How much will Medicare Part B cost you in 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80.

What percentage of Medicare Part B premiums are affected by income?

These income-related monthly premium rates affect roughly five percent of people with Medicare. The total Medicare Part B premiums for high income beneficiaries for 2017 are shown in the following table:

What is the cost of living increase for Medicare?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. On October 18, 2016, the Social Security Administration announced that the cost-of-living adjustment (COLA) for Social Security benefits will be 0.3 percent for 2017.

When will Medicare Part B be privatized?

So it's fair to assume that something will need to change in the coming years. This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

How much did Medicare B increase?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What was the cost of Medicare in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the cost for Medicare Part B for 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

Why did my Medicare Part B premium increase?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What is the standard Medicare Part B premium for 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the cost of Medicare Part B for 2019?

$135.50The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the Irmaa for 2017?

And since 2011, a similar IRMAA surcharge has applied to Part D premiums, applying a flat dollar surcharge of as much as $914/year in 2017.

Does Medicare Part B increase every year?

Each year, the Centers for Medicare & Medicaid Services (CMS) set the following year's Part B premium. In 2022, the Part B base premium will be $170.10. Most people will pay this amount. A small number of people may pay a premium that is lower than the base premium.

Why did my Medicare premium increase for 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

How often are Medicare Part B premiums adjusted?

Each yearEach year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part D premium for 2017?

The average basic premium for Part D plans in 2017 is estimated to be $34 per month, an increase of 4.6 percent from 2016; however, like Part B, individuals are subject to income-related premium adjustments. [iv] The maximum deductible allowed in 2017 for Part D is $400, an 11 percent increase from 2016.

How much are Medicare premiums for 2019?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

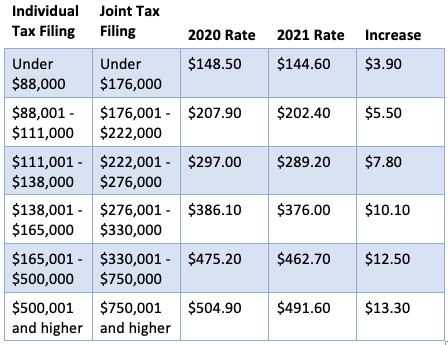

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

How much is Medicare Part B deductible?

In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

How much does Medicare Part A cost?

The Medicare Part A premium which only affects people who did not work and contribute to payroll taxes for 40 quarter over their working life will increase $2 per month to $417. Determining your Part B premium involves taking your individual situation into consideration.

What happens to Part A benefits if you are hospitalized?

If you are hospitalized your Part A benefits will help pay your covered costs. The changes are as follows:

Does Advantage Plan cover Part A and Part B?

If you have an Advantage Plan you shouldn’t be greatly affected by these changes as your plan will generally cover the Part A and Part B deductibles. These costs are also partially covered by your own cost sharing in the form of coinsurance and copays.

Will Medicare supplement costs increase in 2017?

If you are responsible for your Part B deductible you will see that $17 increase in 2017. You should not be affected by increases in the cost of hospitalization. That said, you insurer could increase your premium but increases in care will be a bigger driver of increase than these small changes announced by CMS.

How much does Medicare Part A cost in 2017?

However, recipients who pay premiums for Part A coverage will see their costs rise modestly next year. The maximum cost for coverage is set to rise to $413 in 2017, ...

How many prescription drug plans are there in 2017?

The Kaiser Family Foundation estimates that 746 plans will be offered across the country in 2017, a 16% decrease over the previous year.

Is Medicare rising on fixed income?

Medicare's rising costs tend to be the hardest on Americans who operate on a fixed income. Healthcare costs have risen for years, and 2017 isn't likely to be any different. As always, shopping around and taking steps to stay healthy remain the best ways to keep your healthcare costs in check.

Does Medicare have a cap on Part D deductible?

For 2016, that number was $360, but that's getting bumped up to $400 in 2017. Of course, some Medicare drug plans don't have a deductible at all , so this change isn't likely to affect them.

Do Medicare recipients pay premiums?

Even though most Medicare recipients don't pay premiums for Part A coverage, they still incur a cost when they use the benefit. And those costs are heading higher in 2017.

Will Medicare Part D coverage increase in 2017?

Here's a table that helps to summarize the changes: Monthly costs to for Medicare Part D coverage, which helps to cover the costs of prescription drugs, are also expected to jump in 2017.

Is Medicare a social program?

Medicare provides healthcare coverage to tens of millions of Americans, making it one of the country's most important social programs. With each passing year, the government makes a few tweaks to the way the program operates, making it critical for current and future recipients alike to keep up with what's new.

How much does Medicare Part B cost?

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

Is Medicare Part A funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums. Also, Medicare Part A is in decent financial shape -- for now.

When will the hospital insurance fund run out?

After that, however, deficits are projected, and the Hospital Insurance trust fund is expected to run out in 2028. So it's fair to assume that something will need to change in the coming years.

Is Medicare in financial trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums.

Why does Medicare base premiums on 2015?

Medicare generally bases 2017 premiums on 2015 income because that is the last tax return on file. If your income has decreased since then because of certain life-changing events, such as marriage, divorce, death of a spouse or retirement, you can ask the government to base your premiums on more-recent income.

How much did Medicare pay in 2016?

As you say, most people who have their Medicare premiums deducted from their Social Security benefits are protected by the hold-harmless provision and paid just $104.90 per month in 2016 for Medicare Part B. Their premiums will rise in 2017 based on the 0.3% cost-of-living increase in Social Security benefits, resulting in monthly average premiums ...

What is the maximum adjusted gross income for 2015?

But even if your premiums are paid from your Social Security benefits, if your modified adjusted gross income in 2015 was more than $85,000 for single filers or $170,000 for married couples filing jointly, you won’t be protected by the hold-harmless provision – and you’ll have to pay a high-income surcharge.