The Differences Between Plan G and Plan N:

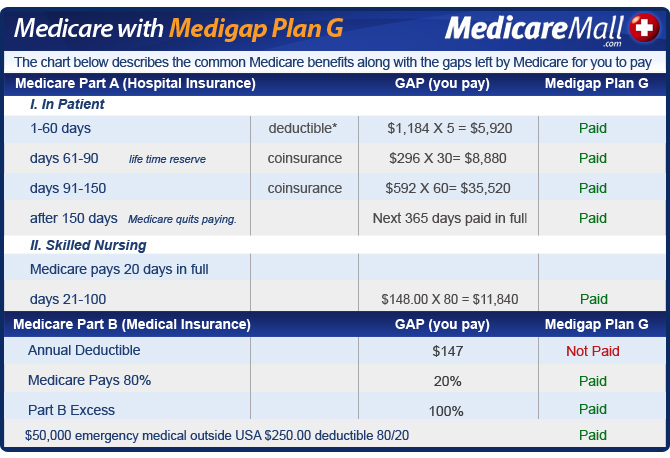

- Plan G has only one out of pocket expense (Annual Part B deductible), then 100% coverage

- Plan N also has this expense, but then possible co-payments

- If you visit the doctor frequently Plan G might be a better option

- Plan N is best for people who visit the doctor infrequently but still want great coverage

Full Answer

What does plan N cover in Medicare?

Jul 23, 2021 · Medicare Plan N has lower premiums than Plan G as well as lower annual rate increases. In exchange for lower premiums, Plan N has some additional out-of-pocket expenses that you could incur. Medicare Plan N vs G The Differences Between Plan G and Plan N: Plan G has only one out of pocket expense (Annual Part B deductible), then 100% coverage

Which is better Medicare Plan F or G?

Apr 29, 2021 · This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we’ll cover next. Doctor Visit Copay

Is Plan G the best Medicare supplement plan?

Jul 27, 2019 · Medicare Plan G offers slightly more comprehensive coverage than Plan N, but with higher monthly premiums. In particular, Plan G covers “excess charges” that go beyond Medicare’s approved rates. For example, if your doctor charges more for a procedure than the amount Medicare covers, you won’t have to pay the difference; Plan G will cover it.

Should You Choose Medicare supplement plan F or Plan G?

Which plan is better g or n?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the difference between plan N and G?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.Apr 29, 2021

What is Medicare Plan G Plan N?

What Do Medicare Supplement Plan G and Medicare Supplement Plan N Cover? Medicare Supplement Plan G and Plan N both cover many of the larger costs leftover from your Original Medicare coverage. For instance, they both cover: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance.

Is Plan G better than Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Can I switch from Plan N to G?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan.

Does Plan N have a deductible?

Does Plan N have a deductible? Most Plan N policies do not have a deductible. However, beneficiaries enrolled in Plan N are required to meet the Medicare Part B deductible, $233 in 2022.Jan 24, 2022

Is Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Does Medicare Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.May 12, 2020

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Why is Plan F more expensive than Plan G?

Because it offers the most benefits, Plan F premiums are generally the most expensive. If you didn't become eligible for Medicare until 2020 or later, Plan F won't be available to you.

The Differences Between Plan G and Plan N

Please note: There’s a standardization of Medigap plans across the USA except for Wisconsin, Minnesota, and Massachusetts.

Medicare Plan G

Plan G offers better coverage than Plan N but at a higher monthly premium. Here are the areas that are covered by Plan G and not Plan N:

Items not covered by Medigap Plan N

These are quite rare, in fact, a recent study showed only 1% of providers even charge these.

What is Medicare assignment?

Medicare Assignment is basically a “fee schedule” or “agreement” between Medicare and a doctor. Accepting assignment by a doctor means that your doctor agrees to the payment terms set forth by Medicare.

How much does Medicare pay for doctor visits?

But, on the other hand, with Medicare Plan N benefits, you must pay a $20 copay for every doctor visit you go to. So, ultimately, if you are a person who visits the doctor frequently, this could definitely add up over a year.

Does Medicare Part B cover excess charges?

Medicare Part B Excess Charges. This is one of the most important coverage differences between the two plans that could cost you a lot more in medical bills than expected. So Plan N does not cover any excess charges, while Plan G does. So what this means if you choose Plan N, medical providers can send you a balance bill if ...

Does Medicare Supplement Plan N cover Part B?

You may be wondering, does Medicare Supplement Plan N cover Part B deductible? Unfortunately, the simple answer is no. Both Plan N and Plan G do not cover the small annual Part B deductible of $203. This means when you go to the doctor the first time at the beginning of the year, you will have to pay this $203 deductible out of pocket with either of these plans.

What is the difference between Plan N and Plan G?

The main differences between the two plans are some of the expenses you’ll pay for outpatient care. Plan N has a copay of $20 for office visits and $50 for emergency room visits (which is not charged if you are admitted to the hospital). Plan G doesn’t have a copay for these visits.

What is Medicare Plan N?

Medicare Plan N is a supplemental insurance policy that covers some of the expenses not covered by Original Medicare, such as the Part A coinsurance and deductible. However, it doesn’t cover the Part B deductible or “excess costs,” which are costs a provider charges beyond the amount covered by Medicare (these are capped at 15%).

How much does Plan N cover?

Plan N covers 3 pints of blood per calendar year and Medicare pays the rest. For Part B (emergency and medical care), Plan N will pay for all expenses that aren’t covered by Medicare except for the $185 deductible per year. You’ll also be expected to pay a $20 copay for office visits and $50 copay for emergency room care.

When is the best time to enroll in Medicare?

The best time to enroll is when you first sign up for Medicare, since during that time, insurers aren’t allowed to turn you down or charge you a higher monthly premium due to pre-existing conditions. After that, you’ll be subject to medical underwriting, which means the company can take your health status into account.

What does Plan G cover?

In particular, Plan G covers “excess charges” that go beyond Medicare’s approved rates . For example, if your doctor charges more for a procedure than the amount Medicare covers, you won’t have to pay the difference; Plan G will cover it.

How much does Medicare cover for a gap?

First, it will cover your Part A deductible ($1,364) for the first 60 days and will cover the gap fee ($341) for the next 30 days. As with Plan N, you’ll be covered for $682 per day for 60 lifetime reserve days, and 100% of eligible expenses for 365 additional days after your Medicare coverage runs out.

Can you buy Medicare Part D separately?

If you need care in any of the categories that aren’t covered, you’ll have to buy those separately, regardless of which Medigap policy you choose. For example, you can purchase prescription drug benefits through Medicare Part D in addition to your Medigap policy.