Top Medicare Advantage plans have been called Medicare replacement plans, though the term isn’t considered correct. But these plans take over your health coverage and Medicare is no longer responsible for the approval of your claim. Instead, the Part C plan chooses whether to deny or approve your health care services.

How to join a Medicare Advantage plan?

Dec 01, 2021 · In most cases, Medicare coverage is nationwide, while Medicare Advantage plans require you to stay in your local area for medical services. …

What are the advantages of Medicare plans?

Medicare Advantage (also known as Part C) • Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. • Plans may have lower out-of- pocket costs than Original Medicare. • In many cases, you’ll need to use doctors who are in the plan’s network.

Who sells Medicare Advantage plans?

Original Medicare: Medicare Advantage: For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible .This is called your coinsurance .. Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.. You pay a premium (monthly payment) for Part B .If you choose to join a Medicare drug plan, you’ll pay …

How do Medicare Advantage plans work?

Dec 08, 2021 · Medicare Part C. Medicare Part C is often referred to as Medicare Advantage. But the Medicare Advantage program is not just one universal plan. There are a number of different Medicare Advantage plans offered by insurance companies all over the country, though plan availability will depend on where you live.

Is Medicare Part C the same as Medicare Advantage?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What are the disadvantages to a Medicare Advantage Plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the purpose of Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

How does Medicare Part C differ from Medicare Part A?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is it worth getting a Medicare Advantage plan?

In general, though, Medicare Advantage costs less upfront and potentially more overall if you need lots of medical care. Many Medigap plans have higher upfront costs but cover most if not all of your expenses when you need care.Sep 17, 2020

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the most popular Medicare Advantage Plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

How does Medicare Part D differ from Medicare Advantage?

Medicare Part D plans differ from Medicare Advantage plans in a number of ways, including: There is a selection of Part D plans depending on where you live, with each plan offering its own list of covered drugs under its own terms. The list of drugs a PDP covers is known as a “formulary.". Part D plans are sold by private insurers.

What is Medicare Part C?

Medicare Part C (or Medicare Advantage) and Medicare Part D (prescription drug plans) are a pair of options for Medicare beneficiaries. Learn more about what exactly these plans are, how they differ, and how you can make an informed choice about which might be the right fit for your needs.

How many parts are there in Medicare?

There are four different parts to Medicare: Part A, Part B, Part C and Part D. Current and potential Medicare beneficiaries may find these labels confusing, but with the right knowledge, you can make an informed decision about which Medicare plan might be the right fit your needs. In this article, we’ll examine Medicare Part C (also commonly known ...

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the coverage area for Medicare Advantage?

The coverage area for a Medicare Advantage plan is often based on your zip code or county of residence. Some Part D plans can encompass larger coverage areas and can even include multiple states on the same plan.

How does Medicare Advantage work?

Medicare Advantage plans can work similarly to traditional health insurance plans in that you pay a premium (although some plans feature $0 monthly premiums) to belong to a plan and may then have cost-sharing responsibilities such as copays or coinsurance and a deductible. Plans typically have a provider care network.

Does Medicare cover hospice?

Medicare Part A still covers hospice care, even if you are enrolled in a Medicare Advantage plan. Medicare Advantage plans may also cover vision and hearing care, or even prescription drugs. Medicare Advantage plans that cover prescription drugs are called MA-PDs.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

What is Medicare Supplement Insurance?

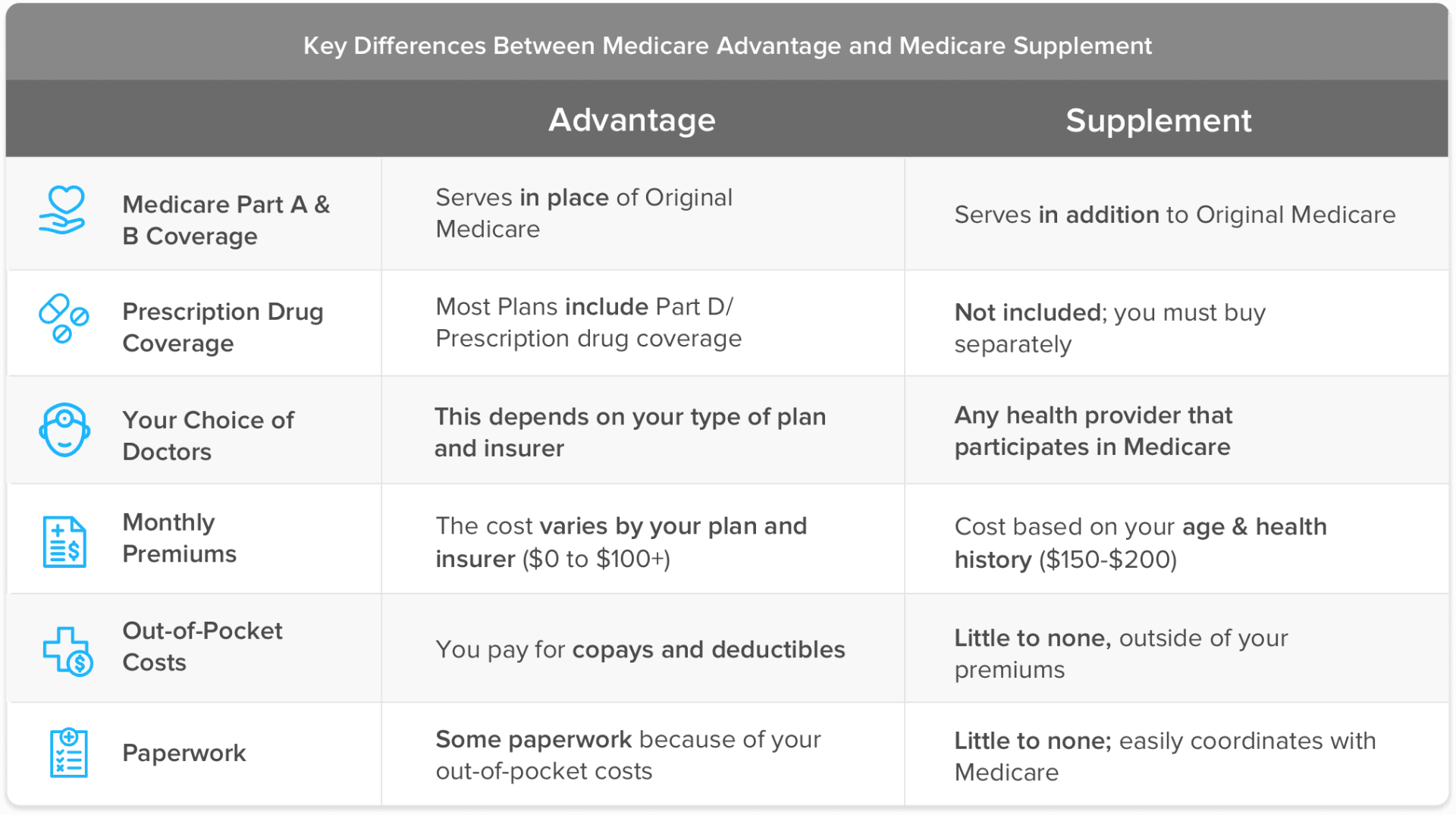

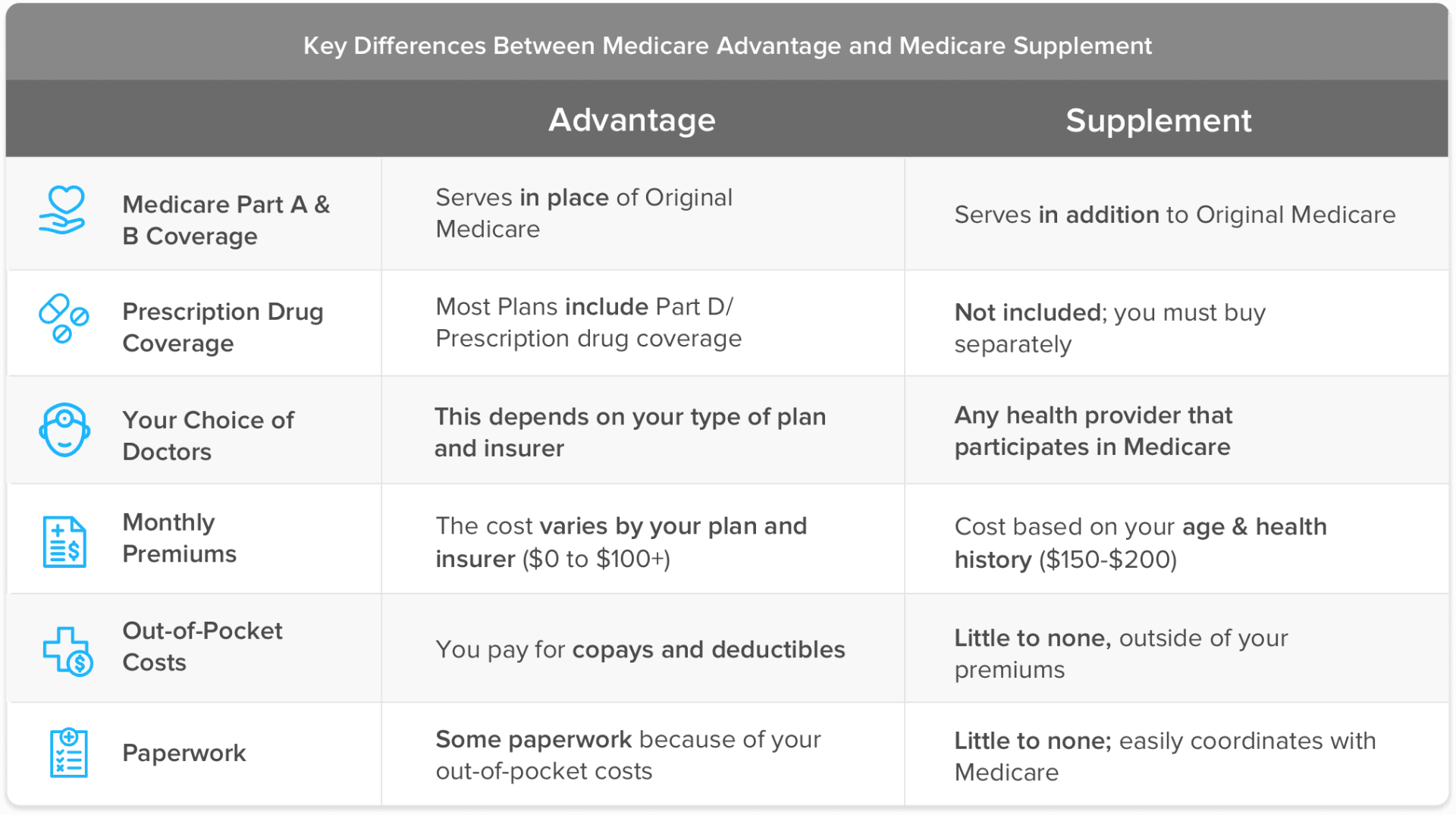

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Medicare cover glasses?

Original Medicare typically does not cover eyeglasses or corrective lenses, so you’ll be left to pay for your glasses out of pocket, unless you have a standalone vision insurance plan. If you had a Medicare Advantage plan that offers vision benefits, your eye exams and glasses may be covered by the plan.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

Does Medicare cover out of pocket costs?

No coverage of Original Medicare out-of-pocket costs, but MA plan out-of-pocket costs may be more affordable than what Original Medicare includes. Coverage for Medicare Part A and B deductibles, copayments and coinsurance (depending on the plan) Additional health benefits not found in Original Medicare.

What is the difference between Medicare and Medicare Advantage?

Medicare Advantage is that the Medicare Advantage program is administered by private insurance companies approved by Medicare to offer benefits. This means that premiums are set by the individual insurance companies and can vary depending on the plan you choose ...

When did Medicare Part C start?

Medicare Advantage, also known as the Medicare Part C program, officially launched in 2003, according the Centers for Medicare & Medicaid Services (CMS). In 2017, about one-third of all Medicare beneficiaries are enrolled in Medicare Advantage plans according to CMS.

Do you have to pay coinsurance for Medicare?

Here’s more details on costs and coverage associated with Original Medicare: You may have to pay copayments or coinsurance amounts for your care; these amounts are determined by the government and are generally the same for most people covered by the program.

Does Medicare cover out of pocket expenses?

There is no annual cap on your out-of-pocket expenses, although you may be eligible for a Medicare Supplement plan (Medigap) to help with out-of-pocket costs Original Medicare doesn’t cover. People with qualifying work histories usually don’t pay a premium for their Part A coverage.

Does Medicare cover prescription drugs?

Original Medicare generally does not include coverage for prescription drugs, except those medications that must be administered by a medical professional, such as chemotherapy and certain types of injections, for example.

Does Medicare cover dental and vision?

In addition, many offer coverage for routine vision, dental, and hearing services that aren’t available under Original Medicare. Medicare Advantage plans can set some of their own rules and guidelines for members.

Do doctors have to accept Medicare?

However, doctors are not required to accept your plan even if they participate in the Medicare program. You’ll need to ask each time you get care, even if you’ve used the provider in the past. Not every type of plan may be available where you live, and plan benefits and premiums vary.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medi care Part A and Medicare Part B).... and Medicare supplement insurance.

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement insurance fills the gaps in Original Medicare, whereas a Medicare Advantage plan completely replaces your Original Medicare coverage. With Medicare Advantage, you pay the majority of your costs when you use healthcare services through deductibles.

Is Medicare Advantage good for seniors?

If you are a super healthy senior, and you rarely see your doctor for anything more than your annual wellness exam, Medicare Advantage is an excellent medical insurance option.

What is Medicare Advantage Special Needs Plan?

People who qualify for a Medicare Advantage Special Needs Plan. People who are exceptionally healthy and rarely use healthcare services outside of their annual wellness visits.

Does Medicare have a provider network?

The one downside might be that Original Medicare and Medicare supplement insurance plans do not have provider networks. If you live in an area without a specialist you need that accepts Medicare, you may have to drive a distance to get the medical care you need. However, the same can be true of Medicare Part C.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begin s to pay its share.... , coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... , copayments.

Is Medicare Advantage better than Original Medicare?

Healthy people with Medicare Advantage plans often enjoy lower costs and more benefits than people in Original Medicare. People with chronic health conditions who enroll in a Medicare Advantage plan often have higher out-of-pocket costs than people in Original Medicare alone.

What is the difference between Medicare Advantage and Original?

With Original Medicare you can go to any hospital and see any doctor or provider within the U.S. who accept Medicare. You do have limited coverage in foreign countries, though.

What are the costs of Medicare Advantage?

Costs with Medicare Advantage vary but may include: 1 The Part B premium 2 A low-cost or $0 plan premium 3 A plan deductible (not all Medicare Advantage plans have one) 4 Copays for covered health services and items

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Does Medicare Advantage cover urgent care?

With Medicare Advantage, most plans have a network of doctors and providers you can see. If you go outside the plan’s network, it’s likely you’ll have to pay more to do so . However, emergency and urgent care are covered nationwide.

Does Medicare cover home care?

Consider how often you leave home. Original Medicare covers care you receive from any provider who accepts Medicare throughout the country. With most Medicare Advantage plans, you need to see providers who are in the plan network in order to avoid added costs.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D). Additionally, Medicare Advantage plans each offer extra benefits, which while they vary by plan and provider, may include coverage for dental, vision, hearing, fitness programs, rides to doctor appointments and more.

Medicare Part D

Part D is a standalone prescription drug coverage plan offered by the government that beneficiaries can purchase in addition to original Medicare (Parts A and B). A Part D plan includes a deductible, which varies by plan but does have a cap put in place by the government. In 2017, the maximum Part D deductible is $400.

Medicare Advantage

Medicare Advantage (MA) is also known as Medicare Part C, and while most Medicare beneficiaries still choose original Medicare, the number of Medicare Advantage enrollees is growing. In 2016, nearly a third of Medicare enrollees chose MA plans.

What are the biggest differences?

There are several differences between Medicare Part D and a Medicare Advantage. No one plan is necessarily better than the other, as each have their own unique advantages and disadvantages. Here are a few of the key differences for comparison’s sake:

Who benefits from each?

There’s a reason that more people are choosing Medicare Advantage plans over Part D coverage, and that’s primarily because MA plans include more comprehensive coverage. Some plans, for instance, even cover vision and dental, which traditional Medicare does not.