Medigap: The Differences

- The freedom to choose your own doctors and hospitals. Medicare Advantage: Your choice of physicians and facilities may be limited to the plan’s network, whether it is HMO or PPO.

- Prescription drug coverage. ...

- Out-of-pocket expenses. ...

- Cost of monthly premiums. ...

- Date you can enroll. ...

- Change of benefits. ...

- Coverage boundaries. ...

Full Answer

How does Medigap differ from Medicare Advantage?

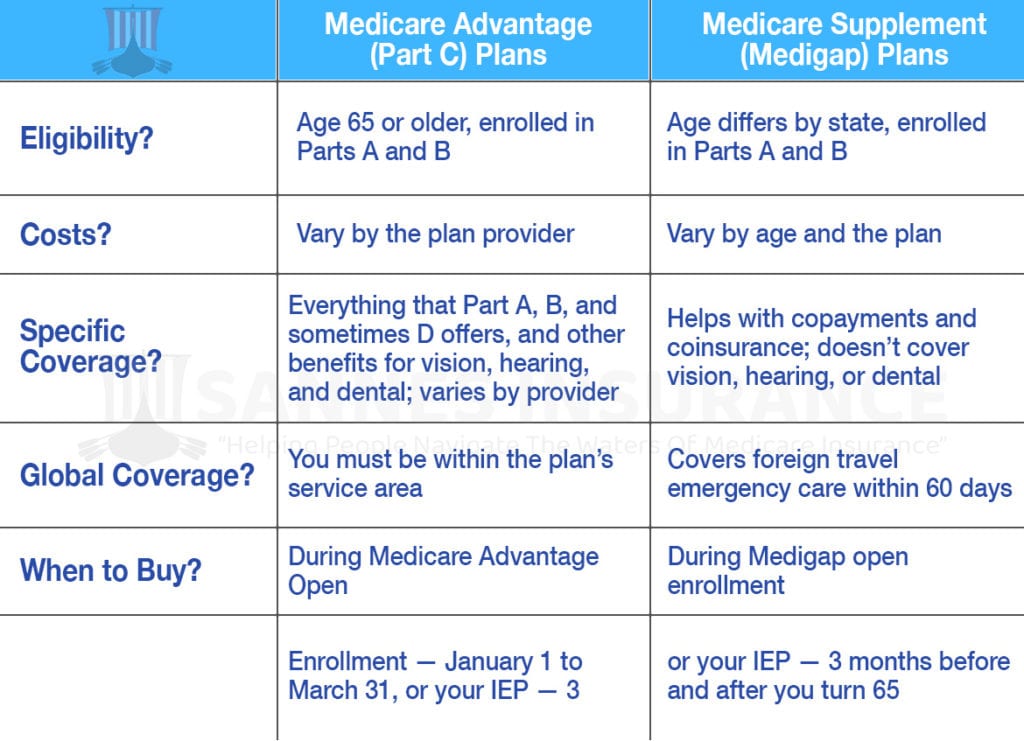

Jan 17, 2022 · Medicare Advantage plans only cover you within the service area, and don’t provide foreign travel emergency coverage. Medigap Coverage Medicare Supplement coverage depends on the specific letter plan you select. Most plans cover the expenses Medicare would otherwise leave you to pay.

What is the difference between Medigap and Medicare Advantage plans?

Dec 20, 2021 · Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program. While this may be the more expensive option, it has a few...

Should I Choose Medicare Advantage or Medigap?

Medigap plans Generally have a higher premiums than Medicare Advantage plans, but in some cases, Medicare Advantage can cover less expenses than Medigap. This means that despite a lower initial cost, you may end up paying more in out-of-pocket expenses with Medicare Advantage than with Medigap.

How to switch from Medicare Advantage to Medigap?

A. There are very big differences between these two types of insurance, although both are options for people with Medicare. Technically, only medigap counts as "Medicare supplemental insurance" — in fact, that's its formal name — but Medicare Advantage plans may provide some extra benefits that could be considered as supplementing Medicare.

Is a Medigap plan better than an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Is Medigap the same as Medicare Advantage?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include:Higher monthly premiums.Having to navigate the different types of plans.No prescription coverage (which you can purchase through Plan D)

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Why should I choose a Medigap plan?

A Medigap plan is a private insurance policy that can help you pay for some of the out-of-pocket costs associated with traditional Medicare and sometimes additional services. You must pay a premium for Medigap insurance in addition to your Medicare Part B premium and Medicare Part D prescription drug premium.

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What states have the Medigap birthday rule?

California and Oregon both have “birthday rules” that allow Medigap enrollees a 30-day window following their birthday each year when they can switch, without medical underwriting, to another Medigap plan with the same or lesser benefits.

What is the difference between Medicare and Medigap?

A. There are very big differences between these two types of insurance, although both are options for people with Medicare. Technically, only medigap counts as "Medicare supplemental insurance" — in fact, that's its formal name — but Medicare Advantage plans may provide some extra benefits ...

How long do you have to buy Medicare if you turn 65?

But when you turn 65, you get federal protections—meaning you cannot be denied coverage or charged more due to health issues, wherever you live—provided that you buy a policy within six months of your 65th birthday. Medicare Advantage plans: Visit the Medicare Plan finder at the Medicare website.

Can you use Medigap for out of network?

Note: If you enroll in a Medicare Advantage health plan you cannot use a medigap policy to cover your out-of-pocket expenses;

Can you use Medigap for Medicare?

Medigap can be used only by people enrolled in traditional Medicare. It is not a government-run program, but private insurance you can purchase to cover some or most of your out-of-pocket expenses in traditional Medicare.

Does Medicare cover Part B?

Most charge a monthly premium in addition to the Part B premium, but some don't.

What are the pros and cons of Medicare Advantage vs. Medigap plans?

Here are some pros and cons of each choice for additional Medicare coverage: Medigap that goes with original Medicare vs. Medicare Advantage, an alternative to it.

Why would you choose a Medicare Advantage over original Medicare coverage?

Medicare Advantage plans combine Medicare Part A (hospital insurance), Part B (medical insurance), and, usually, Part D (prescription drug coverage) in one plan, often for no more than the Part B premium. Many MA plans provide benefits like vision, hearing, and dental care that enrollees don’t get through traditional Medicare.

What are the biggest gaps in Medicare coverage?

Original Medicare doesn’t cover many services important to older adults, such as:

How do you know if you would benefit from a Medigap plan?

Medigap is a supplement to Medicare that helps you cover healthcare copayments, coinsurance, and deductibles from Medicare Part A and Part B. Unlike MA plans, new Medigap policies don’t provide prescription drug coverage.

The bottom line

Medicare Advantage plans bundle Medicare parts together and often offer extra benefits such as dental and hearing care, but they come with limited provider networks and may pose issues if you travel.

About Medicare Advantage

To purchase a Medicare Advantage plan, you must first be enrolled in Medicare Parts A and B. Medicare Advantage plans cover the same services as Original Medicare, but often also include prescription drug coverage. Many Medicare Advantage plans also include additional benefits.

About Medigap

Like Medicare Advantage, you must first be enrolled in Original Medicare to enroll in a Medigap/Medicare Supplement plan. 2

Medicare Advantage vs. Medigap: The Differences

Now that we’ve explained the key differences between Medicare Advantage and Medigap, let’s talk about the smaller differences that further separate the two.

HealthMarkets Helps With Medicare Advantage and Medigap Plans

HealthMarkets can quickly help you find the Medicare plan that best fits your needs. Need help deciding? Answer a few quick questions to see whether a Medicare Advantage or Medigap plan is a better choice for you.

What is Medicare Advantage?

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren’t covered. Medigap plans usually don’t cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care.

Which one is better?

Both Medicare Advantage and Medigap provide advantages and disadvantages.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

How does a Medigap plan work?

Here are a few examples of how a Medigap plan can work: You schedule a doctor’s appointment with a doctor for services that are covered by Medicare Part B. The doctor accepts Medicare “assignment” — this means she accepts Medicare’s reimbursement rate for all covered services as payment in full.

What are the benefits of Medicare Part A and B?

Can offer additional benefits, such as dental, vision, hearing and prescription drug coverage, among other benefits.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

How many Medicare Supplement plans will be available in 2021?

Medicare Supplement Insurance. Availability. 3,550 different plans available nationwide in 2021 1. 10 standardized plans available in most states, though all 10 may not be available to you in every state. Eligibility. Available to beneficiaries enrolled in Original Medicare who live in the plan’s service area.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.