Medigap: The Differences

- The freedom to choose your own doctors and hospitals. Medicare Advantage: Your choice of physicians and facilities may be limited to the plan’s network, whether it is HMO or PPO.

- Prescription drug coverage. ...

- Out-of-pocket expenses. ...

- Cost of monthly premiums. ...

- Date you can enroll. ...

- Change of benefits. ...

- Coverage boundaries. ...

Full Answer

Is Medicare Advantage good or bad?

Jan 17, 2022 · There are plenty of differences between Medigap and Medicare Advantage including doctor networks, coverage benefits, and the need for referrals. Of course, the cost is different, but we’ll get to that. If you want coverage that gives you the most flexibility, a Medigap plan could be your ideal policy.

When to choose Original Medicare vs. Medicare Advantage?

Dec 20, 2021 · While Medicare Advantage can be more affordable for people with long term health issues, Medigap gives you flexibility and choice by expanding your network. What are the benefits to Medicare ...

How much does Medigap insurance cost on average?

Medigap plans Generally have a higher premiums than Medicare Advantage plans, but in some cases, Medicare Advantage can cover less expenses than Medigap. This means that despite a lower initial cost, you may end up paying more in out-of-pocket expenses with Medicare Advantage than with Medigap.

Why Advantage plans are bad?

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D). If you joined a Medicare Advantage Plan when you were first eligible for Medicare, you can choose from any Medigap policy. Some states provide additional special rights.

Is a Medigap plan better than an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Is Medigap and Medicare Advantage the same thing?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Sep 26, 2021

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

How do I choose a good Medigap plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.Feb 9, 2022

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

AARP MedicareComplete plans are forms of Medicare Advantage health care insurance plans. Medicare Advantage plans are offered through private companies, which develop agreements with Medicare to provide some Medicare benefits to those who sign up with them.

Medicare Part A Costs

Original Medicare is broken into two parts: Part A (for hospitalization) and Part B (for medical services). In most cases, there is no cost for Medicare Part A.

Medicare Part B Costs

Medicare Part B premiums are determined by your modified adjusted gross income.

How to Enroll in Original Medicare

If you don’t receive Social Security benefits at age 65, you need to sign up on your own. There are three ways to enroll:

What are the Different Types of Medicare Plans?

Medicare Part A is hospital insurance. It helps cover inpatient care, skilled nursing facility care, hospice care, and home healthcare. In most cases, there is no cost for care, but there is a deductible of $1,484 in 2021.

What is Medicare Advantage (Medicare Part C)?

Medicare Advantage provides all of your Part A (hospital) and Part B (medical) coverage. A majority of Medicare Advantage plans offer extra coverage, such as vision (78%), hearing, dental care (67%) or wellness programs (72%). Most include Part D prescriptions drug coverage (90%).

What is a Medicare Supplement (Medigap) Plan?

Medicare supplement plans (Medigap) plans provide extra coverage to help pay for some of the healthcare costs and services that Medicare doesn’t pay. These plans can offer protection from large out-of-pocket medical costs that result from numerous doctor or hospital visits.

What's the Difference Between Medicare Advantage and Medigap?

Medicare Advantage offers more choice and covers more medical services than Medicare, while still following all of Medicare’s rules. One of the biggest differences between the two is the difference in cost.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you leave Medicare Advantage?

If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a " trial right. " . Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

Does Medicare cover Part B?

Most charge a monthly premium in addition to the Part B premium, but some don't.

Can you use Medigap for Medicare?

Medigap can be used only by people enrolled in traditional Medicare. It is not a government-run program, but private insurance you can purchase to cover some or most of your out-of-pocket expenses in traditional Medicare.

What are the different types of Medicare?

Medicare is available in a few different "parts" or coverage options. They are: 1 Medicare Part A and Part B combine to form the Basic Medicare coverage plan. 2 Part C, also known as Medicare Advantage, provides you with more comprehensive coverage than Basic Medicare and limits out-of-pocket costs. 3 Part D works with Parts A & B. It adds prescription drug coverage, and there is an additional premium for this. 4 Medicare Supplement Insurance, also known as Medigap, can lower your out-of-pocket costs even more than a Medicare Advantage plan can. It does not, however, add additional coverage to Medicare.

How much does Medicare Part B cover?

Medicare Part B covers 80% of your health care costs, which then leaves 20% for you to cover out of pocket. 3 Medicare has no out of pocket maximum, so that 20% could add up to a lot of money if you have a lot of medical needs.

What is Medicare Part C?

Part C, also known as Medicare Advantage, provides you with more comprehensive coverage than Basic Medicare and limits out-of-pocket costs. Part D works with Parts A & B. It adds prescription drug coverage, and there is an additional premium for this.

Who is Mila Araujo?

Mila Araujo is a certified personal lines insurance broker and the director of personal insurance for Ogilvy Insurance. She has over 20 years of experience in the insurance industry, and as insurance expert, has written about homeowners, auto, health, and life insurance for The Balance.

How long is the open enrollment period for Medigap?

The open enrollment period is limited to 6 months/180 days from the Part B effective date.

Does Medigap cover deductibles?

Medigap can help cover that 20% Medicare co-pay or part of the deductibles which you would otherwise pay out of pocket with Basic Medicare coverage. Some of the Medigap plans also include maximum out-of-pocket limits. The scope of coverage depends on the Medigap plan you choose. 5.

Does Medicare Advantage cover out of network providers?

Some plans even offer coverage outside the U.S. 9 10. Medicare Advantage may have its own limits in terms of network, specialist restrictions, and more. There may be some coverage for out-of-network providers, but these are subject to different rates depending on the plan. 2.

What is Medicare Advantage?

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren’t covered. Medigap plans usually don’t cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care.

Which one is better?

Both Medicare Advantage and Medigap provide advantages and disadvantages.

What is the difference between Medicare Advantage and Medigap?

Medicare Advantage and Medigap plans are both sold through private insurers, but there are major differences. Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What is Medicare Advantage?

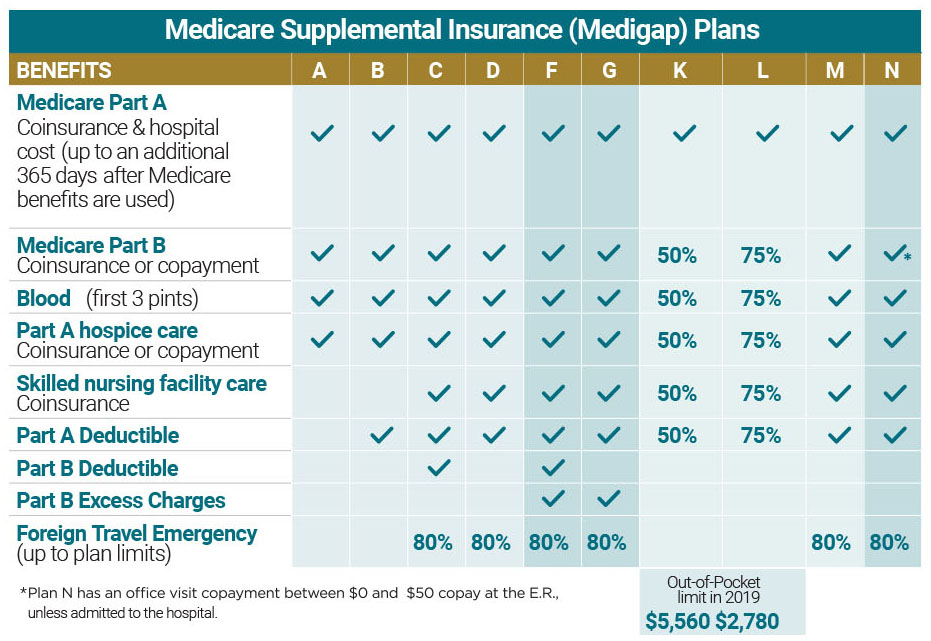

Medicare Advantage: Covers Medicare Parts A and B, but most provide extra benefits, including vision, dental, hearing and prescription drugs. Medigap: You still have Original Medicare Parts A and B, and the choice of eight different Medigap plans each providing different levels of coverage. Out-of-Pocket Limit.

How much is Medicare Advantage 2021?

Medicare Advantage: An average $21 a month premium (for 2021) on top of your Medicare Part B premium. Medigap: The average Medigap cost is $2,100 per year ($175 per month), and covers about $1,600 in out-of-pocket expenses per year, on average. Coverage.

When can I switch to a different Medicare Advantage plan?

If you are in a Medicare Advantage plan, you can make a switch to a different Medicare Advantage plan during Medicare’s open enrollment period, which runs from October 15 through December 7 each year. You may also not be able to get a Medigap policy if you give up your Medicare Advantage plan.

What is the difference between Medicare Supplement and Medicare Advantage?

Licensed insurance advisor John Clark explains the main difference between Medicare Supplement plans and Medicare Advantage plans. You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

How much does Medicare cost out of pocket?

Medicare Advantage: Plans must cap annual out-of-pocket costs at $7,550 for in network services and $11,300 for in - and out-of-network services combined. Medigap: A Medigap policy can ease concerns about Medicare's lack of caps or limits. Each plan has specific benefits with specified out-of-pocket costs. Prescription Drug Coverage.

Does Medicare Advantage include prescription drug coverage?

Medicare Advantage: Plans may include prescription drug coverage. Medigap: You have to buy separate Medicare Part D prescription drug coverage. Referrals. Medicare Advantage: You may be required to get a referral from your primary care doctor to see a specialist.