What are the similarities and differences between Medicare Plan F and Plan G?

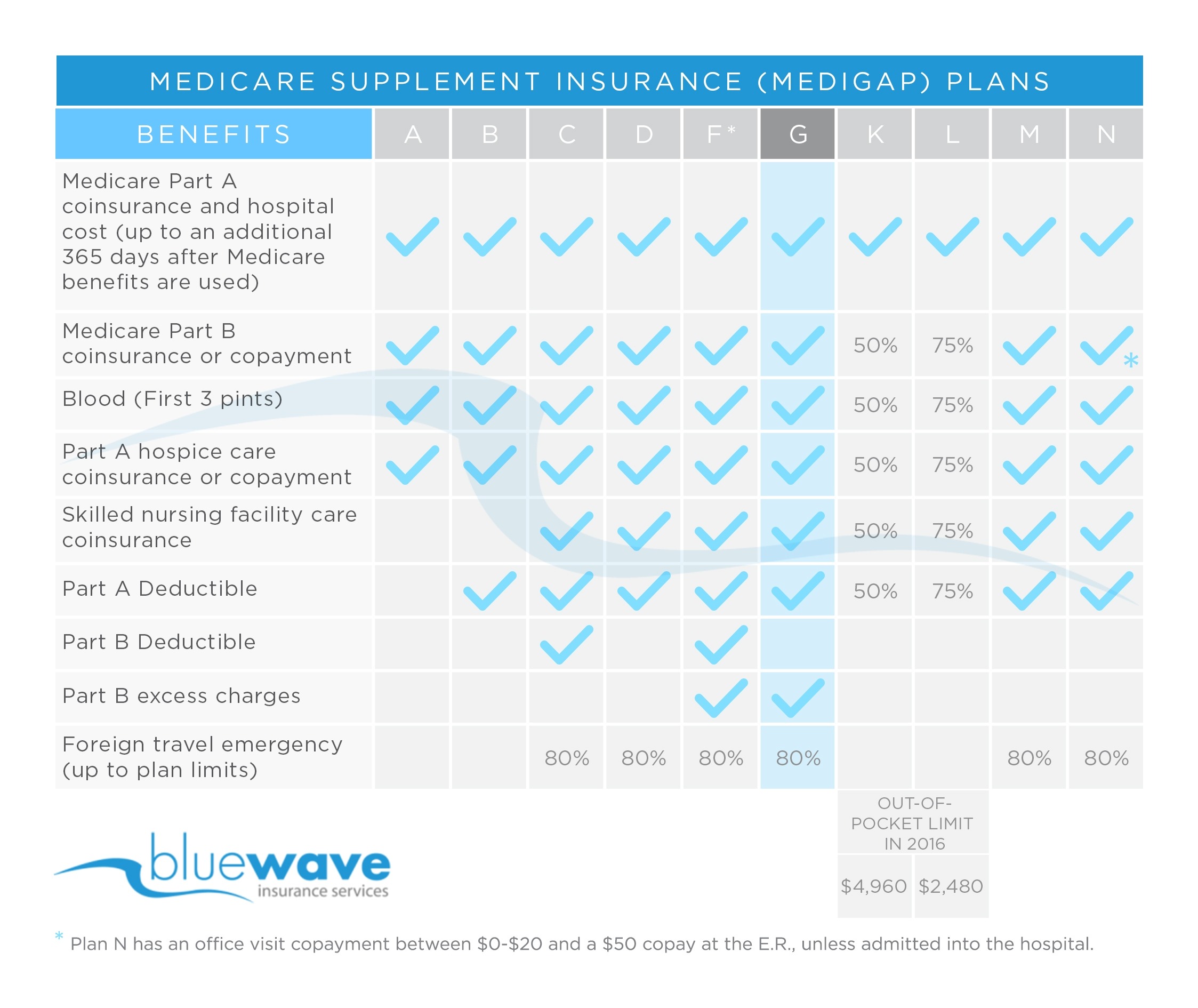

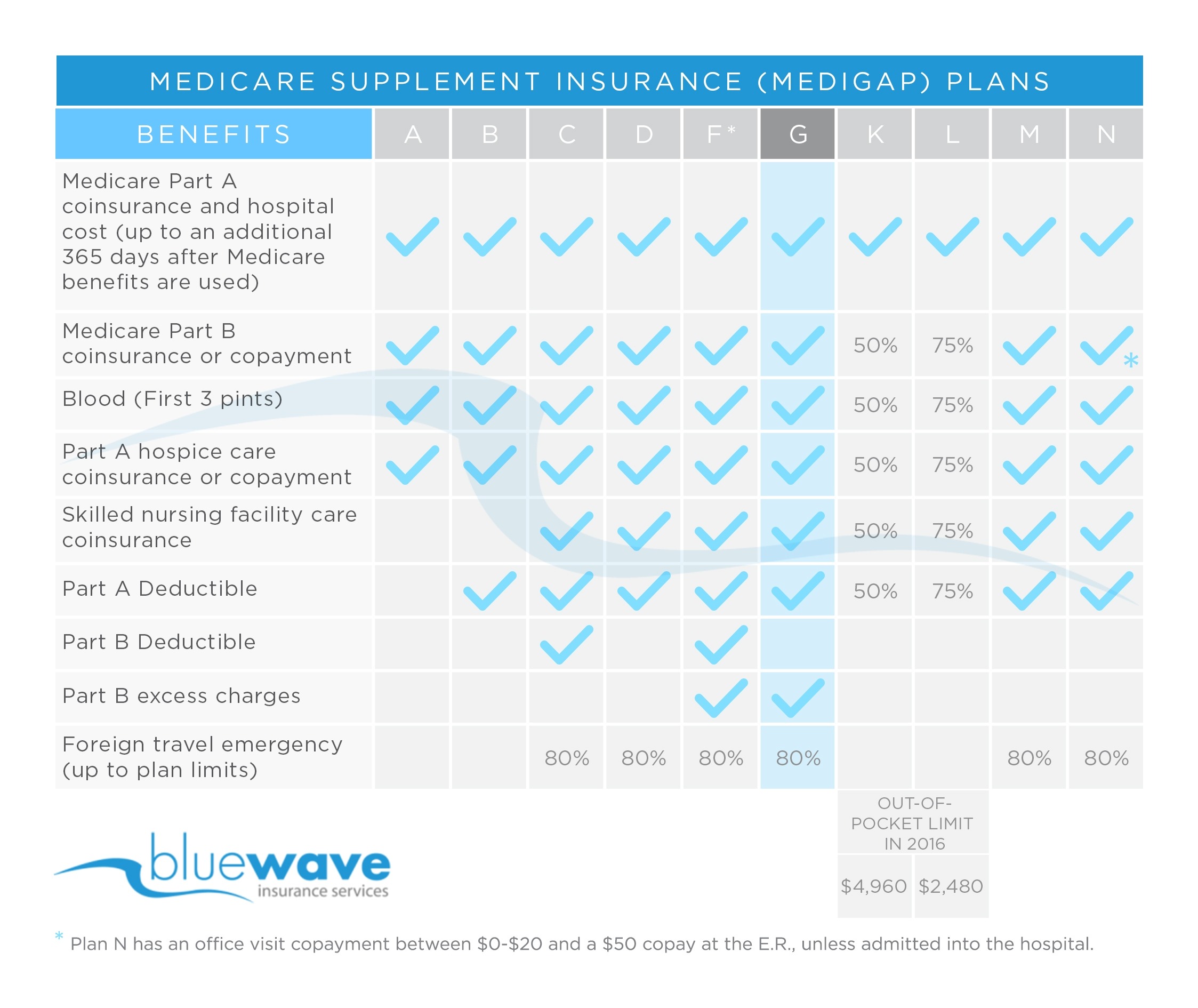

- Benefits. They also cover 80% of the costs of emergency care when traveling abroad. ...

- Policy premiums. Plan F and Plan G both charge monthly premiums. ...

- Out-of-pocket limits. Plan F and Plan G have no limit on the qualifying out-of-pocket costs they'll absorb. ...

- High-deductible plans. ...

- Availability. ...

How much does Medicare Part G cost?

What is the difference between Medicare Supplement Plans F & G? Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid …

Is Medicare Plan G better than Plan F?

Apr 07, 2021 · Plan G Medicare Rates are Lower You see, most savvy seniors have already figured out that Plan G Medicare premiums are lower than Plan F, and that cost difference adds up to more than the Part B deductible (in most areas). So, for these seniors, a Medigap Plan G policy is better than Plan F because they save money.

What are the benefits of Medicare Part F?

“Parts” versus “Plans” in Medicare That’s the case with “Part F” and “Part G.” When people refer to these, they actually mean “Plan F” and “ Plan G .” Parts refer to four aspects of Medicare. Part A refers to inpatient hospital coverage, and Part B refers to outpatient coverage. Together, Parts A and B make up Original Medicare.

What is covered by Medicare Part F?

Nov 18, 2021 · Plan F covers more than Plan G, as it includes the Medicare Plan B deductible. Plan F prices have also jumped substantially since the introduction of the act that discontinued their availability to new Medicare beneficiaries. However, Plan G is also a comprehensive plan.

What is the difference between Medicare Supplement Plan G and F?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you'll need to pay your Part B deductible ($233 for 2022), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

Should I switch from Medicare F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

What does Plan F cover that Plan G does not?

The only benefit Plan F offers that Plan G doesn't is coverage for the Medicare Part B deductible. Even though Plan G doesn't cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.Nov 18, 2021

Does Plan G replace Plan F?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs. Part B copays/coinsurance (not deductibles)

Is Medicare Plan G good?

Is Medicare Plan G worth it? Absolutely, Plan G is worth the cost because it covers the expenses you'd otherwise pay. The policy is especially beneficial when your health starts to decline or when you need routine care.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Why is Plan F better than Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Has Medicare Plan F been discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

Who is eligible for Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.Oct 1, 2021

Does AARP Offer Plan G?

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.Sep 21, 2021

What Is The Difference Between Plan F and G

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible...

Medigap Plan G vs F Benefit Details

Below is a chart we put together with the main benefits covered by Medicare Supplement Plans G and F. As you will see, they mirror each other in al...

Who Should Choose Medigap F?

Everyone looking into Medigap policies should consider Plan F since it offers the most benefits. But who should pick F over G? 1. Anyone who can fi...

Who Should Choose Medigap G?

Everyone consider enrolling in Medicare Supplement Insurance who does not fall under the three bullets above should consider Plan G. Basically if y...

What About Plan F Going away?

First of all, Plan F is not going away. Anyone who is Medicare eligible before 2020 can purchase it at any time in the future and those currently o...

What is guaranteed issue?

Guaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance (aka, Medigap plans). All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting.... , and insurance companies can ask you health questions.

What is Medicare Supplement Plan F?

For decades, Medicare Supplement Plan F. Medicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services....

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment.... Only Medigap Plan F covers all of these costs for you. This is why so many people, both insurance professionals, and policyholders alike, think Plan F is the best.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... : Medicare Part A Coinsurance & Hospital Costs.

What is a deductible in health insurance?

Part A is for hospital inpatient care.... coverage — has deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share....

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

How long does the open enrollment period for Medicare last?

Your personal open enrollment window starts when you first enroll in Medicare Part B (the effective date of your coverage) and lasts for six months.

What Is a Medigap Plan?

First, we need to know what a Medigap plan is. Medigap plans were designed to fill in the “gaps” left by Parts A and B of Original Medicare. Neither Part A nor Part B covers your medical expenses at 100%. There are always out-of-pocket expenses associated with Original Medicare, whether that comes from a deductible, copay, or coinsurance cost.

Medigap Plan F

Medigap Plan F is the most comprehensive Medigap plan on the market. Medicare beneficiaries who enroll in Plan F will pay the monthly premium for Plan F and the monthly premium for Medicare Part B but will have nearly no other out-of-pocket costs for medical services.

Medigap Plan G

Medigap Plan G is almost exactly the same as Plan F, with one small exception. Plan G does not cover the Part B deductible. However, it is the second most comprehensive coverage of all Medigap plans.

How to Choose Between Plan F and Plan G

If Plan F has better coverage, why would anyone choose Plan G over Plan F? There are two main considerations when making this decision: eligibility and premiums.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

Does Plan F cover Medicare Part B?

The only benefit Plan F offers that Plan G doesn’t is coverage for the Medicare Part B deductible. Even though Plan G doesn’t cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

How much is the Part B deductible?

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $203. This means Medigap Plan F pays the $203 while Plan G does not. The other difference is price, and it is a considerable one.

How long do you have to pay Medicare Part A deductible?

Click Here. *Medicare Part A deductible is broken down into 60 day benefit periods. You have to pay the deductible if you reenter the hospital after 60 days from discharge. Example: If you enter the hospital March 1st you’ll pay the Part A deductible.

How much does Plan G save?

Often Plan G can save you $30 or more a month. That would mean you would save $360 a year ($30 x 12), which would more than pay for the $203 the plan requires. Plan G is priced so well that we currently help 4 people enroll in G plan for every 1 F plan.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Is Medigap Plan F better than Plan G?

Anyone who can find a Medigap Plan F with an annual premium that is not $203 more than Plan G’s annual premium. So if the best priced F is only $100 more a year than the best priced G then it’s probably a good deal. Anyone who lives in a state such as CA, MO, NY and OR that allows you to switch plans without medical review.

Is there a charge for Senior65?

Compare prices for yourself. If you need assistance or are ready to enroll, give us a call. There is never a charge or hidden fee to work with Senior65.com. Since Medicare Insurance prices are regulated, no one can sell you the same plan for less than we can.

What is the best Medicare supplement plan?

Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium dollar.

Why do insurance companies recommend Plan F over Plan G?

There are a couple reasons why an agent or insurance company might recommend Plan F over Plan G . Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between ...

Why do people get Plan F?

Most people get Plan F because their friend has Plan F. Or, perhaps their agent or insurance carrier didn’t explain the other plans available. Some agents will quickly tell you that everyone gets Plan F because it “pays for everything”. This is true. But you also need to make sure Plan F’s premium suits your budget.

When will Medicare stop selling Plan F?

This includes Medigap Plan F. Insurance companies will no longer be able to sell Plan F to anyone who becomes eligible for Medicare on or after January 1, 2020.

Does Medigap Plan N cover everything?

Plan N is the 3rd most popular plan. Although Medigap Plan N provides great value and excellent coverage, it won’t cover everything. You will be responsible if there are any excess charges. You’ll also have to pay for your Part B deductible as well as some co-payments at the emergency room and your physician’s office.

Is Part B deductible a Plan G?

Looking at the chart below, you can see the Part B deductible is not a Plan G benefit. Medicare Supplement Benefits.

Does Part B deductible go into premium?

It costs money for the insurance company to manage, handle, and pay the Part B deductible payment for you. This is factored into your premium dollar. So, you actually end up paying for this “convenience” with Plan F. Plan F can also be more susceptible to rate increases.

What is the difference between a plan F and a plan G?

With Plan F, you’ll have zero out of pocket costs outside your monthly premium. This is because it’s a first-dollar coverage plan. This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out ...

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

Can you change your Medigap plan at any time?

You can enroll or change plans at any time. The best time to enroll is during the Medigap Open Enrollment Period , during this time, carriers can’t deny you coverage or charge you more in monthly premiums due to pre-existing health conditions. Outside this enrollment window, you can still enroll or change your plan.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

What is Medicare Supplement Plan C?

Medicare Supplement Plan C, also called Medigap Plan C, is one of the most comprehensive of the 10 standardized supplemental Medicare plans available in most states. In fact, only Medicare Plan F offers more coverage.... , E, F, H, I, and J are no longer available to new Medicare beneficiaries.

How does Medigap work?

With a Medigap plan, you pay for most of your medical services in advance through your monthly premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ...

What is Medicare 2021?

March 12, 2021. The federal Medicare program. Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... is a series of lettered (A, B, C, and D) health insurance programs available to people, age 65 and older, and certain adults with qualifying disabilities. Medicare Part A.

How much does Medicare Plan F cost?

The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment. ... . These occur when your doctor or specialist does not accept the standard Medicare payment for a service.

Which is better, Medicare Supplement Plan F or G?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one cost that Plan G does not cover, the Part B deductible, is often less than the annualized premium difference between the two plans.

When will Medicare Supplement Plan F be available?

As a result, anybody who becomes eligible for Medicare on or after 1 January 2020 will not be able to purchase a Medicare Supplement Plan F policy.

How much does Medicare Supplement pay?

All Medicare Supplement plans may pay 100% of your daily hospital coinsurance under Medicare Part A, and include an additional 365 days of coverage after Medicare coverage runs out. All plans generally pay between 50% and 100% of your Medicare Part B coinsurance and copayments, your Part A skilled nursing home coinsurance, ...

Which Medicare Supplement Plan has the most comprehensive benefits?

Medicare Supplement Plan F has the most comprehensive benefits of the three; your out-of-pocket Medicare costs with this plan are generally minimal. However, Plan F premiums may also be higher compared to Medicare Supplement Plan G or Plan N. Premiums may vary from one company to the next, even for the same plan.

What happens if you don't accept Medicare?

Health-care providers who don’t accept Medicare assignment may charge up to 15% more than the Medicare-approved amount for a service, if they’re legally allowed to do so.

What happens if you wait until after OEP?

If you wait until after the OEP, you may be charged more or turned down for coverage if you have a health condition. The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is essentially the same as Plan F, except it does not cover your Part B deductible. You may still be able to buy Medicare Supplement Plan G in 2020. A Medicare Supplement high-deductible Plan G might become available in 2020.

Does Medicare Supplement Plan F cover out of pocket costs?

Medicare Supplement Plan F also pays 100% of your excess charges under Part B.

Does Medicare Supplement Plan F cover emergency medical expenses?

Plan F usually pays 100% of those charges for you. If you travel outside the country, Medicare Supplement Plan F may cover 80% of your emergency health-care costs, up to the plan’s limit. There is also a high-deductible version of Plan F that might have a lower premium than the regular Plan F, because of its high deductible.

Medicare Supplement Plan C

Medicare Supplement Plan C covers most Medicare-approved out-of-pocket expenses. However, this Medigap insurance plan has been phased out. Those who were eligible for Medicare after January 1, 2020, will no longer be able to purchase Medicare Supplement Plan C.

Medicare Supplement F Plan

Medicare Supplement F plan is considered one of the most popular Medicare Supplement plans because it provides the most comprehensive coverage. Like Plan C, the Medicare Supplement F plan is no longer available to Medicare beneficiaries who were not eligible for Medicare before January 1, 2020.

Medicare Supplement Plan G

Medicare Supplement Plan G provides all of the same benefits offered by Medicare Supplement F Plan, except for the Part B deductibles, which cost $198 in 2020.

Medicare Supplement Plan N

Medicare Supplement Plan N keeps growing in popularity because it has excellent coverage with little fewer benefits than Plan F and G.