What is the difference between Medicare and care plans?

Moreover, care plans are private health insurance companies that Medicare-approves. Plans offer care from a specific network of providers (doctors, hospitals, and others) at a lower overall cost. Medicare divides managed care plans into different plan types.

What is the difference between Medicare and Medigap?

A Medigap policy cover costs such as deductibles and copays, but the monthly premium for Medigap policies varies. Medicare premiums only cover one person. However, private insurers may extend coverage to other family members, such as dependents. Other factors affecting the cost of private insurance include:

What are the different parts of Medicare?

What are the parts of Medicare? The different parts of Medicare help cover specific services: Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is Medicare insurance?

Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Is Medicare coverage the same for everyone?

Factors that affect Original Medicare out-of-pocket costs Most people have both. Whether your doctor, other health care provider, or supplier accepts assignment. The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover.

What are the three types of patients eligible for Medicare?

What's Medicare?People who are 65 or older.Certain younger people with disabilities.People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What are the four types of coverage in Medicare?

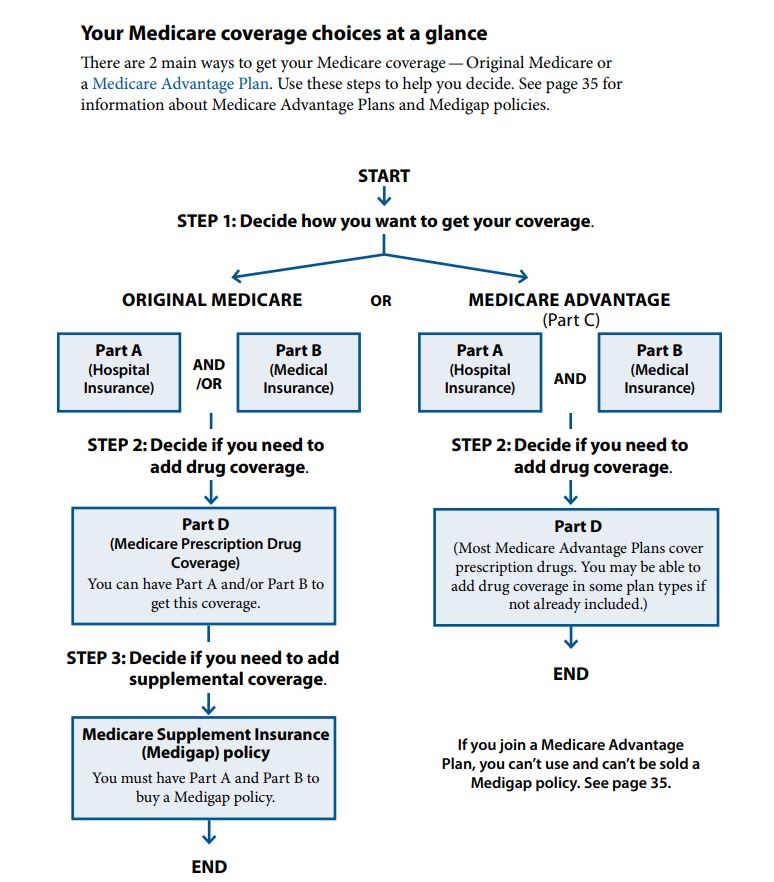

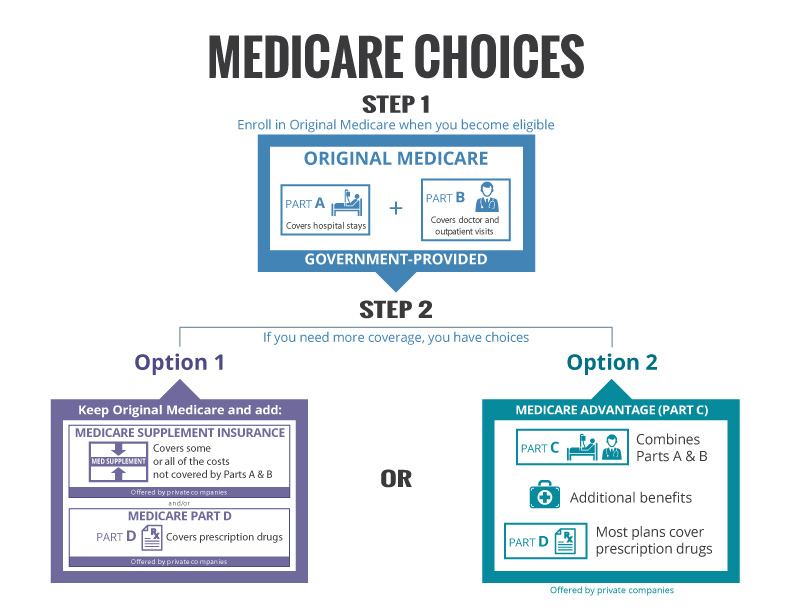

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How does Medicare decide what to cover?

Local coverage decisions made by local companies in each state that process claims for Medicare. These companies decide whether an item or service is medically necessary and should be covered in that area under Medicare's rules. There may be other coverage rules and policies that also apply.

What is the difference between Part C and Part D Medicare?

Medicare Part C and Medicare Part D. Medicare Part D is Medicare's prescription drug coverage that's offered to help with the cost of medication. Medicare Part C (Medicare Advantage) is a health plan option that's similar to one you'd purchase from an employer.

When a patient is covered through Medicare and Medicaid which coverage is primary?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors' visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

What are the two types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What parts of Medicare are free?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Does Medicare cover 100 percent of hospital bills?

Medicare generally covers 100% of your medical expenses if you are admitted as a public patient in a public hospital. As a public patient, you generally won't be able to choose your own doctor or choose the day that you are admitted to hospital.

Does Medicare Part B cover 100 percent?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What percentage does Medicare cover?

You'll usually pay 20% of the cost for each Medicare-covered service or item after you've paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays. Learn more about help with costs.

What is Medicare insurance?

Medicare. Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Do you pay for medical expenses on medicaid?

Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

Is Medicare a federal program?

Small monthly premiums are required for non-hospital coverage. Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Advantage?

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Is Medicare a federal or state program?

Medicaid is a joint federal and state program that provides health coverage for some people with limited income and resources. Medicaid offers benefits, like nursing home care, personal care services, and assistance paying for Medicare premiums and other costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

Which insurance pays first, Medicare or No Fault?

No-fault insurance or liability insurance pays first and Medicare pays second.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is Medicare Part A?

Medicare Part A covers hospital services, including inpatient hospital stays, care in a skilled nursing facility and some home health services.

What are the health insurance subsidies under Obamacare?

Under Obamacare, people who qualify for financial assistance are eligible for health insurance tax credits to help offset the cost of their insurance. Exchanges. Exchanges, or online marketplaces for health insurance, are how people are supposed to purchase affordable insurance policies under the ACA.

What is Obamacare?

Obamacare's primary intention is to give all Americans the ability to purchase affordable health insurance. There are several different parts to the law that each affected a different aspect of health insurance access. Here are some of the more well-known: 1 Individual Mandate#N#One of the most-talked-about aspects of the ACA was its provision stating that everyone is required to have health insurance. Those who do not have health insurance face a tax penalty. 2 Coverage of Pre-Existing Conditions#N#Another one of the biggest changes ACA made was to prohibit insurance companies from denying someone coverage or charging them more because of a pre-existing condition. And because as many as 1 in 2 Americans have some type of pre-existing condition, this provision has been one of the law’s more popular. 3 Health Insurance Subsidies#N#Under Obamacare, people who qualify for financial assistance are eligible for health insurance tax credits to help offset the cost of their insurance. 4 Exchanges#N#Exchanges, or online marketplaces for health insurance, are how people are supposed to purchase affordable insurance policies under the ACA. Private health insurance companies offer policies in the marketplace and compete for the business of shoppers. Any legal citizen can purchase insurance from the exchanges, but not everyone qualifies for the low-income subsidies.

What changes did the ACA make to the health insurance industry?

Another one of the biggest changes ACA made was to prohibit insurance companies from denying someone coverage or charging them more because of a pre-existing condition. And because as many as 1 in 2 Americans have some type of pre-existing condition, this provision has been one of the law’s more popular. Health Insurance Subsidies.

What is Medicare for people over 65?

Medicare is a federal health insurance program for Americans over age 65 and certain people under age 65 who have qualifying conditions or disabilities. "Obamacare" is a nickname for the Patient Protection and Affordable Care Act of 2010 (also known as the ACA).

What is the individual mandate?

Individual Mandate. One of the most-talked-about aspects of the ACA was its provision stating that everyone is required to have health insurance. Those who do not have health insurance face a tax penalty. Coverage of Pre-Existing Conditions.

What is Obamacare's primary intention?

Obamacare's primary intention is to give all Americans the ability to purchase affordable health insurance. There are several different parts to the law that each affected a different aspect of health insurance access. Here are some of the more well-known: Individual Mandate.

What is Section 1 of Medicare?

Section 1: Rights & Protections for Everyone with Medicare

What rights do you have with original Medicare?

If you have Original Medicare, in addition to the rights and protections described in Section 1, you have the right to: ■ See any doctor or specialist (including women’s health specialists), or go to any Medicare-certified hospital, that participates in Medicare.

What is Medicare Beneficiary Ombudsman?

The Medicare Beneficiary Ombudsman is a person who reviews and helps you with your Medicare complaints. They make sure information about Medicare coverage and rights and protections is available to all people with Medicare. The Medicare Beneficiary Ombudsman shares information with the Secretary of Health and Human Services, Congress, and other organizations, and uses Medicare beneficiary feedback and experiences to provide recommendations for improvement to the Medicare program.

What to do when you ask your Medicare plan how it pays its doctors?

When you ask your plan how it pays its doctors, the plan must tell you. Medicare doesn’t allow a plan to pay doctors in a way that could interfere with you getting the care you need. ■ Request an appeal to resolve differences with your plan.

How to appeal a Medicare claim?

For more information on appeals: — Visit Medicare.gov/appeals. — Visit Medicare.gov/publications to view or print the booklet “Medicare Appeals,” or call 1‑800‑MEDICARE (1‑800‑633‑4227) to find out if a copy can be mailed to you. TTY users can call 1‑877‑486‑2048. — If you have a Medicare Advantage Plan, other Medicare health plan, or a Medicare Prescription Drug Plan, read your plan materials. — Call the SHIP in your state. To get the most up‑to‑date SHIP phone numbers, visit shiptacenter.org, or call 1‑800‑MEDICARE. ■ File complaints (sometimes called “grievances”), including complaints about the quality of your care.

How to request Medicare handbook?

TTY users can call 1‑877‑486‑2048. To request the Medicare & You handbook in an alternate format, visit Medicare.gov/ medicare‑and‑you. For all other Centers for Medicare & Medicaid Services (CMS) publications: 1. Call 1‑844‑ALT‑FORM (1‑844‑258‑3676). TTY users can call 1‑844‑716‑3676. 2. Send a fax to 1‑844‑530‑3676. 3. Send an email to [email protected]. 4. Send a letter to: Centers for Medicare & Medicaid Services Offices of Hearings and Inquiries (OHI) 7500 Security Boulevard, Room S1‑13‑25 Baltimore, MD 21244‑1850 Attn: Customer Accessibility Resource Staff

What is ESRD in Medicare?

If you have End-Stage Renal Disease (ESRD) and have a complaint about your care,call the ESRD Network for your state. ESRD is permanent kidney failure that requires a regular course of dialysis or a kidney transplant. To get this phone number, visit Medicare.gov/contacts, or call 1‑800‑MEDICARE.

How much does Medicare cost?

Medicare Costs a Huge Amount to Administrate. In 2018, Medicare spending totaled $731 billion. Currently, that’s approximately 15% of the overall federal budget. That number isn’t expected to get smaller, with many estimating that the percentage will go up to around 18% over the next decade.

How much does Medicare cost per month?

This number is estimated to cost around $135.50 per month. When you compare this to the out-of-pocket cost of operations, prescriptions, and other associated costs, the savings are huge.

What was the impact of Medicare on the market?

The inception of Medicare created a massive market for prescription drug companies. Suddenly, Americans had greater access to prescriptions. When pharmaceutical companies saw the untapped potential in the Medicare market, they began investing in the development of drugs created specifically for seniors.

What is Medicare Part D?

The addition of Medicare Part D Prescription Drug Plans and Medicare Advantage Prescription Drug Plans—both sold through private insurance companies—also gave Americans wider access to prescription medicines. Medicare beneficiaries have had access to these plans since 2006, and enrollments have increased every year since.

How many people will be in Medicare Advantage in 2020?

In fact, enrollment was at 24.1 million in 2020. 2

What would happen if Medicare didn't exist?

Older Americans, who typically need the most medical treatment, would find themselves paying exorbitant medical costs directly out of pocket. The total paid every year would be staggering, most likely exceeding their annual income.

Why is Medicare considered helpful?

Medicare is considered helpful because it covers so many people.

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

Which is better, private or Medicare?

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.