What is the Medicare tax rate for self employed individuals?

Mar 27, 2022 · There is no limit to the amount of earnings subject to the Medicare earnings. Self-employed taxpayers are subject to the total 15. 3% tax rate comprised of 12. 4% for OASDI and 2. 9% for Medicare. The self-employment tax rate for self-employment income earned is 15. 3% (12. 4% for Social Security and 2. 9% for Medicare).

What is the income limit for the Medicare tax?

Feb 03, 2022 · Albert is single and earns $150,000 in Medicare wages at one job and $75,000 in Medicare wages at a second job. His combined wages subject to Medicare total $225,000. Albert will owe the Additional Medicare Tax on the amount by which his combined Medicare wages exceed $200,000, the threshold amount for a single person.

How much of my net earnings are subject to self employment tax?

Nov 16, 2021 · If this is your filing situation, you’ll pay the following amounts for Part B: $170.10 per month if you make $91,000 or less $544.30 per month if you make more than $91,000 and less than $409,000...

Can I deduct Medicare deductibles If I am self employed?

Mar 30, 2021 · Qualifying for Premium-Free Part A When You're Self-Employed. If you’re self-employed and your net earnings are $400 or more for the year, there are several things you need to do each year in order to get the work credits to which you’re entitled: Correctly fill out both Schedule SE (Self-Employment Tax) and Form 1040 (U.S. Individual Income Tax Return) in …

What are the maximum earnings subject to Medicare tax?

What is the minimum income for Medicare tax?

...

When Are You Liable for Additional Medicare Tax?

| Tax Filing Status | Minimum Income |

|---|---|

| Single | $200,000 |

| Married filing jointly | $250,000 |

| Married filing separate | $125,000 |

| Head of household (with qualifying person) | $200,000 |

What income is subject to the 3.8 Medicare tax?

What is the maximum earnings amount taxed for Medicare for 2020?

Do self-employed pay Medicare tax?

Can I be exempt from Medicare tax?

What is the Medicare surtax for 2021?

How do I avoid Medicare surtax?

What is the Medicare surcharge tax for 2021?

How do you calculate Medicare tax 2020?

How is Medicare tax calculated?

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What is net self employment income?

Net self-employment income is the total of all self-employment income after deductions for business expenses are taken on Schedule C, Schedule F, or Schedule E, which reports self-employment income from partnerships. The total self-employment income is then reduced by multiplying it by 92.35%.

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

Is Medicare tax indexed for inflation?

Medicare wages are reported on Form W-2 in box 5. As of tax year 2020, the threshold amounts aren't indexed for inflation. 2 They are: Filing Status.

How much does Barney earn?

Barney earned $75,000 in wages, which is below the $125,000 threshold for a married person filing separately, so he doesn't have wages in excess of the threshold amount. He doesn't have to pay any Additional Medicare Tax. But Betty's wages are $200,000.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

Is Social Security considered self employed?

Who Does Social Security Consider Self-Employed? You operate a trade, business or profession either by yourself or as an independent contractor. You’re a member of a partnership that runs a trade or business. You’re otherwise in business for yourself, including a part-time business or working as a freelancer.

When do you have to pay taxes on self employment?

Pay the proper amount of self-employment tax (based on your net earnings) Note: As long as you’re working, you must submit your tax returns along with your self-employment tax to the IRS each year by April 15, even if you already get Social Security benefits.

When do you have to know about Medicare?

If are or have been self-employed, there are some things you need to know about Medicare before you reach age 65. Find out how working for yourself can affect your Medicare eligibility and whether you can deduct your health insurance premiums from your taxes.

How many credits do you need to get Medicare?

You (or your spouse) have to 10 years of work credits (or 40 quarterly credits) to be eligible for premium-free Part A benefits. You earn work credits (up to the maximum of four credits) each year that you earn wages and pay Medicare taxes.

What are the two parts of Medicare?

When enroll in Medicare, one of the first things you’ll notice is that there are two parts: Part A (hospital insurance) and Part B (medical insurance). Everyone pays a monthly premium for Medicare Part B, but many Medicare enrollees are eligible for premium-free Part A (though some people may need to pay a premium for Part A benefits).

How much do you have to pay in taxes for self employment?

As a rule, you need to pay self-employment tax if your net earnings from self-employment are at least $400 over the tax year. This includes individuals who have their own business, as well as independent contractors and freelancers.

What is the tax rate for self employed?

Self-employment tax ensures that self-employed individuals make the same contribution and receive the same value of benefits as salaried individuals. The 15.3% may shock those who are newly self-employed. But when all is said and done, tax deductions can save you from paying the entire tax.

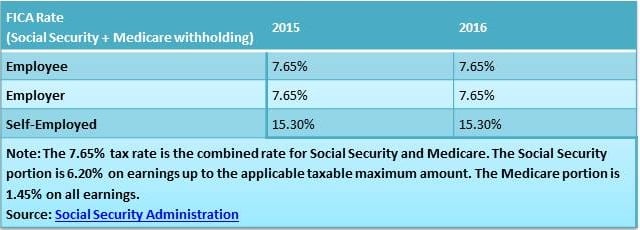

What is the FICA tax?

The FICA tax is 15.3%, paid by employers and employees, who split the burden by each paying half. Employers pay 7.65% and their employees pay 7.65%.

How much is self employment tax for 2020?

Anything over that amount is not subject to the tax. The maximum amount may change annually and has steadily increased over time. It is $137,700 for the 2020 tax year. Let’s say you have $150,000 of net earnings from self-employment in 2020.

How much is the 2020 tax return?

It is $137,700 for the 2020 tax year. Let’s say you have $150,000 of net earnings from self-employment in 2020. You will pay a 12.4% tax on the first $137,700. However, you do not have to pay any Social Security tax on the remaining $12,300.

What is the Medicare tax rate?

The rate for Medicare lands at 2.9%. Unlike with Social Security, the Medicare taxapplies to all of your net earnings regardless of how much you earn. If you have $150,000 of net earnings as in the previous example, you must pay the 2.9% Medicare tax on the entire $150,000.

What is 15.3% tax?

What Are Net Earnings? The 15.3% tax seems high, but the good news is that you only pay self-employment tax on net earnings. This means that you can first subtract any deductions, such as business expenses, from your gross earnings. One available deduction is half of the Social Security and Medicare taxes.

Can self employed people deduct Medicare?

The tax code allows self-employed people to deduct half of their total self-employment tax as an above-the-line deduction. This deduction mirrors the employer portion of Social Security and Medicare that would be paid by your boss if you worked for someone else.

How to avoid self employment taxes?

How to avoid or reduce self-employment tax 1 Track all business expenses. Since self-employment taxes applied to net earnings rather than your gross income, deductible business expenses will reduce the amount you owe. Be sure to track and take advantage of all tax deductions. 2 Take an above-the-line deduction. The tax code allows self-employed people to deduct half of their total self-employment tax as an above-the-line deduction. This deduction mirrors the employer portion of Social Security and Medicare that would be paid by your boss if you worked for someone else. Take your calculated self-employment tax and divide it in half. The result goes on line 14 of Schedule 1 attached to your Form 1040. 3 Make an S-corp election. Some LLC members can reduce their self-employment tax burden by electing to have their LLC taxed like an S corporation. This is because S corp owners pay Social Security and Medicare taxes only on their salary, which LLC members pay self-employment taxes on 100% of their share of the LLC’s profits. However, making an S corp election isn’t right for everyone. Talk to a tax professional to determine whether it’s the right move for you.

How much is Social Security tax in 2021?

That’s because of the Social Security wage base. For 2021, the Social Security wage base is $142,800. This means that in 2021, Social Security tax only applies to the first $142,800 of your combined income from wages and self-employment. After that, you aren’t charged any additional Social Security tax. There is no limit on the Medicare portion of ...

How to calculate net earnings?

To calculate your net earnings, subtract your business expenses from business revenues. If the result is less than the Social Security wage base, the calculation is simple. If your net earnings are more than the Social Security wage base, your calculation will have a few additional steps.

What is the Social Security wage base for 2021?

For 2021, the Social Security wage base is $142,800. This means that in 2021, Social Security tax only applies to the first $142,800 of your combined income from wages and self-employment. After that, you aren’t charged any additional Social Security tax. There is no limit on the Medicare portion of self-employment tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Social Security tax rate for 2021?

For 2021, the rate for the Social Security tax is 6.2% for the employee and 6.2% for the employer, or 12.4% total—the same as 2020. The tax applies to the first $142,800 of income in 2021. The Social Security tax rate is assessed on all types of income that an employee earns, including salaries, wages, and bonuses. 4 .

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is the Medicare tax rate for 2021?

In 2021, the Medicare tax on a self-employed individual’s income is 2.9%, while the Social Security tax rate is 12.4%. 5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically ...

How to calculate self employment tax?

How to calculate self-employment tax 1 For tax purposes, net earnings usually are your gross income from self-employment minus your business expenses. 2 Generally, 92.35% of your net earnings from self-employment is subject to self-employment tax. 3 Once you’ve determined how much of your net earnings from self-employment are subject to tax, apply the 15.3% tax rate. 4 Remember, though — for 2020, only the first $137,700 of earnings was subject to the Social Security portion of self-employment tax. In 2021, that rose to $142,800. 5 If you had a loss or just a little bit of income from self-employment, be sure to check out the two optional methods in IRS Schedule SE to calculate your net earnings.

Is self employment tax the same as income tax?

Self-employment tax is not the same as income tax. One big difference between self-employment tax and the payroll taxes people with regular jobs pay is that typically employees and their employers split the bill on Social Security and Medicare (i.e., you pay 7.65% and your employer pays 7.65%); self-employed people pay both halves.

What is the tax rate for self employment in 2021?

The self-employment tax rate for 2021. As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income tax. One big difference between self-employment tax and the payroll taxes people with regular jobs pay is ...

How much is Social Security taxed in 2021?

For 2021 the first $142,800 of earnings is subject to the Social Security portion. A 0.9% additional Medicare tax may also apply if your net earnings from self-employment exceed $200,000 if you’re a single filer or $250,000 if you’re filing jointly.

What is the purpose of Schedule C?

Generally, you use IRS Schedule C to calculate your net earnings from self-employment. You use IRS Schedule SE to calculate how much self-employment tax you owe. You’ll need to provide your Social Security number or individual taxpayer identification number (ITIN) when you pay the tax.