What are the negatives to a Medicare Advantage plan?

What is the difference between Medicare and Medicare Supplement?

Can you switch from an Advantage plan to a supplemental plan?

What is the difference between plain Medicare and Medicare Advantage?

What's the difference between Advantage plan and supplement plan?

What is the highest rated Medicare Advantage plan?

| Category | Company | Rating |

|---|---|---|

| Best overall | Kaiser Permanente | 5.0 |

| Most popular | AARP/UnitedHealthcare | 4.2 |

| Largest network | Blue Cross Blue Shield | 4.1 |

| Hassle-free prescriptions | Humana | 4.0 |

Does getting a Medicare Advantage plan make you lose original Medicare?

What is the most comprehensive Medicare plan?

Can you switch back and forth between Medicare and Medicare Advantage?

Do you need Medicare Part A and B if you have Medicare Advantage?

Do Medicare Advantage plans have a lifetime limit?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What is Medicare Advantage?

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

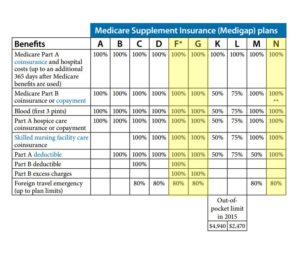

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

When is the best time to buy a Medicare Supplement Plan?

Perhaps the best time to buy a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, which starts the month that you’re both 65 or more years old and enrolled in Medicare Part B.

Is Medicare Supplement coverage guaranteed?

Not guaranteed, unless you buy the plan during your Medicare Supplement Open Enrollment Period or in another “guaranteed issue” period. Yes. Includes emergency medical coverage out of the country. Yes, with some plans (80% up to plan limits) Not in most cases, with some exceptions.

Do you have to be enrolled in Medicare Supplement?

You must be enrolled in Part A and Part B to be eligible for a Medicare Supplement plan, but you’re still getting those benefits directly through the Medicare program (compared with Medicare Advantage, which provides Part A and Part B benefits through a private, Medicare-approved insurance company).

Can you see a doctor who accepts Medicare?

Find Plans. Both types of plans are available from private insurance companies. With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. Medicare Advantage plans can include prescription drug coverage, ...

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage vs Medicare Supplement: the basics. Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs ...

What are the benefits of Medicare Advantage?

When it comes to bonus benefits, Medicare Advantage plans more commonly include them. Medicare Advantage plans may cover the following benefits Medicare Part A and Part B typically don’t cover: 1 Routine vision, including eye glasses, contacts, and eye exams 2 Routine hearing, including hearing aids 3 Routine dental care 4 Prescription drugs and some over the counter medications 5 Fitness classes and gym memberships 6 Meal delivery to your home 7 Transportation to doctor visits 8 Other benefits

What is Medicare premium?

Premiums: A premium is an amount you pay monthly to have insurance, whether or not you use covered services. Some Medicare Advantage plans have premiums as low as $0 a month. However, you still must pay your Medicare Part B premium. Most Medicare Supplement insurance plans also have monthly premiums.

Does Medicare cover out of pocket expenses?

Medicare Supplement insurance plans generally only cover out-of-pocket costs, such as copayments, coinsurance, and deductibles, for services that Original Medicare already covers.

Do you have to pay deductible for Medicare Part B?

This combination of insurance is fairly comprehensive. You may have to pay deductible and copayment/coinsurance amounts. You generally pay separate premiums for Medicare Part B and for your Medicare Advantage plan, if it charges a premium.

Do you pay Medicare out of pocket?

You still may have some out-of-pocket Medicare costs. You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance, and Medicare prescription drug coverage. If the above equation seems like too many pieces to put together, you may appreciate the simplicity of a Medicare Advantage plan.

Does Medicare Supplement cover prescription drugs?

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

What is Medicare Advantage?

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Which states have Medicare Supplement Plans?

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Is Medicare Advantage better than Medicare Supplement?

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage you’re seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Does Medicare Supplement work with Original Medicare?

Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesn’t cover.

What is Medicare Supplement Insurance?

Medicare supplement insurance, also called Medigap, helps fill in the gaps in original Medicare’s coverage, including some copayments, deductibles, and coinsurance. Some supplement insurance, or Medigap, policies cover added services, such as those a person receives while travelling outside the country.

What is Medicare Advantage?

Medicare supplement plans can only be used with original Medicare. Medicare Advantage insurance combines the benefits of Medicare parts A and B. It can also provide prescription drug coverage. A person with this type of plan pays a premium, copayments, and a deductible.

What are the different types of Medicare?

Medicare has several parts, each of which covers different aspects of healthcare. Though there are exceptions and nuances, the general breakdown is as follows: 1 Part A covers hospital care. 2 Part B covers outpatient services. 3 Part C is also called Medicare Advantage. 4 Part D covers prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is an HMO plan?

Health maintenance organization plans: This type, called an HMO plan, covers services from providers in the plan’s network and sometimes certain out-of-network services. Preferred provider organization plans: A person with this type of plan can use in- or out-of-network services, though in-network services cost less.

What is fee for service plan?

Private fee-for-service plans: This type limits how much a person pays to any given service provider, and it removes the requirement of a referral to see a specialist.

How much is Medicare Supplement vs Advantage?

Choosing Medicare Supplement vs. Advantage. $3,400 to $6,700 a year in deductibles and co-pays, depending on the plan. Most or all Part A & B out-of-pocket costs are covered. Part A & B benefits covered in place of Original Medicare. Most plans have Part D coverage.

What is Medicare Advantage?

Medicare Advantage refers to Medicare Part C and provides the same benefits as Part A and B, except for hospice care, a service covered by Part A. Under this plan, members would continue paying their Part B premium. Many Advantage plans offer Part D, which covers prescription drugs.

How many states have Medicare Supplement?

Medicare Supplement or Medigap, is private plan coverage that pays for most of your out-of-pocket costs like co-pays, deductibles, and premiums and picks up where Original Medicare stops. Medicare Supplement has 10 sub-plans in 47 states, while three states—Wisconsin, Minnesota, and Massachusetts have their own customized plans.

What is Medicare Supplement?

Currently, there are two options available: Medicare Supplement (also known as Medigap) and Medicare Advantage. These plans assist in covering non-covered expenses beneficiaries must pay out-of-pocket like deductibles and co-pays.

What is a private supplemental plan?

Private supplemental coverage that pays all or most Part A & B out-of-pocket costs. Private health plan that provides Part A & B benefits directly in place of Original Medicare. 1st 6 months after enrolling in Part B and being 65 years old, as a minimum age. One Medicare Advantage card.

What are the letters on a Medigap plan?

The 10 standard Medigap plans are marked by the letters A, B, C, D, F, G, K, L, M, N . Once enrolled in Medigap, your plan will cover the portion of your bill, once Original Medicare has paid its claims.

Does Medicare Advantage have co-pays?

Medicare Advantage usually requires co-pays and deductibles. However, unlike Original Medicare, these payments put annual limits on how much you pay out-of-pocket. Once you’ve reached that limit, the plan will cover your medical bills for the remainder of the year.

What is Medicare Advantage?

Medicare Advantage plans provide Part A and B benefits in place of Original Medicare. Most also include Part D prescription drug coverage. Medicare Advantage plans generally have a network of doctors and hospitals that you use to receive care. It’s important to make sure your doctor participates in the plan’s network before joining a plan.

What are the different types of Medicare Advantage Plans?

What are the types of Medicare Advantage plans? There are two types of Medicare Advantage Plans: Health Maintenance Organization (HMO) HMO plans use a network of participating hospitals and doctors for your care. You must receive services from participating hospitals and doctors, except for emergency care, out-of-area urgent care, ...

What is a SNP plan?

Medicare Special Needs Plans (SNP) are a type of plan that limit membership to individuals with certain characteristics or chronic conditions. They typically provide high-quality coverage with a $0 monthly premium. Learn more about SNP plans offered through UPMC for Life.

Does UPMC have a contract with Medicare?

UPMC for Life has a contract with Medicare to provide HMO, HMO SNP, and PPO plans. The HMO SNP plans have a contract with the PA State Medical Assistance program. Enrollment in UPMC for Life depends on contract renewal.

Does Medicare cover vision?

Original Medicare does not cover most prescription drugs, dental care, or vision care; or include travel benefits. And, with Original Medicare, you have to pay deductibles and copays for your care with no annual limit on your out-of-pocket costs.

Does Plan G cover Part B?

Plan G offers all the same benefits as Plan F but does not cover your Part B deductible. Plan N offers all the same benefits as Plan F but does not cover your Part B deductible or Part B excess charges. It also covers the Medicare Part A deductible at 50 percent rather than 100 percent.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

Is prescription drug coverage included in most insurance plans?

Prescription drug coverage is included with most plans .

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Do you have to use doctors in a health insurance plan?

You may be required to use doctors and hospitals in the plan network.

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Who manages Medicare Advantage?

Medicare Advantage is managed and sold by private insurance companies . These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in the United States.

What is Medicare Part A?

Inpatient hospital services ( Medicare Part A ). These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

What takes the place of original Medicare add-ons?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap.

How long before you can apply for medicare?

You can also apply for Medicare 3 months before your 65th birthday and up to 3 months after you turn age 65. If you decide to wait to enroll until after that period, you may face late enrollment penalties.

How long do you have to have prescriptions for Medicare?

No matter what option you choose, you’re required to have some form of prescription drug coverage within 63 days of enrolling in Medicare, or you’ll be required to pay a permanent late enrollment penalty.

Does Medicare Advantage cover dental exams?

However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.