Full Answer

What is Medicare Part A and Part B?

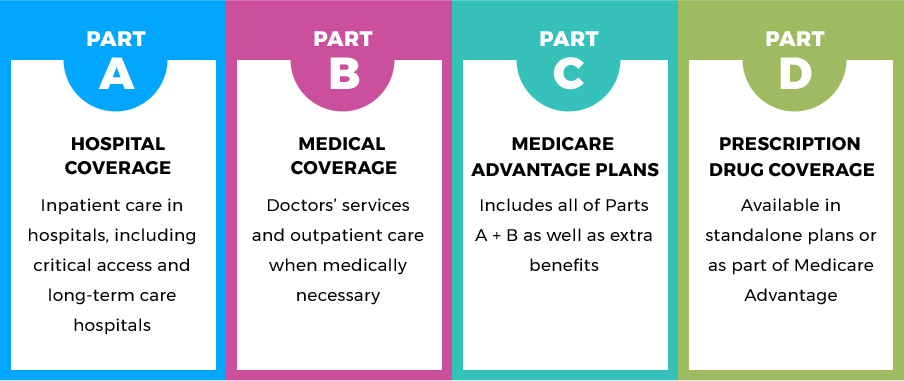

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care.

Does Medicare Part B cover preventive care?

Medicare Part B also covers a variety of preventive care services: Preventive care is care intended to prevent disease, rather than treat disease after it has occurred. Medicare Part B pays 80% of costs for covered services, leaving beneficiaries to pay the remaining 20% of Part B expenses out of pocket.

What is Medicare Part a hospital coverage?

Medicare Part A — Your Hospital Coverage. When you apply to Medicare, you are automatically enrolled in the Part A plan. Part A is your hospital insurance plan. It covers nursing care and hospital stays, although not doctors’ fees.

Is Medicare Part B mandatory for people on disability?

While Part A is required for some people on disability or those receiving other forms of government aid, Medicare Part B is not mandatory for these people. However, you may incur late enrollment penalties if you don't sign up when you're first.

Is Medicare Part B the same as a supplemental plan?

Part B is part of what's called Original Medicare, along with Part A. Plan B refers to Medicare supplement insurance commonly called Medigap. Part A covers hospital bills and Part B, for which a standard premium is paid, covers outpatient care, medical equipment, and other services.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the difference between Medicare and Medicare Supplement?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What is the cost of supplemental insurance for Medicare?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

Is it worth it to get supplemental life insurance?

Supplemental life insurance can be a useful add-on, particularly if health conditions make it tough for you to get enough coverage elsewhere. But be sure to compare policies and prices. In some cases, the benefits may not be worth the cost.

What are the disadvantages of a Medicare Supplement plan?

Medicare Advantage Plans do have a yearly limit on your out-of-pocket costs for medical services, called the maximum out-of-pocket (MOOP). Once you reach this limit, you'll pay nothing for covered services.

What are the top 3 Medicare Advantage plans?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the biggest disadvantage of Medicare Advantage?

Health care costs vary based on your medical care But most of the costs with Medicare Advantage plans come from copays, coinsurance, deductibles and other out-of-pocket costs that emerge as part of the overall care process. And these costs can quickly escalate.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What is supplemental insurance?

Listen to pronunciation. (SUH-pleh-MEN-tul helth in-SHOOR-ents) An additional insurance plan that helps pay for healthcare costs that are not covered by a person's regular health insurance plan. These costs include copayments, coinsurance, and deductibles.

Who needs Medicare D?

Medicare Part D is a specific type of private, government-regulated prescription drug plan that works with your Medicare coverage. You're eligible to enroll in a Part D plan if you receive Medicare upon turning 65. You're also able to enroll if you sign up for Medicare due to a disability.

Medicare Part A—Hospital Insurance

Before jumping into the difference between Medicare A and B, let us explain each of these parts individually. Medicare Part A is designed to cover...

Medicare Part B—Medical Insurance

Medicare Part B is designed to cover medical needs that do not involve the hospital and are considered medically necessary as defined by the federa...

Take Note—You May Need to Sign Up For Both Medicare Parts A and B

Sometimes, people need to sign up for both Medicare Part A and Part B. The following are instances in which you should sign up for both parts: 1. Y...

Are There Alternatives to Medicare Parts A and B?

Yes. If you are still working, you could stay on your employer’s insurance plan. However, be aware that you may pay a penalty if you later enroll i...

HealthMarkets and Medicare

If you’re interested in what Medicare Advantage plans have to offer, give us a call. One of our thousands of licensed insurance agents can talk you...