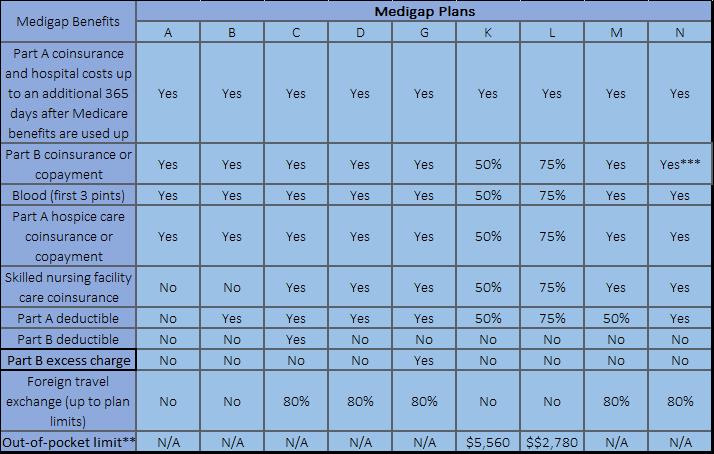

Plan C has no out-of-pocket limit, and covers: Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted Plan F covers everything Plan C does, and also covers Medicare Part B excess charges.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

How much does Medicare Part C plan cost?

The cost of a Medicare Part C (also commonly called “Medicare Advantage”) plan can be quite low relative to the cost of other types of health insurance. The Centers for Medicare and Medicaid Services (CMS) estimates that the average premium for a Medicare Part C plan in 2021 is just $21 per month.

What is the best Medicare supplement plan?

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

What are the benefits of Medicare plan?

Who Plan A is Ideal For

- Those looking for a lower monthly premium

- People who aren’t concerned about out of pocket hospital costs

- Those who do not travel outside the United States

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

What is plan C and F?

Plan F and Plan C are both referred to as “first-dollar” coverage plans because they cover the annual Medicare Part B deductible. This benefit allows policyholders to get non-emergency medical care without having to pay an annual deductible. The Part B deductible is $233 per year in 2022.

What is a Medicare F plan?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is the difference between Medigap plan C and F?

Of the 10 Medigap plans, C and F currently pay that deductible, which is $233 for 2022. The difference between plans C and F is that C does not cover the 15 percent in excess charges that doctors who don't participate in Medicare are allowed to charge their patients; Plan F does.

Why was plan F discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is Medicare Plan C?

Medicare Part C is a type of insurance option that offers traditional Medicare coverage plus more. It's also known as Medicare Advantage. Some Medicare Part C plans offer health coverage benefits such as gym memberships and transportation services.

What are the benefits of plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Who qualifies plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Is Medicare Part C going away 2021?

Is Medicare Part C discontinued? Medicare Part C has not been discontinued. However, Medigap Plan C is no longer available to new Medicare enrollees from January 1, 2020. Medicare is a federal insurance plan for people aged 65 and older.

Is Medicare Part C being discontinued?

Starting on January 1, 2020, Plan C was discontinued. You can keep Plan C if you already have it. You can still enroll in Plan C if you were eligible for Medicare on or before December 31, 2019. Congress has ruled that the Plan B deductible can no longer be covered by Medigap plans.

Is Medicare F plan going away?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Who is eligible for plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

What was plan C?

Plan C is a term that refers to an abortion that's performed using medication. It can also be referred to as a medication abortion. The most effective medication abortion is a combination of mifepristone (Mifeprex) and misoprostol (Cytotec) taken over 1 to 2 days.

Is plan G better than plan C?

What's the Difference Between Plan C vs. Plan G? If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

What is the difference between Plan B and plan C?

Plan C is an emergency contraceptive pill that works more effectively than Plan B, the most-used emergency contraceptive, because it has different ingredients and allows a longer window of time that it can be effective.

What is High Deductible Plan F?

The coverage for a high-deductible Plan F is nearly the same as Medicare Supplement Plan F, but you’re required to satisfy an annual deductible bef...

What is High Deductible Plan G?

A high-deductible Plan G requires you to pay an annual deductible before the plan begins to pay. Once you reach the deductible, you will receive th...

Is Medigap Plan C and Medicare Part C the same?

No. Even though Medigap Plan C and Medicare Part C sound similar, they are very different. Medigap is Medicare Supplement Insurance that helps cove...

How can I enroll in a Medicare Supplement plan?

To be eligible for a Medicare Supplement plan, you must enroll in Original Medicare (Parts A and B). The Medigap open enrollment period lasts six m...

Are there other options rather than enrolling in a Medigap plan?

Yes. Consider enrolling in a Medicare Advantage (Part C) plan, an alternative to Original Medicare that comes with additional benefits and features...

What is the Medicare deductible?

The Medicare deductibles, coinsurance and copays listed are based on the 2019 numbers approved by the Centers for Medicare and Medicaid Services. You can go to any hospital, doctor or other health care provider in the U.S. or its territories that accepts Medicare.

Does Blue Cross Blue Shield of Michigan cover Medicare Supplement?

Blue Cross Blue Shield of Michigan administers Blue Cross Medicare Supplement plans. Where you live, your age, gender and whether you use tobacco may affect what you pay for your plan. Your health status may also affect what you pay. This is a solicitation of insurance. We may contact you about buying insurance.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

Does Medicare cover Part B?

The new MACRA law doesn’t allow Medicare supplement plans to cover the Part B deductible for people who are eligible for Medicare on or after Jan. 1, 2020. Because Plans C, F and high-deductible F cover the Part B deductible, they will no longer be available for beneficiaries who become eligible for Medicare on or after Jan. 1, 2020.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

What is deductible insurance?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Can I sell my Medicare Part B policy?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C ...

What is the difference between Medicare Part C and Medicare Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Who pays Medicare Part C premium?

The premium for Medicare Part C is paid to the private insurance company , which then pays the premium for Medicare Part B to Medicare. Medicare Advantage plans have a yearly out-of-pocket spending limit. If a person reaches the limit in a calendar year, the plan pays all medical expenses for the rest of the year.

What are the requirements to be eligible for Medicare Part C?

In general, a person must meet two requirements to be eligible for Medicare Part C: They must be enrolled in original Medicare, and they must live in an area where an insurance company offers Medicare Part C. During a person’s IEP, they are eligible for Medicare Part C.

What happens when you join a prescription plan?

When a person joins a prescription plan, the insurance company calculates the penalty and adds it to the premium. Generally, this penalty forms part of the premium for as long as the person has a Medicare prescription plan.

How much does Medicare Part D pay?

The individual pays approximately 25% of the cost of prescriptions, and Medicare Part D pays the remaining 75%. If a person reaches the “ catastrophic coverage ” amount, they pay 5% of the cost of prescriptions. This feature of the plan helps individuals with high out-of-pocket prescription expenses.

What is PFFS insurance?

Private Fee-for-Service (PFFS) plans. Medicare usually sets the fee for both the provider and the individual enrollee. For a PFFS plan, the insurance company sets these fees. Insurance companies must follow the Medicare rules, though each plan can have different rules for out-of-pocket costs and access to services.

When is Medicare Part D available?

However, these changes are possible during the annual OEP that runs from October 15 to December 7. Medicare Part D is available for everyone during their IEP for original Medicare. Private insurance companies sell Medicare Part C and Part D.