United States Secretary of the Treasury

The secretary of the treasury is the head of the United States Department of the Treasury which is concerned with all financial and monetary matters relating to the federal government, and, until 2003, also included several major federal law enforcement agencies. This position in the feder…

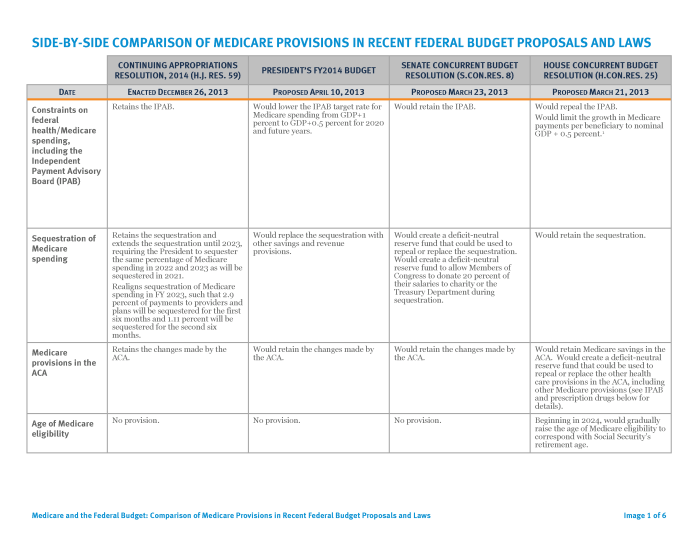

How much does Medicare cost the federal government?

Sep 02, 2021 · Medicare is the second largest program in the federal budget: 2020 Medicare expenditures, net of offsetting receipts, totaled $776 billion — representing 12 percent of total federal spending. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and 39 percent of all home health spending. In 2020, Medicare …

Is Medicare funded by state or federal?

Sep 21, 2020 · Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program and options for changing it.

What percentage of the budget is Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare: Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

How does the federal government funds Medicaid?

Sep 17, 2021 · Published by Jenny Yang , Sep 17, 2021. In 2020, the share of U.S. federal budget spent on Medicare was 12 percent, a four-times increase since 1970. If current laws stand, the share of federal ...

What is the Medicare budget for 2021?

$683 BillionPROJECTIONS FOR MAJOR HEALTH CARE PROGRAMS FOR FY 2021MEDICARE (Net of Offsetting Receipts)$683 BillionMEDICAID$519 BillionPREMIUM TAX CREDITS AND RELATED SPENDING$68 BillionCHILDREN'S HEALTH INSURANCE PROGRAM$16 Billion

How much did the US spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.Dec 15, 2021

How much did the US spend on Medicare in 2019?

796.1Total Medicare spending from 1970 to 2020 (in billion U.S. dollars)*CharacteristicTotal spending in billion U.S. dollars2019796.12018740.72017710.22016678.79 more rows•Sep 8, 2021

What is the percentage of the federal budget that Social Security and Medicare take up?

In 2019, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 51 percent of all federal spending, larger than the portion of spending for other national priorities (such as national defense) combined.

Is Medicare funded by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.Mar 23, 2022

How much does the US government spent on healthcare?

four trillion U.S. dollarsAnnual health expenditures stood at over four trillion U.S. dollars in 2020, and personal health care expenditure equaled 10,202 U.S. dollars per resident.Jan 18, 2022

Is there a federal budget for 2021?

The United States federal budget for fiscal year 2021 ran from October 1, 2020 to September 30, 2021....2021 United States federal budget.Submitted byDonald TrumpSubmitted to116th CongressTotal revenue$4.046 trillion (actual) 18.1% of GDPTotal expenditures$6.818 trillion (actual) 30.5% of GDPDeficit$2.772 trillion (actual) 12.4% of GDP2 more rows

How much did the US spend on healthcare in 2021?

Dig Deeper. Including this government support, national healthcare spending in 2021 increased by 3.4 percent. This modest growth reflects the fact that federal spending decreased significantly last year, going from $287 billion in 2020 to $170 billion in 2021.Feb 24, 2022

Why does the US spend so much on healthcare?

Hospitals, doctors, and nurses all charge more in the U.S. than in other countries, with hospital costs increasing much faster than professional salaries. In other countries, prices for drugs and healthcare are at least partially controlled by the government. In the U.S. prices depend on market forces.

What percent of the federal budget is spent on interest?

Interest payments are a costly part of the federal budget. Even with exceptionally low interest rates, the United States is projected to spend over $300 billion on interest payments this fiscal year. That's the equivalent of 9 percent of all federal revenue collections and roughly $2,400 per household.May 19, 2021

What percentage of the US budget is entitlements?

Entitlement spending totaled 49% of total federal expenditures in fiscal year 2020 and 2021. This is down from 56% in fiscal year 2019 due to increased Covid 19 spending in 2020 and 2021. Entitlement programs include Welfare Programs, Social Security, Medicare, Medicaid and Unemployment (See Entitlement Programs Page).

What percent of federal budget goes to defense?

About one-sixth of federal spending goes to national defense. CBO estimates the budgetary effects of legislation related to national security and assesses the cost-effectiveness of current and proposed defense programs. CBO also analyzes federal programs and issues related to veterans.

What percentage of prescriptions were brand name drugs in 2015?

In 2015, brand-name specialty drugs accounted for about 30 percent of net spending on prescription drugs under Medicare Part D and Medicaid, but they accounted for only about 1 percent of all prescriptions dispensed in each program.

What is Medicare recurring?

Recurring Publications. Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program ...

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much did Medicare cut in ten years?

While the budget would cut Medicare spending by $756 billion over ten years, the cuts amount to $501 billion after accounting for the general revenue payments for GME and uncompensated care. In addition to its specific Medicare proposals, the budget assumes $135 billion in savings over ten years from unspecified comprehensive drug pricing reform.

How much will Medicare be reduced in 2021?

President Trump’s 2021 budget proposes about $500 billion in net Medicare spending reductions over ten years (see table), most of which would come from reducing payments to health care providers and not affect beneficiaries directly. For the most part, the budget does not reflect the President’s efforts to end the Affordable Care Act (ACA) ...

Will the ACA be repealed in 2021?

The President has also pledged to pursue ACA repeal legislation in 2021 if Republicans control Congress. If these efforts succeed, Medicare beneficiaries, providers, and plans could face serious harm.

Does Trump's executive order weaken Medicare?

Unfortunately, other Administration proposals would weaken Medicare’s finances and harm beneficiaries. President Trump’s October executive order on Medicare could weaken the program in several ways. Although many of its proposed changes are vague, and most would require changes in law or regulation, the order would promote private Medicare ...

Will Medicare be depleted in 2026?

Medicare’s trustees project that its Hospital Insurance (HI) trust fund will be depleted in 2026 under current law, though incoming payroll taxes and other revenue could still pay 89 percent of HI costs that year.

What percentage of Medicare beneficiaries are covered by Part B?

Part B coverage is voluntary, and about 91 percent of all Medicare beneficiaries are enrolled in Part B. Approximately 25 percent of Part B costs are financed by beneficiary premiums, with the remaining 75 percent covered by general revenues.

How much is Medicare Part D deductible?

Medicare Part D offers a standard prescription drug benefit with a 2017 deductible of $400 and an average estimated monthly premium of $35.

How many people are on Medicare Advantage in 2018?

In 2018, Medicare Advantage enrollment will total approximately 20.8 million, or approximately 38 percent of all Medicare beneficiaries. Centers for Medicare and Medicaid Services (CMS) data confirm that 99 percent of Medicare beneficiaries will have access to at least one Medicare Advantage plan in 2018.

What is the mission of Quality Improvement Organization?

The mission of the Quality Improvement Organization Program is to improve the effectiveness, efficiency, economy, and quality of services delivered to Medicare beneficiaries. The Organizations are experts in the field working to drive local change, which can translate into national quality improvement.

How much is Medicare Part C?

Part C ($203.0 billion gross spending in 2018) Medicare Part C, the Medicare Advantage Program, pays plans a capitated monthly payment to provide all Part A and B services, and Part D services if offered by the plan.

What is the FY 2018 budget?

The FY 2018 Budget reflects the President’s commitment to preserve Medicare and does not include direct Medicare cuts. The Budget repeals the Independent Payment Advisory Board, commits to improving the Medicare appeals process, and supports efforts to limit defensive medicine as a part of a larger medical liability reform effort.

What is Medicare Part A?

Medicare Part A pays for inpatient hospital, skilled nursing facility, home health related to a hospital stay, and hospice care. Part A financing comes primarily from a 2.9 percent payroll tax paid by both employees and employers.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

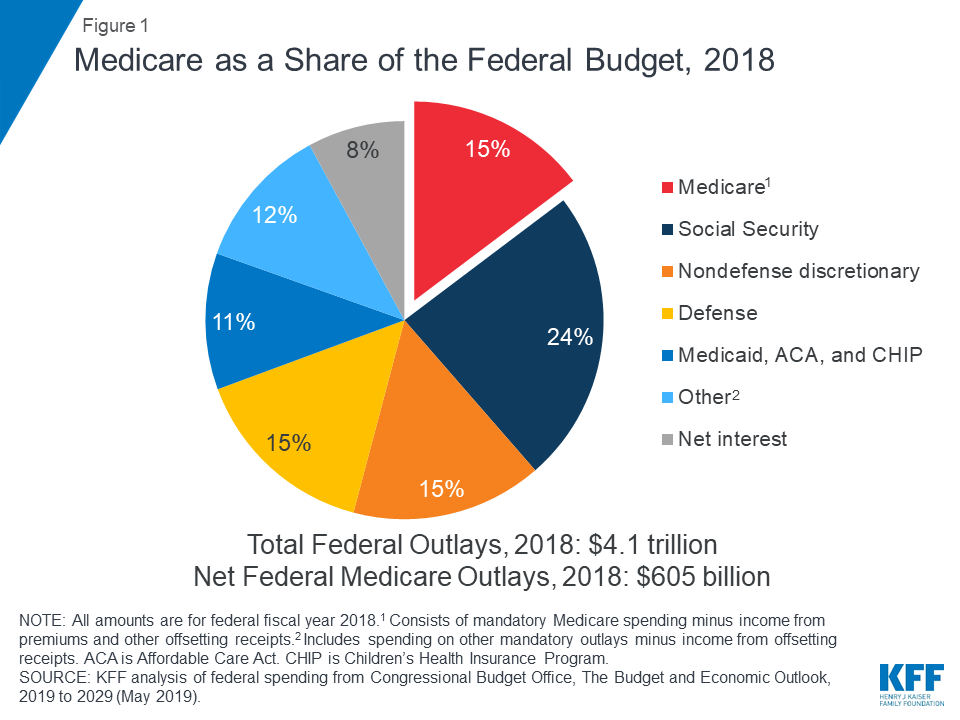

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

What is the FY 2022 HHS?

The FY 2022 targets and most recent activity for key CMS performance measures are included in the FY 2022 Congressional Justification , as required by the Government Performance and Results Act (GPRA) of 1993 and the GPRA Modernization Act of 2010. CMS GPRA performance measures are included and officially reported in the FY 2022 HHS Annual ...

Is the CMS FY 2022 budget finalized?

The CMS FY 2022 budget request has been finalized and submitted to Congress. This Congressional Justification of the budget presents the resource requests for programs, focuses on key performance measures, and summarizes program results.

What is the purpose of Medicare trustees report?

The primary purpose of the report is to analyze whether each of the two trust funds has sufficient income and assets to enable the payment of Medicare benefits and administrative expenses. The MedicareTrusteesReport necessarily has a trust fund perspective. In contrast, the annual budget of the United States includes estimates of projected Medicare incomeand expenditures,but reports on how all three parts of the program

Is sustainability a question of financial adequacy?

The question of sustainabilityis not easily quantified or agreed on. Financial adequacy does not imply sustainability, and sustainability does not indicate financial adequacy. The sustainability of Medicare is a policyissue,and society, through its elected representatives, makes choices according to what it desires and what it is willing to accept. The desired Medicare coverage is balanced against the reasonableness of the cost of that coverage, but this balance is not easily quantified and is not the same as financial adequacy. With an understanding of the differences surrounding the concepts of financial status, budget impact, and sustainability, the following statements are fair, in our opinion:

Is Medicare a financial or actuarial issue?

The evaluation of Medicare’s financial status is a technical, actuarial issue . Medicare’s impact on the Federal budget is a similarly narrow and straightforward calculation. In contrast, assessingthe long-range sustainability of Medicare is anything but straightforward. Sustainabilityis much more difficult to assess because it is a very broad issue and ultimately one that involves societal values. There is no agreed-upon standard by which to measure the sustain-ability of Medicare—indeed, there is considerable confusion about the differences betweentheconceptsof sustainability, financial status, and budget impact.