But there are a few “HMO vs. PPO” contrasts: Although they generally have provider networks, Medicare Advantage PPOs let you see doctors outside the plan network. You might have to pay higher coinsurance or copayments for seeing out-of-network providers. You don’t have to choose a primary care provider with a Medicare PPO, but you do with an HMO.

Full Answer

Is a HMO better than a PPO?

Dec 07, 2021 · There are a few key differences between HMO and PPO plans. Primary care physicians HMO plans generally require members to utilize a primary care physician (PCP), while PPO plans typically do not. Cost On average, HMO members can generally expect to pay lower premiums than members of PPO plans. Referrals

How should I decide between a HMO and a PPO?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you …

Is a HMO cheaper than a PPO?

Sep 03, 2021 · The Advantage of Medicare Advantage Both HMO and PPO plans are Medicare Advantage plans, which cover everything that Original Medicare covers (Medicare Part A and Part B), plus provide additional coverage for dental, vision, hearing and more. Some Medicare Advantage plans, like MyTruAdvantage HMO and PPO plans, also cover prescription drugs.

Is Medigap better than Medicare Advantage?

Jun 16, 2021 · Medicare AdvantagePPO and HMO plans differ in their costs depending on what state you live in and what type of coverage you’re looking for. There may be additional costs associated with your plan...

What is the difference between a Medicare Advantage PPO plan and a Medicare Advantage HMO plan?

Why would a person choose a PPO over an HMO?

A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.Jul 1, 2019

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

What are the two types of Medicare Advantage plans?

- HMO (health maintenance organization) plans.

- PPO (preferred provider organization) plans.

What are the disadvantages of an HMO?

What are the pros and cons of PPO?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

What are the negatives of a Medicare Advantage plan?

What is the most popular Medicare Advantage plan?

Does Medicare have a PPO plan?

Who is the largest Medicare Advantage provider?

Why does zip code affect Medicare?

What is the difference between Medicare Advantage and PPO?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What is Medicare Advantage?

Medicare Advantage offers Medicare through a private insurer. Sometimes called Medicare Part C, these all-in-one plans often provide services original Medicare does not, such as vision and dental insurance and prescription drug ...

Do HMOs require referrals?

Most HMOs require that you choose a primary care provider and get a referral for specialist care.

Do you have to choose a primary care provider with Medicare Advantage?

With a Medicare Advantage PPO, you don't have to choose a primary care provider, and do not usually need a referral to see a specialist.

Is Medicare Advantage the right choice for everyone?

There's no right choice for everyone. Instead, Medicare Advantage beneficiaries should review the terms of specific plans available in their area. HMOs typically have lower monthly premiums, though fewer clinicians will be covered.

Do PPOs pay more?

PPOs generally offer a wider variety of clinician choices, but you may pay a higher monthly premium. And if you choose to seek care out-of-network, you'll pay more.

Does Medicare Advantage cover out-of-network care?

If you use a provider outside of the HMO network, the plan may not cover it. There are certain exceptions to this coverage rule. The plan may cover out-of-network care if:

What is a PPO plan?

A Preferred Provider Organization (PPO) plan is a Medicare Advantage plan that gives you the freedom to receive care from any provider or specialist who accepts Medicare—regardless of if they are in your plan’s network. PPO plan does not require you to stay within a network and will cover care received from providers not in the plan’s network.

What is HMO in healthcare?

A Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that provides healthcare coverage from doctors, other healthcare providers, and hospitals in the plan’s network. You typically must receive your care and services from providers within the network, except in an emergency. If you use a provider outside of the plan’s network, you may have to pay the full cost.

Does Medicare Advantage cover dental?

Both HMO and PPO plans are Medicare Advantage plans, which cover everything that Original Medicare covers (Medicare Part A and Part B), plus provide additional coverage for dental, vision, hearing and more. Some Medicare Advantage plans, like MyTruAdvantage HMO and PPO plans, also cover prescription drugs. As an owner of MyTruAdvantage, we are pleased to offer this Indiana-based Medicare Advantage plan to our patients, neighbors and community. To learn more, visit www.MyTruAdvantage.com.

Is Medicare Advantage HMO good?

Medicare Advantage HMO plans can be a good option for those who want to pay lower costs, and don’t mind staying within the plan’s network and choosing a PCP to coordinate their care.

Does a PPO plan have a higher monthly premium?

PPO plans give you more choices when it comes to your healthcare, but this flexibility does come at a cost. Your copays for office visits will typically cost more when selecting a provider outside of the network. Your annual deductible, which is the amount you need to pay before your plan starts to pay for certain services, can be higher than compared to HMO plans. And PPO plans will usually have a higher monthly premium.

What does an HMO plan cover?

Like PPO plans, HMO plans cover all the services that Medicare Advantage plans usually cover. Each plan also has a list of included “extras” such as gym memberships, hearing aid coverage, and transportation to medical appointments.

How much is a drug deductible for a PPO?

Drug deductible. These deductibles can start at $0 and increase depending on your PPO plan. Copayments. These fees may differ depending on whether you’re seeing a primary care doctor or a specialist and if those services are in-network or out-of-network.

What percentage of Medicare deductible is coinsurance?

Coinsurance. This fee is generally 20 percent of your Medicare-approved expenses after your deductible is met.

Does a PPO plan cover out of network providers?

PPO plans cover both in-network and out-of-network providers, doctors, and hospitals. You will pay less for services from in-network providers and more for services from out-of-network providers. Under a PPO plan, choosing a primary care physician (PCP) is not required and neither is a referral for specialist visits.

Does Medicare cover PPO?

PPO plans generally cover all the services that Medicare Advantage plans cover, including:

Is a PPO plan better than an HMO?

Provider networks. If you value provider flexibility, a PPO plan may be your best option . If you’re fine with using only in-network providers, an HMO plan could work for you and cost less.

Do you have to pay extra for out of network PPO?

This amount varies but is generally in the mid-thousands. With a PPO plan, you will owe additional fees for seeing out-of-network providers. This means that if you choose a PCP, visit a hospital, or seek services from a provider who is not in your PPO network, you may pay more than the average costs listed above.

What Is Medicare PPO (Preferred Provider Organization)?

When you choose a Medicare PPO plan, you may pay less if you use the doctors and hospitals in the plan’s network. PPOs have large networks, but you can also see doctors that aren’t in the network. Plus, you don’t need a referral to see a specialist.

What Is Medicare HMO (Health Maintenance Organization)?

When you choose a Medicare HMO plan, you get most of your care from a network of doctors and hospitals unless it is an emergency. You may also need a referral from a primary doctor to see a specialist. Anthem MediBlue HMO has all the benefits of a Medicare Advantage plan with access to our leading network of quality doctors.

Are PPO And HMO Offered Under Original Medicare?

PPO and HMO plans are only available through private insurers like Anthem as Medicare Advantage plans. If you are enrolling in Medicare for the first time, you’ll have to sign up for Original Medicare first. You can then choose a Medicare Advantage HMO or PPO plan that works for you.

PPO Medicare Costs

PPO plans tend to have higher costs than HMO plans, and it costs more to see a doctor outside the network. You can choose a PPO plan for the flexibility.

HMO Medicare Costs

HMO plan costs tend to be lower than PPO plans as long as you receive care within the network. Choosing doctors outside of the network or seeing a medical specialist without a referral from your primary care doctor will also cost more.

Prescription Drug Coverage By Plan Type

Depending on the plan, both PPO and HMO plan types can offer medical and prescription drug coverage for an all-in-one plan. If you take medications regularly, make sure to find a plan that provides that coverage.

Is Medicare PPO Or HMO Better?

Both types of plans offer different types of coverage based on cost and networks, so the best plan for you depends on your budget and your doctor preferences.

What is Medicare Advantage Plan?

Medicare Advantage, also known as Medicare Part C, is an alternative way to get your benefits under Original Medicare. By law, these plans must cover everything that Original Medicare covers (except for hospice care, which is covered under Part A), but because they are offered by private companies approved by Medicare, they can offer additional benefits and design their own cost-sharing structures.

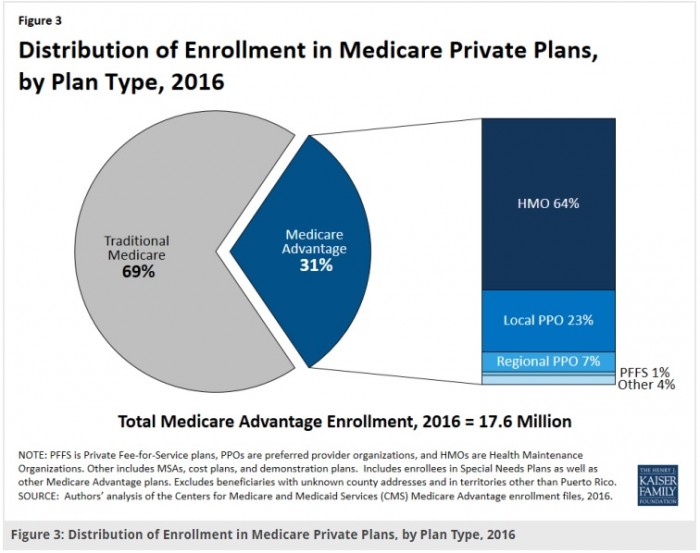

What are the different types of Medicare Advantage plans?

Although there are several different types of Medicare Advantage plans allowed by law, three of the most common are the health maintenance organization, or HMO, the preferred provider organization, or PPO, and the private fee for service plan, or PFFS. If you’re not certain which plan type is right for you, or have questions about ...

Is PPO the same as PFFS?

PPO and PFFS plans are actually quite different, with some of the key considerations being:

Can a provider accept a PPFs plan?

A provider can choose to accept or reject the payment amount of the PPFS plan. There is no mandate to choose a primary care doctor or get a referral for any specialist care, but it’s important to note that providers, even those who participate with Medicare, are not required to accept the terms of your PFFS plan.

Do you have to see a specialist for a PPO?

In addition, most PPO plans don’t require you to choose a primary care doctor or get a referral to see a specialist. Like HMOs, most PPO plans also include Medicare Part D prescription drug coverage, although be sure to read your plan materials carefully to make sure.

Does HMO cover emergency care?

Health coverage area: If you travel outside your HMO plan’s service area frequently, your health-care services (other than urgent or emergency care) may not be covered under your plan. PPO plans might cover you outside your area.

Is coinsurance lower than Medicare?

Also, out-of-pocket costs such as copayments, deductibles, and coinsurance tend to be lower than for other types of Medicare Advantage plans as long as you follow the plan’s rules.

What is the difference between a PPO and a HMO?

The Main Difference: Using the Plan’s Provider Network. Medicare HMO and PPO plans differ mainly in the rules each has about using the plan’s provider network . In general, Medicare PPOs give plan members more leeway to see providers outside the network than Medicare HMOs do.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is a PCP in Medicare?

Medicare HMO plans and provider network rules. Medicare HMO plan members usually have to choose a primary care provider (PCP) from the plan network. The PCP provides general medical care, helps plan members get the services they need and provides referrals to specialists like cardiologists or dermatologists. While Medicare HMO plans may charge ...

What is a provider network?

A provider network is a list of doctors, hospitals and other health care providers under contract with a health plan. Providers in a network agree to accept the plan’s payment terms for covered services, which helps plans manage costs. As a result, plans are able to share the savings with plan members through low out-of-pocket costs.

Does Medicare HMO have a deductible?

While Medicare HMO plans may charge a monthly premium and a deductible, these costs may be quite low – even $0 in some cases. Members usually pay a copayment for covered health care services, after meeting any deductible.

Does Medicare HMO cover outside providers?

Importantly, a Medicare HMO plan may not cover care received from providers outside the network at all. The plan member could be responsible for the entire cost.

Is either plan a good option?

Also, look at how costs may vary for your providers and services between the two plan types. Either plan is a good option but finding which one is best for you is based on your personal health and financial needs.

What are the different types of Medicare Advantage plans?

Medicare Advantage plans come in several different structures, including both HMOs and PPOs. The four available forms of Medicare Advantage plans are as follows: Health Maintenance Organization (HMO): HMOs are among the most common and popular choices for Medicare Advantage users.

Is Medicare Advantage flexible?

Page Reviewed / Updated – August 27, 2020. Unlike Original Medicare Parts A and B, which come in a one-size-fits-all model provided by the government, Medicare Advantage, also known as Medicare Part C, is highly flexible.

Does Medicare cover PFFS?

Most providers who accept Medicare plans will accept PFFS plans; however, users are encouraged to review coverage before making an appointment, due to the absence of a traditional network in this type of plan. PFFS plans can include prescription drug coverage but are not required to do so.

Do PPOs require PCP?

Further, PPO plans do not usually require PCP approval to see a specialist. PPO plans can offer prescription drug coverage, but this is not a requirement under Medicare Advantage. Private Fee-For-Service (PFFS): PFFS plans aren’t as common as PPOs or HMOs, but they can still be a viable choice.

Do HMOs require a primary care physician?

HMOs generally require a designated primary care physician, and any specialist services must be approved through a PCP for coverage to apply.

Do SNPs have to be a Medicare Advantage plan?

Unlike all other forms of Medicare Advantage plans, SNPs are required to offer prescription drug coverage. There is no right answer regarding plan types for seniors considering Medicare Advantage. Whether seniors choose an HMO, PPO or PFFS plan will depend on everything from personal preference to budget.