Is it better to have Medicare Advantage or Medigap?

Medicare members are able to purchase two types of plans to supplement and enhance their coverage: Medigap and Medicare Advantage. How do they differ? Medicare members have two options to supplement their basic coverage to include more services and reduce costs: Medigap and Medicare Advantage. What are Medigap Plans?

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is the best Medicare supplement?

Medicare.gov, describes a five star plan as "excellent" saying that the rating system "help you compare plans based on quality and performance." The ratings for plans are completed each year and can very as new plans become available. Those who select a ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

How many different Medicare Supplement plans are there?

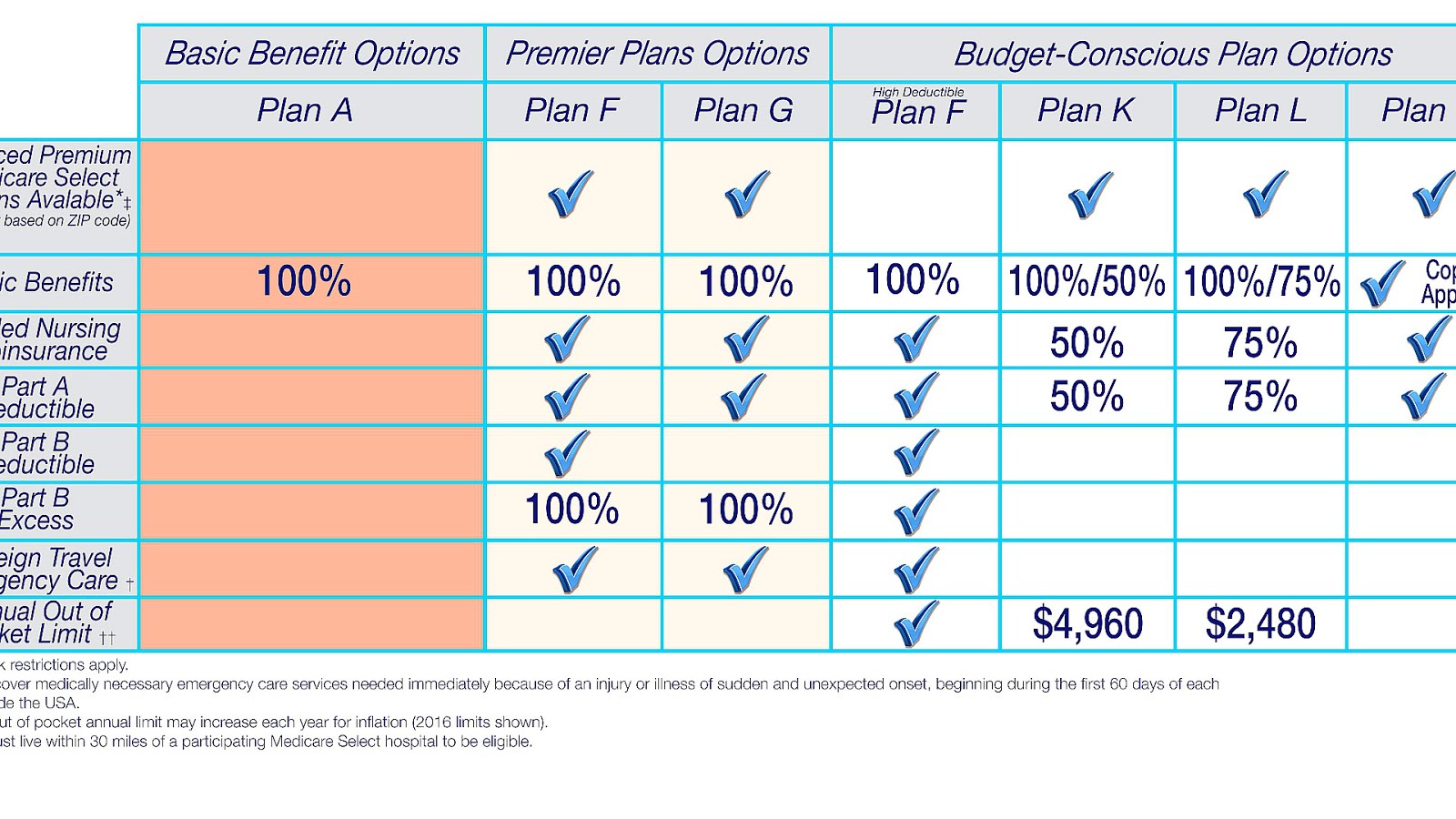

There are 10 different types of Medicare Supplement Insurance plans, each designated by a letter of the alphabet (you can find details about all 10 plans at Medicare.gov ). In most states, the benefits are the same no matter what insurance company you purchase the plan from, though each plan covers different things.

How many parts does Medicare have?

Medicare itself has four parts. Part A (hospital insurance) and Part B (health insurance) come standard in every Original Medicare Plan. Part C is called Medicare Advantage, and it's an alternative to a standard Medicare Plan that offers some additional benefits like prescription drug coverage. Stand-alone prescription drug plans, ...

What is the most popular Medicare plan?

Plan F are the most popular plans, according to Joe Baker, president emeritus of the Medicare Rights Center, a nonprofit that helps older adults understand Medicare benefits. However, these plans are not available to people new to Medicare starting on Jan. 1, 2020 because they cover the Part B deductible.

Does Medicare cover long term care?

Prices depend on your age, where you live, the insurer and type of plan you select. In general, Medicare Supplement Insurance plans usually do not cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing. A Medicare Supplement Insurance plan can also only cover one person.

What is Medicare?

The Medicare program is divided into four parts. Every Medicare plan automatically includes Parts A and B, which cover hospital costs and general health insurance respectively. Medicare Advantage is Part C and it offers an alternative form of coverage that includes certain extra benefits.

What is Medigap?

Many people don’t know what Medigap is. Medigap is a separate type of coverage for people using Medicare. It is private insurance that helps clients to pay for things not covered by any type of Medicare. Such gaps in coverage might include co-payments or coinsurance costs at a rehabilitation hospital.

What is Medicare Advantage?

Medicare Advantage is a good alternative to the combination of Medicare and Medigap. The Advantage alternative offers the benefits found in Medicare A and B but usually with lower co-payments. However, there are sections of the Advantage Plan which cost more.

What is the advantage of Medigap?

The main advantage of Medigap is the larger selection of healthcare providers from which to choose. And, it will save you money if you have long-term treatment. If you are considering purchasing a Medicare Advantage or Medigap Plan, feel free to explore this website, HealthNetwork.com.

What is a Medigap plan?

Medigap introduction. This is an additional insurance policy with Medicare Part A and Part B. It pays for certain medical expenses that are not covered by Medicare. Except for Massachusetts, Wisconsin and Minnesota, every other state has 10 standardized Medigap Plans; A through N.

What are the benefits of Medicare Advantage?

Medicare Advantage health plans are offered by private insurance companies. They include the standard medical and hospitalization coverage of Medicare Part A and Part B, respectively. Additional benefits may also be included, such as prescription drug coverage. The benefits are delivered through: 1 A health maintenance organization (HMO), where you can select a primary care physician 2 A preferred provider organization (PPO), where you have more options for out-of-network physicians 3 A Private Fee-for-Service (PFFS) plan, where you are not limited to a network,, but there is no guarantee your hospital or doctor will accept the plan

What age can you get Medicare meds?

The benefits. Prescription drug coverage and cost sharing for your specific medications. For those who have Medicare because of a disability, Medigap policies may not be available to beneficiaries under the age of 65 .

What is a PPO plan?

A preferred provider organization (PPO), where you have more options for out-of-network physicians. A Private Fee-for-Service (PFFS) plan, where you are not limited to a network,, but there is no guarantee your hospital or doctor will accept the plan. There are a variety of private health care plans.

Does Medigap have more benefits than MA?

However, any standard Medigap plan with Original Medicare (Parts A and B) will have more benefits than any standard MA plan. This is because standard MA plans are only required to offer the same Medicare Part A and B benefits. Prescription drug coverage may be included in some MA plans, with an additional cost.

Does Medigap have prescription coverage?

All Medigap plans have more benefits than Medicare Part A and Part B. But they don’t have prescription coverage. However, it can be added with Medicare Part D plan. Medigap can only be used by people who are enrolled in the conventional Medicare. Medigap is not run by the government, but by private insurance companies.

1. Medigap is not Medicare Advantage

Medigap plans supplement Original Medicare benefits and can be used to help pay some of your out-of-pocket costs that come from Medicare-approved health care.

2. There are 10 standardized Medigap options

You can compare the basic benefits of each type of Medigap plan to find the one that works for your situation.

3. Your open enrollment period is the best time to purchase a Medigap plan

During your Medigap open enrollment period, Medicare Supplement Insurance plans are offered without medical underwriting. That means insurers cannot deny you coverage or charge more for your Medigap plan based on your medical history or current conditions.

4. Medigap plans do not cover prescription drugs

Prescription drugs are covered under Medicare Part D but are not covered by Medicare Supplement Insurance plans.

5. Medigap plans have the same benefits but not the same rates

Benefits for each type of Medigap plan are standardized — in other words, no matter where you purchase your plan, the coverage is exactly the same.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is Medicare Advantage?

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

What is a Medigap policy?

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov . They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. 12 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal.

How long can you stay on medicare?

You generally won't have to pay a penalty if you later decide to enroll in a Medicare prescription drug plan and you haven't gone for longer than 63 continuous days without creditable coverage. 98.

What happens if you don't enroll in Medicare?

Once you’ve enrolled in Medicare, a key decision point is choosing coverage for Part D prescription drug insurance . If you don’t enroll in Part D insurance when you start Medicare and want to buy drug coverage later on, you may be permanently penalized for signing up late. 8

How to get started with Medicare?

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings. 10

Does Medigap cover Part B?

Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.

Does Medicare Advantage cover doctors?

Medicare Advantage plans cover hospitals and doctors and often include prescription drug coverage and some services not covered by Medicare, too.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.