Is Medicare Part C the same as Medigap?

Medigap Plan C is a supplemental insurance coverage plan, but it's not the same as Medicare Part C. Medigap Plan C covers a range of Medicare expenses, including the Part B deductible. Since January 1, 2020, Plan C is no longer available to new Medicare enrollees.May 21, 2020

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include:Higher monthly premiums.Having to navigate the different types of plans.No prescription coverage (which you can purchase through Plan D)

What is the difference between Medicare Part C and G?

The only difference between Plan C and Plan G is coverage for your Part B Deductible.Jan 26, 2022

What is the difference between Medigap and Medicare Advantage plans?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Sep 26, 2021

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Does Medigap cover Part A deductible?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

How do I choose a good Medigap plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.Feb 9, 2022

What is a Medigap plan?

Medigap is a different set of plans that help cover out-of-pocket costs not covered by your original Medicare plan. These costs can include: Medicare Part A coinsurance and hospital fees. Medicare Part A hospice coinsurance or copayment costs. Medicare Part B coinsurance or copayment costs.

What is Medicare Advantage?

Medicare Advantage plans are private insurance options for Medicare coverage. Here is an overview of the coverage, costs, and eligibility rules for Medicare Advantage.

What is the eligibility for Medicare Advantage?

To be eligible for Medicare Advantage: You must be enrolled in original Medicare (Medicare parts A and B). You must live in the service area of a Medicare Advantage insurance provider that’s offering the coverage/price you want and that’s accepting new users during your enrollment period.

What are the factors that affect the cost of Medicare Advantage?

Other factors that may affect the cost of Medicare Advantage plans include: how often you want access to medical services. where you receive your medical care (in network or out of network) your income (this may be used to determine your premium, deductible, and copays amount)

Does Medigap cover Part B?

As of January 1, 2020, newly purchased Medigap plans don’t cover Part B deductibles. This means you cannot purchase Plan C or Plan F if you became eligible for Medicare in 2020 and onward. You can purchase Medigap in addition to your other original Medicare coverage (parts A, B, or D).

Does Medicare Advantage have a monthly premium?

Much like any other insurance plan, Medicare advantage premiums vary depending on the provider and the plan you choose. Some plans don’t have a monthly premium, while others charge several hundred dollars. However, it’s unlikely you’ll pay more for your Part C premium than the one for Part B.

Does Medicare cover outpatient care?

Fortunately, when it comes to choosing Medicare coverage, you’ve got options. While original Medicare covers your basic hospital and outpatient medical needs, you may also want additional coverage for things like medications, vision, and dental. Original Medicare also leaves you with a few different costs like deductibles, premiums, ...

How many parts does Medicare have?

Medicare itself has four parts. Part A (hospital insurance) and Part B (health insurance) come standard in every Original Medicare Plan. Part C is called Medicare Advantage, and it's an alternative to a standard Medicare Plan that offers some additional benefits like prescription drug coverage. Stand-alone prescription drug plans, ...

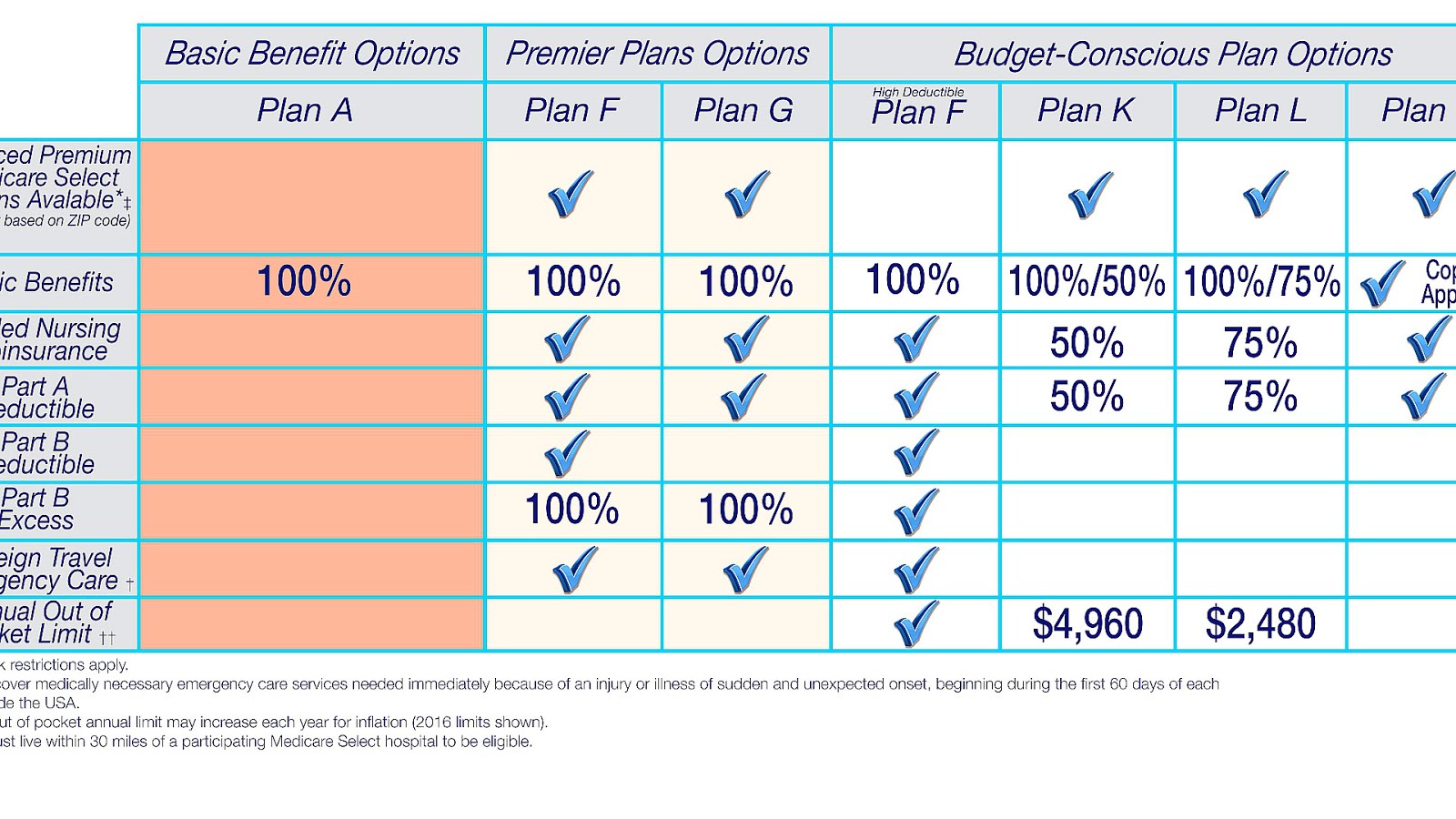

How many different Medicare Supplement plans are there?

There are 10 different types of Medicare Supplement Insurance plans, each designated by a letter of the alphabet (you can find details about all 10 plans at Medicare.gov ). In most states, the benefits are the same no matter what insurance company you purchase the plan from, though each plan covers different things.

What is the most popular Medicare plan?

Plan F are the most popular plans, according to Joe Baker, president emeritus of the Medicare Rights Center, a nonprofit that helps older adults understand Medicare benefits. However, these plans are not available to people new to Medicare starting on Jan. 1, 2020 because they cover the Part B deductible.

Does Medicare cover long term care?

Prices depend on your age, where you live, the insurer and type of plan you select. In general, Medicare Supplement Insurance plans usually do not cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing. A Medicare Supplement Insurance plan can also only cover one person.

What is Medicare Part C?

Plan C is supplemental insurance for people who have Original Medicare. Medicare Part C is a private health insurance alternative to Original Medicare.

What is the difference between Plan C and Plan G?

The only difference between Plan C and Plan G is coverage for your Part B Deductible.

What is a plan C?

Plan C is one of the most comprehensive plans available and will supplement your Original Medicare benefits. The only benefit that Plan C doesn’t cover is excess charges. There are three Medigap plans that fall under the category of first-dollar coverage plans, Plan C is one of them.

Is Medicare changing?

Since Medicare is always changing, it's important to have a licensed agent by your side. To begin the process call us; or, you can use our online rate comparison tool to see a side by side comparison of rates in your area now.

Is Plan C still available?

Yes, Plan C has been discontinued, but only for those who are considered newly eligible after 2020. If you were eligible for Medicare before 2020, then you can still enroll in Plan C.

What is Medicare Advantage?

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

What is a Medigap policy?

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov . They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. 12 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal.

How long can you stay on medicare?

You generally won't have to pay a penalty if you later decide to enroll in a Medicare prescription drug plan and you haven't gone for longer than 63 continuous days without creditable coverage. 98.

What happens if you don't enroll in Medicare?

Once you’ve enrolled in Medicare, a key decision point is choosing coverage for Part D prescription drug insurance . If you don’t enroll in Part D insurance when you start Medicare and want to buy drug coverage later on, you may be permanently penalized for signing up late. 8

How to get started with Medicare?

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings. 10

Does Medigap cover Part B?

Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.

Does Medicare Advantage cover doctors?

Medicare Advantage plans cover hospitals and doctors and often include prescription drug coverage and some services not covered by Medicare, too.

What is the difference between Medigap Plan N and Plan C?

You’ll see the difference is that Plan C covers everything but excess charges, while Plan N doesn’t cover that, and it also doesn’t cover the Part B deductible AND it makes you pay copays. Check it out:

When was Medigap last updated?

Last Updated: Dec 23, 2020 11:23 pm. Medicare Supplement plans, also known as Medigap, offer several plans. In this article we will compare Medigap Plan C to Plan N.

When to apply for Medigap?

For many people the best time to apply for a Medicare Supplement plan is during the Medigap Open Enrollment Period. This period lasts for 6 months and begins on the first day of the month in which you’re age 65 or older and enrolled in Medicare Part B. (Some states may have additional open enrollment periods.)

Is there a difference between Medicare Supplement and Medigap?

There’s no difference between Medigap and Medicare Supplement. Medicare Supplement and Medigap are synonyms for the same type of health insurance – they have the same meaning. These plans are offered by private insurance companies and are designed to help pay your out-of-pocket costs for services covered under Medicare Part A (hospital insurance) ...

Can insurance companies sell Medicare Supplement Plans?

Insurance companies in most states can sell only “standardized” Medicare Supplement plans, identified by letter. You can find coverage details about all 10 standardized Medicare Supplement plans using the Medicare Supplement (Medigap) Plan Comparison Chart.

Does Medigap pay for coinsurance?

Different Medigap plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles . Medigap plans work alongside Medicare Part A and Part B; you need to be enrolled in both, and you must also live within the plan’s service area.

Does Medicare Supplement Plan have the same benefits?

Medicare Supplement plans: Availability and costs. Each standardized, lettered Medicare Supplement plan must offer the same basic benefits, no matter which insurance company sells it. But the plan premiums may vary from one insurance company to another.