What are the similarities and differences between Medicare Plan F and Plan G?

- Benefits. They also cover 80% of the costs of emergency care when traveling abroad. ...

- Policy premiums. Plan F and Plan G both charge monthly premiums. ...

- Out-of-pocket limits. Plan F and Plan G have no limit on the qualifying out-of-pocket costs they'll absorb. ...

- High-deductible plans. ...

- Availability. ...

Should You Choose Medicare supplement plan F or Plan G?

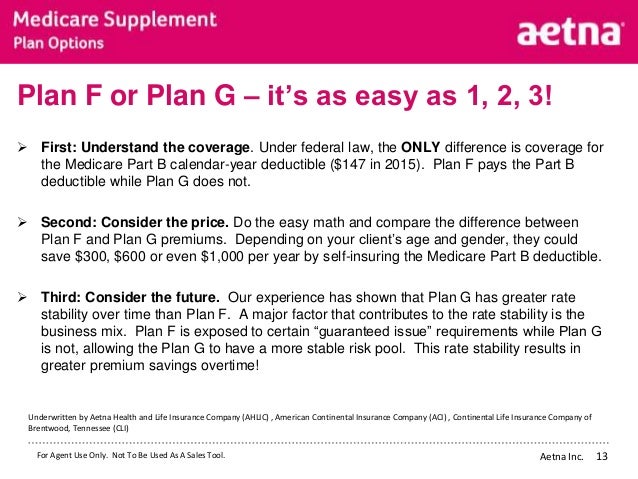

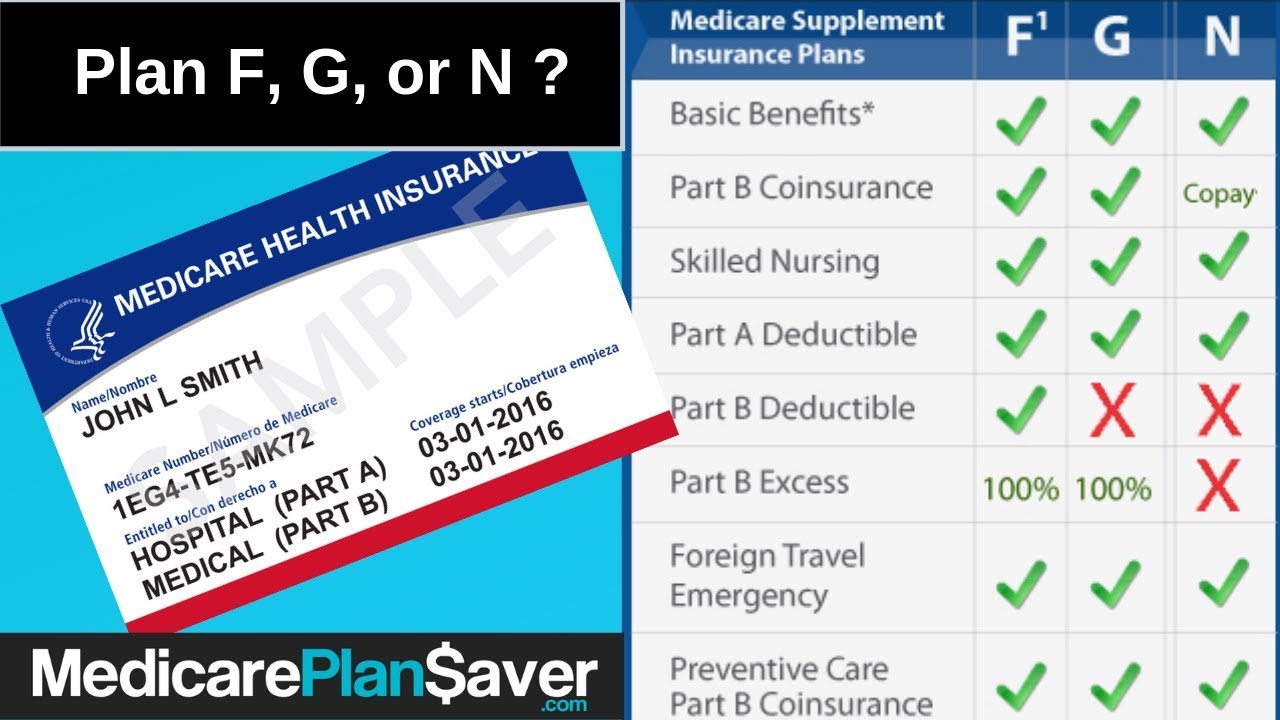

Nov 18, 2021 · Plan F covers more than Plan G, as it includes the Medicare Plan B deductible. Plan F prices have also jumped substantially since the introduction of the act that discontinued their availability to new Medicare beneficiaries. However, Plan G is also a comprehensive plan.

Is Medigap Plan G better than Plan F?

Aug 10, 2018 · Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid for, you essentially have Plan F.

What are the benefits of Medicare Plan F?

Apr 07, 2021 · Once it’s paid, then Plan G acts just like a Plan F policy and covers all Medicare-approved costs. But here’s the thing, for many people Plan G is actually cheaper overall. That’s what makes it better. Plan G Medicare Rates are Lower. You see, most savvy seniors have already figured out that Plan G Medicare premiums A premium is an amount that an insurance …

Is Medicare Plan F the best?

Sep 15, 2017 · This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible and Plan G doesn’t. The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $233.

What is the difference between F Plan and G Plan?

Should I switch from Plan F to Plan G?

What is the difference between Medicare Plan F & G?

Is Medicare Plan F being discontinued?

What Is The Difference Between Plan F and G

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible...

Medigap Plan G vs F Benefit Details

Below is a chart we put together with the main benefits covered by Medicare Supplement Plans G and F. As you will see, they mirror each other in al...

Who Should Choose Medigap F?

Everyone looking into Medigap policies should consider Plan F since it offers the most benefits. But who should pick F over G? 1. Anyone who can fi...

Who Should Choose Medigap G?

Everyone consider enrolling in Medicare Supplement Insurance who does not fall under the three bullets above should consider Plan G. Basically if y...

What About Plan F Going away?

First of all, Plan F is not going away. Anyone who is Medicare eligible before 2020 can purchase it at any time in the future and those currently o...

which is better medicare plan f vs plan g?

The better plan will depend on your coverage goals and budget. Plan F makes sense if you want to simply pay a monthly premium and all of your Medic...

should i switch from plan f to plan g?

This will be a personal decision and will depend on your coverage goals. If you want to save some money each year, then a Plan G is a great option....

can i switch from medicare plan f to plan g?

Yes you can switch from Medicare Plan F to Plan G. However, you may be subjected to medical underwriting. This will be determined by the Medicare S...

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

Which is better, Plan G or Plan F?

Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage.... Plan G is better than Plan F because it’s the most coverage the government will let us get.

What is Medicare Supplement Plan F?

For decades, Medicare Supplement Plan F. Medicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services....

What is guaranteed issue?

Guaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance (aka, Medigap plans). All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting.... , and insurance companies can ask you health questions.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment.... Only Medigap Plan F covers all of these costs for you. This is why so many people, both insurance professionals, and policyholders alike, think Plan F is the best.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... : Medicare Part A Coinsurance & Hospital Costs.

What is a deductible in health insurance?

Part A is for hospital inpatient care.... coverage — has deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share....

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

How much does Plan G save?

Often Plan G can save you $30 or more a month. That would mean you would save $360 a year ($30 x 12), which would more than pay for the $203 the plan requires. Plan G is priced so well that we currently help 4 people enroll in G plan for every 1 F plan.

How long do you have to pay Medicare Part A deductible?

Click Here. *Medicare Part A deductible is broken down into 60 day benefit periods. You have to pay the deductible if you reenter the hospital after 60 days from discharge. Example: If you enter the hospital March 1st you’ll pay the Part A deductible.

How much is the Part B deductible?

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $203. This means Medigap Plan F pays the $203 while Plan G does not. The other difference is price, and it is a considerable one.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Is there a charge for Senior65?

Compare prices for yourself. If you need assistance or are ready to enroll, give us a call. There is never a charge or hidden fee to work with Senior65.com. Since Medicare Insurance prices are regulated, no one can sell you the same plan for less than we can.

Is Medigap Plan F better than Plan G?

Anyone who can find a Medigap Plan F with an annual premium that is not $203 more than Plan G’s annual premium. So if the best priced F is only $100 more a year than the best priced G then it’s probably a good deal. Anyone who lives in a state such as CA, MO, NY and OR that allows you to switch plans without medical review.

Why do insurance companies recommend Plan F over Plan G?

There are a couple reasons why an agent or insurance company might recommend Plan F over Plan G . Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between ...

When will Medicare stop selling Plan F?

This includes Medigap Plan F. Insurance companies will no longer be able to sell Plan F to anyone who becomes eligible for Medicare on or after January 1, 2020.

What is the best Medicare supplement plan?

Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium dollar.

Why do people get Plan F?

Most people get Plan F because their friend has Plan F. Or, perhaps their agent or insurance carrier didn’t explain the other plans available. Some agents will quickly tell you that everyone gets Plan F because it “pays for everything”. This is true. But you also need to make sure Plan F’s premium suits your budget.

Is Part B deductible a Plan G?

Looking at the chart below, you can see the Part B deductible is not a Plan G benefit. Medicare Supplement Benefits.

Does Part B deductible go into premium?

It costs money for the insurance company to manage, handle, and pay the Part B deductible payment for you. This is factored into your premium dollar. So, you actually end up paying for this “convenience” with Plan F. Plan F can also be more susceptible to rate increases.

Is Plan G the same as Plan F?

After the deductible is met , Plan G benefits are exactly the same as Plan F . Plan F benefits include coverage for all copays, deductibles and coinsurance. This type of coverage has made Plan F extremely popular among seniors on Medicare.

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

What is Medicare Plan F and G?

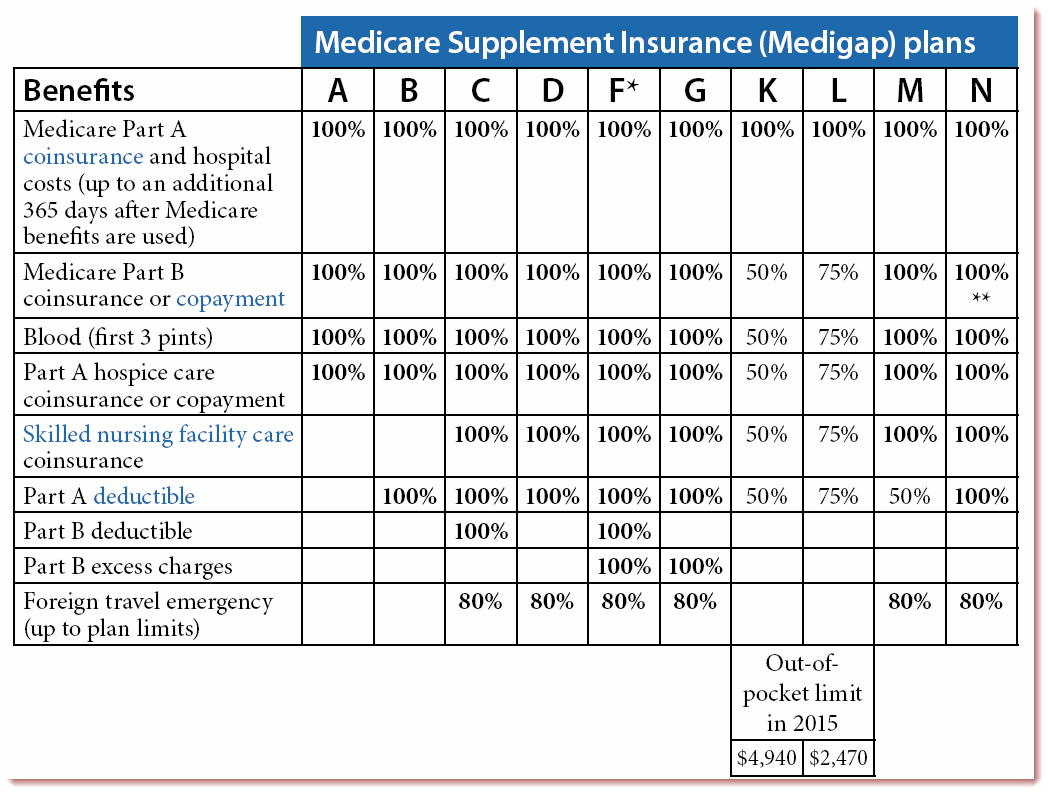

Medicare Plan F and Plan G are two of the 10 different types of standardized Medicare supplemental health insurance plans available in most states. You pay a premium for both types of plans, but both plans help pay for out-of-pocket expenses that Original Medicare doesn’t cover. The following chart provides a side-by-side look at all 10 ...

Why switch to Medicare Plan G?

Switching to a Medicare Plan G might be a good idea because you’ll pay lower premiums, and you might also never pay the $203 Medicare Part B deductible.

How much does Medicare cover if you have a plan F?

If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $203 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Medicare change to Plan F?

Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Is everyone eligible for Medicare Plan F and Plan G?

Medicare Plan F and Plan G can help you save money on your Medicare costs. However, as of January 1, 2020, not everyone is eligible for both plans, and you need to understand the new requirements.

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How many Medigap policies are there?

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

What is the maximum amount of medical expenses for a foreign traveler?

A $250 annual deductible may be applied by Plan F and Plan G to cover foreign travel emergency services, with a lifetime limit generally set at $50,000. The healthcare must begin during the first 60 days of a person’s trip, and no other Medicare benefit may cover it.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Can you have a Medigap plan if you are enrolled in Medicare Advantage?

In addition, if a person is enrolled in a Medicare Advantage plan, they cannot also have a Medigap plan.

What is the difference between a plan F and a plan G?

With Plan F, you’ll have zero out of pocket costs outside your monthly premium. This is because it’s a first-dollar coverage plan. This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out ...

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Which Medicare Supplement Plan has the most comprehensive benefits?

Medicare Supplement Plan F has the most comprehensive benefits of the three; your out-of-pocket Medicare costs with this plan are generally minimal. However, Plan F premiums may also be higher compared to Medicare Supplement Plan G or Plan N. Premiums may vary from one company to the next, even for the same plan.

How much does Medicare Supplement pay?

All Medicare Supplement plans may pay 100% of your daily hospital coinsurance under Medicare Part A, and include an additional 365 days of coverage after Medicare coverage runs out. All plans generally pay between 50% and 100% of your Medicare Part B coinsurance and copayments, your Part A skilled nursing home coinsurance, ...

What happens if you don't accept Medicare?

Health-care providers who don’t accept Medicare assignment may charge up to 15% more than the Medicare-approved amount for a service, if they’re legally allowed to do so.

What happens if you wait until after OEP?

If you wait until after the OEP, you may be charged more or turned down for coverage if you have a health condition. The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service.

Does Medicare Supplement Plan F cover out of pocket costs?

Medicare Supplement Plan F also pays 100% of your excess charges under Part B.

Does Medicare Supplement Plan F cover emergency medical expenses?

Plan F usually pays 100% of those charges for you. If you travel outside the country, Medicare Supplement Plan F may cover 80% of your emergency health-care costs, up to the plan’s limit. There is also a high-deductible version of Plan F that might have a lower premium than the regular Plan F, because of its high deductible.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is essentially the same as Plan F, except it does not cover your Part B deductible. You may still be able to buy Medicare Supplement Plan G in 2020. A Medicare Supplement high-deductible Plan G might become available in 2020.