Full Answer

Is there still a donut hole in Medicare?

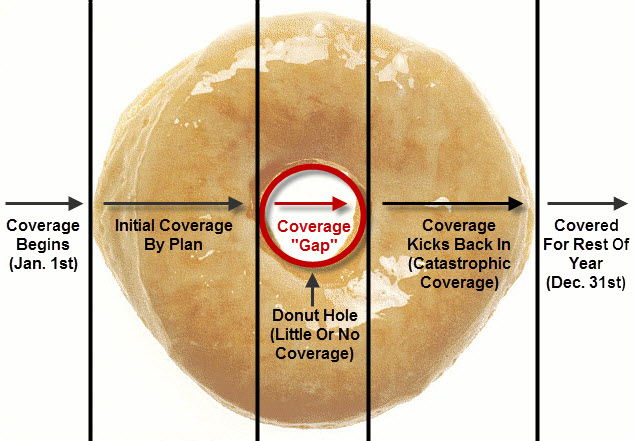

The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

How to avoid the Medicare Part D Donut Hole?

- Your prescription drug plan’s yearly deductible

- The amount you pay for your prescription medications

- The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

Why is there a hole in a doughnut?

Highlights

- Turns out that it was a deliberate move by a certain American sailor

- The most popular theory is credited to Captain Hanson Gregory

- Doughnuts were referred to as fried cakes

When does the Medicare Donut Hole End?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

What is the Medicare donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What happens when you reach the donut hole in Medicare?

Once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. You'll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail. Some plans may offer you even lower costs in the coverage gap.

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

How long do you stay in the donut hole with Medicare?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

What is the Medicare donut hole for 2022?

$4,430In 2022, you'll enter the donut hole when your spending + your plan's spending reaches $4,430. And you leave the donut hole — and enter the catastrophic coverage level — when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

Does the donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

What happens when you reach the donut hole?

Just like in the Initial Coverage Period, when you enter the donut hole you will be responsible for paying 25% of the costs of your medications. Once you have spent $7,050 out of pocket in 2022 on your prescription drug costs, you enter the Catastrophic Coverage Period.

Is the donut hole going away in 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

Has the donut hole been eliminated?

After the passage of the Affordable Care Act, discounts and subsidies started to apply during the Donut Hole, and in 2020, the Donut Hole was effectively eliminated for consumers' purposes.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Does Medigap cover the donut hole?

But Medigap plans don't include any drug coverage at all. Rather, you'll need to get a standalone prescription drug plan and therefore, the donut hole would still apply.

Initial coverage limit

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

OOP threshold

This is the amount of OOP money that you have to spend before you exit the donut hole.

Extra Help considerations

Some people enrolled in Medicare qualify for the Medicare Extra Help program based on their income. This program helps people pay for their prescription drug costs.

Generic drugs

For generic drugs, only the amount you actually pay counts toward your OOP threshold. For example:

Brand-name drugs

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.

What happens after I exit the donut hole?

After you exit the donut hole, you’ll receive what’s called catastrophic coverage. This means that you’ll have to pay whatever is greater for the rest of the year: Five percent of a drug’s cost or a small copay.

1. Consider switching to generic drugs

These are often less expensive than brand-name drugs. If you’re taking a brand-name drug, ask your doctor about generic drugs.

What is the Medicare donut hole?

Back to the visual donut image. Picture a donut with a hole in the middle. Maybe it’s an old fashioned style, chocolate glazed, vanilla frosted with sprinkles, apple cider or any other flavor of your choice. Now that we’ve got your attention, let’s continue.

What is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

Did the Medicare donut hole go away in 2020?

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Can I avoid the Medicare donut hole?

The only way to avoid the Medicare donut hole is to prevent your out-of-pocket expenses for prescription drugs from reaching $4,130 in 2021. Once you hit that amount, you enter the Medicare coverage gap.

Do Medicare Advantage plans cover the Medicare donut hole?

Some Medicare Advantage plans may offer extended gap coverage for enrollees in the Medicare donut hole, though you should check with your specific plan for more details.

Stage 1 – Deductible

Some prescription drug plans have a yearly deductible, which is the amount you must pay out-of-pocket for your medications before your plan begins to pay its share. Deductibles vary between Medicare drug plans, and not all plans have one, but if your drug plan has a deductible, it cannot be greater than $405 in 2018.

Stage 2 – Initial Coverage

Once you reach the yearly deductible amount, your insurance plan will begin to pay some of the prescription drug costs.

Stage 3 – Coverage Gap (Donut Hole)

How will you know when you reach the donut hole? Your drug plan’s monthly “Explanation of Benefits” (EOB) notice will lay out how much you’ve spent on covered drugs and if you’ve reached the coverage gap.

Stage 4 – Catastrophic Coverage

Once you have reached the coverage gap limit – $5,000 in 2018 – your catastrophic coverage automatically begins. Your plan will begin to contribute more, and you will only pay a small coinsurance or copayment amount for covered drugs for the rest of the year.

In this Article

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What Are the Payment Stages of Medicare Part D Prescription Drug Coverage?

There are four payment stages of Medicare Part D prescription drug coverage, which starts over January 1 of each year. 3 Medicare Interactive. “Phases of Part D coverage.” medicareinteractive.org (accessed June 2020).

How Does the Coverage Gap Work?

Once you’re in the coverage gap, or donut hole, you’re responsible for a percentage of your covered drug costs. What you’ll pay depends on whether it’s a brand-name or generic prescription drug. 4 U.S. Government website for Medicare. “Costs in the coverage gap.” medicare.gov (accessed June 2020).

How Can You Get Help Paying for Prescription Drug Coverage?

If you qualify, Medicare and Social Security offer a program called Extra Help that lowers your drug costs to $3.95 for each generic covered drug and $9.85 for each brand-name covered drug. 5 NOTE TO: Medicare Advantage Organizations, Prescription Drug Plan Sponsors, and Other Interested Parties. cms.gov. Accessed on October 9, 2021.

How Did the Medicare Donut Hole Work Before?

Originally, once Part D participants reached the end of their initial coverage, if they didn’t receive low-income subsidies, they were required to pay 100% of their drug costs until their out-of-pocket totals qualified them for catastrophic coverage. 7 “ Closing the Medicare Part D Coverage Gap: Trends, Recent Changes, and What’s Ahead .”

When Did the Donut Hole Close?

The donut hole gradually lessened until it closed in 2020, leaving users responsible for 25% of costs for both brand-name and generic prescription drugs, versus the 100% they had to pay previously. 8 “ Closing the Medicare Part D Coverage Gap: Trends, Recent Changes, and What’s Ahead .”

How Much Will You Pay for Prescription Drug Coverage?

Premiums for Medicare Part D coverage vary by plan. And if you join a Medicare Advantage Plan (Part C) or Medicare Cost Plan that includes Medicare prescription drug coverage, there may be an amount for drug coverage included in the plan’s monthly premium.

Estimate Your Drug Costs

Use our drug cost estimator tool to determine what your prescription drug costs would be with a UnitedHealthcare© Medicare insurance plan.

Tips for Navigating the Part D Coverage Gap

It’s best to avoid the coverage gap all together if you can. People who reach the coverage gap need to get through it wisely so they can get the most from their Part D coverage.

Medicare Made Clear

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Medicare Made Clear

Whether you're just starting out with Medicare, need to brush up on the facts, or are helping a loved one, start your journey here.

Get the Latest

Boost your Medicare know-how with reliable, up-to-date news and information delivered to your inbox every month.

Brand-name prescription drugs

Once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. You'll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail. Some plans may offer you even lower costs in the coverage gap.

Generic drugs

Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

If you think you should get a discount

If you think you've reached the coverage gap and you don't get a discount when you pay for your brand-name prescription, review your next " Explanation of Benefits" (EOB). If the discount doesn't appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date.