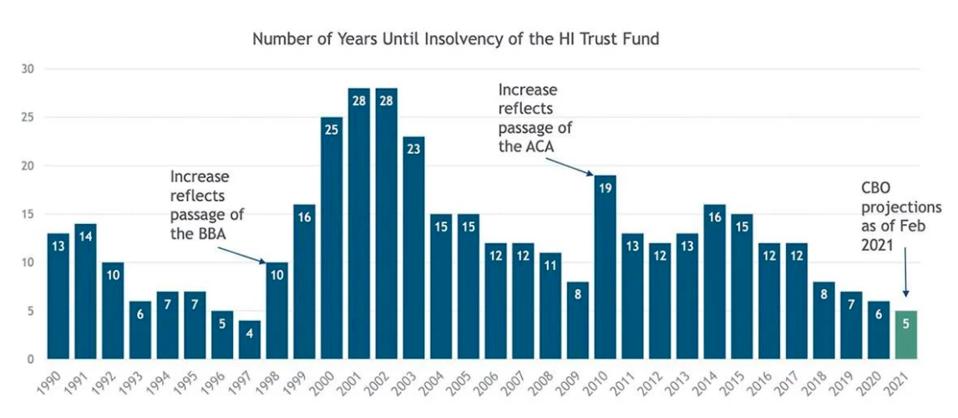

The trust fund financing Medicare's hospital insurance coverage will remain fully funded until 2028, a solvency date two years shorter than what was predicted last July and in 2014. However, Medicare Trustees said the 2028 date is 11 years longer than they projected in 2009 before the passage of the Affordable Care Act.

Will Medicare go broke in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

What are the 4 predictions about the future of Medicare Advantage?

4 Predictions About the Future of Medicare Advantage Plans 1 Medicare Advantage plans may continue to offer more new benefits. ... 2 Medicare Advantage plan prices should remain stable or possibly drop. ... 3 Quality of care could get better. ... 4 Enrollment will continue to climb. ... 5 Enrolling in a Medicare Advantage plan. ...

Will Medicare’s part a trust fund remain solvent until 2028?

A female physician is meeting with a patient in the patient's home. The Medicare trustees’ new estimate that the program’s Part A Hospital Insurance (HI) Trust fund will remain solvent for an extra two years—to 2028—sounds like good news.

Will you be eligible for Medicare by 2030?

By 2030, it is expected that 20% of the U.S. population will be eligible for Medicare. 5 6 Not only are thousands of people reaching Medicare age every day, but life expectancy is also on the rise. A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, 84.2 years.

What is the future of Medicare?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

What trend is expected with Medicare costs in the future?

Spending per person in Medicare Advantage is projected to grow 5.3 percent a year on average between 2021 and 2029, an amount which is similar across plan types (based on KFF analysis of data from the 2020 Medicare Trustees Report).

How much will the US spend on healthcare by 2030?

$6.8 trillionThe CMS Office of the Actuary released its national health spending projections for 2021-30 March 28.

What is the fastest growing sector of Medicare services today?

Medicare Advantage is the fastest growing business segment in the health care insurance industry in the United States. This growing market segment represents a big opportunity for Medicare Advantage Organizations.

Is Medicare running out of money?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

What is the expected growth of Medicare beneficiaries by the year 2030?

The Congressional Budget Office (CBO) projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to about 51 percent by 2030. This analysis has been updated to reflect changes in methodology in how KFF calculates the total number of Medicare beneficiaries.

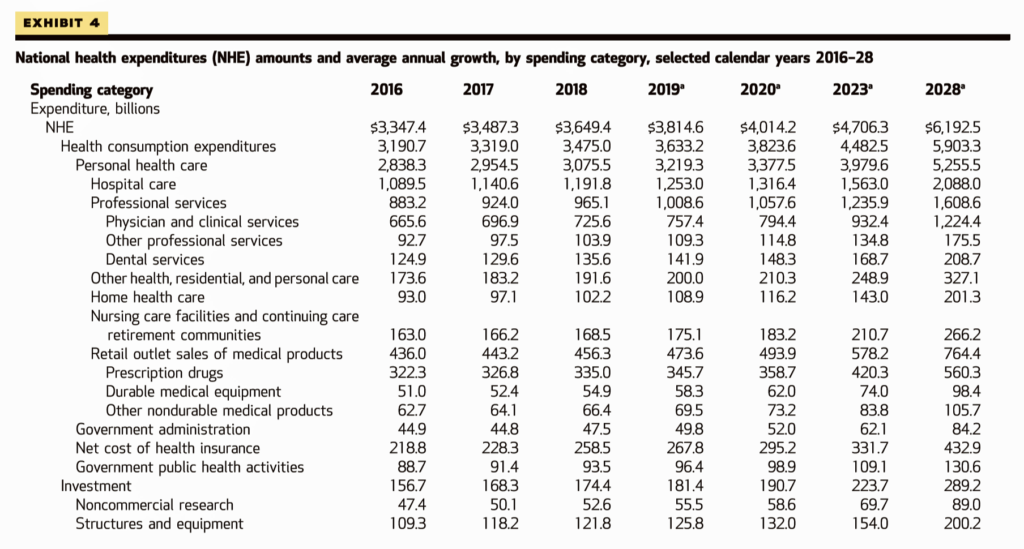

What percentage of GDP will us spend on healthcare in 2028?

19.7 percentProjected NHE, 2019-2028: Because national health expenditures are projected to grow 1.1 percentage points faster than gross domestic product per year on average over 2019–28, the health share of the economy is projected to rise from 17.7 percent in 2018 to 19.7 percent in 2028.

Why are Medicare costs rising?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

How much will Americans spend on healthcare in the next 10 years?

Overall healthcare costs — including all private and public spending — are anticipated to rise by an average of 5.5 percent per year over the next decade — growing from $3.5 trillion in 2017 to $6 trillion by 2027.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Which country spends most on healthcare?

The United StatesThe United States is the highest spending country worldwide when it comes to health care. In 2020, total health expenditure in the U.S. exceeded four trillion dollars. Expenditure as a percentage of GDP is projected to increase to 19 percent by the year 2025.

What is the average cost of Medicare per person?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

What is the role of Medicare in the future?

Medicare plays a central role in broader discussions about the future of entitlement programs. Together, Medicare, Medicaid and Social Security account for more than 40 percent of the federal budget.

When did Medicare Part D take effect?

After years of discussion and debate, in 2003 Congress authorized a new outpatient prescription drug benefit (Medicare Part D) that took effect in 2006.

What is Medicare Advantage?

Medicare beneficiaries have the option to get their benefits through the traditional fee-for-service (FFS) program – sometimes called Original Medicare – or through private health plans, such as health maintenance organizations (HMOs) and preferred provider organizations (PPOs) – currently called Medicare Advantage.

What is the source of Medicare funding?

Medicare funding comes primarily from three sources: payroll tax revenues, general revenues, and premiums paid by beneficiaries.

How does Medicare affect spending?

Annual growth in Medicare spending is largely influenced by the same factors that affect health spending in general: increasing prices of health care services, increasing volume and utilization of services, and new technologies. In the past, provider payment reforms, such as the hospital prospective payment system, ...

What is Medicare and Social Security?

Like Social Security, Medicare is a social insurance program that provides health coverage to individuals, without regard to their income or health status.

Why is Medicare facing a challenge?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries. Annual increases in health care costs are placing upward pressure on Medicare spending, as for other payers.

How many Medicare Advantage plans are there in 2020?

By 2020, that number increased to 3,148. Also in 2020, the average Medicare beneficiary can choose from 28 available plan options, compared to only 18 plan options in 2014. 1. Many Medicare Advantage plans offer $0 premiums. With more Medicare Advantage plan options being sold by more providers, the increased competition between insurance companies ...

How many Medicare beneficiaries were there in 2003?

Based on current trends, here are four predictions Medicare beneficiaries can keep an eye on. In 2003, just over five million Medicare beneficiaries enrolled in a Medicare Advantage plan, which represented only 13 percent of the total Medicare beneficiary population.

Is Humana a Medicare Advantage?

Humana, one company that provides Medicare Advantage plans, pulled out of the individual health insurance exchange in 2018 to invest more heavily in the Medicare Advantage program. 3.

Does Medicare have a star rating?

In addition to the bonus program, Medicare issues star ratings for all Medicare Advantage plans each year, and these Medicare Star Ratings can be a large point of emphasis for shoppers. 2. Medicare offers a Special Enrollment Period for anyone who is not enrolled in a five-star Medicare Advantage plan (the highest Medicare Star Rating) ...

Is Medicare Advantage plan going to drop?

Medicare Advantage plan prices should remain stable or possibly drop. The number of available Medicare Advantage plan options in the U.S. is on the rise. In 2012, there were a total of 1,974 Medicare Advantage plans available nationwide. By 2020, that number increased to 3,148.

Who is the CEO of UnitedHealthcare?

Steven Nelson, CEO of Medicare Advantage plan provider UnitedHealthcare, predicted that 50% of seniors will soon be enrolled in a Medicare Advantage plan. 4.

Does Medicare Advantage offer the same benefits as Original Medicare?

Medicare Advantage plans offer the same benefits that are covered by Medicare Part A and Part B (Original Medicare), and many Medicare Advantage plans offer additional benefits not covered by Original Medicare. These additional benefits can serve as an incentive to consumers.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

Why is there a doctor shortage?

As it stands, there is already an impending doctor shortage because of limited Medicare funding to support physician training. Decrease Medicare fraud, waste, and abuse. Private insurance companies run Medicare Advantage and Part D plans.

When was Medicare created?

Medicare was created in 1965 as a means to address the sudden explosion in births that followed the end of WWII. The so-called Baby Boomers are a generation that makes up the bulk of Medicare recipients in 2020, and more are retiring and taking advantage of Medicare every single day.

What is Medicare benefits?

Medicare benefits provide access to affordable healthcare for millions of seniors and those with certain disabilities in the United States, meaning the future of this vital program is often on the minds of recipients.

Why is Medicare going into insolvency?

Because of changing economies and the aforementioned longer life spans of Americans, Medicare looks to be heading toward insolvency sooner rather than later. Combine this with lower birth rates in the United States in the current generation, and it seems like some major changes will need to be put into place in order to bring ...

Is Medicare going to be viable in the future?

In recent decades, there have been a number of concerns as to the viability of Medicare in the future, both in terms of financing the program and ensuring that its liabilities are covered. These concerns raise the question as to how long Medicare can continue in its current configuration, but they also cause potential future recipients ...

Is it a good time to discuss Medicare benefits?

Whether you currently receive Medicare benefits or you will be taking advantage of Medicare coverage in the future, now would be a good time to discuss your needs and options with a Medicare plan administrator. These professionals will be able to guide you in selecting the options that are right for you now, but they will also be able ...

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

Is Medicare healthy?

Not broke, but not healthy. However, that does not mean Medicare is healthy. Largely because of the inexorable aging of the Baby Boomers, program costs continue to grow. And, as the Trustee’s report forthrightly acknowledges, long-term costs could well increase even faster than the official predictions.

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

Will Medicare be insolvent in 2026?

Government Says Medicare won't be able to cover costs by 2026. Report puts Medicare insolvency sooner than forecast. Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.