What is the difference between Medicare Part A and Part D?

Medicare Part C combines the benefits of Part A and Part B, while Medicare Part D covers prescription drugs. Medicare Part A and Part B are known collectively as original Medicare. Part A covers hospital costs, and Part B covers other medically necessary expenses. , and its original name was Medicare+Choice.

What are the benefits of Medicare Part D Plan D?

1 Foreign travel emergency benefits. Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. ... 2 No networks. You can visit any provider nationwide who accepts Medicare. 3 Guaranteed renewable. Your plan can’t be canceled as long as you continue to pay your premium 1.

What is the difference between part a and Part B health insurance?

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouse’s health plan.

How do I compare Medicare supplement plans F and G?

Or call (888) 815-3313 – TTY 711 to compare Medicare Supplement Plans F and G over the phone and get answers and guidance from an experienced licensed sales agent.

What is Medicare Part F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Why is Medicare getting rid of F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Who is eligible for plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Is plan G better than plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022). Once you pay the Part B deductible, the coverage is the same for both plans.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Can I keep my plan F after 2020?

If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible), you can generally keep it. If you were eligible for Medicare before January 1, 2020, you may be able to buy Medicare Supplement Plan F or Plan C.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Is Medicare Plan F being discontinued in 2020?

It's been big news this year that as of Jan. 1, 2020, Medigap plans C and F will be discontinued. This change came about as a part of the Medicare Access and CHIP Reauthorization legislation in 2015, which prohibits the sale of Medigap plans that cover Medicare's Part B deductible.

What is the premium for plan F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

When did plan F going away?

January 1st, 2020As of 2015, Medicare Supplement Plan F is no longer available to anyone who became eligible for Medicare after January 1st, 2020.

How much does AARP plan F Cost?

$256Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

Is Medicaid part of Medicare?

Medicare and Medicaid (called Medical Assistance in Minnesota) are different programs. Medicaid is not part of Medicare. Here’s how Medicaid works for people who are age 65 and older: It’s a federal and state program that helps pay for health care for people with limited income and assets.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

Does Medicare cover colonoscopy?

If you had a different screening for colorectal cancer called a flexible sigmoidoscopy, Medicare covers a screening colonoscopy if it is 48 months or longer after that test. Eye exams. Medicare doesn’t cover routine eye exams to check your vision if you wear eyeglasses or contacts.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare cover wheelchair ramps?

In addition, in recent years the Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover such extras as wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What is Medicare Part C?

Medicare Part C (or Medicare Advantage) and Medicare Part D (prescription drug plans) are a pair of options for Medicare beneficiaries. Learn more about what exactly these plans are, how they differ, and how you can make an informed choice about which might be the right fit for your needs.

How many parts are there in Medicare?

There are four different parts to Medicare: Part A, Part B, Part C and Part D. Current and potential Medicare beneficiaries may find these labels confusing, but with the right knowledge, you can make an informed decision about which Medicare plan might be the right fit your needs. In this article, we’ll examine Medicare Part C (also commonly known ...

How does Medicare Advantage work?

Medicare Advantage plans can work similarly to traditional health insurance plans in that you pay a premium (although some plans feature $0 monthly premiums) to belong to a plan and may then have cost-sharing responsibilities such as copays or coinsurance and a deductible. Plans typically have a provider care network.

What is Medicare enrollment?

Enrollment. Enrollment is one area in which Medicare Advantage and Part D plans can be similar. Both types of plans utilize the Medicare Initial Enrollment Period (IEP) and the Annual Enrollment Period (AEP, also called the fall Open Enrollment Period), where you may join, change or drop coverage for each type of plan.

How many Medicare Advantage plans are there in 2020?

The average Medicare beneficiary will have access to 28 Part D plans in 2020. 3. There will be 3,148 Medicare Advantage plans available nationwide in 2020. A total of 948 standalone Medicare Part D plans will be available in 2020.

What is the coverage area for Medicare Advantage?

The coverage area for a Medicare Advantage plan is often based on your zip code or county of residence. Some Part D plans can encompass larger coverage areas and can even include multiple states on the same plan.

Does Medicare have an out-of-pocket limit?

When it comes to out-of-pocket expenses, there is an annual out-of-pocket limit for all Medicare Advantage plans . The out-of-pocket spending limit can vary from plan to plan. Some Medicare Advantage plans do not have a deductible.

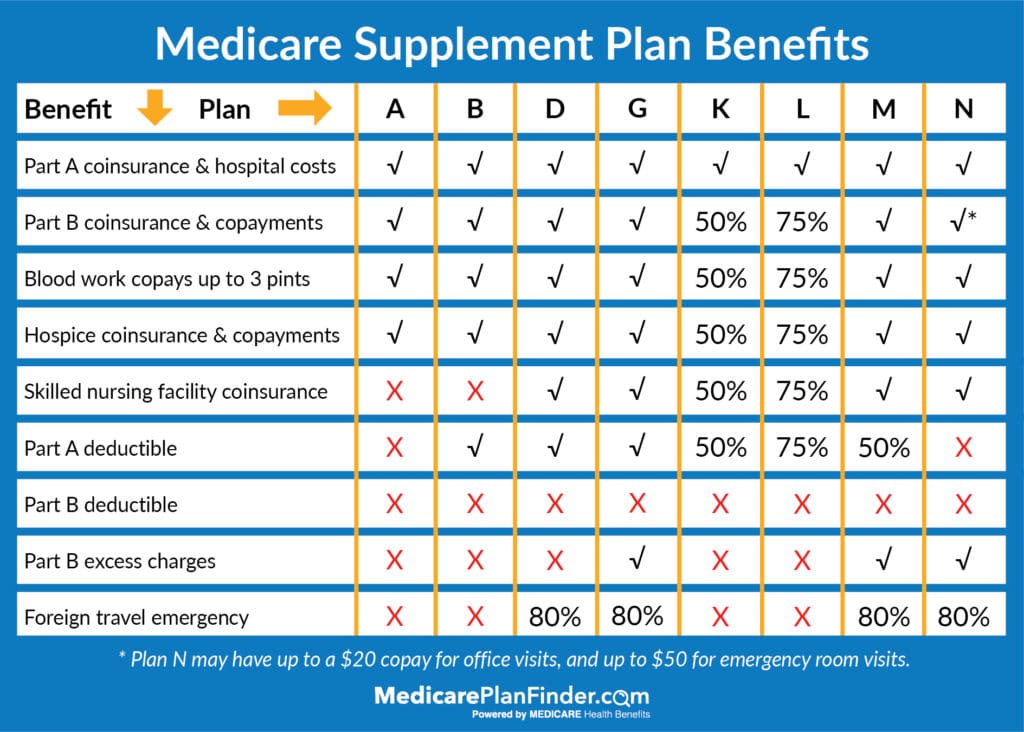

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

What is Medicare Supplement Plan D?

Medicare Supplement Plan D. Medicare Part D. Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

How long does Medigap Plan D last?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins ...

How much is coinsurance for Part B?

For example, Part B charges a 20% coinsurance for covered services after you’ve met your Part B deductible ($203 in 2021). 1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged ...

How much is the cost of a Plan D in 2021?

The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida. 6.

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Does Medicare Supplement Plan D cover prescription drugs?

But these plans are not the same thing as Medicare Part D, which is for prescription drug coverage. Medicare Supplement Plan D policies do not cover prescription drugs.

What is the difference between Medicare Part C and Medicare Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is Medicare Part C and Part D?

Medicare Part C and Part D offer different benefits to people eligible for Medicare. It is important that people consider the benefits they may need to cover their medical expenses.

What are the requirements to be eligible for Medicare Part C?

In general, a person must meet two requirements to be eligible for Medicare Part C: They must be enrolled in original Medicare, and they must live in an area where an insurance company offers Medicare Part C. During a person’s IEP, they are eligible for Medicare Part C.

What happens when you join a prescription plan?

When a person joins a prescription plan, the insurance company calculates the penalty and adds it to the premium. Generally, this penalty forms part of the premium for as long as the person has a Medicare prescription plan.

How much does Medicare Part D pay?

The individual pays approximately 25% of the cost of prescriptions, and Medicare Part D pays the remaining 75%. If a person reaches the “ catastrophic coverage ” amount, they pay 5% of the cost of prescriptions. This feature of the plan helps individuals with high out-of-pocket prescription expenses.

What is PFFS insurance?

Private Fee-for-Service (PFFS) plans. Medicare usually sets the fee for both the provider and the individual enrollee. For a PFFS plan, the insurance company sets these fees. Insurance companies must follow the Medicare rules, though each plan can have different rules for out-of-pocket costs and access to services.

When is Medicare Part D available?

However, these changes are possible during the annual OEP that runs from October 15 to December 7. Medicare Part D is available for everyone during their IEP for original Medicare. Private insurance companies sell Medicare Part C and Part D.