What are the similarities and differences between Medicare Plan F and Plan G?

- Benefits. They also cover 80% of the costs of emergency care when traveling abroad. ...

- Policy premiums. Plan F and Plan G both charge monthly premiums. ...

- Out-of-pocket limits. Plan F and Plan G have no limit on the qualifying out-of-pocket costs they'll absorb. ...

- High-deductible plans. ...

- Availability. ...

Full Answer

Should You Choose Medicare supplement plan F or Plan G?

Nov 18, 2021 · The only benefit Plan F offers that Plan G doesn’t is coverage for the Medicare Part B deductible. Even though Plan G doesn’t cover the Part B deductible, some Plan F options could have high enough premiums that the cost difference between Plan F vs. Plan G would be higher than the Part B deductible itself.

Is Medigap Plan G better than Plan F?

Aug 10, 2018 · What is the difference between Medicare Supplement Plans F & G? Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for …

What are the benefits of Medicare Plan F?

Apr 07, 2021 · Once it’s paid, then Plan G acts just like a Plan F policy and covers all Medicare-approved costs. But here’s the thing, for many people Plan G is actually cheaper overall. That’s what makes it better. Plan G Medicare Rates are Lower. You see, most savvy seniors have already figured out that Plan G Medicare premiums A premium is an amount that an insurance …

Is Medicare Plan F the best?

Dec 07, 2020 · Let’s look into the differences between Plan F and G so you can make the right decision before you buy your insurance plan. Plan F vs Plan G. Medigap Plan F is usually the number one policy and Plan G is right behind. Why are these Medicare polices #1 and #2? It’s all about value. The Difference Between Plan F and Plan G is $233. It really is quite that simple. …

What is the difference between F Plan and G Plan?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

Why was Medigap Plan F discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Why is Plan F more expensive than Plan G?

Because it offers the most benefits, Plan F premiums are generally the most expensive. If you didn't become eligible for Medicare until 2020 or later, Plan F won't be available to you.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Can I change from Medicare Plan F to Plan G?

If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance. However, every state has different rules worth considering before making the switch.Nov 18, 2021

Is Medigap plan G being phased out?

Medicare Plan G is not going away. There is a lot of confusion surrounding which Medigap plans are going away and which are still available. Rest assured that Plan G isn't going away. You can keep your plan.Feb 11, 2020

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

Who is eligible for Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.Oct 1, 2021

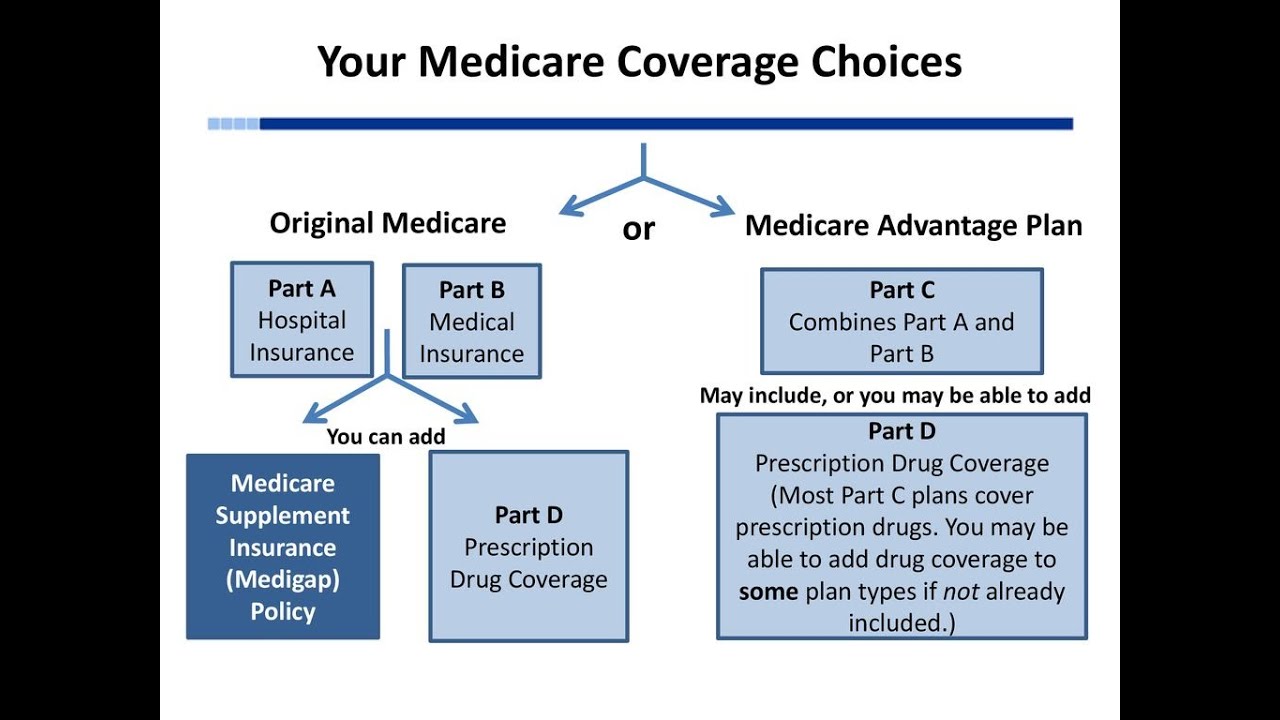

Does Medigap F cover drugs?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

Which is better, Plan G or Plan F?

Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage.... Plan G is better than Plan F because it’s the most coverage the government will let us get.

What is Medicare Supplement Plan F?

For decades, Medicare Supplement Plan F. Medicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services....

What is guaranteed issue?

Guaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance (aka, Medigap plans). All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting.... , and insurance companies can ask you health questions.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment.... Only Medigap Plan F covers all of these costs for you. This is why so many people, both insurance professionals, and policyholders alike, think Plan F is the best.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... : Medicare Part A Coinsurance & Hospital Costs.

What is a deductible in health insurance?

Part A is for hospital inpatient care.... coverage — has deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share....

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

Why do insurance companies recommend Plan F over Plan G?

There are a couple reasons why an agent or insurance company might recommend Plan F over Plan G . Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between ...

When will Medicare stop selling Plan F?

This includes Medigap Plan F. Insurance companies will no longer be able to sell Plan F to anyone who becomes eligible for Medicare on or after January 1, 2020.

What is the best Medicare supplement plan?

Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium dollar.

Why do people get Plan F?

Most people get Plan F because their friend has Plan F. Or, perhaps their agent or insurance carrier didn’t explain the other plans available. Some agents will quickly tell you that everyone gets Plan F because it “pays for everything”. This is true. But you also need to make sure Plan F’s premium suits your budget.

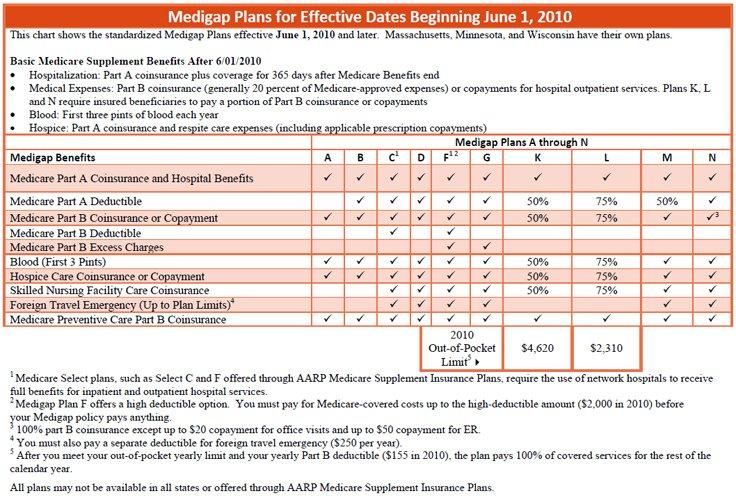

Is Part B deductible a Plan G?

Looking at the chart below, you can see the Part B deductible is not a Plan G benefit. Medicare Supplement Benefits.

Does Part B deductible go into premium?

It costs money for the insurance company to manage, handle, and pay the Part B deductible payment for you. This is factored into your premium dollar. So, you actually end up paying for this “convenience” with Plan F. Plan F can also be more susceptible to rate increases.

Is Plan G the same as Plan F?

After the deductible is met , Plan G benefits are exactly the same as Plan F . Plan F benefits include coverage for all copays, deductibles and coinsurance. This type of coverage has made Plan F extremely popular among seniors on Medicare.