Costs for a Medicare Advantage plan and a Medicare Supplement Plan G differ substantially in both premium costs and potential out-of-pocket costs. A Medicare Advantage plan often has no monthly premium, while a Medicare Supplement Plan G always has a monthly premium.

Full Answer

Is Medicare Advantage better than Medicare?

The MA program helps address social determinants of health and improve health equity: "...over 95 percent of Medicare Advantage beneficiaries have access to meal services, telehealth, transportation, dental, fitness, vision, and hearing benefits.

Is Medicare Advantage really an advantage?

The researchers discovered that the Advantage plans didn't substantially improve beneficiaries' health care experiences compared to traditional Medicare, but did offer somewhat more care management.

What is the difference between Medicare and Medicare Advantage?

- You get built-in financial protection with Medicare Advantage. ...

- Your premiums may be higher with Original Medicare. ...

- You may pay more copays with Medicare Advantage than with Original Medicare. ...

- Medicare Advantage provides financial protection with an annual out-of-pocket limit. ...

Is Medigap better than Medicare Advantage?

While Medigap premiums are generally higher than Medicare Advantage, Medigap will likely charge you lower out-of-pocket expenses. You’ll need to calculate how much you expect to pay for health care over a year and compare that to your annual premium cost.

Is Medicare Advantage the same as Part G?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F. Plan N is the least expensive of these three plans but you'll have more out-of-pocket costs with it.

What is the difference between Plan G and an Advantage plan?

Costs for a Medicare Advantage plan and a Medicare Supplement Plan G differ substantially in both premium costs and potential out-of-pocket costs. A Medicare Advantage plan often has no monthly premium, while a Medicare Supplement Plan G always has a monthly premium.

What is the biggest disadvantage of Medicare Advantage?

The takeaway There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling. Whether you choose original Medicare or Medicare Advantage, it's important to review healthcare needs and Medicare options before choosing your coverage.

What are the benefits of Medicare G?

What Does Medigap Plan G Offer?Coverage for an additional 365 days of hospital care after Original Medicare benefits are exhausted, as well as coverage for hospital coinsurance and deductible.Coverage for Medicare Part B coinsurance and copays.Coverage for the first three pints of a blood transfusion.More items...

What is the monthly premium for plan G?

How Much Does a Medigap Plan G Cost?StateMonthly premium rangeNumber of Plans availableColorado$110 to $375 $32 to $66 high-deductible57 total *49 (attained age) ^4 (community) ~4 (issue age)California$128 to $246 $37 to $81 high-deductible28 total *26 (attained age) ^2 (issue age)1 more row•Apr 12, 2022

Does Medicare Plan G have a deductible?

Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end. Part A hospice care coinsurance or copayment.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is Plan G Medicare supplement?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What are the top 3 Medicare Advantage plans?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Does Medicare G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

Does Medicare Plan G have a maximum out-of-pocket?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

What is the deductible for plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

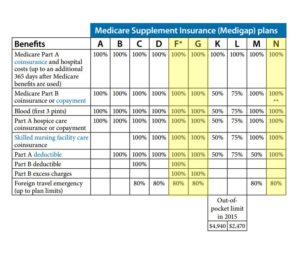

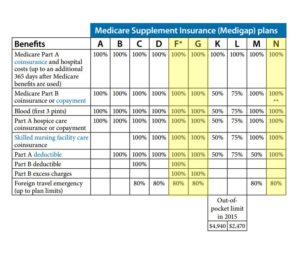

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

What is the deductible for Plan L in 2021?

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

How much is Plan K 2021?

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Which states have Medigap plans?

Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, and Wisconsin standardize their Medigap plans in different ways than most states.

Can you sell a Medicare plan for 2020?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C to people who become eligible for Medicare after January 1, 2020, because both plans cover the Part B deductible.

What is Medicare Part A?

Inpatient hospital services ( Medicare Part A ). These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

Who manages Medicare Advantage?

Medicare Advantage is managed and sold by private insurance companies . These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in the United States.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

What takes the place of original Medicare add-ons?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap.

How long before you can apply for medicare?

You can also apply for Medicare 3 months before your 65th birthday and up to 3 months after you turn age 65. If you decide to wait to enroll until after that period, you may face late enrollment penalties.

How long do you have to have prescriptions for Medicare?

No matter what option you choose, you’re required to have some form of prescription drug coverage within 63 days of enrolling in Medicare, or you’ll be required to pay a permanent late enrollment penalty.

Does Medicare Advantage cover dental exams?

However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

How long does a hospital stay last after Medicare runs out?

It also covers the expensive daily copays that you might encounter for a hospital stay that runs longer than 60 days. It provides an additional 365 days in the hospital after Medicare runs out, and it covers your skilled nursing facility co-insurance, too.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Medicare pay for Frank's glucose meter?

His Medicare Supplement Plan G pays the rest. Frank’s coverage even provides his lancets, test strips and a new glucose meter at no charge to him. Medicare and his Supplement work together to pay 100% of the costs for these diabetes supplies.

Does Medicare pay for Supplement G?

Medicare will pay 80% of your outpatient costs and your Supplement will pay the other 20%. If you are just starting your research into Medicare Supplements, you might also read what Medicare covers, before you choose which supplemental coverage is right for you. Medicare Supplement G usually costs more than Plan N, because it covers more.

Why would someone choose Plan G?

However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost. Therefore, when you get a quote, compare the premium amount against the deductible to select the more cost-effective option.

How long does Medicare cover hospital costs?

Hospital costs: Part A coinsurance and hospital costs for 365 additional days after Medicare benefits are used up as well as coinsurance or copayments for hospice care.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Does Medicare cover eye exams?

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

Do you pay for Part B?

You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium and may help pay all or part of your Part B premium. Most plans include Medicare drug coverage (Part D).

Why is high deductible plan G better than regular plan?

You can get all of those by High Deductible Plan G. Another best reason is that it has lower premium rates than regular plan G.

Which is better, high deductible plan G or high deductible plan F?

High Deductible Plan G is one of the best plans. It is better than High Deductible Plan F. However; plan F will not be available for new beneficiaries this year. This plan is almost $2,370. When you have got High Deductible Plan G, then you can get coverage for regular plan G.

How many types of Medicare supplement insurance are there?

Before jumping towards plan g, we will tell you what Medigap policies are. Basically, there are 11 basic types of Medicare supplement insurance policies. If you have a Medigap policy, then you can easily use it for any doctor, hospital, etc that accepts original Medicare.

How much does a 401(k) plan cost?

The plans range dependant upon where you live. Usually, they can range from $99 to $500 per month. And this is for the premium part. So, for each year, you will have to pay from $1,108 to almost $6000.

How long do you have to work to qualify for Medicare?

If you have been working in America for ten years, then you will easily qualify for it. But suppose you have not worked for ten years, you can still qualify by paying for Part A premium.

Is Plan G the best Medigap?

Suppose you think about whether to consider plan G or not. Then here is the answer to that question. Plan G is considered the best and top-of-the-line Medigap option. Even if you are newly eligible, you will still have many options.

Does Medicare cover excess charges?

Not only this, but the regular Medicare plan G also covers the excess charges. Sometimes, the doctors do not accept full payment as an approved Medicare plan. So, they can charge you up to 15%, which is more than the approved amount. This extra 15% is known as an excess charge. But luckily, excess charges are now illegal in some states. If you live in New York, Ohio, Pennsylvania, and Vermont, etc., there will be no extra charge for you.

Which is better, Medicare Supplement Plan G or Plan N?

Medicare Supplement Plan G offers more protection than Plan N. There are two areas that Plan G covers, that Plan N doesn’t.

What does Medicare Supplement Plan G cover?

Medicare Supplement Plan G and Plan N both cover many of the larger costs leftover from your Original Medicare coverage. For instance, they both cover: Neither Plan G nor Plan N cover the Part B deductible, which is $203 in 2021. Medicare Part B covers your outpatient services, like visits to your doctor’s office.

What does Plan N cover?

Plan N doesn’t cover: 1 Excess Charges: This an additional cost that some providers charge. Most healthcare providers that accept Medicare also accept Medicare assignment, which is the cost that Medicare states they’ll pay for a given service. If the provider wants to be paid more, they can bill you for excess charges, which can only be up to an additional 15% of the original cost. 2 Copayments: With Plan N, you’ll be responsible for copays of up to $20 for some office visits, or up to $50 if you go to the emergency room but aren’t admitted as an inpatient.

What is the deductible for Medicare Part A in 2021?

Medicare Part A deductible ($1,484 in 2021) Foreign travel emergency. Neither Plan G nor Plan N cover the Part B deductible, which is $203 in 2021. Medicare Part B covers your outpatient services, like visits to your doctor’s office.

Does Medicare Supplement cover gaps?

Medicare Supplement insurance can help you cover the gaps in Medicare, but many people have difficulty deciding which plan is right for them. If you’re unsure which plan to choose, you aren’t alone. Fortunately, Medicare Supplement Plan G and Medicare Supplement Plan N, two of the most popular plans, are relatively simple to compare.

Does Medicare pay for excess charges?

Most healthcare providers that accept Medicare also accept Medicare assignment, which is the cost that Medicare states they’ll pay for a given service. If the provider wants to be paid more, they can bill you for excess charges, which can only be up to an additional 15% of the original cost.

Is Plan G or N better for copays?

If you visit the doctor regularly or prefer not to have to budget for copays, Plan G may be the best option for you. Plan N may be a good fit if you’d like to save money on premiums, you’re in great health, and rarely need to visit the doctor.