:max_bytes(150000):strip_icc()/Medicare-d551795432844085a39194550b613baf.jpg)

There are some important differences between Medicare Parts A and B: – Medicare Part A covers inpatient care only. Outpatient care is not covered under this program. – Medicare Part B covers a wide range of outpatient services, including doctor visits and tests.

What is better than Medicare Part B?

When one enrolls in Medicare Parts A and B, then it is time to choose whether to go with Original Medicare with a Medicare Supplement and a stand-alone Medicare Part D for your prescriptions or pick a Medicare Advantage plan with a Medicare Part D plan.

What is the difference between Medicare Part an and Part B?

Summary:

- Both Medicare Part A and B are federally funded plans that come with different coverages.

- Part A is free, and the patients need not pay a premium for the coverage. People have to pay some premium for availing themselves of the Part B coverage.

- Part A can be called hospital insurance whereas Part B can be termed as medical insurance.

What is the best Medicare Choice?

Only 15 weekdays are left for Medicare recipients to choose or change their plans. Only 15 days left for choosing the best Medicare coverage | News | annistonstar.com Thank you for reading! Please log in, or sign up for a new account andpurchase a subscription to continue reading. Sign Up Log In Purchase a Subscription

What is Medicare A, B, C, and D?

While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services (CMS), Medicare Part C and Medicare Part D are managed by private insurance companies. Medicare is similar to the health insurance coverage you’ve probably had with an employer or an individual policy.

Which is Better Part A or Part B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

Do I need both A and B Medicare?

Medicare Part B (Medical Insurance) Part B helps cover medically necessary services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

What does Medicare type A pay for?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

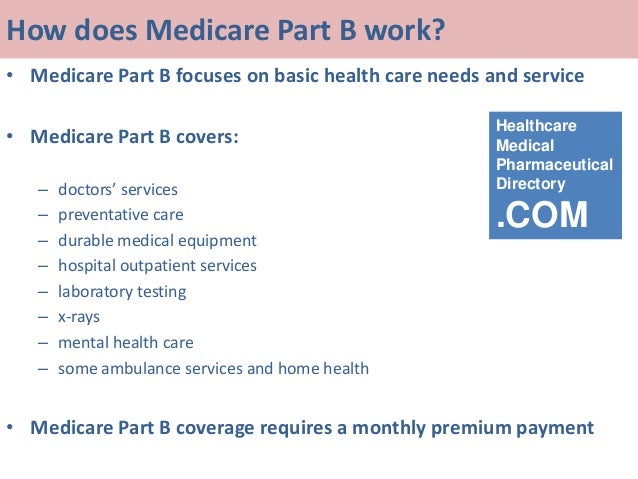

What is Medicare Part B used for?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Medicare Part A cover surgery?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What is not covered by Medicare Part A?

A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Do I have to pay for Medicare Part B?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Medicare Part A—Hospital Insurance

Before jumping into the difference between Medicare A and B, let us explain each of these parts individually. Medicare Part A is designed to cover...

Medicare Part B—Medical Insurance

Medicare Part B is designed to cover medical needs that do not involve the hospital and are considered medically necessary as defined by the federa...

Take Note—You May Need to Sign Up For Both Medicare Parts A and B

Sometimes, people need to sign up for both Medicare Part A and Part B. The following are instances in which you should sign up for both parts: 1. Y...

Are There Alternatives to Medicare Parts A and B?

Yes. If you are still working, you could stay on your employer’s insurance plan. However, be aware that you may pay a penalty if you later enroll i...

HealthMarkets and Medicare

If you’re interested in what Medicare Advantage plans have to offer, give us a call. One of our thousands of licensed insurance agents can talk you...

Are There Alternatives to Medicare Part A and B?

Yes. If you are still working, you could stay on your employer’s insurance plan. However, be aware that you may pay a penalty if you later enroll in Medicare outside of your enrollment period. Or, if you want Medicare benefits but need more flexibility than Parts A and B provide, you could opt for the next letter of the alphabet: Medicare Part C, known as Medicare Advantage.

What is the coinsurance for Medicare Part B?

You will likely pay a premium and deductible for your Medicare Part B insurance. After your deductible is met, coinsurance for most services will be 20% when the doctor accepts Medicare assignment.

How to learn Medicare ABCs?

To start learning your Medicare ABCs, you need to distinguish between the first two letters of the alphabet: A and B. HealthMarkets is here to help you learn the difference between Medicare Parts A and B, the services they insure, and their costs.

What does Medicare cover?

If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects: 1 The cost of your hospitalization and surgery 2 The skilled nursing care you’d need as part of your recovery

Can you get Medicare Part A for ESRD?

Some younger people with disabilities or life-threatening diseases, such as End-Stage Renal Failure (ESRD), may also qualify for premium-free Medicare Part A. You likely will pay certain out-of-pocket expenses, such as coinsurance and deductibles, with Medicare Part A.

What are the services that are included in a medical plan?

These could include various services, such as: Preventive care, such as doctor’s appointments, lab tests, and vaccines. Diagnostic services from your primary doctor or from specialists. “ Durable Medical Equipment ,” such as canes, walkers, wheelchairs, oxygen tanks, and many other devices. Mental health care.

Is Medicare Advantage still available for seniors?

Seniors that purchase Medicare Advantage are still enrolled in Medicare Parts A and B, but they also have more coverage options⃰. Those options depend on the plan. For instance, some Medicare Part C plans may offer you dental or vision care, while others expand your prescription drug coverage.

How much is Medicare Part B?

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 (up from $135.50 in 2019) and increases with income. 3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier. The annual deductible for Part B is $198 in 2020 (up ...

What is Medicare Part A?

Medicare Part A is sometimes referred to as “hospital insurance.” As the name implies, this is the Medicare plan that covers hospital stays and inpatient treatment. For treatment to be covered by Medicare Part A, it must be deemed medically necessary. This means a doctor has agreed that the treatment is required to prevent or treat a condition or illness.

How much is the 2020 Medicare premium?

For 2020, the monthly premium is $458 (up from $437 in 2019). 1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 (up from $1,364 in 2019) to cover hospital inpatient care. 2.

Why is Medicare Part B called medical insurance?

Medicare Part B is known as “medical insurance” because it covers doctor visits and medical care outside the hospital. Like with Medicare Part A, treatment must be determined as medically necessary or preventative to be covered by Medicare Part B.

How much does Medicare pay for covered services?

Medicare Part B pays 80% of costs for covered services, leaving beneficiaries to pay the remaining 20% of Part B expenses out of pocket.

What is nursing home care?

Hospital care, including long-term care facilities and inpatient rehab. Nursing home care, but only if the beneficiary requires more than custodial care. Skilled nursing facility care, including meals, supplies, and nurse-administered injections.

What is long term custodial care?

Most prescription drugs. Routine foot care. If you require any of these services, you may want to consider switching to a Medicare Advantage Plan that offers additional coverage beyond Original Medicare, which is a common term for Part A and Part B combined.

What is not covered under Medicare Part A and B?

Medicare Part A and Part B don’t pay for everything. In most cases, there is no coverage for prescription drugs you take at home. If you get medication in the hospital, Medicare will generally pay for it.

Are there any alternatives to Original Medicare Part A and Part B?

About a third of all Medicare beneficiaries choose to get their benefits through a Medicare Advantage plan. Also known as Medicare Part C, Medicare Advantage includes all the same benefits as Medicare Part A and Part B, but many also include Part D coverage for prescription drugs, so you get all of your Medicare benefits in a single plan.

How much is deductible for Medicare?

In addition to your monthly premium, you will have an annual deductible plus a coinsurance amount, generally 20% of the Medicare allowable charge, for your care. In some cases, you will pay a copayment, for certain outpatient services.

What is Medicare Part A?

The easiest way to understand Medicare Part A is to think of it as the part of Medicare that pays for your care when you are admitted to a hospital or skilled nursing facility. Medicare Part A is often called your hospital insurance. It also helps pay for some home health services and hospice care. If you’re wondering what Medicare Part A is going ...

What age do you have to be to get Medicare?

According to the Department of Health and Human Services (HHS), you are eligible for Medicare if you are age 65 or over, or under age 65 with a qualifying disability or disease. You may also qualify for Medicare at any age if you have end-stage renal disease requiring dialysis or a kidney transplant, or amyotrophic lateral sclerosis (also known as ALS or Lou Gehrig’s disease). There are two parts to the program: Medicare Part A and Part B. If you have a qualifying work history, you generally won’t pay a premium for your Part A benefits. Most people will, however, pay a monthly premium for Part B.

Does Medicare Part D cover custodial care?

There are several different ways to get Part D coverage, but in most cases, you’ll pay an additional monthly premium plus a copayment for each prescription you fill. Medicare Part A and Part B also doesn’t cover custodial care in ...

Can you have multiple Medicare benefits in one year?

You can have several benefit periods in a single calendar year. If you are concerned about your out-of-pocket costs with Medicare, you can enroll in a Medicare Supplement Plan to help cover your medical bills. There are several different plans to choose from; each covers different parts of your Medicare Part A and Part B costs.

What are the expenses for Medicare 2021?

For 2021, these expenses include: Quarters worked and paid Medicare taxes. Premium. 40+ quarters.

What is Medicare Part A and Part B?

Enrollment. Takeaway. Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other ...

What is the Medicare deductible for 2021?

The annual deductible for 2021 is $203.

What is the deductible for Medicare Part B 2021?

The annual deductible for 2021 is $203. If you do not sign up for Medicare Part B in your enrollment period (usually right around when you turn age 65), you may have to pay a late enrollment penalty on a monthly basis.

How much is the 2021 Medicare premium?

Costs in 2021. most pay no monthly premium, $1,484 deductible per benefit period, daily coinsurance for stays over 60 days. $148.50 monthly premium for most people, $203 annual deductible, 20% coinsurance on covered services and items.

How much does Medicare Part B cost?

If you enrolled in Medicare during the open enrollment period and your income did not exceed $88,000 in 2019, you’ll pay $148.50 a month for your Medicare Part B premium in 2021.

How old do you have to be to qualify for Medicare?

Eligibility. For Medicare Part A eligibility, you must meet one of the following criteria: be age 65 or older. have a disability as determined by a doctor and receive Social Security benefits for at least 24 months. have end stage renal disease.

What is the difference between Medicare Advantage and Medigap?

It’s important to know the difference between Medicare Advantage and Medigap, along with the pros and cons of each. After that, you may be wondering, “Can I switch from Medicare Advantage to Medigap?” This article will help you understand if you can, and when it’s possible. What's the Difference Between Medicare Advantage and Medigap? Medicare Advantage, or Medicare Part C, is an all-inclusive alternative to Original Medicare. It generally encompasses Medicare Parts A, B, and D. However, because your coverage is provided by a private insurer and not the government, there are limitations on your provider network. You can also expect different — and sometimes lower — copayments, deductibles, and coinsurance. People choose Medicare Advantage because they enjoy getting additional benefits, such as low-cost health club memberships, vision and dental coverage, and more. They also prefer the predictable out-of-pocket costs rather than a percentage coinsurance. Medigap is an add-on to Original Medicare and helps you pay for healthcare costs like your deductible, copayments, and coinsurance. There are several plans, lettered from A to N. However, some are not available to beneficiaries after a certain date. Medigap is sold by private insurers, and the only difference between providers offering the same letter is cost — every Plan A will be the same as every other Plan A. Medicare beneficiaries choose Medigap because it lowers or eliminates a lot of out-of-pocket costs. Medigap has to pay its share when Medicare covers its part. You can see any doctor in the U.S. that accepts Medicare, and you don’t need referrals for specialist appointments. In general, no one can sell you a Medigap plan if you have Medicare Advantage. In order to get Medigap, you have to disenroll from Medicare Advantage and return to Original Medicare. Switching From Medicare Advantage to Medigap FAQ People have a lot of questions about switching from Medicare Advantage to Medigap. This section will answer some of the most frequently asked questions. Can You Switch From Medicare Advantage to Medigap Without Underwriting? If you choose Medigap with Original Medicare during your initial enrollment period around your 65th birthday, you were guaranteed acceptance even if you had known health conditions. After that initial period, if you want to join a Medigap plan, they generally use underwriting to review your health risk before they decide to accept you. If you want to avoid this underwriting, you’ll need a special enrollment period that has guaranteed issue rights. For instance, if you decide to switch out of a Medicare Advantage plan within the first 12 months, you can get Medigap without underwriting. Other times you can get Medigap without underwriting include: If you move out of your Medicare Advantage service area If you’re in one of four states that require Medigap to be freely available at certain times of year (Maine, Massachusetts, Connecticut, and New York) Can I Switch From Medicare Advantage to Medigap During Open Enrollment? In order to switch to Medigap, you need to disenroll in Medicare Advantage and go back to Original Medicare. You can do this during two enrollment periods. The first is Open Enrollment, which occurs from October 15th-December 7th each year. During this time you can make any changes you’d like, including returning to Original Medicare and getting Medigap. You might wonder about Medicare Advantage’s Annual Enrollment period, from January 1-March 31 each year. While you can leave your Medicare Advantage plan during that time and return to Original Medicare, you won’t be able to sign up for Medigap until the next Open Enrollment period. Contact us to Learn More About Medicare Plans Understanding your rights under Medicare can be challenging. It’s often easier when you speak to a licensed insurance agent about your situation. If you’d like to discuss your options and see whether Medicare Advantage or Medigap is better for you, we’re here to help. Contact us today!

What is Medicare Part A?

Medicare Part A is known as hospital insurance because it helps cover the costs when you are hospitalized. Part A pays for inpatient care, hospice care, skilled nursing, and some home health care services.

Is Medicare Part A premium free?

Medicare Part A can be premium-free for many Americans. In order to qualify for this, you have to be receiving Social Security or the Railroad Retirement Board, and you need to have a qualifying work history. This means that you or your spouse have worked a specific number of quarters while paying FICA taxes.

Does Medicare Part A cover deductibles?

Medicare Part A generally does not cover 100 percent of costs. There is usually a copay or deductible that you are responsible for. Also, in order to qualify for coverage, the services must be deemed medically necessary.

Is Medicare Part A and Part B the same thing?

Fortunately, we can help. Medicare Part A and Part B are both elements of Original Medicare. They cover your health costs in different situations. Here’s what you need to know.

How Are Medicare Part A and Part B Different?

The main difference between Part A vs Part B is the services covered under each plan. Medicare Part A is a form of hospital insurance. It covers inpatient hospital stays, hospice care, skilled nursing care and limited home health services. Medicare Part A may also cover temporary nursing home care.

How much does Medicare pay for coinsurance?

Enrollees pay no coinsurance for the first 60 days of an inpatient stay. For days 61 to 90, the coinsurance amount is $352 ...

What is deductible in Medicare?

A deductible is the amount of money a beneficiary must pay before his or her Medicare benefits kick in. So what is the difference between Medicare Part A and Part B when it comes to deductibles?

What is Medicare Part A?

Medicare Part A covers costs for inpatient hospital care, while Part B covers most outpatient and preventive care. Learn more about the costs for Parts A and B, also known as Original Medicare.

How much is coinsurance for 2020?

For days 61 to 90, the coinsurance amount is $352 per day for 2020. If the enrollee remains hospitalized or in a skilled nursing facility for more than 90 days, the coinsurance amount increases to $704 per day up to the maximum number of lifetime reserve days.

How many credits do you need to get Medicare?

Because the funds for Medicare come from payroll taxes, a beneficiary typically needs to earn at least 40 credits to receive Part A coverage without having to pay a premium. 40 credits is equivalent to working and paying Medicare taxes for 10 years. For individuals with 30-39 work credits, the Part A premium is $252 for 2020.

When does the benefit period end for Medicare?

With Medicare Part A, a benefit period starts on the first day of admission for inpatient care and ends when the enrollee hasn't received inpatient hospital care or inpatient care at a skilled nursing facility for 60 consecutive days.