What is the income limit to receive Medicare?

There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

What is the resource limit for extra help with Medicare prescription drugs?

Application for Extra Help with Medicare Prescription Drug Plan Costs (Form SSA-1020) Resources and Income What is the resource limit? To qualify for Extra Help , your resources must be limited to $14,790 for an individual or $29,520 for a married couple living together. Resources include the value of the things you own. Some examples are:

How much can Medicare extra help save you a year?

The Social Services Administration (SSA) estimates that the Medicare Extra Help program could help an individual save around $5,000 annually. According to the SSA, to qualify for Extra Help, a single person’s income must be less than $19,140, and they must have less than $14,610 in resources.

How much does Medicare Prescription Drug help cost?

with the costs — monthly premiums, annual deductibles, and prescription co-payments — related to a Medicare prescription drug plan. The Extra Help is estimated to be worth about $5,000 per year.

How much do you need to make to qualify for SLMB?

How many types of Medicare savings programs are there?

What is the Medicare Part D premium for 2021?

How much is Medicare Part B 2021?

How does Social Security determine IRMAA?

What is Medicare Part B?

What is the income limit for QDWI?

See more

About this website

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is the income limit for extra help in Michigan?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

How do I get cheaper prescriptions with Medicare?

Lower prescription costsAsk about generic drugs—your doctor can tell you if you can take a generic drug instead of a brand-name drug or a cheaper brand-name drug.Look into using mail-order pharmacies.Compare Medicare drug plans to find a plan with lower drug costs.Apply for.More items...

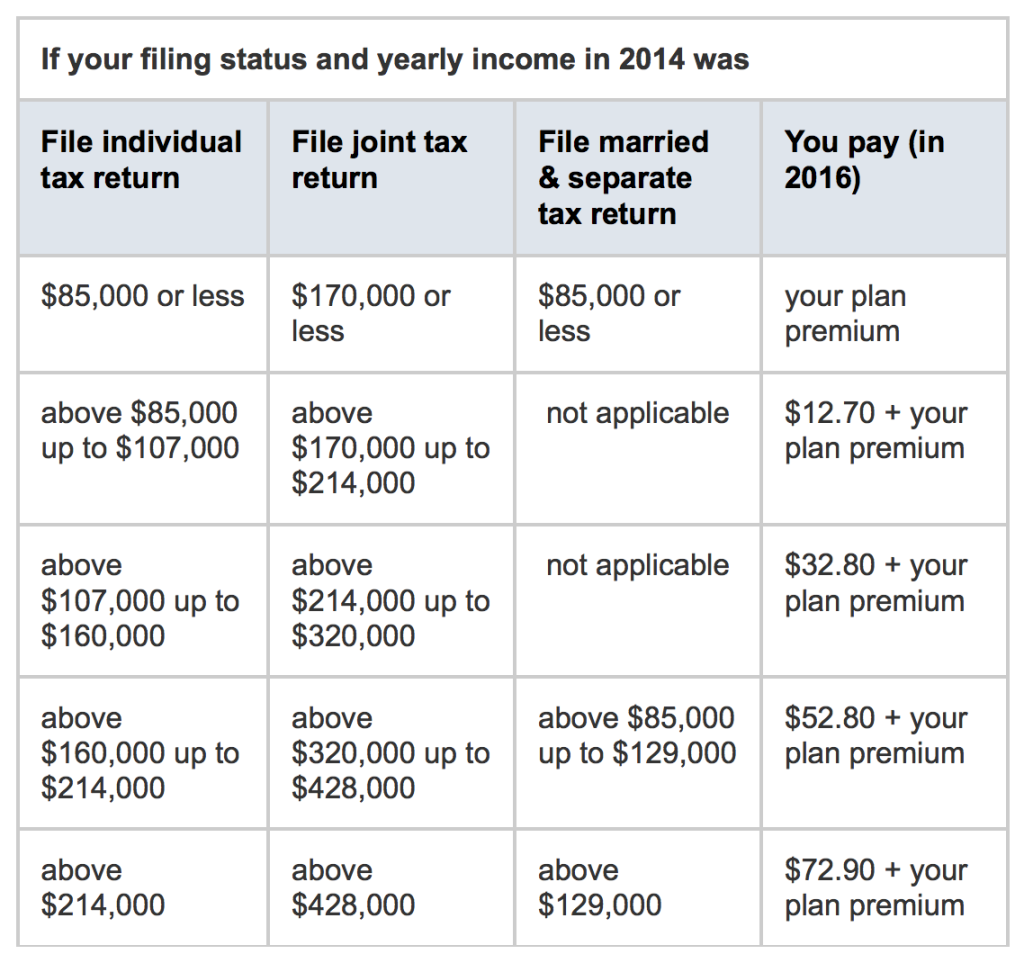

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the income limit for Medicare in Michigan 2021?

Income eligibility: The income limit is $1,063 a month if single and $1,437 a month if married. Asset limits: The asset limit is $2,000 if single and $3,000 if married.

What is the income limit for Medicare in Michigan?

See if you qualify for the Healthy Michigan Plan. Have income at or below 133% of the federal poverty level* ($16,000 for a single person or $33,000 for a family of four)

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Can seniors on Medicare use GoodRx?

Key takeaways: GoodRx can't be used in combination with Medicare, but it can be used in place of Medicare.

Why are my prescriptions so expensive with Medicare?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

What are the magi limits for 2021?

If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $140,000 for the tax year 2021 and under $144,000 for the tax year 2022 to contribute to a Roth IRA, and if you're married and file jointly, your MAGI must be under $208,000 for the tax year 2021 and 214,000 for the tax year ...

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Are Medicare premiums based on total income or adjusted gross income?

The cost of Medicare B and D (prescription drug coverage) premiums are based on your modified adjusted gross income (MAGI). If your MAGI is above $87,000 ($174,000 if filing a joint tax return), then your premiums will be subject to the income-related monthly adjustment amount (IRMAA).

2022 Medicare Parts A & B Premiums and Deductibles/2022 Medicare Part D ...

On November 12, 2021, the Centers for Medicare & Medicaid Services (CMS) released the 2022 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2022 Medicare Part D income-related monthly adjustment amounts. Medicare Part B Premium and Deductible

CMS Announces 2022 Medicare Part B Premiums | CMS

Today, the Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts.

What are the income limits for Medicare in 2021?

When it comes to receiving Medicare benefits, there are no income restrictions. Here is a complete detail of Medicare income limits for 2021.

2022 Medicare Costs.

CMS Product No. 11579 November 2021. You have the right to get Medicare information in an accessible format, like large print, Braille, or audio.

How Does Income Affect Monthly Medicare Premiums?

It can. If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.)

How much does a generic prescription cost?

For those enrolled in Extra Help, generic prescription costs are no more than $3.60 each, and brand-name prescription costs are no more than $8.95 each. If you didn’t enroll in Part D when you first became eligible, you won’t have to pay the late enrollment penalty if you have Extra Help.

What is the income limit for extra help in 2021?

What Are the Income and Resource Limits for Extra Help in 2021? In 2021, the annual income limit for Extra Help for an individual is $19,140. For a married couple who is living together, the limit is $25,860. When your income is calculated, governmental assistance such as food stamps, housing assistance, and home energy assistance aren’t counted.

How much does extra help save?

On average, Extra Help is estimated to save beneficiaries $5,000 in these costs per year. If you’re eligible for Medicaid or any of the following Medicare Savings Programs, you automatically qualify for Extra Help. Qualified Medicare Beneficiary (QMB)

What is extra help for Part D?

Getting Extra Help with your Part D can: Eliminate the coverage gap, also known as the donut hole. This means your prescriptions won’t cost more just because you went over a spending limit in a particular year. On average, Extra Help is estimated to save beneficiaries $5,000 in these costs per year.

Can you mail a color coded document to Medicare?

You can mail your color-coded document to your Part D plan to help verify the level of Extra Help for which you qualify. Those who are dual-eligible to receive Medicare and Medicaid qualify for full Extra Help.

Is food stamps counted as extra help?

When your income is calculated, governmental assistance such as food stamps, housing assistance, and home energy assistance aren’t counted. Even if your income is higher than the limits, you should still apply for Extra Help if you think you qualify. Some scenarios where you’d still be eligible for Extra Help even though your income is over ...

How much income do you need to qualify for Medicare Extra Help?

According to the SSA, to qualify for Extra Help, a single person’s income must be less than $19,140, and they must have less than $14,610 in resources. The SSA also advises that a married couple’s income must be less than a combined $25,860, and they must have resources of $29,160 or less. Medicare Extra Help can only pay costs associated ...

What is the maximum income for Medicare Extra Help 2020?

To qualify for assistance in 2020, a person must: enroll in Medicare parts A and B. receive a single annual income of less than $19,140, or $25,860 for a married couple. have resources of less than $14,610, ...

How often does Medicare Extra Help change?

The level is set for each state every year, depending on the cost of living and average income. The income limit for Medicare Extra Help changes in line with the federal poverty level. If a person has a higher income, they may still qualify depending on circumstance.

What is Medicare Extra Help?

This means that the amount of help a person receives from the government may vary as it depends on income and financial need. Medicare Extra Help could save an individual a substantial amount of money each year by helping them to pay for premiums, deductibles, and copayments.

What is extra help?

Alternative options. Summary. Extra Help is a financial support program for those with Medicare. It helps people with limited resources manage the cost of prescribed drugs. An income limit is set which determines eligibility. Extra Help is also known as a low income subsidy (LIS). This means that the amount of help a person receives from ...

Does Medicare cover take home prescriptions?

Original Medicare covers the costs of medication during a stay in the hospital, but there is limited coverage for take-home prescription drugs. Medicare Part D is a plan that covers prescription drugs. The plan is also known as a prescription drug plan (PDP). When a person has a PDP, they must usually pay monthly premiums, copayments, ...

Can I pay for Medicare Part A or Part B?

It cannot help to pay towards Medicare Part A or Part B costs. An individual who is eligible for Medicaid has a Medicare savings program (MSP) that helps them to pay their Part B premiums. A person with an MSP or Supplemental Security Income (SSI) benefit will automatically qualify for Extra Help.

What to do if you disagree with Medicare decision?

If you disagree with the decision we made about your eligibility for Extra Help, complete an Appeal of Determination for Extra Help with Medicare Prescription Drug Plan Costs. We also provide Instructions for Completing the Appeal.

Can you get help with Medicare?

With the Medicare Savings Programs (MSP), you can get help, from your state, paying your Medicare premiums. In some cases, MSPs may also pay Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) deductibles, coinsurance, and copayments if you meet certain conditions. If you qualify for certain MSPs, you automatically qualify ...

Can Medicare beneficiaries get extra help?

Table of Contents. Medicare beneficiaries can qualify for Extra Help paying for their monthly premiums, annual deductibles, and co-payments related to Medicare Part D (prescription drug coverage).

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.