The Medicare hold-harmless provision is a special rule designed to protect retirees’ Social Security checks from rising Medicare Part B costs. If Medicare Part B premiums rise higher than the cost-of-living-adjustment, the recipient's premium cost will be reduced instead of their Social Security benefit checks.

What is Medicare's "hold harmless" rule?

Medicare Hold Harmless Provision Understanding the Medicare Hold Harmless Provision. The Medicare hold harmless provision stems from a statutory restriction that prevents Medicare from raising most Social Security recipients' Medicare Part B premiums by ... Requirements for the Hold Harmless Provision. ... Special Considerations. ...

Which part of Medicare requires premium payment?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

How much is part a Medicare premium?

Medicare’s “Part B” outpatient premium will jump by $21.60 next year, one of the largest increases ever. Officials said Friday a new Alzheimer’s drug is responsible for about half of that. The increase guarantees that health care will gobble up a ...

Can I avoid paying more in Medicare premiums?

You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, regardless of income.

What is the hold harmless rule?

Last Updated: November 30, 2021 A special rule called the “hold harmless provision” protects your Social Security benefit payment from decreasing due to an increase in the Medicare Part B premium. The Part B base premium for 2022 is $170.10, which is $21.60 higher than the 2021 base premium.

Are Medicare Part B premiums locked in?

This is called the “hold harmless” provision, and it protects about 70 percent of Medicare beneficiaries from having to pay the full amount of the Part B premium increase in years when the COLA wouldn't be enough to cover the premium hike.

Why does Medicare Part B go up every year?

And in recent years Part B costs have risen. Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

What is the penalty for canceling Medicare Part B?

Your Part B premium penalty is 20% of the standard premium, and you'll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

What will the Medicare Part B premium be in 2022?

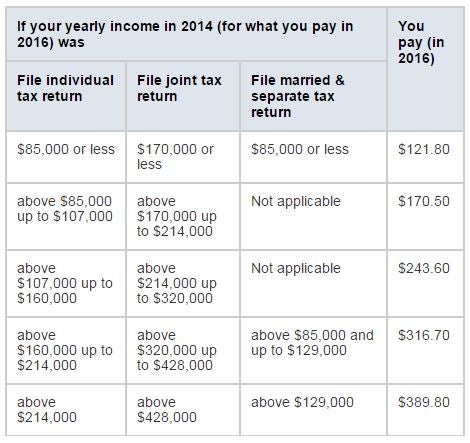

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Is Medicare Part B premium going down 2022?

Medicare Part B Premiums Will Not Be Lowered in 2022.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Can you drop Medicare Part B anytime?

So long as you have creditable coverage elsewhere, you can disenroll from Medicare Part B without incurring late penalties. Although Medicare offers very good coverage for most enrollees, there are various reasons why you may want to cancel your coverage.

Can you cancel Medicare B at any time?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What is the hold harmless provision for Medicare?

The Medicare hold harmless provision stems from a statutory restriction that prevents Medicare from raising most Social Security recipients’ Medicare Part B premiums by more than the cost of living adjustment (COLA) provided by Social Security in a given year. The administration calculated the adjustment for 2021 at 1.3%. 1

Do you have to pay out of your Social Security for Medicare Part B?

To qualify for reduced payments under this provision, you must receive Social Security benefits and have Part B premiums paid out of those benefits for at least two months in the previous year. Those who make payments for Part B insurance directly to Medicare and those who have premiums paid by Medicaid do not qualify and, as a result, may be subject to higher premiums. 2

What Is the Medicare Hold Harmless Provision?

What is the hold harmless provision in Medicare? It sounds like a fancy legal term, but it’s actually a simple protection put in place for recipients. It ensures that this year’s Medicare premium increases won’t completely eliminate the cost of living increase you received this year.

Hold Harmless Provision Requirements

Once you understand what the hold harmless agreement represents in Medicare, it’s time to look at some of the exceptions to the provision. In order to cap your Medicare increases, you have to meet the following criteria as a Social Security recipient:

Special Considerations

COLA has been pretty good to Social Security recipients in recent years. But it wasn’t too long ago that the economy was suffering, leading the COLA to fall to zero. In 2016, this was the case for only the third time in 40 years. The cost of Medicare for social security recipients had to stay stagnant because of the hold harmless provision.

Final Thoughts

Inflation is inevitable, but at least Social Security recipients know they’ll get a raise to compensate for it. Medicare premiums could increase, as well, though. Thanks to the hold harmless provision, Social Security recipients have the confidence of knowing they won’t lose money because premiums increased more than the cost of living.

How to qualify for hold harmless?

To qualify for the hold harmless provision, you must: Receive Social Security benefits or be entitled to Social Security benefits for November and December of the current year. Have your Medicare Part B premiums for December and January deducted from your monthly benefits.

Why do people pay Medicare premiums?

Most people with Medicare will pay the new premium amount because the increase in their benefit amount will cover the increase. However, a small number of people will see little or no increase in their Part B premium — and their Social Security benefit checks will remain the same — because the amount of their cost-of-living adjustment isn’t large ...

Does Social Security reduce Medicare?

Social Security works together with the Centers for Medicare & Medicaid Services to make sure you won’t have a reduction in your Social Security benefits as a result of Medicare Part B premium increases.

Does hold harmless apply to Part B?

The hold harmless provision does NOT apply to you if: You enroll in Part B for the first time in 2021. You pay an income-related monthly adjustment amount premium. You are dually eligible for Medicaid and have your premium paid by a state Medicaid agency. You can learn more by visiting Medicare. Tags: Medicare.

Many misunderstand how the rule works

Retirees need help with basic living expenses, and healthcare is a vital need for people as they age. Together, Social Security and Medicare aim to give retirees vital assistance with their medical and financial obligations.

Why the hold-harmless provision exists

The hold-harmless provision stemmed from the fact that the CMS and SSA work together to facilitate their joint operations. Online applications for both Social Security and Medicare run through a page on the SSA website, and those who visit Social Security offices in person can apply for both benefits at the same time if they so choose.

How hold-harmless really works

Many people mistakenly believe that the hold-harmless provision kicks in whenever percentage increases in Medicare costs outpace Social Security's COLA percentage. That would be ideal in helping retirees keep as much of their benefits as possible. However, that's not the way the rule works.

A temporary benefit

The other thing to remember about the hold-harmless provision is that it doesn't permanently reduce your monthly Medicare premiums. When future-year COLAs exceed the increase in Medicare costs, then you'll have to make up the difference with additional Medicare premium boosts that you temporarily avoided because of the rule.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What is the hold harmless rule?

The hold harmless rule protects you from having your previous year’s Social Security benefit level reduced by an increase in the Part B premium so long as: You are entitled to Social Security benefits for November and December of the current year (2019);

Does Hold harmless apply to 2020?

You are new to Medicare in 2020. Hold harmless does not apply to you because you have not been enrolled in Medicare Part B long enough to qualify. You are subject to IRMAA. You are enrolled in a Medicare Savings Program (MSP). However, the MSP should continue paying for your full Part B premium.

Does COLA cover Part B?

The COLA in 2020 is likely to cover the full Part B premium for most people. If your COLA is large enough to cover the full amount of your increased premium, you will not be held harmless and your premium will increase to $144.60. The hold harmless provision does NOT protect you if: You are new to Medicare in 2020.

What is the hold harmless provision for Medicare?

This is called the “hold harmless” provision, and it protects about 70 percent of Medicare beneficiaries from having to pay the full amount of the Part B premium increase in years when the COLA wouldn’t be enough to cover the premium hike.

What was the Medicare premium for 2016?

For 2016, the standard Medicare Part B premium was $121.80/month. But about 70 percent of enrollees were only paying $104.90 (the same rate they paid in 2015), because they were “held harmless” from the rate hike in 2016.

What percentage of Medicare Part B will receive COLA?

The federal government estimated that only about 3.5 percent of Medicare Part B enrollees would receive COLAs that still weren’t sufficient to cover the full increase in their Part B premiums, and would thus still be paying less than the standard premium in 2019. For 2018, the Social Security COLA was 2 percent.

Is Medicare Part B premium larger than Social Security?

But sometimes the Medicare Part B premium increase is larger than the Social Security COLA. In that situation, the result would be a decrease in net Social Security checks from one year to the next (for example, if the COLA only adds $5/month to a person’s check but their Part B premiums go up by $8/month, their net Social Security check would be ...

Did Medicare Part B increase in 2016?

The COLA was zero percent that year, so Medicare Part B premiums couldn’t increase at all for most enrollees. 2016 was only the third time in 40 years that the COLA was zero. Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006.

What Is The Medicare Hold Harmless Provision?

- What is the hold harmless provision in Medicare? It sounds like a fancy legal term, but it’s actually a simple protection put in place for recipients. It ensures that this year’s Medicare premium increases won’t completely eliminate the cost of living increase you received this year. Here’s an example of the Medicare Part B hold harmless provision....

Hold Harmless Provision Requirements

- Once you understand what the hold harmless agreement represents in Medicare, it’s time to look at some of the exceptions to the provision. In order to cap your Medicare increases, you have to meet the following criteriaas a Social Security recipient: 1. You must have been entitled to benefits in both November and December of the current year. 2. Medicare Part B premiums mus…

Special Considerations

- COLA has been pretty good to Social Security recipients in recent years. But it wasn’t too long ago that the economy was suffering, leading the COLA to fall to zero. In 2016, this was the case for only the third timein 40 years. The cost of Medicare for social security recipients had to stay stagnant because of the hold harmless provision. As recently as 2016, 70 percent of enrollees di…

Final Thoughts

- Inflation is inevitable, but at least Social Security recipients know they’ll get a raise to compensate for it. Medicare premiums could increase, as well, though. Thanks to the hold harmless provision, Social Security recipients have the confidence of knowing they won’t lose money because premiums increased more than the cost of living. If you’re currently planning your retirement, a C…