Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Is high deductible plan F the best?

This Plan is Perfect For Those Who:

- Need a lower monthly premium

- Are comfortable with paying a higher deductible before receiving full coverage

- See the doctor or visit the hospital semi-frequently

- Live in states that allow excess charges

- Like to travel outside the United States

What is AARP Medicare supplement plan F?

Medicare Supplement Plan F is a specific type of Medicare Supplement plan. Medicare Supplement (also called Medigap) insurance may help pay for out-of-pocket costs of Medicare Part A and Part B. Is AARP doing away with Plan F? According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, it’s the most popular plan among those eligible for Medicare.

What is Aetna plan?

- A.M. Best awarded Aetna an A rating (excellent) for financial strength.

- Business Wire reported in December 2020 that “Aetna is one of the top three U.S. ...

- Aetna has been conducting business since 1853. Health insurance services include medical, pharmacy and dental. ...

- Aetna health insurance was acquired by CVS Health in 2018. ...

What is the difference between plan F and plan F high deductible?

Medicare Supplement Plan F and High Deductible Medicare Supplement Plan F are almost identical Medigap plans. The only difference in plan details is that High Deductible Plan F requires you to meet a deductible before it begins covering you ($2,490 in 2022), whereas Plan F provides coverage immediately.

Does Medicare Supplement plan F have a deductible?

As with other health insurance policies, premiums for Plan F are tax-deductible. However, people who became eligible for Medicare after January 2020 will be unable to purchase a Plan F policy.

Who is eligible for high deductible Plan F?

High Deductible Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020) or you qualified for Medicare due to a disability before January 1, 2020.

Does coverage F have a deductible?

Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of $2,370 for 2021 before the plan pays anything. This amount can go up each year.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

What is Medicare Supplement plan F+?

Plan F includes coverage for Medicare Part A and B deductibles, copayments and coinsurance, plus skilled nursing facility care, foreign travel emergencies, 100 percent coverage of Medicare Part B excess charges and more.

How much does AARP plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

Is plan F better than plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the high deductible plan F for 2020?

For 2020, the out-of-pocket cost before coverage kicks in for High-Deductible Plan F is $2,340. This deductible rises slightly every year – it was $2,240 in 2018 and $2,220 in 2017.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

What is the advantage of a high deductible Medigap plan?

A high-deductible Medigap plan makes more sense than a standard version if the amount you spend to meet the deductible and premiums are less expensive than the premiums of a standard insurance policy.

How much does Medicare Supplement Plan F cost?

High-Deductible Plan F: Your premium may cost $72 per month, but you may have to pay a $2,240 deductible before your plan pays anything. Whether you choose Medicare Supplement Plan F or High-Deductible Plan F depends on your needs and budget.

When do you have to buy Medicare Supplement?

However, if you want any Medicare Supplement plan, it is highly recommended that you buy a policy during your six-month Medigap open enrollment period which starts the month you turn 65 and are enrolled in Medicare Part B (Medical Insurance).

What to do after enrolling in Medicare Part A and Part B?

After enrolling in Original Medicare Part A and Part B, you may decide to purchase a private supplemental insurance plan to help pay the costs that Original Medicare doesn’t cover.

Is Medicare Supplement Plan F the same as High Deductible Plan F?

High-Deductible Plan F is attractive to some Medicare beneficiaries because it offers the same coverage as Medicare Supplement Plan F but has a lower monthly premium. However, the deductible is typically much higher. Therefore, you’ll pay more out-of-pocket with High-Deductible Plan F before your plan starts paying.

How much does a high deductable plan cost?

If you are looking to have lower monthly payments, you can choose a high-deductible Plan F, which generally costs $50 per month or less in premiums. 2 With this plan, you should expect to pay a fraction of what you’d pay per month for the standard Plan F.

How much is the 2020 F deductible?

For 2020, the out-of-pocket cost before coverage kicks in for High-Deductible Plan F is $2,340. This deductible rises slightly every year – it was $2,240 in 2018 and $2,220 in 2017. To cover your medical costs, the High-Deductible Plan F will run you a considerable amount of money out-of-pocket, but it won’t be a monthly burden on your wallet.

What is the most popular Medicare Supplement Plan?

There’s a good reason Plan F is the most popular Medicare Supplement plan. Largely, it provides the most comprehensive coverage of any Medigap policy. Once Medicare pays its share of covered charges for care in the U.S., Plan F will cover in full, the rest of your costs for any services covered under Medicare Parts A and B.

What is a plan F?

What You Need to Know. Plan F provides the most comprehensive coverage of any Medicare Supplement plan. High deductible Plan F offers similar coverage but requires you to pay out-of-pocket before your carrier pays for your healthcare. Plan F is only available if you qualified for Medicare before January 1, 2020.

How long does it take to sign up for Medicare Supplement?

You have a 6-month Medigap Open Enrollment Period during which you can sign up for a Medicare Supplement plan. Unless you’re granted a Medigap Special Enrollment Period, the only way you can switch your Medigap policy is during that same Open Enrollment Period.

How much does HDPF cost in 2020?

For 2020, the out-of-pocket cost before coverage kicks in for High-Deductible Plan F is $2,340.

How much is Plan F in Hawaii?

Plan F is available in rural Hawaii for monthly premiums of just $150, while Plan A is sold for $113. Whatever the cost, you can safely assume that Plan F’s monthly premium is higher than any other plan in your area. Over time, Plan F premiums certainly add up.

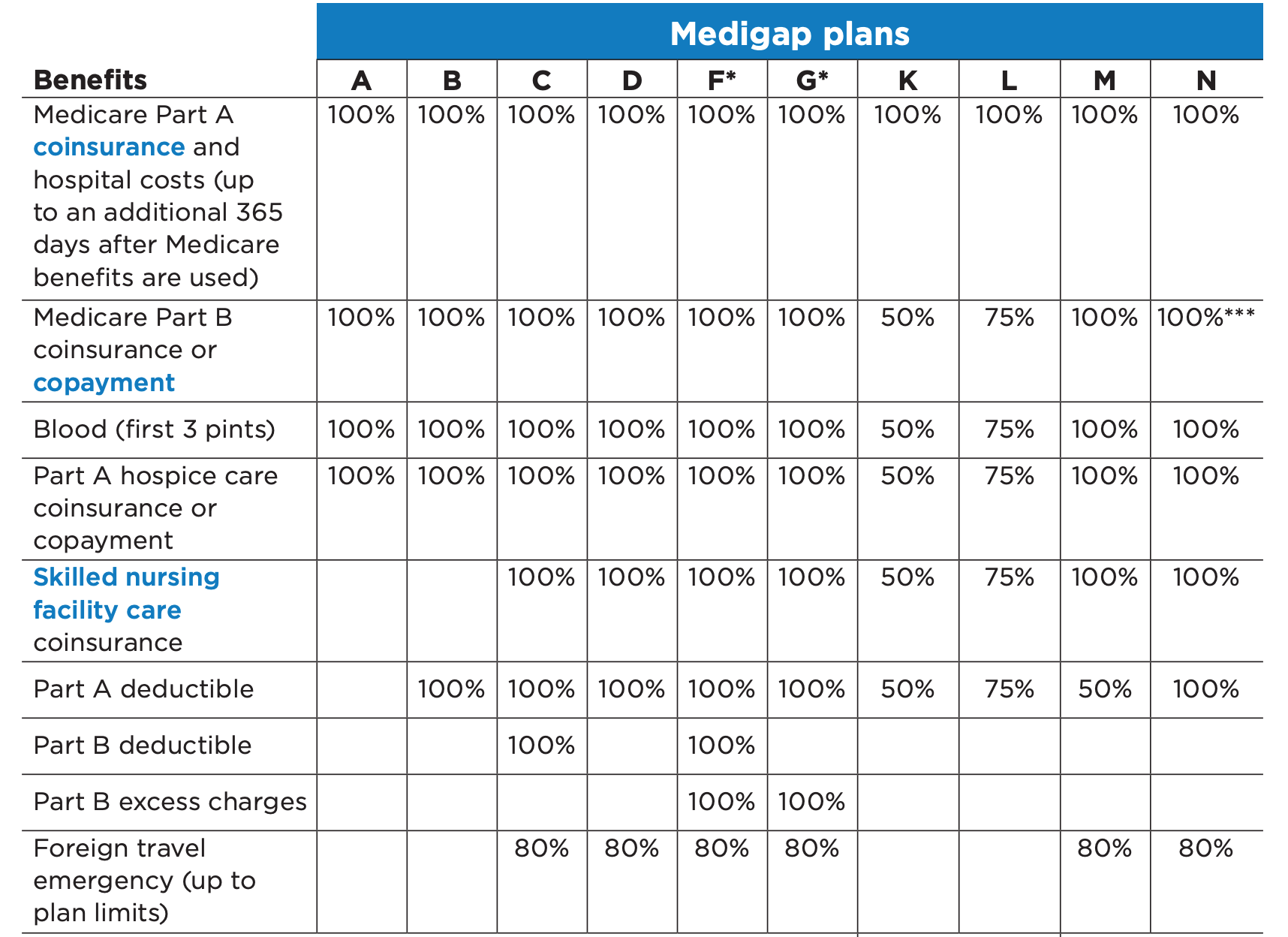

Medigap Plan High F Vs F Benefit Details

Below you will see how the Medigap High F’s annual deductible of $2,490 must be paid before coverage kicks in. As well as, you will see on the chart how once the High F deductible is paid for you have IDENTICAL coverage. We’ll explain more about the High Deductible after the chart.

High F Deductible Explained

We get a lot of questions about how the High F deductible works. And, we get that it’s confusing.

Who Should Choose Medigap High F?

Medigap High F is for a very specific client. If you prefer to save money on your premium, but are okay with paying everything out of pocket until you meet the high deductible, this plan might be right for you.

Who Should Choose Medigap Plan F?

We think everyone enrolling in a Medigap Plan should consider Plan F. Medigap Plan F is probably right for you, if you prefer to just have a set monthly premium, and not have to think about being nickeled and dimed with every service or appointment, or you prefer not to shell out a large sum of money if you had a serious injury or illness.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

What is the deductible for Plan F 2021?

What is the Deductible for High Deductible Plan F in 2021? In 2021, the deductible is $2,370. Therefore, you would have to pay $2,370 out-of-pocket on this plan. Once you reach this deductible, the plan will cover 100% of the costs.

What is a standard plan F?

Standard Plan F is the Medigap plan offering the most comprehensive benefits. Yet, with more coverage comes higher monthly premiums. Thus, this plan, with its lower monthly premiums, could be a good choice for cost-conscious beneficiaries who find standard Plan F’s benefits attractive.

How to get a medical insurance plan?

This Plan is Perfect For Those Who: 1 Need a lower monthly premium 2 Are comfortable with paying a higher deductible before receiving full coverage 3 See the doctor or visit the hospital semi-frequently 4 Live in states that allow excess charges 5 Like to travel outside the United States

How much is the average premium for a high deductible plan?

In 2019, the average premium for high-deductible Plan F was $57.16 per month. In 2019, the average premium for standard Plan F was $169.14 per month. 1. If you are interested in enrolling in a high-deductible Medigap Plan F, you should consider a few things. You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will ...

What is a high deductible plan?

High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums. The tradeoff for these lower monthly premiums is a high deductible.

What happens if you meet your deductible on Medigap?

Once you meet your deductible, your Medigap insurance company will begin paying the benefits offered in the plan. Before you choose the high-deductible Plan F, you should consider how likely you are to use enough medical services to meet the yearly deductible. Then evaluate how much coverage you would need after the deductible is met.

How much will Medicare cover in 2021?

You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will kick in. For example, if you need a blood transfusion, a traditional Medigap plan will cover the cost of the first three pints, and Medicare will cover the cost of pints four and beyond.

High-Deductible Plan F

The same benefits and coverage are offered for both Medicare Supplement Plan F and High-Deductible Plan F. The benefits include:

High-Deductible Plan G

The same benefits and coverage are offered for both Medicare Supplement Plan G and High-Deductible Plan G. The benefits include:

Questions about each plan?

If you’re interested in knowing what each Medicare Supplement plan offers, then reach out to Bobby Brock Insurance today! Our well-trained and experienced agents offer Medicare help for free to give you the answers you need.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.