Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other to provide health coverage at a doctor’s office and hospital. What is Medicare Part A?

What is Medicare Part A and Part B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care.

What is Medicare supplement insurance and how does it work?

Medicare Supplement Insurance is used along with Original Medicare to help pay certain Medicare out-of-pocket costs. These costs can include costs like Medicare Part A coinsurance, the Medicare Part A deductible or Part B coinsurance. Medigap plans do not typically offer additional benefits beyond what Original Medicare covers.

What is the difference between Medicare Supplement Insurance Plan C and B?

The only real difference between these plans is that Plan C also covers Part B's full deductible. This is universally one of the most popular Medicare Supplement Insurance health plans, due to its comprehensive coverage of certain health costs.

What is the difference between Original Medicare and Medicare Advantage?

Medicare Advantage (also known as “Part C”) is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Most plans offer extra benefits Original Medicare doesn’t cover–like vision, hearing, dental, and more.

Is Medicare Part B the same as a supplemental plan?

What does Medicare Supplement Plan B cover? Medicare Supplement (Medigap) Plan B is not the same as Medicare Part B, which is part of Original Medicare (along with Medicare Part A). Medigap Plan B serves to fill in the gaps in coverage left by Original Medicare, Part A and Part B.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the difference between Medicare Part A and Medicare Part B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

What is the difference in Medicare Advantage plans and Medicare supplement plans?

Medicare Supplement plans. A Medicare Advantage plan (Medicare Part C) is structured to be an all-in-one option with low monthly premiums. Medicare Supplement plans offer additional coverage to Original Medicare with low to no out-of-pocket costs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Medicare Part A—Hospital Insurance

Before jumping into the difference between Medicare A and B, let us explain each of these parts individually. Medicare Part A is designed to cover...

Medicare Part B—Medical Insurance

Medicare Part B is designed to cover medical needs that do not involve the hospital and are considered medically necessary as defined by the federa...

Take Note—You May Need to Sign Up For Both Medicare Parts A and B

Sometimes, people need to sign up for both Medicare Part A and Part B. The following are instances in which you should sign up for both parts: 1. Y...

Are There Alternatives to Medicare Parts A and B?

Yes. If you are still working, you could stay on your employer’s insurance plan. However, be aware that you may pay a penalty if you later enroll i...

HealthMarkets and Medicare

If you’re interested in what Medicare Advantage plans have to offer, give us a call. One of our thousands of licensed insurance agents can talk you...

What is the coinsurance for Medicare Part B?

You will likely pay a premium and deductible for your Medicare Part B insurance. After your deductible is met, coinsurance for most services will be 20% when the doctor accepts Medicare assignment.

What does Medicare cover?

If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects: 1 The cost of your hospitalization and surgery 2 The skilled nursing care you’d need as part of your recovery

How to learn Medicare ABCs?

To start learning your Medicare ABCs, you need to distinguish between the first two letters of the alphabet: A and B. HealthMarkets is here to help you learn the difference between Medicare Parts A and B, the services they insure, and their costs.

What are the services that are included in a medical plan?

These could include various services, such as: Preventive care, such as doctor’s appointments, lab tests, and vaccines. Diagnostic services from your primary doctor or from specialists. “ Durable Medical Equipment ,” such as canes, walkers, wheelchairs, oxygen tanks, and many other devices. Mental health care.

Is Medicare Advantage still available for seniors?

Seniors that purchase Medicare Advantage are still enrolled in Medicare Parts A and B, but they also have more coverage options⃰. Those options depend on the plan. For instance, some Medicare Part C plans may offer you dental or vision care, while others expand your prescription drug coverage.

Does Medicare pay for home health?

Some home health services. Most people who qualify for Medicare Part A will not pay a premium for their care. If you or your spouse are over 65 and qualify for Social Security benefits, currently receive benefits from Social Security or the Railroad Retirement Board, or had Medicare-covered government employment, ...

Does Medicare Part A cover surgery?

Medicare Part A is designed to address that reality. If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects: The cost of your hospitalization and surgery.

What is Medicare Part A and Part B?

Enrollment. Takeaway. Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other ...

How much does Medicare Part B cost?

If you enrolled in Medicare during the open enrollment period and your income did not exceed $88,000 in 2019, you’ll pay $148.50 a month for your Medicare Part B premium in 2021.

What are the expenses for Medicare 2021?

For 2021, these expenses include: Quarters worked and paid Medicare taxes. Premium. 40+ quarters.

What is the Medicare deductible for 2021?

The annual deductible for 2021 is $203.

What is the deductible for Medicare Part B 2021?

The annual deductible for 2021 is $203. If you do not sign up for Medicare Part B in your enrollment period (usually right around when you turn age 65), you may have to pay a late enrollment penalty on a monthly basis.

How much is the 2021 Medicare premium?

Costs in 2021. most pay no monthly premium, $1,484 deductible per benefit period, daily coinsurance for stays over 60 days. $148.50 monthly premium for most people, $203 annual deductible, 20% coinsurance on covered services and items.

How old do you have to be to qualify for Medicare?

Eligibility. For Medicare Part A eligibility, you must meet one of the following criteria: be age 65 or older. have a disability as determined by a doctor and receive Social Security benefits for at least 24 months. have end stage renal disease.

What is Medicare Part A and Part B?

Medicare Part A and Part B make up what’s known as Original Medicare. Original Medicare is a federally administered, fee-for-service health insurance for people age 65 and older and younger people with certain disabilities or medical conditions.

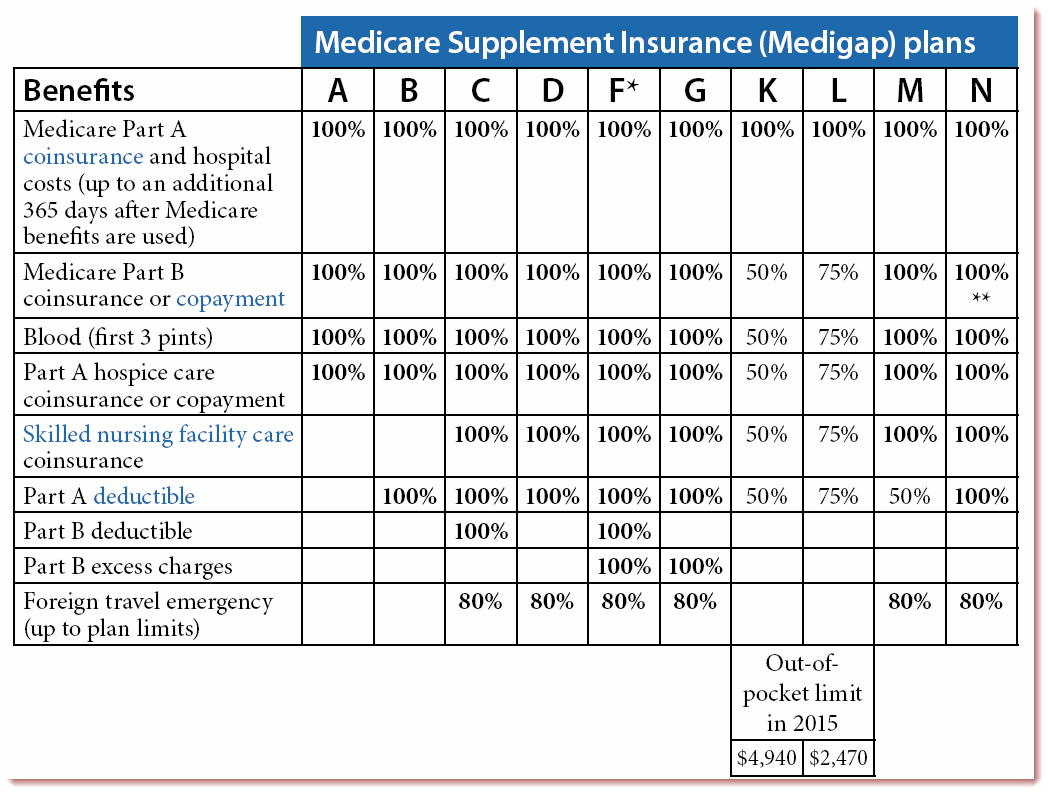

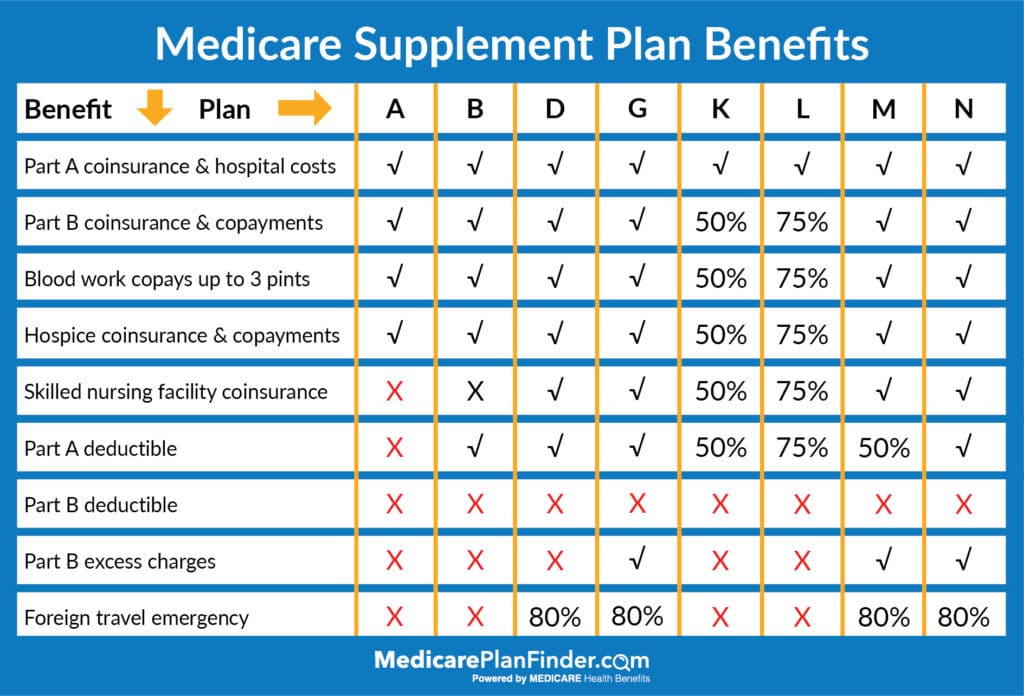

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) plans help cover certain Medicare out-of-pocket costs, such as deductibles, coinsurance, copays and other fees. There are 10 standardized Medigap plans in most states, and each provides its own level of coverage.

What is Medicare Advantage?

Medicare Advantage plans are an alternative to Original Medicare that are sold by private health insurers. These private health plans provide you with all your Part A and Part B benefits, and some plans may include additional benefits such as: Vision. Hearing. Dental services.

How many parts are there in Medicare?

Medicare is made up of four parts: Medicare Part A, Part B, Part C and Part D. Each part provides different benefits, and some even work together. Learn more about the 4 parts of Medicare and the benefits they offer below.

How much is Medicare Part B 2021?

Medicare Part B: Medical Insurance. The standard premium amount for Medicare Part B is 2021 is $148.50 per month (or more, depending on your income). In addition to your monthly premium, you pay $203 per year for your Part B deductible in 2021. Once your deductible is met, you usually pay a coinsurance of 20% of the Medicare-approved amount ...

What is the difference between Medicare Part A and Part B?

As mentioned above, they offer 100% coverage of Medicare Part A coinsurance and hospital costs, Part B coinsurance or copayments, the first three pints of blood, and Part A hospice care or copayments. The only difference between Plans A and B is that Plan B also covers Medicare Part A's deductible.

How many Medicare Supplement Plans are there?

Medicare Supplement Plans, also called Medigap Plans, are standardized across most of the United States, though there are some exceptions. Each of the ten plans is designated a letter: A, B, C, D, F, G, K, L, M, and N. Though these plans are provided by private insurance companies, all plan types with the same letter must offer the same set ...

What does Medicare plan N cover?

Though both plans cover all of Medicare Part A coinsurance and hospital costs, as well as Part B coinsurance or copayments, Plan N may have copayments of up to $20 for some office visits, and some emergency room visits that don't result in hospital admissions may charge $50 in copayments. Other than that, both plans also cover the first three pints of blood, Part A hospice care copayments or coinsurance, and skilled nursing facility care coinsurance. However, Plan M only covers half of Part A's deductible, though Plan N covers it completely. Both M & N cover 80% of foreign travel emergencies.

How long does Medicare cover hospital stays?

For instance, during most hospital stays, Medicare will cover the first sixty days, minus a deductible. After that period, beneficiaries are charged ever-increasing fees until the 151st day, after which Medicare coverage ends. All Medigap plans pay for those copay fees, as well as 100% of an additional 365 days.

What is Medicare Advantage?

The first thing to do is understand the different options available to you. Medicare is available for people over 65, or who have certain types of conditions and receive Social Security Disability Insurance. They're divided into three parts: A, B, and C. Part A covers approved inpatient costs, and Part B focuses on providing approximately 80% of your outpatient costs. Part C (also called Medicare Advantage), isn't really separate health insurance, but rather allows private health insurance companies to provide Medicare benefits.

Do all insurance plans have the same letter?

Though these plans are provided by private insurance companies, all plan types with the same letter must offer the same set of basic benefits, regardless the location. You'll see that there are some elements which are always covered, no matter what.

Does Medicare cover 80% of Part B?

Likewise, since Medicare typically only covers 80% of Part B coinsurance or copayments, all Medigap plans pay for some or all of the remaining 20% cost. This is also true for the first three pints of blood needed, and for Part A hospice care coinsurance or copayments.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.