Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have a very low income. If you are eligible for both Medicare and Medicaid (dually eligible), you can have both.

Should I Choose Medicare Advantage or Medigap?

Jun 27, 2020 · Medicaid is a state-funded program for low-income individuals and families. It’s possible to be eligible for both Medicare and Medicaid, (known as “dual eligibility”) and they will work together to provide coverage at a very low cost. The program is funded jointly by states and the federal government.

Is a Medicare Advantage or Medigap plan better for You?

Jan 31, 2022 · Medicare is a federally funded program and Medicaid is a state-funded program. These programs have different eligibility criteria and provide different insurance coverage. Medicaid Eligibility vs. Medicare Eligibility Medicaid is a state-funded program for low-income individuals and families. Each state has its own requirements for eligibility.

Can I change from Medicare Advantage to Medigap?

Medicaid. Medicaid is an assistance program. It serves low-income people of every age. Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

How to compare Medigap insurance plans?

Oct 12, 2021 · You can sign up for a Medicare Supplement Insurance plan or Medicare Advantage plan online or by calling Medicare at 1-800-633-4227. (TTY users can call 1-877-486-2048, and the line is open 24 ...

Is Medigap and Medicare supplement the same thing?

What is the downside to Medigap plans?

What is Medigap and why would someone choose it?

Why is Medigap so expensive?

What are the pros and cons of Medigap?

| Medigap Pros | Medigap Cons |

|---|---|

| All plans offer an additional 365 days in hospital | Not all plans cover hospital deductible |

| Some plans offer extras like excess charges, foreign travel, and Silver Sneakers program | Does not include drug coverage |

| Nationwide coverage | Doesn't cover acupuncture |

Who pays for Medigap?

When should you buy Medigap?

What exactly does Medigap cover?

Do Medigap plans cover drugs?

Does Medigap have an out-of-pocket maximum?

Do Medigap premiums increase with age?

Are Medigap premiums based on income?

Does Medicare cover medical services?

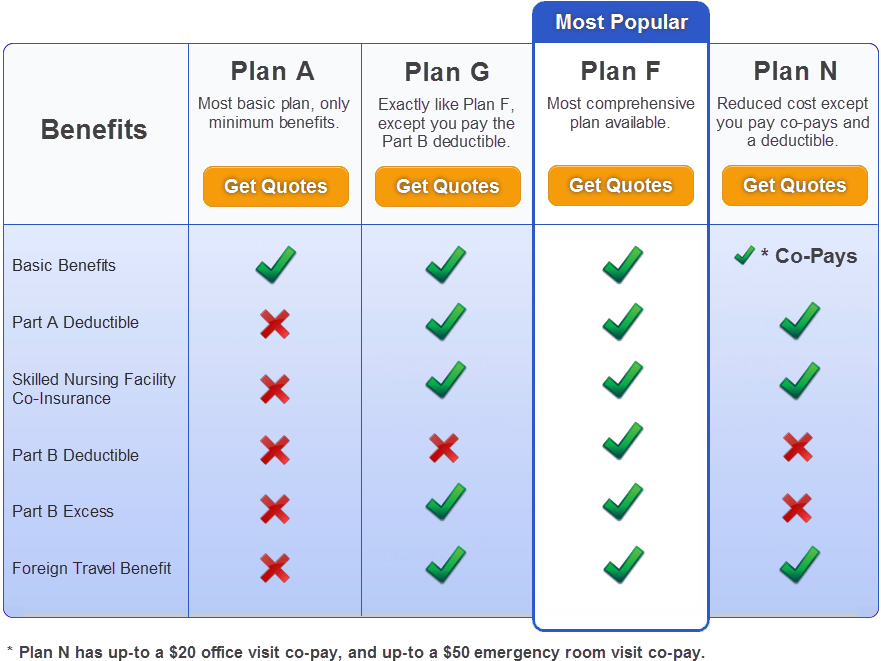

10 Medical Services Medicare Doesn’t Cover. ] To be eligible for a Medicare Supplement Insurance plan, you must already have Medicare parts A and B. The most comprehensive Medicare Supplement Insurance plan is Plan F, which covers a comprehensive array of benefits.

How many parts does Medicare have?

Medicare itself has four parts. Part A (hospital insurance) and Part B (health insurance) come standard in every Original Medicare Plan. Part C is called Medicare Advantage, and it's an alternative to a standard Medicare Plan that offers some additional benefits like prescription drug coverage. Stand-alone prescription drug plans, ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans are private health insurance plans that can help you pay for the "gaps" in your traditional Medicare policy – such as copayments at a doctor's office, coinsurance at skilled nursing facilities and out-of-pocket hospital costs not covered by Medicare Part A. There are 10 different types ...

When is the best time to buy a Medigap policy?

The best time to buy a Medigap policy is during your six-month Medigap Open Enrollment Period, which starts the month you turn 65 and are enrolled in Medicare Part B. You generally will get better prices and more choices among policies, according to Medicare.gov.

What is the most popular Medicare plan?

Plan F are the most popular plans, according to Joe Baker, president emeritus of the Medicare Rights Center, a nonprofit that helps older adults understand Medicare benefits. However, these plans are not available to people new to Medicare starting on Jan. 1, 2020 because they cover the Part B deductible.

How many different Medicare Supplement plans are there?

There are 10 different types of Medicare Supplement Insurance plans, each designated by a letter of the alphabet (you can find details about all 10 plans at Medicare.gov ). In most states, the benefits are the same no matter what insurance company you purchase the plan from, though each plan covers different things.

Does Medicare cover long term care?

Prices depend on your age, where you live, the insurer and type of plan you select. In general, Medicare Supplement Insurance plans usually do not cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing. A Medicare Supplement Insurance plan can also only cover one person.

Is Medicare the same as Medicaid?

The words “Medicare” and “Medicaid” are so much alike that it’s easy to get confused. To add to the confusion, both are government programs that help people pay for health care. But that’s where the similarities end. See below for more information about each program and how they compare.

Is Medicare a state or federal program?

Medicare is a federal program generally for people who are 65 or older or have a qualifying disability or medical condition. Medicare Part A and Part B are provided by the federal government, and Medicare Part C and Part D, while federally governed, are provided by private insurance companies. Medicaid is a state government program ...

What is Medicare Part D?

Medicare Part D is prescription drug coverage, and Part C (Medicare Advantage) is an all-in-one coverage option that combines Parts A, B and D, as well as other benefits that may include items like dental, vision, fitness and hearing. Medicare Part A and Part B coverage is standard, but Part C and Part D will vary based in terms ...

Does Medicare include copays?

Both Medicare and Medicaid may include premiums, deductibles, copays and coinsurance. For Medicare, how much you pay will vary based on when you enroll, what coverage options you select and what health services and items you use throughout the year. For Medicaid, the amount you pay depends on your income and the rules in your specific state.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Does medicaid pay out of pocket?

For Medicaid, the amount you pay depends on your income and the rules in your specific state. Additionally, some specific groups under Medicaid are exempt from many out-of-pocket costs. There are also four different Medicare Savings Programs, which are designed to help with the cost of Medicare.

What does "dual eligible" mean?

Dual eligible simply means that you are both Medicare eligible and Medicaid eligible. A blue Medicare circle appears beside a white Medicaid circle. The white circle disappears, and an animated birthday cake with 65+ written under it appears.

Can you use Medigap with Medicare?

Medigap can only be used by people who are enrolled in the conventional Medicare. Medigap is not run by the government, but by private insurance companies. It can cover most of the usual expenses that you have to pay in Medicare.

What is a Medigap plan?

Medigap introduction. This is an additional insurance policy with Medicare Part A and Part B. It pays for certain medical expenses that are not covered by Medicare. Except for Massachusetts, Wisconsin and Minnesota, every other state has 10 standardized Medigap Plans; A through N.

What are the benefits of Medicare Advantage?

Medicare Advantage health plans are offered by private insurance companies. They include the standard medical and hospitalization coverage of Medicare Part A and Part B, respectively. Additional benefits may also be included, such as prescription drug coverage. The benefits are delivered through: 1 A health maintenance organization (HMO), where you can select a primary care physician 2 A preferred provider organization (PPO), where you have more options for out-of-network physicians 3 A Private Fee-for-Service (PFFS) plan, where you are not limited to a network,, but there is no guarantee your hospital or doctor will accept the plan

What is a PPO plan?

A preferred provider organization (PPO), where you have more options for out-of-network physicians. A Private Fee-for-Service (PFFS) plan, where you are not limited to a network,, but there is no guarantee your hospital or doctor will accept the plan. There are a variety of private health care plans.

Is Medigap the same as Plan F?

Medigap benefits are the same in most states, but their prices are not. In the same state, one insurance company may have lower prices for Plan F than another insurance company. You should carefully read the benefit descriptions for each MA or Medigap plan. Some points to consider are:

What is the advantage of Medigap?

The main advantage of Medigap is the larger selection of healthcare providers from which to choose. And, it will save you money if you have long-term treatment. If you are considering purchasing a Medicare Advantage or Medigap Plan, feel free to explore this website, HealthNetwork.com.

What is PFFS in healthcare?

A Private Fee-for-Service (PFFS) plan, where you are not limited to a network,, but there is no guarantee your hospital or doctor will accept the plan. There are a variety of private health care plans. And, they may offer extra benefits and lower copayments, but not always.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.