What is the Medicaid income limit in North Carolina?

Mar 28, 2022 · The medically needy income limit has remained the same for many years, and in 2022, continues to be $242 / month for a single individual and $317 / month for a married couple. The “spend down” amount, which can be thought of as a deductible, is the difference between one’s monthly income and the medically needy income limit.

When are you eligible for Medicare in North Carolina?

Oct 04, 2020 · Income eligibility: The income limit is $1,064 a month if single and $1,437 a month if married. This is the same income limit as MQB-Q – meaning MQB-Q enrollees who meet Medicaid’s more restrictive asset limit receive full Medicaid benefits. Asset limits: The asset limit is $2,000 if single and $3,000 if married.

How does Medicare work in North Carolina?

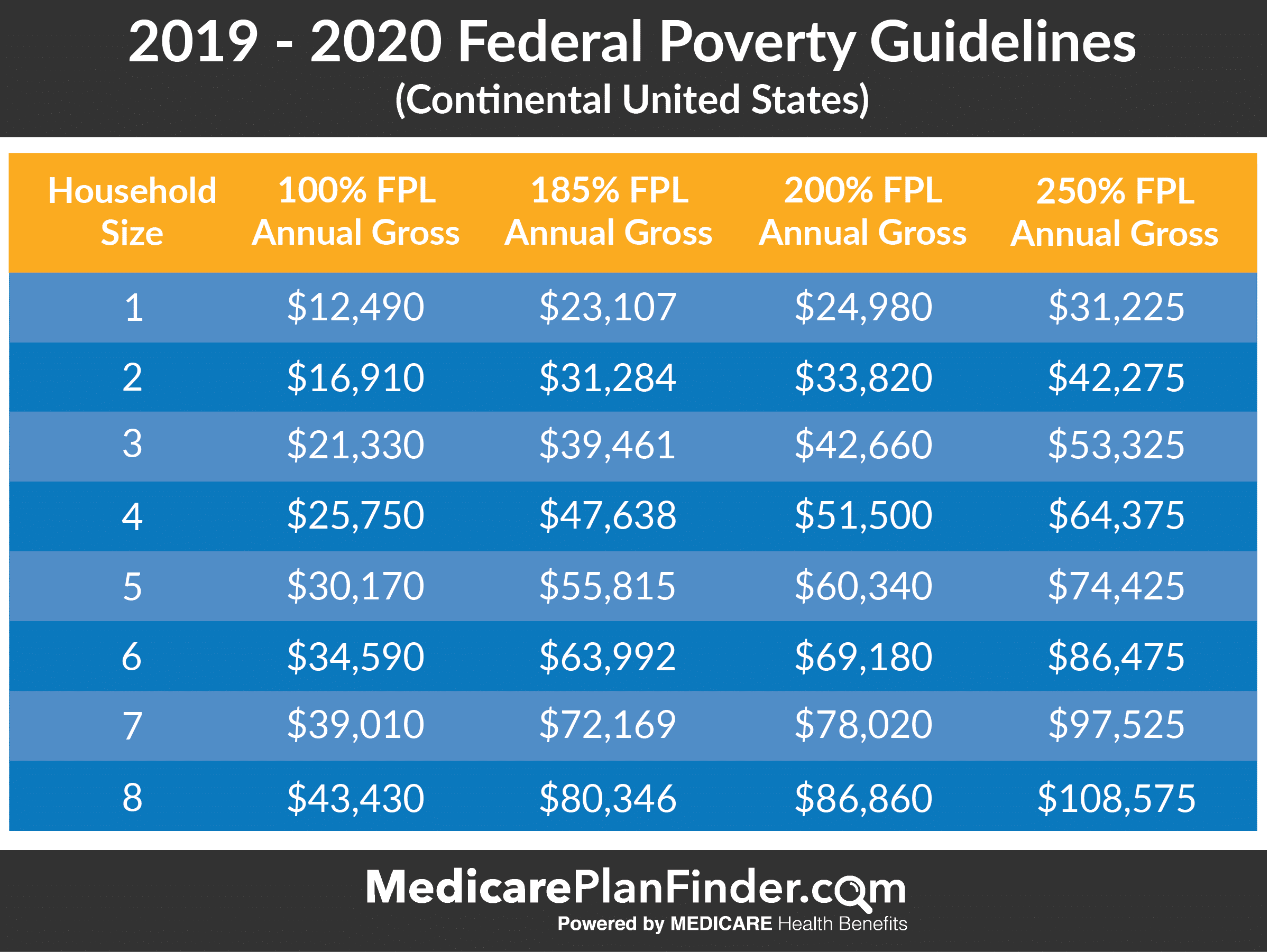

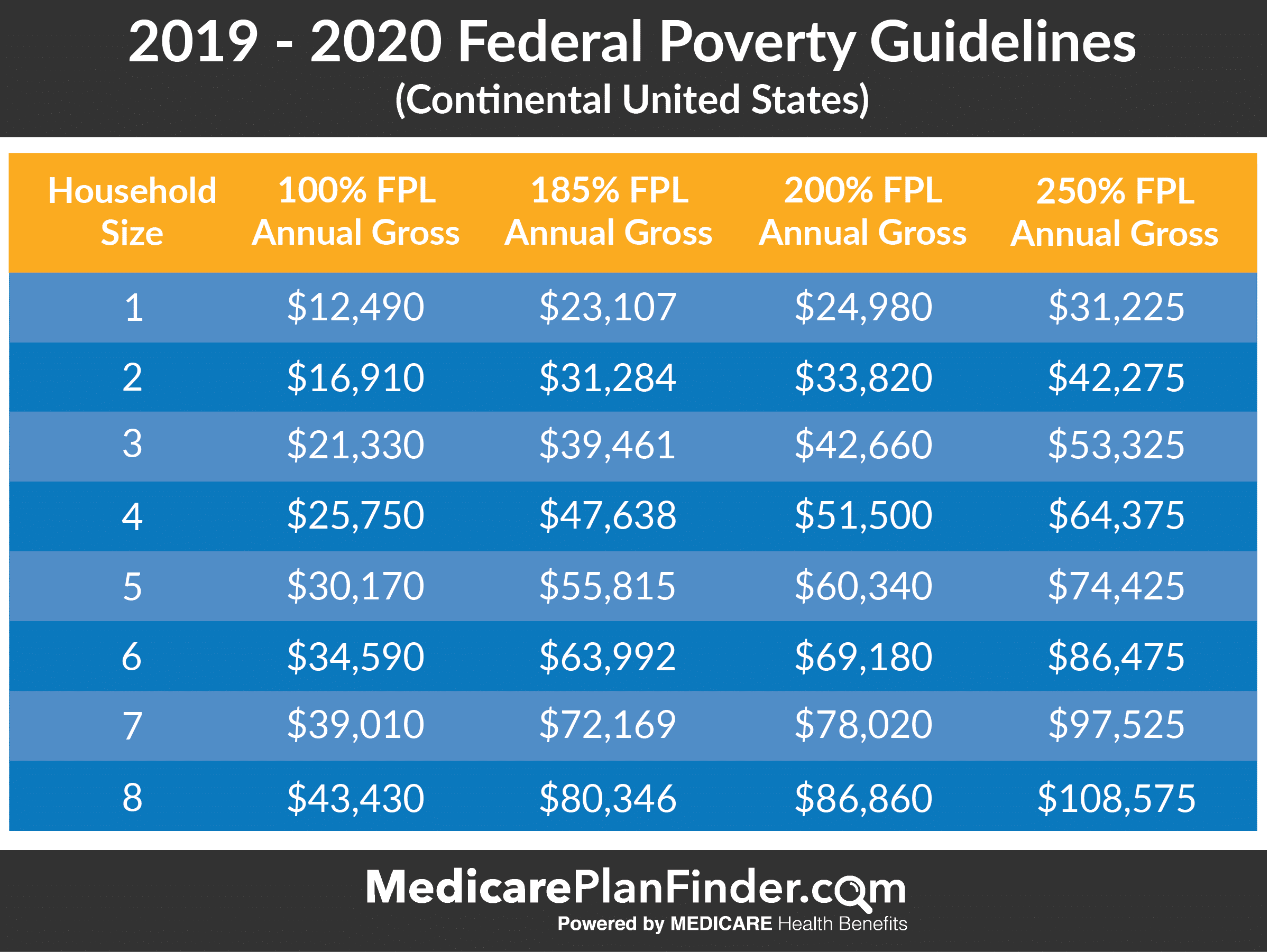

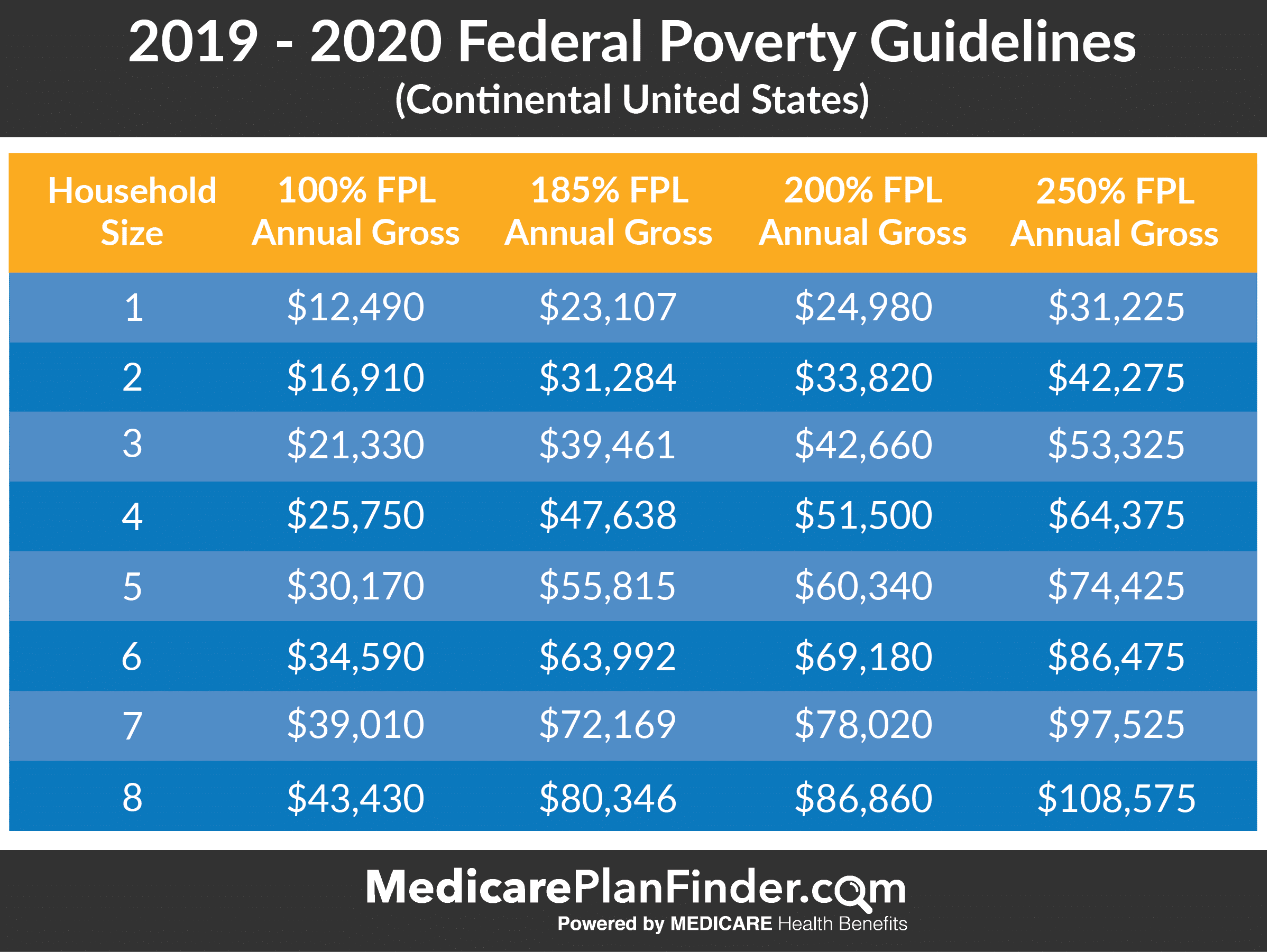

Apr 30, 2021 · For example, if you are pregnant, to qualify for Medicaid, you cannot have an income higher than 196% of the Federal Poverty Level – which for a family of two is $34,143 as shown in the chart above. How to Apply for North Carolina Medicaid There are 3 ways you can apply for Medicaid in North Carolina. Option 1 – Apply online

What are the different types of Medicare in North Carolina?

Extra Help is a Medicare program to help people with limited income and resources pay Medicare prescription drug costs. You may qualify for Extra Help if your yearly income and resources are below these limits in 2022: Single person - yearly income less than $20,388 ($1,699 monthly) and less than $14,010 in other resources per year. Married person living with a spouse and no …

Does North Carolina help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled in North Carolina?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

Where can Medicare beneficiaries get help in North Carolina?

Seniors’ Health Insurance Information Program (SHIIP) Free volunteer Medicare counseling is available by contacting the Seniors’ Health Insurance I...

Where can I apply for Medicaid in North Carolina?

Medicaid is administered by the State Department of Health and Human Services (NCDHHS) in North Carolina. You can apply for Medicaid or an MSP usin...

What is the income limit for Medicare in North Carolina?

Comprehensive Medicare-Aid (MQB-Q): The income limit is $1,063 ...

What age can you recover from Medicaid in North Carolina?

Estate recovery in North Carolina. A state’s Medicaid agency is required to recover what it paid for LTSS and related medical costs beginning at the age of 55. States can also pursue estate recovery for other Medicaid costs (and recover from enrollees who didn’t receive LTSS) if the enrollee was 55 or older.

Does Medicare cover long term care?

Medicare beneficiaries increasingly rely on long-term services and supports (LTSS) – or long-term care – which is mostly not covered by Medicare. In fact, 20 percent of Medicare beneficiaries who lived at home received some assistance with LTSS in 2015.

Can you keep all your income for nursing home?

However, this doesn’t mean applicants can keep all of their income up to the cost of care. Nursing home enrollees must pay nearly all their income toward their care, other than a small personal needs allowance and money to pay for health insurance premiums (such as Medicare Part B and Medigap ).

How much can a spouse keep on medicaid?

If only one spouse has Medicaid, the other can keep up to $128,640.

What is the maximum home equity for Medicaid?

In 2020, states set this home equity level based on a federal minimum of $595,000 and maximum of $893,000.

When is Medicaid required to recover?

A state’s Medicaid agency is required to recover what it paid for LTSS and related medical costs beginning at the age of 55. States can also pursue estate recovery for other Medicaid costs (and recover from enrollees who didn’t receive LTSS) if the enrollee was 55 or older.

Does North Carolina have Medicaid?

North Carolina has not expanded Medicaid to include adults without dependents. Therefore, adults without dependents do not qualify for Medicaid in North Carolina. For an update on the Medicaid expansion debate and timeline in North Carolina, see our North Carolina Medicaid Expansion update below.

What are the income requirements for medicaid?

Additionally, to be eligible for Medicaid, you cannot make more than the income guidelines outlined below: 1 Children up to age 1 with family income up to 210 percent of FPL 2 Any child age 1-5 with a family income up to 210 percent of FPL 3 Children ages 6- 18 with family income up to 133 percent of FPL 4 CHIP for children with family income up to 211 percent of FPL 5 Pregnant women with family income up to 196 percent of FPL 6 Parents of minor children with family income up to 41 percent of FPL 7 Individuals who are elderly, blind, and disabled with family income up to 100% of the FPL

What is Medicaid insurance?

What is Medicaid? Medicaid is a federal and state health insurance program for people with a low income. It provides free or low-cost health coverage to millions of Americans, including families and children, pregnant women, the elderly, and people with disabilities.

Can you get medicaid if your income is higher than poverty level?

You cannot have an income higher than the Federal Poverty Level percentage described for your group to be eligible for Medicaid. Similarly, when you identify the income group that applies to you, the income limit you see refers to the maximum level of income you can earn to qualify for benefits.

How many people are on medicaid in 2020?

According to the Centers for Medicare & Medicaid Services, as of November 2020, here are the number of people enrolled in Medicaid and Chip in the entire United States: 78,521,263 individuals were enrolled in Medicaid and CHIP. 72,204,587 individuals were enrolled in Medicaid. 6,695,834 individuals were enrolled in CHIP.

Do you have to pay for long term care with Medicare?

If you have Medicaid, you won’t have to pay a monthly premium for the long-term care portion of the PACE benefit. If you have Medicare but not Medicaid, you’ll be charged a monthly premium to cover the long-term care portion of the PACE benefit and a premium for Medicare Part D drugs.

Can you get help with Medicare premiums?

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) deductibles, coinsurance, and copayments if you meet certain conditions. There are four kinds of Medicare Savings Programs:

What to call if you don't want to join Medicare?

If you don’t want to join a Medicare drug plan (for example, because you want only your employer or union coverage), call the plan listed in your letter, or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. Tell them you don’t want to be in a Medicare drug plan (you want to “opt out”). If you continue to qualify ...

What is extra help for Medicare?

Extra Help is a Medicare program to help people with limited income and resources pay Medicare prescription drug costs. You may qualify for Extra Help if your yearly income and resources are below these limits in 2021:

What happens if you don't have Medicare?

If you're not enrolled in a Medicare drug plan, Medicare may enroll you in one so that you'll be able to use the Extra Help . If Medicare enrolls you in a plan, you'll get a yellow or green letter letting you know when your coverage begins, and you'll have a Special Enrollment Period to change plans.

Does Medicaid cover long term care?

Medicaid can cover services that Medicare does not , like long-term care. It can also pick up Medicare’s out-of-pocket costs (deductibles, coinsurances, copayments). Some states offer a Medicaid spend-down program or medically needy program for individuals with incomes over their state’s eligibility requirements.

How much does SSI cost in 2020?

You get Supplemental Security Income (SSI) benefits. Drug costs in 2020 for people who qualify for Extra Help will be no more than $3.60 for each generic drug and $8.95 for each brand-name drug.

Understanding Medicare Eligibility in North Carolina and Choosing a Plan

Once you’re eligible for Medicare, it’s time to review your choices. Medicare is actually divided into four separate parts, which are:

How Do I Apply for Medicare in North Carolina?

You can apply for Medicare in North Carolina by contacting the Social Security Administration, either by phone or online.

What is Medicare Part B?

Medicare Part B covers a range of medical services such as (but not limited to) physician services, mental health care, ambulance services, some durable medical equipment, and preventive services such as flu shots.

What is a North Carolina Ship?

North Carolina State Health Insurance Counseling and Assistance Program (SHIP): North Carolina SHIP staff members counsel the state’s Medicare beneficiaries and caregivers on many different topics related to Medicare. The counselors also help beneficiaries and their caregivers recognize and prevent billing errors and possible Medicare fraud. To learn more about the North Carolina SHIP program, visit the North Carolina Department of Insurance website.

Is income the only eligibility factor for Medicaid?

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

Does Medicare have income limits?

Medicare has set income limits for people filing individual tax returns, joint tax returns and individuals who are married or living with their spouse at any time during the year and file separate tax returns. These limits are then used to determine adjusted costs for Medicare Part B and Part D premiums. Depending on how much you make, you may have ...

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.