Disadvantages of Medicare Advantage

- Limited service providers. If you choose one of the more popular Medicare Advantage plan types, such as an HMO plan, you may be limited in the providers you can see.

- Complex plan offerings. ...

- Additional costs for coverage. ...

- State-specific coverage. ...

Full Answer

What are the pros and cons of Medicare Advantage plans?

Oct 11, 2021 · Medicare Advantage is completely different. The people who have chosen to go into Medicare Advantage, Medicare no longer pays doctors on your behalf. Medicare no longer pays the hospitals on your behalf. Instead, Medicare pays an insurance company, a Medicare Advantage insurance company, Humana, Blue Cross.

Why are Medicare Advantage plans are bad?

8 rows · Jan 20, 2022 · Despite the advantages of enrolling in Original Medicare, the program also has disadvantages, ...

Why Advantage plans are bad?

Apr 16, 2021 · A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. If you’re new to Medicare, you may be curious about Medicare Advantage. Here are some pros and cons of enrolling in a Medicare Advantage plan.

What are the disadvantages of Medicare supplement plans?

Apr 23, 2022 · Disadvantages of Medicare Advantage Plans In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their ...

What are the disadvantages of going to a Medicare Advantage plan?

Why do people dislike Medicare Advantage plans?

Are Medicare Advantage plans too good to be true?

Can I drop my Medicare Advantage plan and go back to original Medicare?

Do you still pay Medicare Part B with an Advantage plan?

What is the maximum out-of-pocket for Medicare Advantage plans?

Who is the largest Medicare Advantage provider?

Who Has the Best Medicare Advantage plan for 2022?

What is the highest rated Medicare Advantage plan?

Can I switch from a Medicare Advantage plan to a Medicare supplement?

Can you get out of a Medicare Advantage plan?

What is the difference between Medicare Supplement and Medicare Advantage plans?

How Do Medicare Advantage Plans Work?

Medicare Advantage plans are offered by private insurance companies that are approved by Medicare. Every month, Medicare pays the private insurance...

What Are The Downsides of Medicare Advantage Plans?

Since Medicare Advantage plan coverage is administered through a private insurance company, the rules and guidelines can vary, which can lead to re...

What Are The Pros of Medicare Advantage Plans?

1. Some insurance companies could offer a $0 premium for the Medicare Advantage plan. Medicare Advantage plan availability will depend on the count...

How Do I Choose A Medicare Advantage Plan?

It’s up to you to determine which type of coverage is the right option. It’s important to read all of the details of each Medicare Advantage plan,...

Do I Qualify For Enrollment in A Medicare Advantage Plan?

Qualifying for enrollment in a Medicare Advantage plan requires that you are enrolled in both Medicare Part A and Part B. People with end-stage ren...

What are the advantages and disadvantages of Medicare?

The Advantages and Disadvantages of Medicare. The advantages of Medicare include cost savings and provider flexibility. Among the disadvantages are potentially high out-of-pocket costs. Once you qualify for Medicare, you have several options when it comes to enrolling in a plan. You can enroll in Original Medicare, ...

Does Medicare Advantage have additional benefits?

Additional Benefits are sometimes provided. Although Medicare Advantage plans must provide the same benefits as Original Medicare, some of them provide additional benefits such as dental, vision and prescription drug coverage. There are many types of plans to choose from.

What is Medicare Part A?

Medicare Part A (hospital insurance) covers inpatient care, including care received in a hospital and skilled nursing facility.

What are the advantages of Medicare?

Advantages. The main advantages of enrolling in Original Medicare include: Low monthly premiums. Medicare Part A is usually premium free for most people, and the standard premium for Part B starts at $148.50 per month in 2021 (but can be higher based on your income). Broad acceptance.

What are the benefits of Medicare Part A?

The main advantages of enrolling in Original Medicare include: Low monthly premiums. Medicare Part A is usually premium free for most people, and the standard premium for Part B starts at $148.50 per month in 2021 (but can be higher based on your income). Broad acceptance.

How much is Medicare Part A in 2021?

Medicare Part A is usually premium free for most people, and the standard premium for Part B starts at $148.50 per month in 2021 (but can be higher based on your income). Medicare offers a wide range of flexibility when it comes to choosing a healthcare provider.

Does Medicare cover vision?

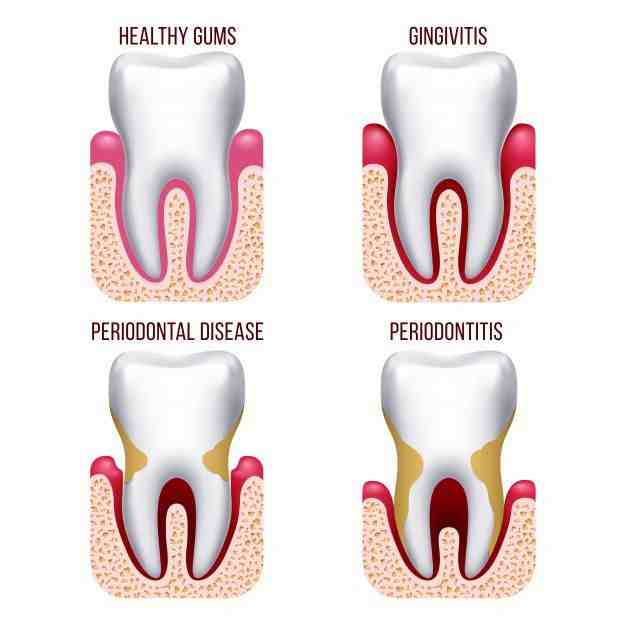

Medicare Part B, for example, typically covers 80% of your medical costs, but you may be responsible for covering the remaining 20%. No vision, dental or hearing benefits. If you receive a routine hearing test, or if you visit an eye doctor or a dentist, Original Medicare generally will not cover the cost.

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

Does Medicare Advantage have a deductible?

Under Medicare Advantage, each plan negotiates its own rates with providers. You may pay lower deductibles and copayments/coinsurance than you would pay with Original Medicare. Some Medicare Advantage plans have deductibles as low as $0.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

Is Medicare Advantage a private insurance?

For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, you must continue to pay your Medicare Part B premium.

Does Medicare Advantage have a monthly premium?

For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, you must continue to pay your Medicare Part B premium. Some Medicare Advantage plans have premiums as low as $0.

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Does Medicare cover dental?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare ...

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

What is Medicare Advantage Plan?

Medicare Advantage plans are an alternative to Medicare Part A and Part B. Medicare Advantage plans must cover at least the same benefits as Original Medicare. One advantage of joining a Medicare Advantage plan is that some plans also cover things like prescription drugs and routine vision and dental care.

Does Medicare have an out-of-pocket limit?

Original Medicare does not have an out-of-pocket limit. This means that Medicare beneficiaries have no limit to the amount of money they may be required to pay out of their own pocket for covered health care services in a single year.

How old do you have to be to get Medicare?

To be eligible for Medicare Part A and Part B, you typically must be: At least 65 years old. A U.S. citizen or a legal permanent resident for at least five years. Under age 65 but have a qualifying disability or condition, such as Lou Gehrig’s Disease (ALS) or End-Stage Renal Disease (ESRD)

Does Medicare cover dental care?

Medicare Part A and Part B cover a wide range hospital and medical benefits, but they still leave many things not covered. Original Medicare doesn’t typically cover items or services such as: Prescription drugs. Routine dental care or dentures. Routine vision care or eyeglasses. Routine hearing care or hearing aids.

How much will Medicare pay in 2021?

You could potentially pay additional coinsurance costs of up to $742 per day in 2021 for inpatient hospital stays of over 90 days. Though this is a rare situation, it’s worth considering. Medicare Part B includes a deductible of $203 per year in 2021.

How much is Medicare Part B deductible in 2021?

Medicare Part B includes a deductible of $203 per year in 2021. After you meet your Part B deductible, you are typically responsible for paying 20 percent of the Medicare-approved cost for your covered services or items.

Does Medigap cover Part B?

One advantage of Medigap plans is that all 10 standardized Medigap plans that are sold in most states cover Medicare Part B coinsurance or copayments, at least partially. Depending on the types of Part B services you receive and how often you need them in a year, this could help save you money.

What Does a Medicare Advantage Plan Cover?

Medicare Advantage plans are sold by private insurance companies and are required by law to provide all of the same coverage included in Original Medicare ( Medicare Part A and Medicare Part B ).

Is a Medicare Advantage Plan Worth It?

A Medicare Advantage plan may be worth it to some beneficiaries and perhaps not worth it to others. A Medicare Advantage plan may be worth it if:

How Do You Choose a Medicare Advantage Plan?

One way to shop for a Medicare Advantage plan is to work with a licensed insurance agent. This is also a great way to learn more about the advantages and disadvantages of these plans and determine if one may be worth it for you. You can also compare plans online for free to get a better idea of the advantages and disadvantages of each plan.

Does Medicare Advantage cover dental?

Through a Medicare Advantage plan, premiums are lower, and sometimes free, and will also likely include benefits for vision and dental, something original Medicare doesn't offer. "In America nothing is free, you pay now or pay later," Goldberg said. "It's wonderful until there is a large bill.".

Which insurance company has the largest Medicare Advantage enrollment?

UnitedHealthcare, the nation's largest insurer, is among those payers which have the largest Medicare Advantage enrollment. Steve Warner, senior vice president of Medicare Advantage for UnitedHealthcare Medicare and Retirement, was asked to comment about Goldberg's claims that MA will be more costly for most seniors in the long run.

Is CDPHP a non profit?

For example, CDPHP, a regional, not-for-profit health plan in upstate New York, is working with Mom's Meals to offer home-delivered, fully-prepared meals at no cost to Medicare Advantage members returning home from the hospital. Premiums declined for 2021 offerings, adding to the growing popularity of MA plans.

What are the benefits of Medicare Advantage?

Benefits of Medicare Advantage Plans 1 You may get extra coverage. Medicare Advantage plans typically include coverage that Original Medicare doesn’t. Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. 2 Health equipment may be covered. Your plan may also offer discounts or coverage for health and fitness equipment and services, such as gym memberships, meal subscriptions, and telehealth access. 3 You may pay less out of pocket. Your out-of-pocket costs — how much you pay on your own for health and prescription expenses because they aren’t covered by health insurance — may be less with a Medicare Advantage plan, helping you save money. 4 You have simplified care. If you have Original Medicare, you may have to add on Medigap coverage and Medicare Part D coverage to pay for all your health expenses. With a Medicare Advantage plan, you’ll have just one insurer for all of your health coverage instead of several, streamlining your healthcare. 5 Your care can be coordinated. With a Medicare Advantage plan, you can have coordinated care. With in-network providers, all your healthcare providers can work together and collaborate on your care, minimizing unnecessary tests and lab work.

Is Medicare Advantage for everyone?

Medicare Advantage plans are popular, but they’re not for everyone. Everyday Health. If you’re approaching 65, qualifying for Medicare can give you much-needed coverage for your healthcare needs. But dealing with the different aspects of Medicare — including Medicare Part A, Part B, stand-alone prescription drug coverage, ...

How does Medicare pay for a plan?

Medicare pays a set amount toward your Medicare Advantage plan each month. But you may have to pay a fee for your plan, depending on the options you choose. There are typically four types to choose from: 1 Health maintenance organization (HMO) When you’re in an HMO plan, you usually have to stay in network, meaning you can only go to doctors and healthcare providers who have agreements with your insurance company. The only exceptions are if you’re facing a serious emergency, need out-of-area urgent care, or out-of-area dialysis. If you need to see a specialist, you’ll need to get a referral for one from your primary care doctor. 2 Preferred provider organization (PPO) With a PPO, you pay less if you see doctors and healthcare providers that are within your network. You can opt to see doctors outside of your network, but insurance will cover less of the cost. In most cases, you don’t need a referral before you see a specialist. 3 Private fee-for-service (PFFS) Under a PFFS, you can go to a healthcare provider who has agreed to accept the plan’s payment terms and treat you. Some PFFS plans have in-network providers, but you can also choose to see out-of-network providers. 4 Special needs plans (SNPs) SNPs are plans for people with specific diseases or characteristics. You can usually get care only from healthcare providers within the plan network, except for emergency situations.

What are the benefits of a health insurance plan?

Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. Health equipment may be covered. Your plan may also offer discounts or coverage for health and fitness equipment and services, such as gym memberships, meal subscriptions, and telehealth access.

Can you get Medicare if you have end stage renal disease?

If you have end-stage renal disease (ESRD), you don’t qualify. While people with preexisting conditions can qualify for Medicare Advantage plans, that’s not the case if you have ESRD. If you have ESRD, you have to enroll in Original Medicare. You may not be able to see a provider of your choice.

Does Medicare Advantage cover prescriptions?

Many Medicare Advantage plans also include prescription drug coverage, as well, so you can use your policy to get access to branded and generic medications. Medicare pays a set amount toward your Medicare Advantage plan each month. But you may have to pay a fee for your plan, depending on the options you choose.

Can you cancel a Medigap plan?

You’ll have to cancel your Medigap policy, or return to Original Medicare. If you have end-stage renal disease (ESRD), you don’t qualify. While people with preexisting conditions can qualify for Medicare Advantage plans, that’s not the case if you have ESRD. If you have ESRD, you have to enroll in Original Medicare.