Medicare Supplement Plans

- Both types of plans are available from private insurance companies.

- With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment.

- Some Medicare Supplement plans may cover emergency medical care when you’re out of the country.

- Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement plans sold today can’t.

Is Medicare Advantage better than Medicare?

Nov 03, 2021 · Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider.. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

What are the best Medicare Advantage plans?

May 25, 2021 · There are many differences between Medicare Advantage plans Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medicare Part A and Medicare Part B). and Medicare supplement insurance Medicare Supplements are additional …

Should I Choose Medicare Advantage or Medigap?

Aug 01, 2019 · To improve options for Medicare coverage, The Centers for Medicare and Medicaid Services (CMS) contracts with private insurance companies to offer Medicare Advantage plans. Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance plans are …

What to consider when comparing Medicare plans?

May 05, 2021 · Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement plans sold today can’t. You might learn some other surprising differences. First, let’s start with a brief description of the Medicare Advantage program (Medicare Part C) vs. Medicare Supplement (also called Medigap) insurance.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the difference between a supplement and an Advantage plan?

Keep in mind that Medicare Supplement insurance plans can only be used to pay for Original Medicare costs; they can't be used with Medicare Advantage plans. In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, you're still in the Medicare program.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Can you switch from an Advantage plan to a supplemental plan?

From January 1 to March 31 each year, a person can switch from one Medicare Advantage plan to another or drop their Medicare Advantage plan altogether in favor of original Medicare. During this time, a person can also join a prescription drug plan and Medigap.

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.Jun 2, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Can I drop my Medicare Advantage plan and go back to original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Does a Medicare Advantage plan replace Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

What is the most comprehensive Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.Sep 25, 2021

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

Can I opt out of Medicare Advantage plan?

You can leave a Medicare Advantage plan in one of three ways: Call the plan you wish to leave and ask for a disenrollment form. Call 1-800-MEDICARE (1-800-633-4227) to request that your disenrollment be processed over the phone.Jan 10, 2019

Is it better to have Medicare Advantage or Original Medicare and Medigap?

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it cost...

What is the difference between Medicare and Medicare Advantage plans?

Original Medicare is a Private Fee-for-Service (PFFS) health insurance system. Beneficiaries can use any healthcare provider that accepts Medicare....

What is the downside to Medicare Advantage plans?

The primary benefit of Medicare Advantage is extra benefits. And, if you are a healthy senior, the additional benefits and cost savings really add...

Are Medicare supplement plans worth it?

Here's who gets to truly experience the advantage private health plans offer:People with retiree benefits that help with Medicare Advantage premium...

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement insurance fills the gaps in Original Medicare, whereas a Medicare Advantage plan completely replaces your Original Medicare coverage. With Medicare Advantage, you pay the majority of your costs when you use healthcare services through deductibles.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medi care Part A and Medicare Part B).... and Medicare supplement insurance.

What is Medicare Advantage Special Needs Plan?

People who qualify for a Medicare Advantage Special Needs Plan. People who are exceptionally healthy and rarely use healthcare services outside of their annual wellness visits.

What are the advantages of Medicare Advantage?

The primary benefit of Medicare Advantage is extra benefits. And, if you are a healthy senior, the additional benefits and cost savings really add up. But, there are some serious disadvantages as well, including network provider limitations, costly inpatient copays, and no coverage traveling away from home.

How are Medicare premiums paid?

Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... . Most Medicare Advantage plans require their members to get a referral from their primary care doctor to see a specialist.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begin s to pay its share.... , coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... , copayments.

Is Medicare Advantage good for seniors?

If you are a super healthy senior, and you rarely see your doctor for anything more than your annual wellness exam, Medicare Advantage is an excellent medical insurance option.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage vs Medicare Supplement: the basics. Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs ...

What are the benefits of Medicare Advantage?

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically don’t cover: 1 Routine vision, including eye glasses, contacts, and eye exams 2 Routine hearing, including hearing aids 3 Routine dental care 4 Prescription drugs and some over the counter medications 5 Fitness classes and gym memberships 6 Meal delivery to your home 7 Transportation to doctor visits 8 Other benefits

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

What is deductible insurance?

Deductibles: A deductible is an amount you pay before your insurance begins to pay. A higher deductible means you will generally pay more out of pocket before your insurance kicks in. Sometimes insurance plans with lower premiums have higher deductibles.

Why are networks important?

Networks are designed to keep costs low, which could be an advantage to beneficiaries. On the other hand, you may also feel that a network restricts you from getting care from a provider you like. However, you don’t need to worry about networks in the case of an emergency.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

Is Medicare Supplement insurance mutually exclusive?

Medicare Supplement insurance plans are also available from private insurance companies. However, Medicare Advantage and Medicare Supplement insurance plans are mutually exclusive; this means that you will have to choose between Medicare Advantage vs Medicare Supplement. Also, it may be illegal for a private insurer to sell you one plan knowing you ...

What is Medicare Advantage?

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

When is the best time to buy a Medicare Supplement Plan?

Perhaps the best time to buy a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, which starts the month that you’re both 65 or more years old and enrolled in Medicare Part B.

Do you have to be enrolled in Medicare Supplement?

You must be enrolled in Part A and Part B to be eligible for a Medicare Supplement plan, but you’re still getting those benefits directly through the Medicare program (compared with Medicare Advantage, which provides Part A and Part B benefits through a private, Medicare-approved insurance company).

Can you see a doctor who accepts Medicare?

Find Plans. Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, ...

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

Does Medicare save you money?

If you’re new to Medicare or will be eligible soon, and you have frequent doctor visits and/or hospitalizations, a Medicare Supplement plan might save you money by helping you with those costs – especially if you make sure to purchase the plan as soon as you’re eligible so your acceptance is guaranteed.

What is the difference between Medicare Advantage and Medicare Supplement?

The main difference between Medicare Advantage plans and Medicare supplement plans is that with a Medicare supplement plan, you have the ability to see any provider in the country that accepts Medicare. There are no networks you are restricted to, and you never have to choose a primary care doctor. Unlike Medicare Advantage plans you have ...

What are the different types of Medicare Advantage plans?

Medicare Advantage plans, also referred to as “MA” or “Part C”, are Medicare health plans offered by private insurance companies that combine all of your Part A and Part B benefits. Some plans may have prescription drug coverage as well (MAPD). The most common forms of Medicare Advantage plans are the following: 1 Health Maintenance Organization (HMO) 2 Preferred Provider Organization (PPO) 3 Private Fee for Service Organization (PFFS)

What is a Medigap plan?

A Medigap plan is meant to pay what Part A and Part B of Medicare plans do not cover in full. There are 10 standardized Medigap plans and they are offered in every state except Massachusetts, Wisconsin and Minnesota. The ten plans range from Plan A to Plan N. Each plan is different and offers a unique combination of coverage and deductibles.

How much is Medicare deductible?

These deductibles are often $5,000 to $10,000. Medicare supplement plans are not subsidized by the government, therefore they are not subject to any budget cuts. As a result of the budget cuts, many doctors have stopped accepting Medicare Advantage plans.

Why is Plan F the same as Plan F?

Because the plans are standardized, any given plan (e.g. Plan F) will have the same exact benefits regardless what company is offering the plan. The only difference is the price you pay in premium. When comparing plans, make sure you compare the premium cost for the same plan from company to company.

Do you have to answer health questions when applying for Medicare Advantage?

I would also like to add something that companies and agents offering Medicare Advantage plans will never tell you. That is, you never have to answer health questions when applying for a Medicare Advantage plan. You do, however, have to answer health questions to get a Medicare supplement plan; unless you are turning 65, new to Medicare, or in a Guarantee issue scenario. Because of this it is also a good idea to get a Medicare supplement while you are healthy or when you aren’t subject to the health questions as mentioned previously. You can always go from a Medicare supplement to a Medicare Advantage plan regardless of your health but not vice-versa.

Do you have to choose a primary care doctor?

There are no networks you are restricted to, and you never have to choose a primary care doctor. Unlike Medicare Advantage plans you have the freedom to go to any doctor you wish. Also, as mentioned above, there are 10 standardized Medicare supplement plans to choose from, so you have more choices in choosing which plan is best for you. ...

What is Medicare Advantage?

Medicare Advantage plans provide Part A and B benefits in place of Original Medicare. Most also include Part D prescription drug coverage. Medicare Advantage plans generally have a network of doctors and hospitals that you use to receive care. It’s important to make sure your doctor participates in the plan’s network before joining a plan.

What are the different types of Medicare Advantage Plans?

What are the types of Medicare Advantage plans? There are two types of Medicare Advantage Plans: Health Maintenance Organization (HMO) HMO plans use a network of participating hospitals and doctors for your care. You must receive services from participating hospitals and doctors, except for emergency care, out-of-area urgent care, ...

What is the phone number for UPMC for life?

This information is available for free in other languages. Please call our customer service number at 1-877-539-3080 ( TTY: 711 ). UPMC for Life has a contract with Medicare to provide HMO, HMO SNP, and PPO plans.

What is a SNP plan?

Medicare Special Needs Plans (SNP) are a type of plan that limit membership to individuals with certain characteristics or chronic conditions. They typically provide high-quality coverage with a $0 monthly premium. Learn more about SNP plans offered through UPMC for Life.

Does UPMC have a contract with Medicare?

UPMC for Life has a contract with Medicare to provide HMO, HMO SNP, and PPO plans. The HMO SNP plans have a contract with the PA State Medical Assistance program. Enrollment in UPMC for Life depends on contract renewal.

Does Medicare cover vision?

Original Medicare does not cover most prescription drugs, dental care, or vision care; or include travel benefits. And, with Original Medicare, you have to pay deductibles and copays for your care with no annual limit on your out-of-pocket costs.

Does Plan G cover Part B?

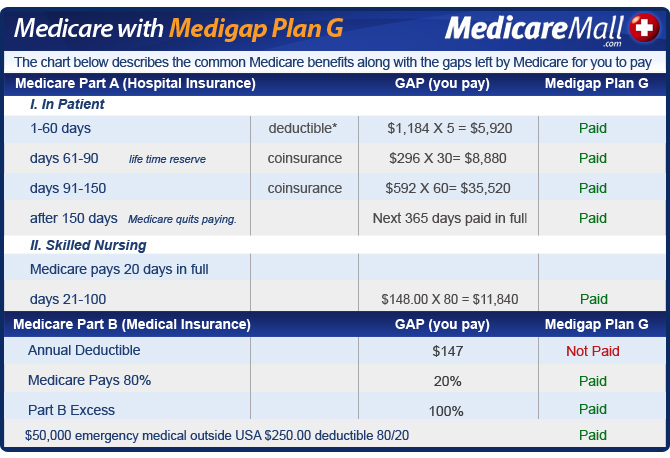

Plan G offers all the same benefits as Plan F but does not cover your Part B deductible. Plan N offers all the same benefits as Plan F but does not cover your Part B deductible or Part B excess charges. It also covers the Medicare Part A deductible at 50 percent rather than 100 percent.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is Medicare Advantage?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap. Instead of having multiple insurance plans to cover medical costs, a Medicare Advantage plan offers all your coverage in one place.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

Is Medicare a government or private insurance?

Original Medicare is a government-run option and not sold by private insurance companies. Medicare Advantage is managed and sold by private insurance companies. These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in ...

Does Medicare Advantage save money?

For some people, Medicare Advantage plans can help save money on long-term medical costs, while others prefer to pay for only what they need with Medicare add-ons. Below you’ll find an estimated cost comparison for some of the fees associated with Medicare Advantage in 2021: Cost. Medicare. Advantage amount.

Does Medicare cover dental and vision?

Medical services. If you’re someone who rarely visits the doctor, Medicare and Medicare add-ons may cover most of your needs. However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Does Medicare cover all your needs?

For example, Medicare may not cover all your needs, but a Medicare Advantage Special Needs Plan could help with long-term costs.

Do you pay Medicare premiums monthly?

If you have Medicare, you’ll pay a monthly premium for Part A (if you don’t qualify for premium-free Part A) and Part B, yearly deductibles for parts A and B, and other costs if you buy add-on coverage.

Why are Advantage plans better than Original Plans?

Advantage plans come with their own separate premium costs, but benefits can be better for a lot of people because Advantage plans are more comprehensive than original plans. Many MA plans provide prescription drug coverage, usually requiring beneficiaries to pay a set copay.

Why do people choose Medicare Advantage over Part D?

There’s a reason that more people are choosing Medicare Advantage plans over Part D coverage, and that’s primarily because MA plans include more comprehensive coverage. Some plans, for instance, even cover vision and dental, which traditional Medicare does not. But MA plans aren’t necessary for everyone, and you may be fine with original Medicare ...

What is a Part D plan?

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400. It increases to $405 next year. Once you meet the deductible, you’ll pay 25 percent for the cost of your prescriptions while the plan pays for the remainder until you meet your plan’s coverage limit.#N#The initial coverage limit is $3,700 in 2017 and will increase to $3,750 in 2018. Once you hit the coverage limit, you’ll be stuck in a situation known as the “donut hole,” or coverage gap, a scenario that the Affordable Care Act has been working on addressing by giving seniors additional discounts while they’re in the gap.

How to contact Medicare Advantage?

Medicare Part D vs. Medicare Advantage Plans. For more information on Medicare, please call the number below to speak with a healthcare specialist. 1-800-810-1437. Choosing which Medicare plan works best for you can be overwhelming. If you are one of many seniors who also takes prescription drugs, there are added considerations.

What is the out of pocket limit for MA?

Out-of-pocket threshold is capped by the government; once you reach it, you’ll pay 5% of your drug coverage. Out-of-pocket maximum is capped by the government; once you reach it, the MA plan will pay for the rest of covered drugs.

Is MA insurance necessary?

But MA plans aren’t necessary for everyone, and you may be fine with original Medicare and a Part D add-on. The best way to determine which plan will cover more and cost you less is to make a comprehensive list of your prescription needs as well as their monthly costs.

Can you get a donut hole with Medicare Part D?

With low prescription costs, you may never reach the donut hole. Choosing between Medicare Part D and a Medicare Advantage plan with drug coverage comes down to cost and long-term benefit. Evaluate your medication needs, talk to your doctor and make a list of questions to ask a qualified Medicare specialist.

What is an individual health plan?

Individual Plan: Individual health plans must charge the same premium to all beneficiaries throughout a given region / area. Employer Group Waiver Plan: CMS waives the uniform premium requirement for EGWPs, meaning that Group MAOs can vary premium amounts by class of retiree.

What is EGWP in Medicare?

Group Medicare Advantage, or Employer Group Waiver Plans (EGWP), is one of the most challenging markets within Medicare, igniting interest and questions from health plan executives as this market grows. In 2018, there were 4.1 million retirees in EGWPs out of nearly 20 million Medicare Advantage beneficiaries making this a highly valuable business ...

What is failure to pay Medicare?

Failure to Pay. Individual Plan: If the individual is paying the premium directly, you must follow the traditional rules for Medicare non-payment. Employer Group Waiver Plan: If the employer group is paying the premium, there are no particular disenrollment criteria.

Why is discipline important in EGWP?

Discipline is essential to manage EGWP accounts effectively. Because of the complexities of operating successful EGWPs, there are high-level considerations to keep in mind when determining the value of managing group vs. individual Medicare Advantage plans. For example, the following are fundamental operational differences to consider:

What is the 800 series?

The “800 series” represents most EGWPs. The second basic category is Direct Contract EGWPs (“E contracts”). Employers or unions that directly contract with CMS to become Prescription Drug Plan (PDP) sponsors or Medicare Advantage Organizations (MAO) for their members offer this type of plan. The employer is self-insured and assumes most of the risk.

Do MA EGWPs submit bids to CMS?

Individual Plan: Individual plans must submit Part C and Part D bids. Employer Group Waiver Plan: MA-EGWPs do not submit bids to CMS, and their offerings do not have to meet CMS’ meaningful difference requirements.

Is an employer self-insured?

The employer is self-insured and assumes most of the risk. Advantages: Employers can provide group medical, drug, and supplemental coverage to their retiree population at a reduced cost and / or increased benefits because of the prospective payment and management opportunities found in high performing MA plans.