A Medicare Supplement Plan (or insurance policy) is an insurance product designed to supplement Original Medicare (Part A and Part B). A Medicare Supplement Plan pays for cost sharing for Medicare Parts A and B, but not Medicare Part D.

Full Answer

What is the difference between Medicare Supplement Insurance Plan C and B?

The only real difference between these plans is that Plan C also covers Part B's full deductible. This is universally one of the most popular Medicare Supplement Insurance health plans, due to its comprehensive coverage of certain health costs.

What is the difference between Medicare Part A and Part B?

Both original Medicare and Advantage plans have pros and cons. Part A and Part B allow a person to choose any healthcare provider, but the out-of-pocket costs may be higher. Conversely, Advantage plans require an individual to choose from in-network providers, but they may involve lower out-of-pocket costs.

What is the difference between Medicare supplement insurance and Medicare Advantage?

Both Medicare Supplement Insurance and Medicare Advantage plans are private Medicare options sold through individual insurance companies. Medicare Supplement Insurance is used along with Original Medicare to help pay certain Medicare out-of-pocket costs.

Is Medicare Part B a stand alone insurance plan?

Part B is not a stand-alone insurance plan. As original Medicare comprises Part A and Part B, a person who enrolls in Part B is automatically enrolled in Part A, which covers inpatient hospital care, hospice care, skilled nursing facility care, lab tests, and home health care. Medicare Part A and Part B do not cover the following:

Is Medicare Part B the same as a supplemental plan?

Part B is part of what's called Original Medicare, along with Part A. Plan B refers to Medicare supplement insurance commonly called Medigap. Part A covers hospital bills and Part B, for which a standard premium is paid, covers outpatient care, medical equipment, and other services.

Do you need Medicare Part B to get a supplement?

*You don't technically need Medicare Part B to enroll in a Medicare Supplement plan, however without it, your supplement won't cover any of your outpatient costs. Ultimately, it's not likely to be cost-efficient to have a Medicare Supplement plan without Medicare Part B, and it isn't recommended.

What is the purpose of Medicare supplemental insurance?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What happens if you don't take Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the difference between Medicare and Medicare Supplement?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What does a Medicare Supplement plan cost?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

What are the disadvantages of a Medicare Supplement plan?

Medicare Advantage Plans do have a yearly limit on your out-of-pocket costs for medical services, called the maximum out-of-pocket (MOOP). Once you reach this limit, you'll pay nothing for covered services.

What are the top 3 Medicare Advantage plans?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCMS ratingHumana5.03.6Blue Cross Blue Shield5.03.8Cigna4.53.8United Healthcare4.03.81 more row•Feb 25, 2022

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What Is Supplemental Health Insurance?

Supplemental insurance is any coverage that goes beyond what is included in your standard health care plan. Depending on the type of plan you buy, supplemental insurance may help cover some out-of-pocket costs (such as deductibles, coinsurance or copays) or pay a lump sum of cash in the event of a specific event or illness.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is only available to people enrolled in Original Medicare (Part A and Part B). You may not have a Medicare Supplement Insurance plan and a Medicare Advantage plan (Part C) at the same time.

Have Questions About Medicare Supplement Insurance?

You can call to speak with a licensed insurance agent today to learn more about Medicare Supplement Insurance, including plans available where you live.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

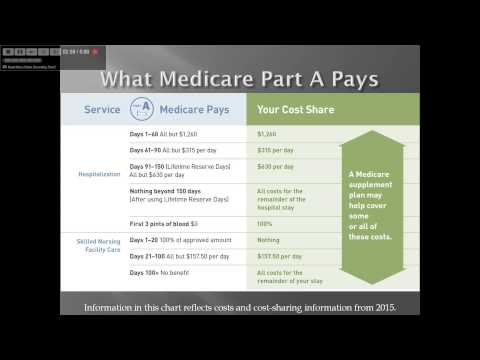

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

What is Medicare Part B?

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider (i.e. vaccines, injections, infusions, nebulizers, etc.), or through medical equipment at home. Examples of drugs covered under Medicare Part B include: 1 Injections for osteoporosis 2 Some transplant medications 3 Immunosuppressants 4 End-stage renal disease (ESRD) medications 5 Flu, pneumonia, and Hepatitis B shots

What is Part B insurance?

Part B is your medical coverage. This part pays for things like doctor visits, lab tests, and home health care. Part B also covers certain medications and durable medical equipment like diabetic test strips, nebulizers, and wheelchairs. You can get your Part B medical coverage through your former employer, through a standalone plan, ...

What items are covered by Medicare Part B and not Part D?

Items that may be covered by Medicare Part B, and not Part D: Certain medications (commonly referred to as Part B drugs) Durable medical equipment (wheelchairs, diabetic test strips, nebulizers, etc.) Specialty pharmacy. Mail-order pharmacy.

Is mail order pharmacy covered by Medicare?

Mail-order pharmacy. Not all items that you purchase at a pharmacy are covered by your prescription drug plan (Part D). Certain health supplies or equipment may be covered by the medical part of your Medicare plan, Part B. Learn more about Medicare Part D Prescription Drug Plans.

Can a pharmacy bill Medicare?

Many retail pharmacies cannot bill a medical plan for Medicare medical prescriptions (commonly referred to as Part B drugs) or medical equipment. If you need Part B drugs or medical equipment, ask if your pharmacy is able to bill your medical plan directly. Or, consider using these types of specialty service providers:

Does Medicare cover osteoporosis?

Some transplant medications. Immunosuppressants. End-stage renal disease (ESRD) medications. Flu, pneumonia, and Hepatitis B shots. Medicare Part D may cover medications that aren’t covered under Part B, and vice versa. When you choose a Medicare plan, make sure it will cover your current medications.

What is Medicare Part C?

Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage. Medicare Part D offers only prescription drug coverage. Below, we examine the differences between Medicare Part B and Part C in terms ...

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medicare Part A cover dental care?

As original Medicare comprises Part A and Part B, a person who enrolls in Part B is automatically enrolled in Part A, which covers inpatient hospital care, hospice care, skilled nursing facility care, lab tests, and home health care. Medicare Part A and Part B do not cover the following: prescription drugs. dental care.

Does Medicare have a monthly premium?

Every year, each Medicare plan sets out the amount it will charge for premiums, deductibles, and services. The amount varies among plans, and some plans offer zero premiums. Also, because a person must have enrolled in Medicare Part A and Part B to qualify for Medicare Advantage, they must pay the Part B monthly premium.

Does Medicare pay for Part A?

A person with Plan B also has Plan A, but most people with original Medicare do not pay a Part A monthly premium. However, a $1,484 deductible is payable for Part A hospital inpatient services for each benefit period, together with coinsurance that varies from $0 to $742.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.