Why is Medicare Plan F popular?

| Medicare Supplement Benefits | Plan G covers? |

| Medicare Part A coinsurance & hospital c ... | YES |

| Medicare Part B coinsurance or copayment | YES |

| Blood (first 3 pints) | YES |

| Part A hospice care coinsurance or copay ... | YES |

Which is better Medicare Plan F or G?

Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid for, you essentially have Plan F.

Is Medicare Plan G better than Plan F?

8 rows · Nov 18, 2021 · November 18, 2021. Reviewed by John Krahnert. Plan F and Plan G are the most comprehensive ...

What is the difference between Medigap plan F and G?

Feb 03, 2022 · Then your Medicare Supplement plan would cover the 20% coinsurance. Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020.

Is Medicare supplement plan F the best?

Sep 15, 2017 · This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible and Plan G doesn’t. The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $233.

What is the difference between Part F and Part G Medicare supplement?

What is Part F Medicare supplement?

Should I switch from F to G?

Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is Plan G cheaper than Plan F?

Why is Plan F being discontinued?

Can I switch from Plan F to Plan G?

Can you switch from Plan F to Plan G in 2021?

What is the deductible for Plan G in 2022?

What is Medicare Plan G deductible for 2021?

What Is The Difference Between Plan F and G

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible...

Medigap Plan G vs F Benefit Details

Below is a chart we put together with the main benefits covered by Medicare Supplement Plans G and F. As you will see, they mirror each other in al...

Who Should Choose Medigap F?

Everyone looking into Medigap policies should consider Plan F since it offers the most benefits. But who should pick F over G? 1. Anyone who can fi...

Who Should Choose Medigap G?

Everyone consider enrolling in Medicare Supplement Insurance who does not fall under the three bullets above should consider Plan G. Basically if y...

What About Plan F Going away?

First of all, Plan F is not going away. Anyone who is Medicare eligible before 2020 can purchase it at any time in the future and those currently o...

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

Which states have Medigap plans?

Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, and Wisconsin standardize their Medigap plans in different ways than most states.

Can you sell a Medicare plan for 2020?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C to people who become eligible for Medicare after January 1, 2020, because both plans cover the Part B deductible.

Is Plan G the most popular Medigap plan?

Plan F has long been the most popular Medigap plan. However, Medicare Supplement Plan F is no longer available for new Medicare beneficiaries. As a result, Plan G is quickly becoming the next most popular Medigap plan.

Is Medigap Plan F the same as Plan G?

As you can see , Medigap Plan F and Plan G are very similar. There are several points to consider when deciding which Medigap plan suits your need, especially if you already have Plan F coverage. Plan F covers more than Plan G, as it includes the Medicare Plan B deductible.

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

How much does Medicare cover if you have a plan F?

If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $203 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What to consider before switching Medigap?

Before switching Medigap plans, you may want to consider the cost of premiums for Medicare Plan F vs. Plan G as well as how often you anticipate using your health insurance. That will help you find the best Medigap plan based on your needs.

Why switch to Medicare Plan G?

Switching to a Medicare Plan G might be a good idea because you’ll pay lower premiums, and you might also never pay the $203 Medicare Part B deductible.

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What are the two most popular Medicare Supplemental Plans?

This article will explain the two most popular types of Medicare supplemental plans: Medicare Plan F and Medicare Plan G.

How many Medigap plans are there?

The following chart provides a side-by-side look at all 10 standardized Medigap plans.

How much does Plan G save?

Often Plan G can save you $30 or more a month. That would mean you would save $360 a year ($30 x 12), which would more than pay for the $203 the plan requires. Plan G is priced so well that we currently help 4 people enroll in G plan for every 1 F plan.

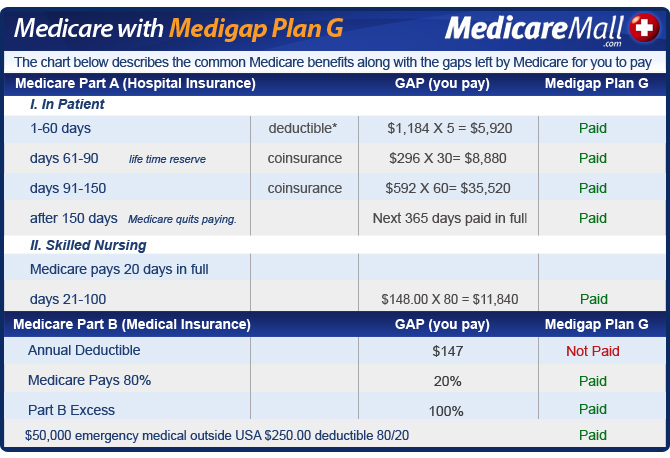

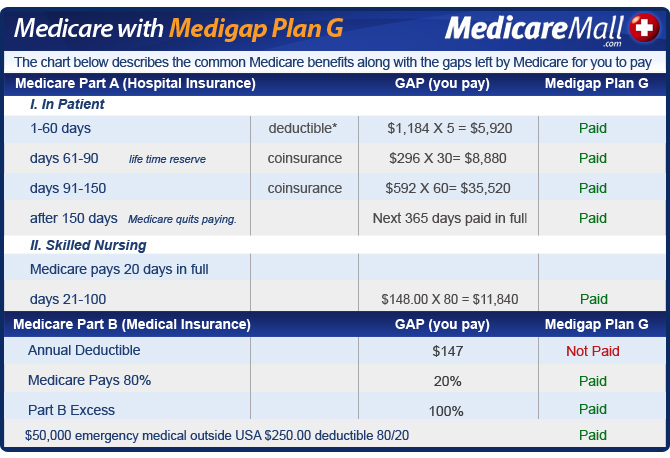

How long do you have to pay Medicare Part A deductible?

Click Here. *Medicare Part A deductible is broken down into 60 day benefit periods. You have to pay the deductible if you reenter the hospital after 60 days from discharge. Example: If you enter the hospital March 1st you’ll pay the Part A deductible.

How much is the Part B deductible?

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $203. This means Medigap Plan F pays the $203 while Plan G does not. The other difference is price, and it is a considerable one.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Can you switch plans without medical review?

Anyone who lives in a state such as CA, MO, NY and OR that allows you to switch plans without medical review. Going with a Plan F will almost always give you more options than G should you want to switch in the future.

Does Senior65 sell your information?

Senior65 believes in your privacy. We will not sell your personal information. This is a solicitation for insurance.

Is Medigap Plan F better than Plan G?

Anyone who can find a Medigap Plan F with an annual premium that is not $203 more than Plan G’s annual premium. So if the best priced F is only $100 more a year than the best priced G then it’s probably a good deal. Anyone who lives in a state such as CA, MO, NY and OR that allows you to switch plans without medical review.

How much does Medicare Supplement pay?

All Medicare Supplement plans may pay 100% of your daily hospital coinsurance under Medicare Part A, and include an additional 365 days of coverage after Medicare coverage runs out. All plans generally pay between 50% and 100% of your Medicare Part B coinsurance and copayments, your Part A skilled nursing home coinsurance, ...

Which Medicare Supplement Plan has the most comprehensive benefits?

Medicare Supplement Plan F has the most comprehensive benefits of the three; your out-of-pocket Medicare costs with this plan are generally minimal. However, Plan F premiums may also be higher compared to Medicare Supplement Plan G or Plan N. Premiums may vary from one company to the next, even for the same plan.

What happens if you don't accept Medicare?

Health-care providers who don’t accept Medicare assignment may charge up to 15% more than the Medicare-approved amount for a service, if they’re legally allowed to do so.

Does Medicare Supplement Plan F cover out of pocket costs?

Medicare Supplement Plan F also pays 100% of your excess charges under Part B.

Does Medicare Supplement Plan N have a low monthly premium?

Medicare Supplement Plan N has fairly comprehensive benefits, as well, and if you’re someone who doesn’ t visit the doctor a lot , your Medicare out-of-pocket costs will be very low. This plan may also have the lowest monthly premium of the three, depending on the insurance company you choose.

Does Medicare Supplement Plan F cover emergency medical expenses?

Plan F usually pays 100% of those charges for you. If you travel outside the country, Medicare Supplement Plan F may cover 80% of your emergency health-care costs, up to the plan’s limit. There is also a high-deductible version of Plan F that might have a lower premium than the regular Plan F, because of its high deductible.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is essentially the same as Plan F, except it does not cover your Part B deductible. You may still be able to buy Medicare Supplement Plan G in 2020. A Medicare Supplement high-deductible Plan G might become available in 2020.

What is the difference between a F and G plan?

It really is quite that simple. The difference between F and G is the annual Part B deductible. In 2021, the Part B deductible is $203. After the deductible is met, Plan G benefits are exactly the same as Plan F. Plan F benefits include coverage for all copays, deductibles and coinsurance. This type of coverage has made Plan F extremely popular among seniors on Medicare.

Which has a higher premium, Plan F or Plan G?

Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission.

Why do people get Plan F?

Most people get Plan F because their friend has Plan F. Or, perhaps their agent or insurance carrier didn’t explain the other plans available. Some agents will quickly tell you that everyone gets Plan F because it “pays for everything”. This is true. But you also need to make sure Plan F’s premium suits your budget.

When will Medicare stop selling Plan F?

This includes Medigap Plan F. Insurance companies will no longer be able to sell Plan F to anyone who becomes eligible for Medicare on or after January 1, 2020.

Which Medicare supplement is the most expensive?

Plan F is the most popular plan, however it can also be the most expensive. Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium ...

Does Medigap Plan N cover everything?

Plan N is the 3rd most popular plan. Although Medigap Plan N provides great value and excellent coverage, it won’t cover everything. You will be responsible if there are any excess charges. You’ll also have to pay for your Part B deductible as well as some co-payments at the emergency room and your physician’s office.

Is Part B deductible a Plan G?

Looking at the chart below, you can see the Part B deductible is not a Plan G benefit. Medicare Supplement Benefits.

Which Medicare Supplement Plan is the most comprehensive?

Of the ten Medicare Supplement plans, Medicare Supplement Plan F offers the most comprehensive coverage, which is why many people prefer it. If you choose Plan F, you’ll essentially only pay your monthly premium, and have no out-of-pocket costs for your covered medical expenses. Because it offers the most benefits, Plan F premiums are generally the most expensive.

Is Plan G the same as Plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($203 for 2021). Once you pay the Part B deductible, the coverage is the same for both plans.

Is Medigap Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G’s monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you’ll need to pay your Part B deductible ($203 for 2021), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

What is the difference between Medicare Plan F and Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments . Plan G does not.

How much is the deductible for Medicare 2021?

If you’re currently enrolled in the Plan F high-deductible option for 2021, you are required to pay for Medicare-covered costs up to the deductible amount of $2,370 before your Medigap plan begins to cover any expenses.

When is the last day to enroll in Medicare?

The last possible day for new enrollment was December 31, 2019. If you currently have Medicare Plan F, you can continue with the plan, if you so decide. This distinction is worth noting when reviewing the differences involved with Medicare Plan F vs. Plan G.

Is Medicare Plan F the same as Plan G?

Medicare Plan F and Plan G are similar and offer the same basic coverage benefits, which include:1

Is Plan F still available?

It’s important to note that as of December 31, 2019, Plan F is no longer available for new Medicare enrollees. However, if you enrolled in Medicare before 2019 or already have Plan F, the decision between Medicare Plan F vs. Plan G is still an important one.

Does Plan G cover Part B?

Although Plan G does not cover the Part B deductible ($198 in 2020), the premium savings could offset the cost of the yearly deductible. For example, the average 2020 premium ranges from $160 to $210 for Plan G and $185 to $250 for Plan F for a 65-year-old Florida woman who does not use tobacco.

Does HealthMarkets have Medicare Supplement plans?

HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you. We can help you quote and compare various Medicare Supplement plans to figure out which one is the right fit for your needs.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens after Medigap Open Enrollment Period?

After your one-time Medigap Open Enrollment Period expires, you’ll be subject to medical underwriting once you apply for a new plan. That means the insurance company can refuse coverage or charge higher premiums for your plan.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How long does coinsurance last after Medicare?

Hospital coinsurance for a full year (365 days) after Original Medicare Part A benefits are used up

Which is better, Plan F or Plan G?

Plan F is the most comprehensive plan. It covers one more benefit than Plan G. Plan G typically has higher premiums than Plan N because it includes more coverage. You could save money with Plan N because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

Which is the most comprehensive Medicare Supplement Plan?

Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible. Plan G and Plan N premiums are lower to reflect that. 7

When is the best time to buy Medicare Supplement Plan?

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B.

Why is Plan G higher than Plan N?

Plan G and Plan N premiums are lower to reflect that. 7. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Which Medicare plan pays 100% of Part B coinsurance?

Plan N will pay 100% of the Part B coinsurance, except for copays of up to $20 for certain office visits and up to $50 for emergency room visits when you’re not admitted to the hospital. Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible.

Is Medicare Part B deductible?

Plan F, which covers Medicare Part B deductible, is not available to those newly eligible for Medicare on or after January 1, 2020. However, if you already have Plan F or its high-deductible version, you can keep it. Plans F and G offer a high-deductible option, though not every carrier offers them.

Does Healthcare.com sell insurance?

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.