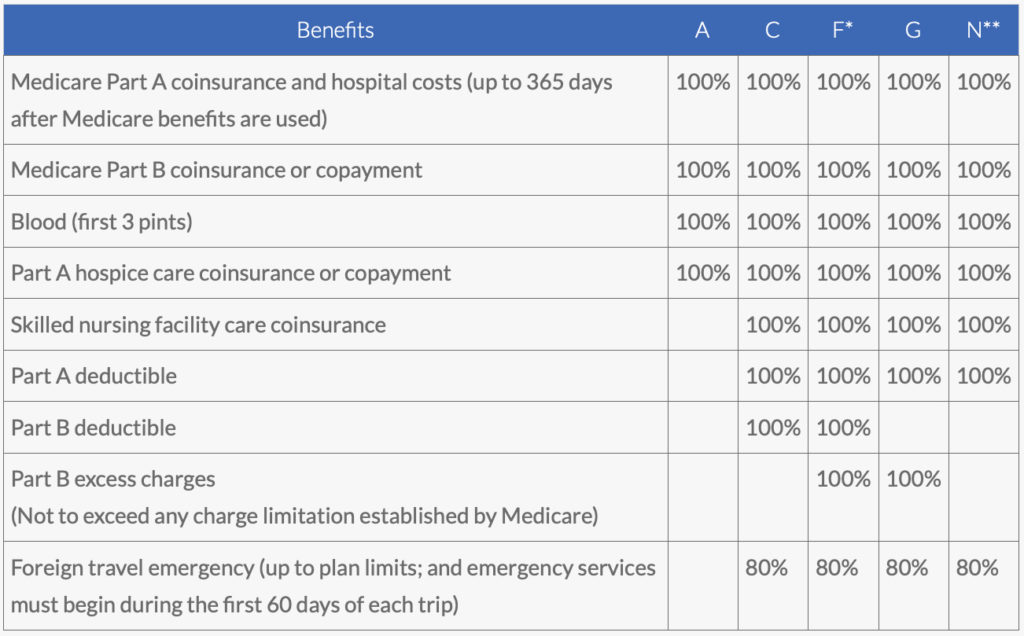

What is a Medigap policy?

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov . They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. 12 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal.

How long can you stay on medicare?

You generally won't have to pay a penalty if you later decide to enroll in a Medicare prescription drug plan and you haven't gone for longer than 63 continuous days without creditable coverage. 98.

What happens if you don't enroll in Medicare?

Once you’ve enrolled in Medicare, a key decision point is choosing coverage for Part D prescription drug insurance . If you don’t enroll in Part D insurance when you start Medicare and want to buy drug coverage later on, you may be permanently penalized for signing up late. 8

How to get started with Medicare?

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings. 10

Is Medicare Advantage better than Medigap?

People with chronic diseases and those who develop a serious health condition should look deeper into the choices available. A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care. Check whether any expensive drugs or equipment (such as supplies for people with diabetes) will be covered by your Medicare prescription drug plan, whether it's a stand-alone one or part of a Medicare Advantage plan.

Does Medigap cover Part B?

Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.