What is the exact Medicare Part D Donut Hole amount?

The Donut Hole remains the third phase or part of your Medicare Part D prescription drug coverage and you only enter the Donut Hole when (if) the total retail value of your purchased medications exceeds your plan's 2022 Initial Coverage Limit (ICL) of $4,430.

Is there still a donut hole in Medicare?

The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

How does the Medicare Part D doughnut hole work?

- If you have a Medicare Prescription Drug Plan that covers you specifically for the donut hole stage.

- You have another prescription drug coverage plan from a union or employer that pays for a percentage of your prescription costs.

- You use generic brands or don’t take a lot of prescription drugs.

What you should know about Medicare Part D?

You are eligible for a Medicare Part D plan if:

- You are 65 years of age or older.

- You have a qualifying disability for which you have been receiving Social Security Disability Insurance (SSDI) for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease (permanent kidney failure requiring a kidney transplant or dialysis).

- You are entitled to Medicare Part A or Part B.

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What is the Medicare Part D donut hole and how does it work?

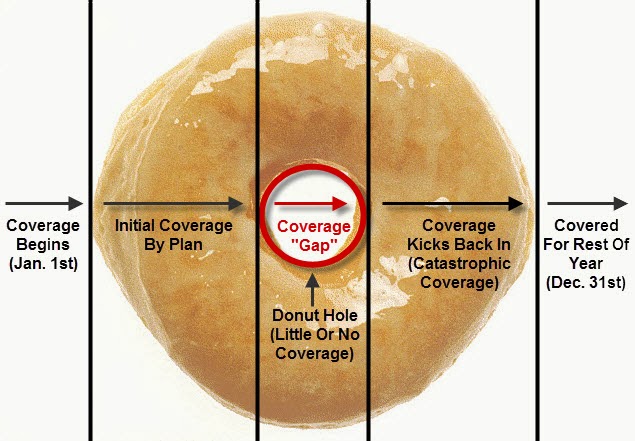

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

How do you explain Part D donut hole?

The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.”

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Is the donut hole going away in 2021?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

Does the donut hole reset each year?

While in Catastrophic Coverage you will pay the greater of: 5% of the total cost of the drug or $3.95 for generic drugs and $9.85 for brand-name drugs. You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

What is the Medicare donut hole for 2022?

$4,430You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

How long does the donut hole last?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

How do you calculate the donut hole?

An individual and their insurance company have spent $4,020 on medications since the start of their plan. That person is now in the donut hole. The person pays 25% of their medication costs. For example, if they have a medicine that costs $100, they will pay $25.

What is the maximum out-of-pocket for Medicare Part D?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

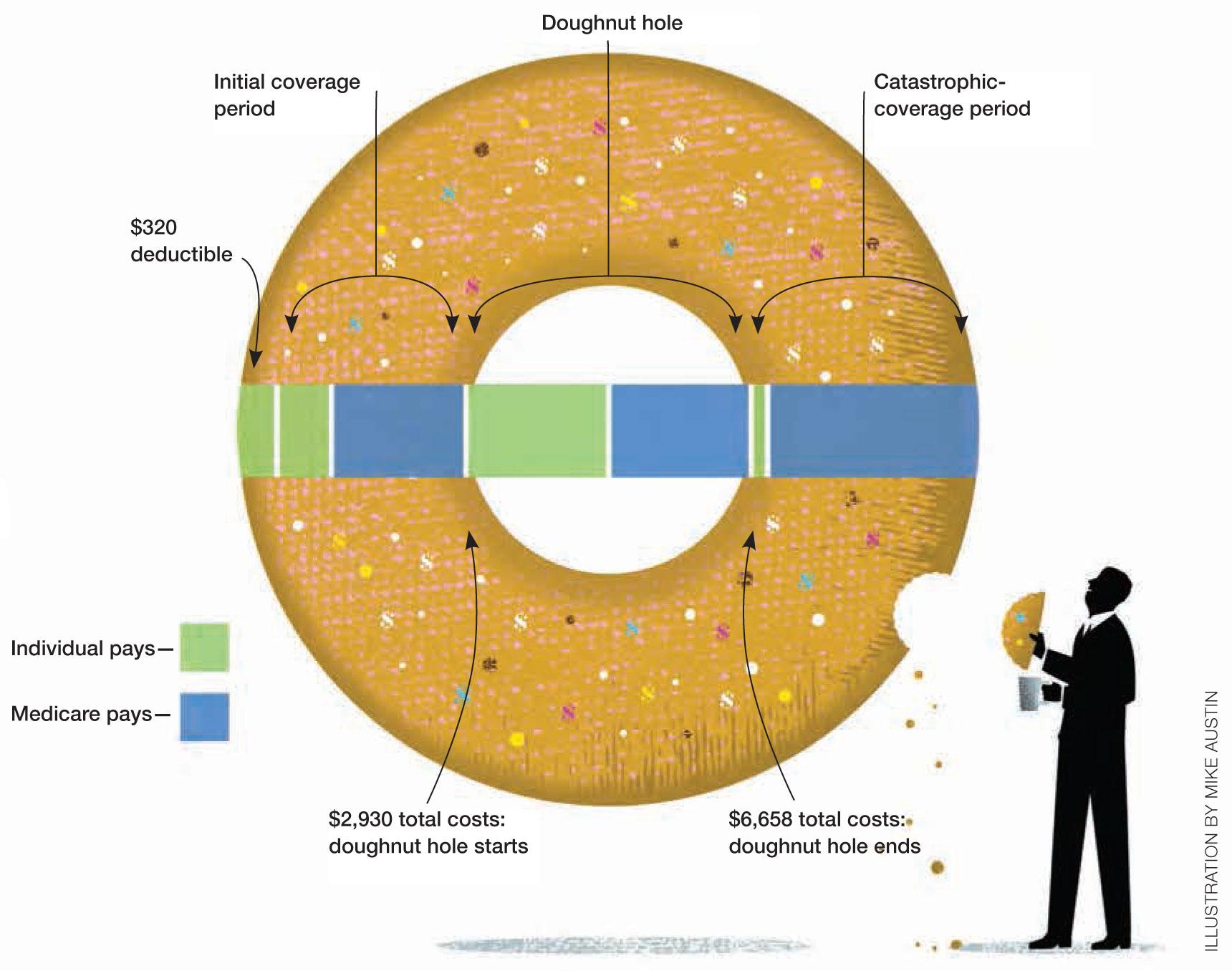

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

When does the catastrophic coverage period end for 2021?

Finally, your policy period ends on December 31, ...

How to avoid coverage gap?

One way is to switch from a brand name drug to a generic drug or from a brand name to a less expensive brand name drug, if possible. Ask your physician whether this is possible based on your specific medical condition and health history.

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

What percentage of Tufts pays for Part D?

25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

How much does it cost to get into catastrophic coverage?

While in Catastrophic Coverage you will pay the greater of: 5% of the total cost of the drug or $3.70 for generic drugs and $9.20 for brand- name drugs. You will remain in the Catastrophic Coverage Stage until January 1.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

What is the donut hole in Medicare?

When Part D plans first became available in 2006, beneficiaries paid 100% of their drug costs while they were in this spending window (known as the coverage gap, or more commonly, as the "donut hole"). In other words, they would pay a deductible, and then the Part D plan would pay a significant amount of their drug costs—but only until their spending got high enough to enter the donut hole. At that point, the enrollee would start paying 100% of their drug costs, and would have to continue to do so until they reached what's known as the catastrophic coverage level. The enrollee's costs would drop at that point, although they never drop to $0 since Medicare Part D does not have an upper cap on total out-of-pocket costs.

What happened before the ACA closed the donut hole?

Before the ACA closed the donut hole, it caused some seniors to pay significantly higher costs for their medications after they had reached a certain level of spending on drugs during the year. Those higher costs would continue until the person reached another threshold, after which the costs would decrease again.

How does the Donut Hole work?

Each year, the federal government sets a maximum deductible for Part D plans, and establishes the dollar amounts for the thresholds where the donut hole starts and ends.

How much does Mary pay for her prescriptions?

This is what her prescription medications will cost in the plan she has selected: Mary will pay a deductible of $435.

How much does Medicare pay for drugs?

If you're enrolled in a Medicare Part D plan, you now pay a maximum of 25% of the cost of your drugs once you meet your plan's deductible (if you have one). Some plans are designed with copays that amount to less than 25% of the cost of the medication, but after the deductible is met, Part D plans cannot impose cost-sharing that exceeds 25% ...

How much is deductible for Medicare?

Deductible: If you're enrolled in a Medicare prescription drug plan, you may have to pay up to the first $435 of your drug costs, depending on your plan. 5 This is known as the deductible. Some plans don't have a deductible, or have a smaller deductible, but no Part D plan can have a deductible in excess of this amount.

What is catastrophic coverage?

This level, when you're only paying a very small portion of your drug costs, is known as catastrophic coverage (this term is specific to Medicare Part D, and isn't the same thing as catastrophic health insurance ). The expenses outlined above only include the cost of prescription medications.

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

How much is the OOP in 2021?

For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole. When you’re in the donut hole, certain things count toward your total OOP cost to exit it. These include:

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

What is the 2022 Medicare coverage limit?

For 2022, the initial coverage limit has increased to $4,430. This is up from $4,130 in 2021. Generally speaking, this means that you’ll be able to get more medications before you fall into the donut hole.

What to consider before choosing a Medicare plan?

Below are some things to consider before choosing a plan. Use the Medicare website to search for a plan that’s right for you. Compare a Medicare Part D with a Medicare Advantage (Part C) plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

What is the gap in Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs.

What to do if you don't get a discount on a prescription?

If you think you've reached the coverage gap and you don't get a discount when you pay for your brand-name prescription, review your next " Explanation of Benefits" (EOB). If the discount doesn't appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What to do if your drug plan doesn't agree with your discount?

If your drug plan doesn't agree that you're owed a discount, you can file an appeal.