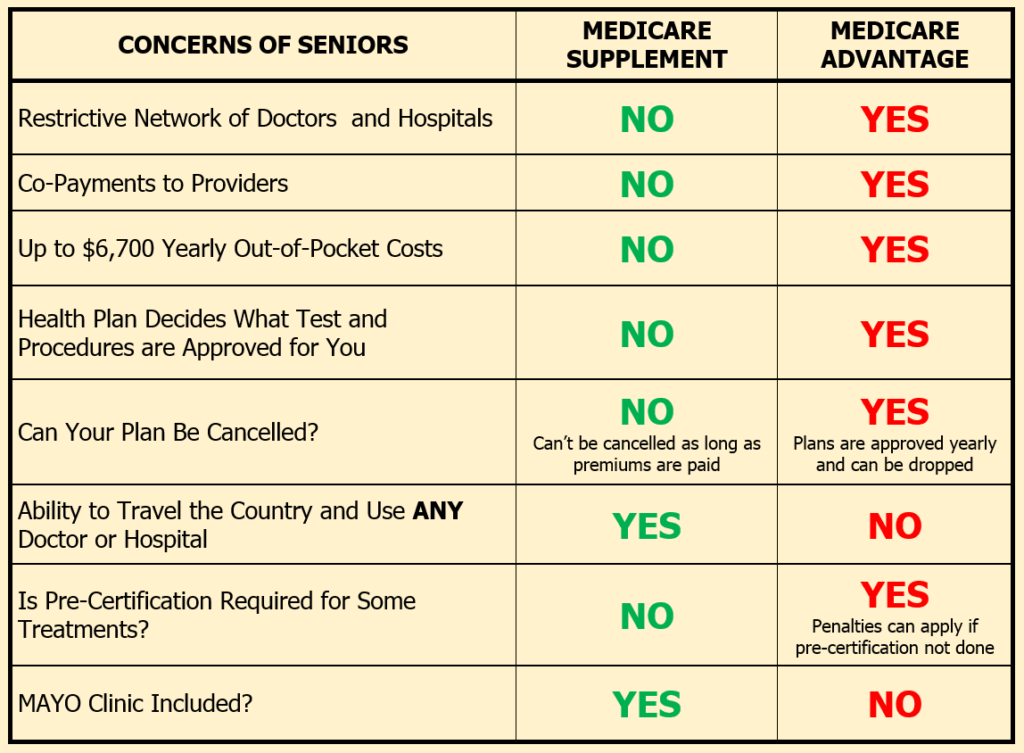

Medicare Advantage - Key Differences

- Price. The primary difference between the Medigap and Medicare Advantage plans come at a different cost. Generally speaking, Medigap plans have higher premiums than Medicare Advantage plans.

- Choice of Physicians. One key difference that might influence your decision to select Medigap or Medicare Advantage plan is the choice of physicians they offer.

- Location. One major determinant of which plan you choose is where you are located and your lifestyle. ...

Should you buy a Medigap or Medicare Advantage plan?

About 14.5 million beneficiaries are enrolled in a Medigap plan, which helps cover certain cost-sharing aspects of original Medicare ... "I've seen it a lot." If you work with an agent, you should ask how many insurance companies they work with (or ...

Should I Choose Medicare Advantage or Medigap?

If you want dental and vision coverage, then a Medicare Advantage plan may be the cheapest way to get it. If you are happy with your Part D plan, then a Medigap plan may be a simpler option to help you cover Original Medicare fees without losing your prescription drug plan.

What is Medicare Advantage vs supplement?

Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans both offer coverage for out-of-pocket medical expenses. You cannot have both a Medicare Advantage and Medicare Supplement plan. Understanding your health and how you’ll use your plan will help you determine which one may fit your needs.

What is the difference between Medicare and advantage?

- Routine vision, including eye glasses, contacts, and eye exams

- Routine hearing, including hearing aids

- Routine dental care

- Prescription drugs and some over the counter medications

- Fitness classes and gym memberships

- Meal delivery to your home

- Transportation to doctor visits

- Other benefits

Is Medigap the same thing as Medicare Advantage?

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the difference in Medicare Advantage plans and Medicare Supplement plans?

Medicare Supplement plans. A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Do Medigap plans have a maximum out-of-pocket?

Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

Why are Medicare Advantage plans being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

Can you change from Medicare Advantage to Medigap?

You may have chosen Medicare Advantage and later decided that you'd rather have the protections of a Medicare Supplement (Medigap) insurance plan that go along with Original Medicare. The good news is that you can switch from Medicare Advantage to Medigap, as long as you meet certain requirements.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What is Medigap coverage used for?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

What is Medicare Advantage?

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren’t covered. Medigap plans usually don’t cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care.

Which one is better?

Both Medicare Advantage and Medigap provide advantages and disadvantages.

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

How long does it take to switch from Medicare Advantage to Medigap?

Switching between plan types. There are three opportunities for a person to switch from Medicare Advantage to Medigap. During the initial enrollment period (IEP): This 7-month period begins the month before a person reaches 65 years of age.

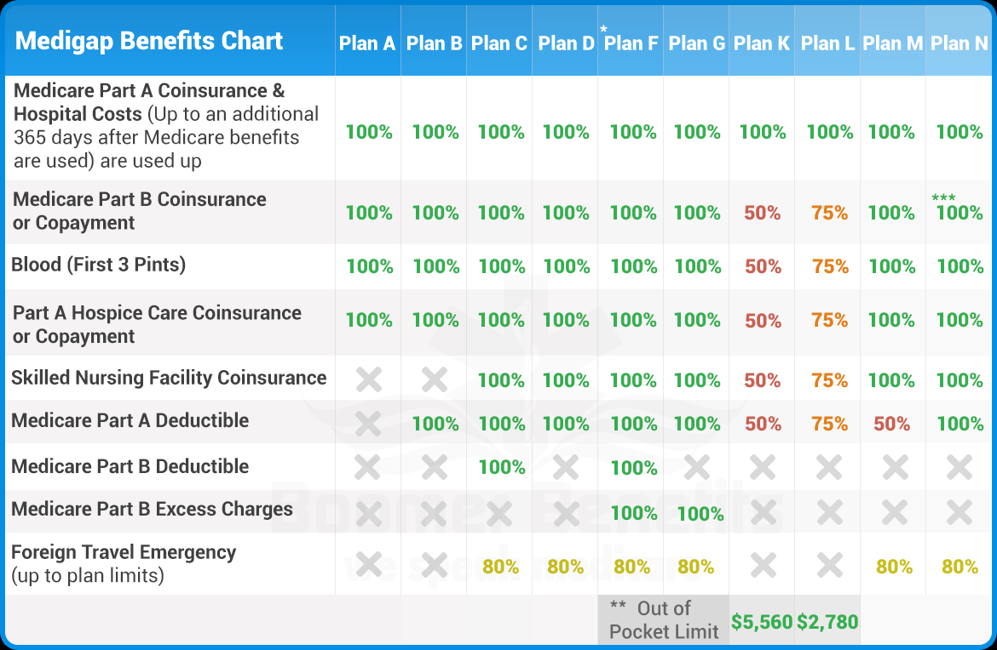

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

How long do you have to switch back to Medicare after enrolling?

Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

What are the parts of Medicare Advantage?

Medicare Advantage plans combine original Medicare’s parts A and B, and the majority include coverage for prescription drugs . Advantage plans often also include other benefits not available with original Medicare, including vision, dental, or hearing coverage.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

How long do you have to keep Medicare Advantage Plan?

If you don’t drop your Medicare Advantage Plan and return to Original Medicare within 12 months of joining, generally, you must keep your Medicare Advantage Plan for the rest of the year. You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period.

Does Medigap have prescription drug coverage?

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a. Medicare Drug Plan (Part D) Part D adds prescription drug coverage to: Original Medicare. Some Medicare Cost Plans. Some Medicare Private-Fee-for-Service Plans.

Can you get a Medigap policy back if you leave Medicare?

If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a " trial right. ". If you have a Medicare Advantage Plan, it's illegal for anyone to sell you a Medigap policy unless you're switching back to. Original Medicare.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

Can You Change From Medicare Advantage to Medigap Coverage?

You can change from Medicare Advantage to Original Medicare with Medigap coverage with certain limitations. If you missed your initial six-month enrollment period for Medigap, you might not be able to purchase Medigap policies sold in your area.

Which is Better: Medicare Advantage or Medigap?

The question of whether Medicare Advantage or Medigap is better is one of the most common questions Cicchelli gets, but unfortunately comes with no easy answer, he says. The reason is that the decision is subjective and depends on your individual needs.

Experts

Ryan Cicchelli, founder of Generations Insurance & Financial Services in Cadillac, Michigan Joe Boden, CFP, vice president and partner at EP Wealth Advisors in Seattle, Washington

What are the pros and cons of Medicare Advantage vs. Medigap plans?

Here are some pros and cons of each choice for additional Medicare coverage: Medigap that goes with original Medicare vs. Medicare Advantage, an alternative to it.

Why would you choose a Medicare Advantage over original Medicare coverage?

Medicare Advantage plans combine Medicare Part A (hospital insurance), Part B (medical insurance), and, usually, Part D (prescription drug coverage) in one plan, often for no more than the Part B premium. Many MA plans provide benefits like vision, hearing, and dental care that enrollees don’t get through traditional Medicare.

What are the biggest gaps in Medicare coverage?

Original Medicare doesn’t cover many services important to older adults, such as:

How do you know if you would benefit from a Medigap plan?

Medigap is a supplement to Medicare that helps you cover healthcare copayments, coinsurance, and deductibles from Medicare Part A and Part B. Unlike MA plans, new Medigap policies don’t provide prescription drug coverage.

The bottom line

Medicare Advantage plans bundle Medicare parts together and often offer extra benefits such as dental and hearing care, but they come with limited provider networks and may pose issues if you travel.