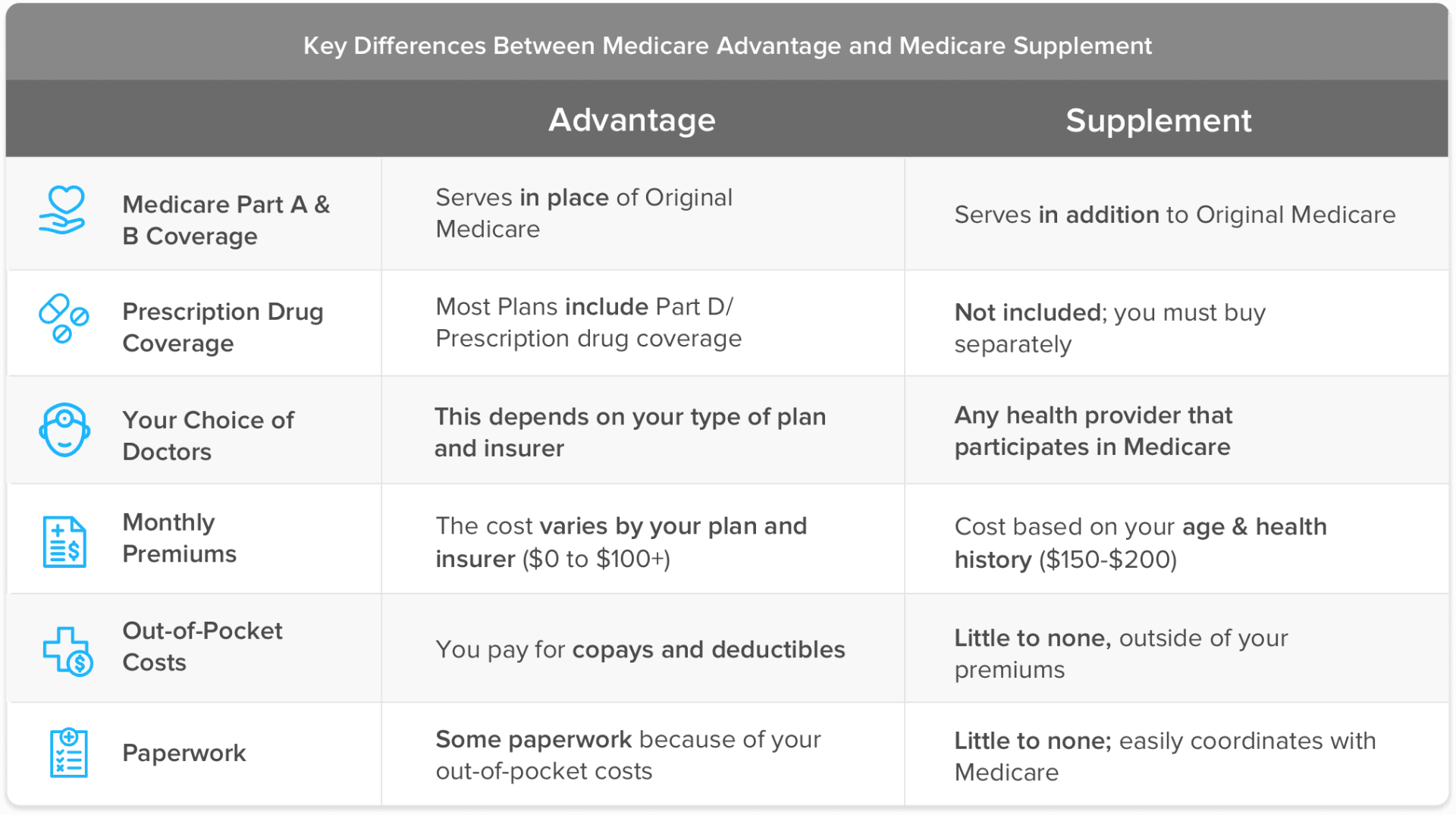

The short answer is that a Medicare Advantage plan “replaces” your Original Medicare (Medicare Parts A and B) coverage – hence the term “replacement plan” – while a Medicare supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

How much cheaper is Medicare Advantage compared to Medicare?

Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.” Some Medicare Supplements cover 100% of the cost sharing left by Medicare on Medicare approved expenses.

Is Medicare Advantage better than Medicare?

The MA program helps address social determinants of health and improve health equity: "...over 95 percent of Medicare Advantage beneficiaries have access to meal services, telehealth, transportation, dental, fitness, vision, and hearing benefits.

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

Can I switch between Medicare Advantage and Original Medicare?

You can move from Medicare Advantage to Original Medicare for up to two months after you’re discharged. Once you become eligible for Medicaid benefits, then you can drop your Medicare Advantage plan and switch to Original Medicare.

Are Medicare replacement and Medicare Advantage the same?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Advantage a replacement plan?

A Medicare Advantage plan serves as a replacement for original Medicare. The costs, benefits, and coverage rules for Medicare Advantage may be different than those of original Medicare. They may also vary among plans.

What is the difference between original Medicare and Advantage plans?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Does a Medicare Advantage plan replace Medicare Part B?

Medicare Advantage doesn't replace Original Medicare Part A and Part B coverage; it simply delivers these benefits through an alternative channel: private insurance companies. Medicare Advantage plans are offered by private insurance companies that contract with Medicare.

Is Medicare Advantage cheaper than original Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

How can Medicare Advantage plans have no premiums?

$0 Medicare Advantage plans aren't totally free Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

What are the 4 types of Medicare?

Part A covers any inpatient hospital care at no cost to those who have paid into the system through their employers. This coverage can be purchased...

How do Medicare Advantage Plans work?

Medicare Advantage plans are structured like employer-offered insurance plans and can be obtained by paying a monthly premium. Many cover all the s...

Is Medicare Advantage better than traditional Medicare?

Your unique circumstances determine whether Medicare Advantage is the right choice for you. Coverage is often more comprehensive, and your medical...

What are the pros and cons of Medicare Advantage plans?

Pros: All-in-one coverage, including prescriptions, vision and dental Familiar for seniors who have been covered under employer-offered insurance M...

Who is eligible for Medicare Part C?

Medicare Part C is available to anyone who qualifies for and enrolls in Medicare Parts A and B.

How and when should I enroll in a Medicare Advantage plan?

Enrollment in a Medicare Advantage plan can be done through the government Medicare program, via their website or over the phone, through a third-p...

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

Why do Medicare Advantage plans require a primary care provider?

Because many Medicare Advantage plans require the identification of a primary care provider, this could also be beneficial to someone with complex health issues by creating a single physician to help coordinate the efforts of multiple specialists.

How long does Medicare Advantage last?

The Initial Enrollment Period (IEP) includes your 65th birth month and the three months before and after, adding up to seven months in total.

How long do you have to wait to enroll in Medicare Part B?

If seniors choose to wait to enroll in Medicare Part B due to existing coverage through an employer, they have a Special Enrollment Period (SEP) of eight months after they lose this coverage to enroll in Medicare. They can enroll in Medicare Advantage once they have enrolled in both Part A and B coverage.

What is Medicare for seniors?

For many seniors over the age of 65, Medicare provides the health insurance necessary to ensure regular access to the medical professionals and treatments they need. Those who collect Social Security benefits are often enrolled automatically unless they choose to opt out and take the appropriate steps.

How to enroll in Medicare Advantage?

You have a few enrollment options once you’ve made your decision: 1 You can enroll directly with the insurance provider you choose, either online or by contacting them over the phone. 2 You can enroll from the Medicare.gov website or by contacting a customer service representative using the number above. 3 You can choose a third-party independent health insurance agency to help you select and enroll in a Medicare Advantage plan.

What are the pros and cons of Medicare?

Pros and Cons of Medicare. One of the biggest benefits of Medicare is the guaranteed availability of healthcare coverage for seniors who couldn’t otherwise afford private health insurance.

When is the fall enrollment period for Medicare?

This period is open every year from October 15 through December 7.

What are the elements of Medicare?

Under original Medicare, to get the full array of services you will likely have to enroll in four separate elements: Part A; Part B; a Part D prescription drug program; and a supplemental or Medigap policy. Physicians and hospitals have to file claims for each service with Medicare that you'll have to review.

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

What is Medicare Part B?

Under original Medicare, the federal government sets the premiums, deductibles and coinsurance amounts for Part A (hospitalizations) and Part B (physician and outpatient services ). For example, under Part B, beneficiaries are responsible for 20 percent of a doctor visit or lab test bill. The government also sets maximum deductible rates for the Part D prescription drug program, although premiums and copays vary by plan. Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

Is Medicare Advantage a PPO or HMO?

Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Does MA have a copay for doctor visits?

But instead of paying the 20 percent coinsurance amount for doctor visits and other Part B services, most MA plans have set copay amounts for a physician visit , and typically that means lower out-of-pocket costs than original Medicare. MA plans also have an annual cap on out-of-pocket expenses.

Is Medicare Advantage based on out-of-network providers?

Medicare Advantage plans are based around networks of providers that are usually self-contained in a specific geographic area. So, if you travel a lot or have a vacation home where you spend a lot of time, your care may not be covered if you go to out-of- network providers, or you would have to pay more for care.

Why are Advantage Plans also known as Replacement Plans?

Advantage plans are also known as replacement plans because, in a way, they replace Original Medicare. If you’re thinking about signing up for an Advantage plan, we’re here to tell you everything you need to know.

What is Medicare replacement plan?

What is a Medicare Replacement Plan. If you’ve heard of a Medicare replacement plan, it’s the same as an Advantage plan. Advantage plans are also known as replacement plans because, in a way, they replace Original Medicare. If you’re thinking about signing up for an Advantage plan, we’re here to tell you everything you need to know.

How does an Advantage plan work?

The way these plans work is by providing benefits through a private insurance company rather than through Medicare. When enrolled in an Advantage plan, you must use the plan’s network of providers to be covered. When signing up for an Advantage plan, you must have enrolled in both Parts A and B.

What to do if you enroll in Advantage Plan?

If you enroll in an Advantage plan, check your Summary of Benefits. This document will let you know what’s not covered, as well as list copay amounts for which you’ll be responsible. Additionally, your benefits are subject to change each year.

Can you return to Medicare Advantage during Open Enrollment Period?

Replacement plans, Advantage, or Part C, plans stand-in for your Medicare for each year you’ve enrolled. They don’t act as a permanent replacement, and you can always return to Medicare during the Medicare Advantage Open Enrollment Period or Annual Enrollment Period. The way these plans work is by providing benefits through a private insurance ...

Can an Advantage Plan replace Medicare?

Again, an Advantage plan doesn’t permanently replace Medicare. However, it acts as your primary coverage. Medicare pays private insurance companies offering Advantage plans to handle beneficiary claims and benefits. The Advantage plan must offer the same benefits as Parts A and B.

Can you drop a Medicare Advantage plan?

Can a Medicare Advantage plan drop you? If you don’t pay your premium for your plan or Part B, your Advantage plan can drop you. Likewise, if you move outside the service area, they can drop you.

Medicare Replacement Plans

Original Medicare refers to Medicare Part A and Medicare Part B. These are the public, federally-funded parts of Medicare for which most people qualify at age 65 (some people younger than 65 may qualify based on a disability or specific health condition).

Medicare Supplement Plans

Original Medicare requires certain out-of-pocket costs like deductibles, copayments and coinsurance. A Medicare Supplement Insurance plan, or Medigap, covers the cost of these expenses.

Choosing Between Medicare Advantage and Medigap

Here’s a kicker for anyone considering signing up for a Medicare replacement or Medicare Supplement plan: You are not allowed to have both at the same time. You may only choose one or the other.

What benefits do you get with Medicare Advantage?

When enrolled in Medicare Advantage, you will receive your Part A and Part B benefits through your Medicare Advantage plan except for hospice care, which you will continue to receive through Part A.

What is Medicare Part A and Part B?

Medicare Part A covers hospital insurance, and Part B covers medical insurance. By law, Medicare Advantage plans (which are sold by private insurance companies) are required to provide the same benefits as Original Medicare. When enrolled in Medicare Advantage, you will receive your Part A and Part B benefits through your Medicare Advantage plan ...

Does Medicare replace Original Medicare?

The answer is that in a sense, yes , Medicare Advantage does replace Original Medicare. But there’s much more to understanding the relationship between Medicare and Medicare Advantage. This guide will help you learn more about Medicare Advantage plans so that you can better decide which type of Medicare coverage is right for your needs.

Does Medicare Advantage cover prescriptions?

Many Medicare Advantage plans include prescription drug coverage, though benefits and plan availability vary based on your location. Some plans may also offer benefits not found in Original Medicare, such as coverage for dental, hearing, vision, and other benefits.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

What is Medicare Advantage Plan?

Individuals who have traditional Medicare, or a Medicare Advantage plan that does not include prescription drug coverage, who want Part D coverage, must purchase it separately. This is called a “stand-alone” Prescription Drug Plan (PDP). A Medicare Advantage plan that includes both health and drug coverage is referred to as a Medicare Advantage ...

What is a Medigap plan?

Medigap plans (also known as Medicare Supplement Insurance), are private health insurance plans that help pay for the "gaps" in payment for Medicare-covered care left by traditional Medicare ; these include copayments, coinsurance, and deductibles. In many cases, someone with traditional Medicare must purchase a separate Part D drug plan as well as a Medigap plan to supplement their Medicare benefits. Medigap policies do not work with MA plans and it is illegal for anyone to sell an MA enrollee a Medigap policy unless they are switching to traditional Medicare.

Does Medicare have a cap on out-of-pocket expenses?

You may also have to pay for deductibles, coinsurance and copays. Traditional Medicare has no out-of-pocket maximum or cap on what you may spend on health care. With traditional Medicare, you will have to purchase Part D drug coverage and a Medigap plan separately (if you choose to purchase one). Medicare Advantage.

Do you need to buy a Medigap plan?

Some beneficiaries have employer or union coverage that pays costs that traditional Medicare does not cover; those who do not may need to buy a Medigap plan. Other individuals may be eligible for Medicaid that can also cover such costs and may not need Medigap.

Does Medicare Part B require monthly premiums?

Medicare Part B requires the payment of a monthly premium. You must elect to either accept or decline this coverage, but be aware that there may be penalties for not enrolling during your initial enrollment period. For more details, see our Eligibility and Enrollment page. Medicare Advantage.

Can you use a network of providers in MA?

If you are enrolled in a Medicare Advantage plan you may be limited by the MA plan to using a network of specific providers in order for the plan to cover your care. You may have to choose a primary care physician, obtain referrals to see specialists, and get prior authorization for certain services.

Can you change providers in MA plan?

The MA plan can also change the providers in the network anytime during the year. Costs. Traditional Medicare. In traditional Medicare, Part A is free if you have worked and paid Social Security taxes for at least 40 calendar quarters (10 years).

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.