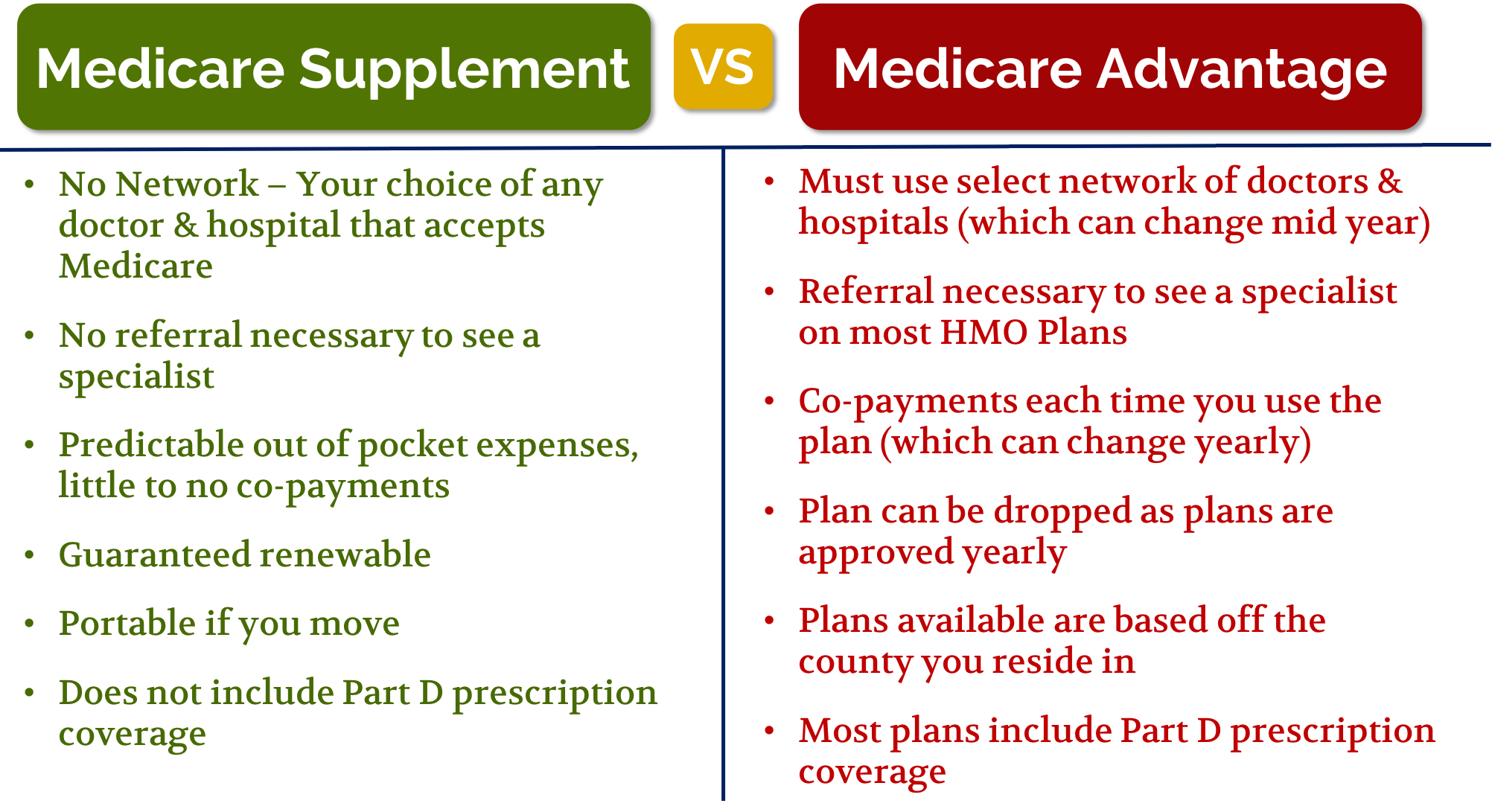

Some of the major differences include:

- All Medicare Advantage plans have required cost sharing, while Medicare Supplement insurance often has little or zero cost sharing.

- Since Medicare Supplement Insurance works with Original Medicare, there are no networks or referrals needed. ...

- Medicare Advantage usually has lower premiums than Medicare Supplement insurance.

Are Medicare Advantage plans the same as Medicare supplements?

No. Medicare Advantage plans are not the same as Medicare Supplements or Medigap policies. And here are a few key differences between the plans: Medigap policy design

Which Medicare Advantage plan is the best?

What to know about Medicare in Maryland

- The average monthly premium in 2022 for a Medicare Advantage plan in Maryland is $45.97. (It was $46.52 in 2021.)

- There are 49 Medicare Advantage plans available in Maryland in 2022. (This number is up from 41 plans in 2021.)

- All Medicare-eligible people in Maryland have access to a $0-premium Medicare Advantage plan.

Which is better Medicare Advantage or Medicare supplement?

Medicare Advantage may also be a good option for seniors who want prescription drug coverage or want additional coverage options like routine dental care. Seniors who have significant health problems and a lot of medical expenses are generally better off with Medicare supplement plans.

Is Medicare supplement better than advantage?

Medicare Advantage plans generally have lower premiums than Medicare supplements. There are some areas where Medicare Advantage plans have no monthly premiums at all. That is usually offset by higher co-pays and deductibles. This is one reason the MA plans have gotten so popular. But don’t be fooled by the premium.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is the main difference between Medicare Advantage and Medigap?

Medigap is used in conjunction with Original Medicare (Parts A and B), whereas Medicare Advantage wraps all of the Medicare Part A and Part B benefits into one plan. And most Medicare Advantage plans will generally also include extras like dental and vision coverage, hearing aid coverage, and gym memberships.

What's the big deal about Medicare Advantage plans?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Do you have to renew Medicare supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is a Supplement plan (Medigap)?

Supplement plans are offered by private insurance carriers. They enhance Original Medicare by paying all or most of the Part A and B out-of-pocket...

What are the types of Medicare Advantage plans?

Health Maintenance Organization (HMO)HMO plans use a network of participating hospitals and doctors for your care.You must receive services from pa...

Can I change from Medicare Supplement to Medicare Advantage?

Yes, switching from a Medicare Supplement plan to a Medicare Advantage plan is easy. Make sure you’ve taken time to compare and understand the diff...

What is the difference between Medicare Supplement Plans G and N?

Medicare Supplement plans are standardized across the nation. These plans are offered by private insurance companies, but plan types with the same...

Are there Medicare plans designed for people with chronic medical conditions?

Yes. Medicare Special Needs Plans (SNP) are a type of plan that limit membership to individuals with certain characteristics or chronic conditions....

How much is Medicare Supplement vs Advantage?

Choosing Medicare Supplement vs. Advantage. $3,400 to $6,700 a year in deductibles and co-pays, depending on the plan. Most or all Part A & B out-of-pocket costs are covered. Part A & B benefits covered in place of Original Medicare. Most plans have Part D coverage.

What is Medicare Advantage?

Medicare Advantage refers to Medicare Part C and provides the same benefits as Part A and B, except for hospice care, a service covered by Part A. Under this plan, members would continue paying their Part B premium. Many Advantage plans offer Part D, which covers prescription drugs.

How many states have Medicare Supplement?

Medicare Supplement or Medigap, is private plan coverage that pays for most of your out-of-pocket costs like co-pays, deductibles, and premiums and picks up where Original Medicare stops. Medicare Supplement has 10 sub-plans in 47 states, while three states—Wisconsin, Minnesota, and Massachusetts have their own customized plans.

What is Medicare Supplement?

Currently, there are two options available: Medicare Supplement (also known as Medigap) and Medicare Advantage. These plans assist in covering non-covered expenses beneficiaries must pay out-of-pocket like deductibles and co-pays.

What is a private supplemental plan?

Private supplemental coverage that pays all or most Part A & B out-of-pocket costs. Private health plan that provides Part A & B benefits directly in place of Original Medicare. 1st 6 months after enrolling in Part B and being 65 years old, as a minimum age. One Medicare Advantage card.

Does Medicare Advantage have co-pays?

Medicare Advantage usually requires co-pays and deductibles. However, unlike Original Medicare, these payments put annual limits on how much you pay out-of-pocket. Once you’ve reached that limit, the plan will cover your medical bills for the remainder of the year.

What is Medigap?

The Medigap definition is easy: Medigap and Medicare Supplement are the same thing. In this article, we’ll use “Medicare Supplement” to keep things simple.

What is Medicare Part C?

Here is another easy one. Medicare Part C and Medicare Advantage are the same thing. This article will use “Medicare Advantage”. So far, so good.

What is Medicare Supplement?

Medicare Supplement is just that, a supplement to Medicare coverage. In order to use Medicare Supplement, you must have Original Medicare coverage (Medicare Parts A and B).

What plan is more affordable?

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits too —such as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

What is an Enrollment Period?

If you just became eligible for Medicare, you can enroll in a Medicare Advantage plan right away.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

Is it better to have Medicare Advantage or Medicare Supplement (Medigap)?

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

Can you have a Medicare Advantage plan and a Medicare Supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Can you change from a Medicare Advantage plan to a Medicare Supplement plan?

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period. 4

What is Medicare Advantage?

Medicare Advantage plans provide Part A and B benefits in place of Original Medicare. Most also include Part D prescription drug coverage. Medicare Advantage plans generally have a network of doctors and hospitals that you use to receive care. It’s important to make sure your doctor participates in the plan’s network before joining a plan.

What are the different types of Medicare Advantage Plans?

What are the types of Medicare Advantage plans? There are two types of Medicare Advantage Plans: Health Maintenance Organization (HMO) HMO plans use a network of participating hospitals and doctors for your care. You must receive services from participating hospitals and doctors, except for emergency care, out-of-area urgent care, ...

What is a SNP plan?

Medicare Special Needs Plans (SNP) are a type of plan that limit membership to individuals with certain characteristics or chronic conditions. They typically provide high-quality coverage with a $0 monthly premium. Learn more about SNP plans offered through UPMC for Life.

Does UPMC have a contract with Medicare?

UPMC for Life has a contract with Medicare to provide HMO, HMO SNP, and PPO plans. The HMO SNP plans have a contract with the PA State Medical Assistance program. Enrollment in UPMC for Life depends on contract renewal.

Does Medicare cover vision?

Original Medicare does not cover most prescription drugs, dental care, or vision care; or include travel benefits. And, with Original Medicare, you have to pay deductibles and copays for your care with no annual limit on your out-of-pocket costs.

Does Plan G cover Part B?

Plan G offers all the same benefits as Plan F but does not cover your Part B deductible. Plan N offers all the same benefits as Plan F but does not cover your Part B deductible or Part B excess charges. It also covers the Medicare Part A deductible at 50 percent rather than 100 percent.

What is Medicare Advantage?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap. Instead of having multiple insurance plans to cover medical costs, a Medicare Advantage plan offers all your coverage in one place.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

Is Medicare a government or private insurance?

Original Medicare is a government-run option and not sold by private insurance companies. Medicare Advantage is managed and sold by private insurance companies. These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in ...

Does Medicare Advantage save money?

For some people, Medicare Advantage plans can help save money on long-term medical costs, while others prefer to pay for only what they need with Medicare add-ons. Below you’ll find an estimated cost comparison for some of the fees associated with Medicare Advantage in 2021: Cost. Medicare. Advantage amount.

Does Medicare cover dental and vision?

Medical services. If you’re someone who rarely visits the doctor, Medicare and Medicare add-ons may cover most of your needs. However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Does Medicare cover all your needs?

For example, Medicare may not cover all your needs, but a Medicare Advantage Special Needs Plan could help with long-term costs.

Do you pay Medicare premiums monthly?

If you have Medicare, you’ll pay a monthly premium for Part A (if you don’t qualify for premium-free Part A) and Part B, yearly deductibles for parts A and B, and other costs if you buy add-on coverage.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

Can I switch to a different Medicare Advantage plan?

And you generally can’t be denied coverage or charged more based on your health status . You can apply to buy a plan any time after you turn 65.

Do I have to pay a monthly premium for Medicare?

For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium. When you use services, you’ll have. low—or no—copays and coinsurance, depending on the plan selected. Prescription drug coverage is included with most plans.

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Does Medicare cover prescription drugs?

Prescription drug coverage is included with most plans. You can select your own doctors and hospitals that accept Medicare patients. You can see specialists without referrals. Coverage goes with you when you travel across the United States and, depending on the plan, may cover emergency care when traveling abroad.