Full Answer

Should you buy a Medigap or Medicare Advantage plan?

About 14.5 million beneficiaries are enrolled in a Medigap plan, which helps cover certain cost-sharing aspects of original Medicare ... "I've seen it a lot." If you work with an agent, you should ask how many insurance companies they work with (or ...

Should I Choose Medicare Advantage or Medigap?

If you want dental and vision coverage, then a Medicare Advantage plan may be the cheapest way to get it. If you are happy with your Part D plan, then a Medigap plan may be a simpler option to help you cover Original Medicare fees without losing your prescription drug plan.

What is Medicare Advantage vs supplement?

Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans both offer coverage for out-of-pocket medical expenses. You cannot have both a Medicare Advantage and Medicare Supplement plan. Understanding your health and how you’ll use your plan will help you determine which one may fit your needs.

What is the difference between Medicare and advantage?

- Routine vision, including eye glasses, contacts, and eye exams

- Routine hearing, including hearing aids

- Routine dental care

- Prescription drugs and some over the counter medications

- Fitness classes and gym memberships

- Meal delivery to your home

- Transportation to doctor visits

- Other benefits

Is a Medigap plan better than an Advantage plan?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the difference between plan G and an Advantage plan?

Costs for a Medicare Advantage plan and a Medicare Supplement Plan G differ substantially in both premium costs and potential out-of-pocket costs. A Medicare Advantage plan often has no monthly premium, while a Medicare Supplement Plan G always has a monthly premium.

Is Medicare Advantage the same as Part G?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F. Plan N is the least expensive of these three plans but you'll have more out-of-pocket costs with it.

What is the main difference between Medicare Advantage and Medigap?

Medigap plan F, a more expensive plan, pays for Part B deductibles while covering the 20% cost of services Medicare doesn't pay. Medigap plans do not provide prescription drug coverage, and Medigap cannot be combined with Medicare Advantage.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Can I switch from Medicare Advantage to Medigap?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

What is the most popular Medigap plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan.

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Do Medigap plans have a maximum out-of-pocket?

Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

How long does it take to switch from Medicare Advantage to Medigap?

Switching between plan types. There are three opportunities for a person to switch from Medicare Advantage to Medigap. During the initial enrollment period (IEP): This 7-month period begins the month before a person reaches 65 years of age.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

How long do you have to switch back to Medicare after enrolling?

Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

What are the parts of Medicare Advantage?

Medicare Advantage plans combine original Medicare’s parts A and B, and the majority include coverage for prescription drugs . Advantage plans often also include other benefits not available with original Medicare, including vision, dental, or hearing coverage.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

What is Medicare Advantage?

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren’t covered. Medigap plans usually don’t cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care.

Which one is better?

Both Medicare Advantage and Medigap provide advantages and disadvantages.

How much does Medicare Advantage cost?

Medicare Advantage plans typically have multiple copays with a maximum out-of-pocket cost limit of $4,000-$6,700/year. For years with high use of medical care including hospitalizations, the total cost (including premiums) of a Medicare Supplement Plan G approach will usually be less expensive.

What is the best Medicare Supplement Plan?

The simple answer is that a Medicare Supplement Plan G is the best option for most Medicare enrollees currently initially enrolling in a Medicare Supplement plan. (There is both a standard [low deductible] and a high deductible version of Plan G.

How much is Medicare Part B deductible in 2021?

Medicare Plan G with the standard (low) deductible has a $203 Medicare Part B deductible in 2021. This deductible amount is indexed to the inflation rate and will change annually. (Three states, Massachusetts, Minnesota, and Wisconsin, use a different system and the comments on this website don’t apply.) top of page.

How long does it take to switch to Medicare Supplement?

In contrast, after initially choosing a Medicare Advantage plan, changing to a Medicare Supplement plan can be very difficult. After the initial 12 months of being in a Medicare Advantage plan, an individual usually no longer has the right to go to any Medicare Supplement plan.

Is there a high deductible for Medicare Supplement Plan G?

Update: As of 2020, in addition to the standard Medicare Supplement Plan G, there is a Medicare Supplement Plan G with a high deductible option ($2,370 in 2021): Plan G- HD. The following comments are for the standard Medicare Supplement Plan G with the lower deductible- ($203 in 2021).

Does Medicare Supplement Plan have a separate drug plan?

With a Medicare Supplement plan approach, a separate drug prescription plan (Medicare Part D) needs to be purchased. The government heavily subsidizes both the Medicare Advantage drug plan and the separate Medicare Part D drug plan. 5. Best Medicare option for most individuals when turning 65 years of age.

Is Medicare Supplement Plan G better than Medicare Advantage Plan?

A Medicare Supplement Plan G is a much better choice for many. ( Also called a Medigap Plan G ). (As of 2020, there is now a High Deductible version of Plan G in addition to the standard Plan G.)

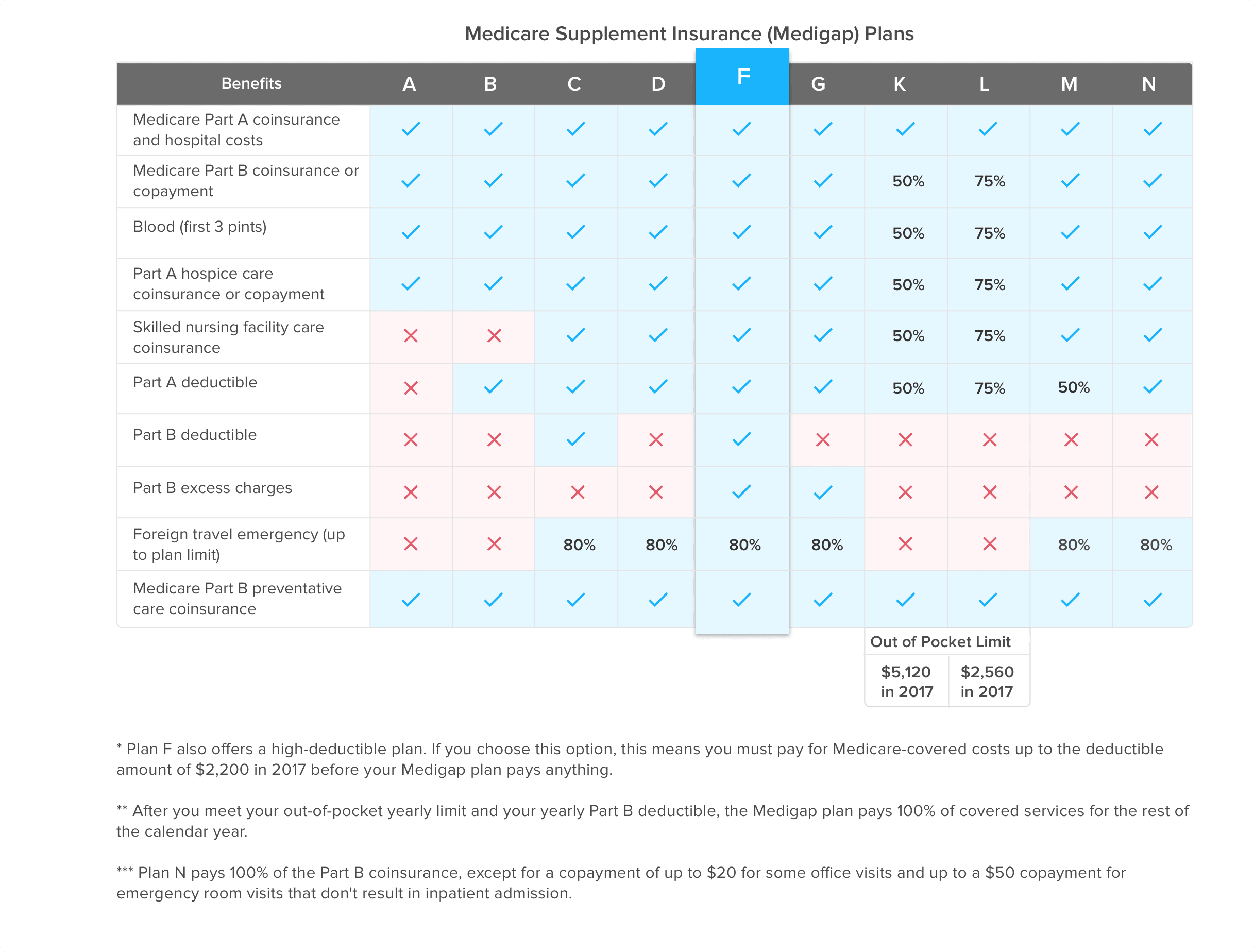

Medicare Supplement Insurance Plan Options

In most states, there are 10 standardized Medigap plans to choose from — labeled Plan A, B, C, D, F, G, K, L, M and N.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

What are the pros and cons of Medicare Advantage vs. Medigap plans?

Here are some pros and cons of each choice for additional Medicare coverage: Medigap that goes with original Medicare vs. Medicare Advantage, an alternative to it.

Why would you choose a Medicare Advantage over original Medicare coverage?

Medicare Advantage plans combine Medicare Part A (hospital insurance), Part B (medical insurance), and, usually, Part D (prescription drug coverage) in one plan, often for no more than the Part B premium. Many MA plans provide benefits like vision, hearing, and dental care that enrollees don’t get through traditional Medicare.

What are the biggest gaps in Medicare coverage?

Original Medicare doesn’t cover many services important to older adults, such as:

How do you know if you would benefit from a Medigap plan?

Medigap is a supplement to Medicare that helps you cover healthcare copayments, coinsurance, and deductibles from Medicare Part A and Part B. Unlike MA plans, new Medigap policies don’t provide prescription drug coverage.

The bottom line

Medicare Advantage plans bundle Medicare parts together and often offer extra benefits such as dental and hearing care, but they come with limited provider networks and may pose issues if you travel.

What Does Medigap Plan G Offer?

According to the official U.S. government website for Medicare, Medigap Plan G offers 100% coverage of the following expenses:

What Does Medigap Plan N Offer?

According to the official U.S. government website for Medicare, Medigap Plan N offers 100% coverage of the following expenses:

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.